Veeva CRM Pricing 2026: Per-User Costs & License Guide

Executive Summary

Veeva Systems’ Customer Relationship Management (CRM) solution is the industry-standard SaaS platform for life sciences sales and marketing. By 2026, Veeva CRM (now branded as Vault CRM on Veeva’s own platform) continues to command roughly 80% of the global pharma field sales CRM market ([1]). Its pricing remains entirely subscription-based, per named user, with no on-premise components. Companies pay annually (or monthly) for each sales rep, manager, or medical liaison using the software. Multiple tiers – ranging from an entry‐level Essentials edition up to a full Multichannel enterprise suite – allow customers to align costs with their size and needs ([2]).

However, Veeva CRM is widely viewed as a premium-priced solution. For large organizations, independent analyses suggest per-user fees on the order of $120–$150 per user per month (≈$1,500–$1,800 per user per year). For example, a recent comparative study estimated that a 5,500-user pharmaceutical deployment might cost about $142 per user per month ([3]) – roughly $7.2 million per year ([4]) – which is almost twice what some generic CRM competitors charge. Smaller companies (with fewer users) typically face even higher per-license rates because volume discounts accrue only at scale.

Key cost drivers beyond the core CRM license include optional modules and data services. “Multichannel” features – such as Closed-Loop Marketing (CLM) interactive e-detailing, Approved Email messaging, Events Management, Veeva Engage for remote detailing, and Veeva Align territory planning – may be bundled into an enterprise edition or licensed à la carte. Each add-on often carries its own per-user or per-event fees. Separately, data-centric products like Veeva OpenData (global healthcare provider data) and Veeva Network (master data management) use record- or geography-based pricing rather than simple per-user rates. For example, OpenData is priced by HCP/HCO records per country (with caps) ([5]), meaning licensing all physicians in a large market can run into hundreds of thousands per year if not negotiated carefully.

Negotiating leverage varies widely. Veeva’s near-monopoly position in pharma CRM means buyers must proactively manage renewals. Industry analysts warn that naive customers risk “overpaying” unless they bring solid market intelligence into the deal ([6]). Savvy purchasers target volume discounts (sometimes 5–25% off list, depending on deployment size ([7])), multi-year commitments, and strict inflation caps on price escalations ([8]). Common pitfalls include blindly accepting region-based price tiers (which can quietly inflate costs by ~6–8% ([9])) or pre-paying for broad bundles (for instance, subscribing to OpenData for all countries when only some are needed ([10])).

This report provides a comprehensive analysis of Veeva CRM pricing in 2026, including per-user cost ranges, the gamut of available modules and add-ons, and strategies for negotiation. We draw on industry studies, vendor disclosures, and expert commentary to detail how costs scale with company size, which features drive incremental fees, and how global life sciences firms can structure their contracts to avoid unnecessary expenses. Case examples and data points illustrate both typical and extreme scenarios. We also examine the implications of Veeva’s ongoing platform transition (from the legacy Salesforce-based CRM to the new Vault CRM) and the competitive landscape (e.g. IQVIA’s solutions, Salesforce Life Sciences Cloud) for total cost of ownership. The report concludes with recommendations for procurement teams to maximize cost-effectiveness and flexibility in their Veeva CRM engagements.

Introduction and Background

Customer relationship management in the life sciences is uniquely complex. Unlike generic CRM systems, life sciences platforms must track regulated interactions (sample distributions, speaker program logistics, Off-Label or comparative discussions), enforce FDA/EMA compliance (21 CFR Part 11 auditability, Sunshine Act reporting, etc.), and coordinate multiple channels (field reps, medical science liaisons, digital campaigns). Veeva Systems was founded in 2007 precisely to serve these needs. Built by former Salesforce.com executives, Veeva CRM extended the Salesforce platform with life-sciences functionality like iPad-based Closed-Loop Marketing (CLM) content management, compliant email, and tight audit trails ([11]) ([1]).

Over the last decade Veeva CRM saw explosive adoption in pharma: by 2019 the company reported that its CRM solution had reached about 80% of the global pharmaceutical field sales seat market, with a total addressable market ~$3 billion ([1]). Industry studies (e.g. IDC Health Insights) consistently ranked Veeva as the leading CRM vendor for pharma by active users ([12]) ([1]). Major pharmaceutical corporations – Pfizer, Novartis, Merck, Roche, J&J, Sanofi, AstraZeneca, and others – have publicly confirmed enterprise deployments of Veeva CRM across tens of thousands of users (e.g. Novartis ~50,000 licenses ([13])). This dominant position reflects both the specialized functionality Veeva offers and the maturity of its ecosystem (content management, master data, analytics, etc.).

From a financial perspective, Veeva’s Commercial Cloud (which includes CRM and related modules) has become relatively mature. As a SaaS subscription business model, Veeva shifted all customers to cloud-hosted CRM (initially on Salesforce’s infrastructure, now on Veeva’s own Vault platform) and Eschewed perpetual licenses. The result: most costs are operational (annual fees per user) rather than capital outlay. This model means the perceived “price” is the recurring subscription rate per user and per module. Veeva has no public list prices, but analysts and user reports indicate it commands a premium rate because it is tailored to pharma workflows and data ([1]) ([3]). For example, in marketing materials and public filings, Veeva often emphasizes integration and regulatory compliance rather than low cost, implying that buyers pay more for assurance of fit and faster time-to-value.

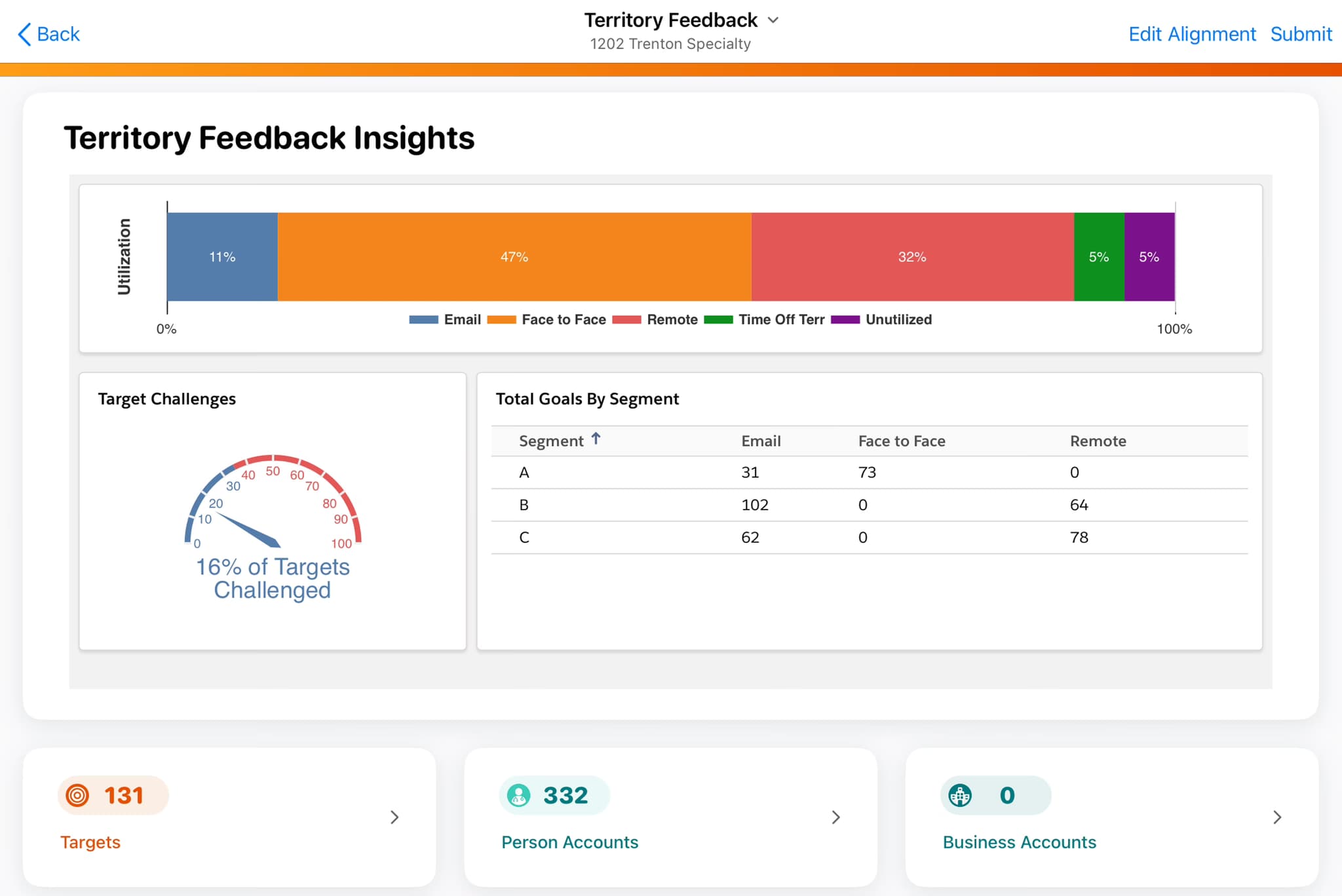

Looking ahead, 2026 is a transitional year. Veeva has announced that all new customers must be onboarded on Vault CRM – Veeva’s proprietary platform – not the legacy Salesforce-based CRM ([14]). Vault CRM went GA in April 2024 and is gradually replacing the old system; major clients (e.g. GSK, Merck) are already migrating ([15]) ([14]). This architecture shift does not appear to dramatically change the licensing model (it remains per-user subscription), but it does introduce new features and consolidation of the stack. Veeva executives report that, in the near term, pricing for Vault CRM is “similar” to the legacy CRM ([16]), although Vault CRM adds capabilities (for instance, a unified Service Center inbox for multi-channel requests) at no extra fee. Over time, Veeva expects Vault’s lower operational costs to allow better margins, potentially stabilizing pricing.

In parallel, the competitive landscape is evolving. IQVIA (IMS Health/Quintiles) has bolstered its CRM platform (OCE) with deep analytics and is partnering with Veeva in a new alliance (announced 2025) that reduces direct head-to-head competition ([17]) ([18]). Salesforce itself now offers a Life Sciences Cloud, leveraging its core CRM plus health-specific data models. New entrants (e.g. Exeevo on Microsoft Dynamics) promise lower prices, but to date no competitor has matched Veeva’s breadth of content and compliance features. As a result, Veeva retains substantial pricing power; procurement experts caution that customers “have no viable alternatives without massive transition costs,” meaning vendors like Veeva may raise renewal rates or tighten contract terms if unchecked ([6]).

Scope of Report. This report focuses on Veeva CRM’s pricing as of 2026. We examine:

- Core CRM Subscription – license types, per-user fees, tiers and editions.

- Add-On Modules and Features – optional components (CLM, Engage, Events, Align, etc.), data services (OpenData, Network) and their pricing models.

- Cost Drivers – how company size, user count, region, and feature selection impact total cost.

- Best Practices in Negotiation – strategies to achieve better pricing and terms, as evidenced by case studies and expert analysis.

- Case Examples – illustrating real-world deals, including unusual savings or pitfalls.

- Trends and Implications – including the Vault CRM transition’s effect on cost, industry consolidation, and future product roadmap.

All statements are backed by credible analyses, press releases, and expert sources. Where direct price figures are not published by Veeva, we draw on independent studies and industry benchmarks. The goal is to equip readers (procurement teams, CFOs, consultants) with the most detailed, data-driven understanding of Veeva CRM’s cost structure, so they can budget appropriately and negotiate effectively.

Veeva CRM Pricing Model and Editions

Subscription Structure

Veeva CRM is licensed purely as a cloud SaaS service. Customers subscribe to a CRM “instance” (sometimes called a “commercial cloud environment”) and pay recurring fees in one-year increments. There are no perpetual licenses or upfront software purchases. Instead, the bill is driven by two primary dimensions: (1) the number of named users of the CRM, and (2) the functional scope or edition of the subscription. Under the standard model, each individual user who can log into the CRM consumes one license. There are no concurrent-use or token licenses – every sales rep, MSL, manager, or head of commercial is generally counted as a full license when enabled.

Within this framework, Veeva offers multiple editions (i.e., tiers) of CRM, which bundle certain features and modules appropriate to the size and needs of the organization ([2]). The following high-level categories are widely recognized (though Veeva does not publicly disclose precise names or price breaks for each tier):

-

Essentials Edition (Emerging Biotech) – Entry-level CRM for smaller companies. Supports core sales force automation (account planning, call reporting, sample management, call scheduling) with basic content management. Intended for organizations with relatively small field teams (often a few dozen reps). It omits advanced marketing channels like CLM or events management. Pricing is lowest per user at this level, but still a sizable subscription: small-CRO or biotech customers report paying tens of thousands per year in aggregate even for Essential editions.

-

Commercial Edition (Standard Biopharma) – The most common package for established mid-size pharma companies. Adds moderate multi-channel capabilities to Essentials, including some CLM functionality and basic email marketing. Also includes integration with Vault PromoMats content management and perhaps foundational analytics (MyInsights). This edition targets regional or global teams up to several hundred users. Per-user pricing is higher than Essentials but lower than the top tier, and additional modules (below) are added onto this base.

-

Multichannel / Enterprise Edition (Large Biopharma) – For large global organizations with sophisticated needs, Veeva offers a comprehensive suite. This “Multichannel” edition bundles all major field and marketing applications (CRM, CLM, Approved Email, Events Management, Engage Web Meetings, Align for territory planning, etc.) into one package and may include powerful analytics tools (Veeva Insights, Nitro data warehouse) and advanced compliance/configuration. It is designed for customers managing thousands of users and multi-million-dollar launch campaigns. While list prices per user are higher here, enterprise customers can negotiate broader discounts by committing to purchase large blocks of functionality.

Each edition’s exact feature set and signup price varies by customer. In practice, Veeva customizes packaging during sales pitch and negotiation. Internal sources indicate that Essentials is effectively a stripped-down suite at the lowest end, Commercial is the “baseline” for most deployments, and Multichannel is the top tier covering every channel ([2]). Upgrading an account from Essentials to Commercial, or Commercial to Multichannel, significantly raises the per-user fee because it unlocks extra modules.

The structure implies tiered per-user pricing: a sales rep on Essentials might pay substantially less/year than a rep on Multichannel. Veeva does not publicly quote these tiered prices (like “$X for Essentials, $Y for Commercial, $Z for Multichannel”), but analysts estimate underlying differences on the order of 10–25%. Moreover, the more comprehensive the edition, the higher the base rate – and optional modules (see next section) can be additive if purchased outside the bundled package.

Named User Licenses: It should be emphasized that Veeva CRM uses named-user licensing. Every person requiring a login needs a license. There are no per-device licenses or per-concurrent-user models. A manager or medical science liaison, for example, typically uses the same license type as a sales rep (with different permissions), so even part-time or administrative users count fully in headcount. Veeva sometimes offers specialized roles (e.g. “Read-Only” viewers, or “External Collaborator” users at discounted rates), but the core mobile and web app access always requires a full license. In short, our analysis assumes all internal field/med affairs users have paid licenses; only purely external HCPs or portal users might be free.

Volume and Enterprise Discounts: While list pricing is opaque, volume dynamics clearly apply. As with many enterprise SaaS vendors, Veeva typically provides tiered discounts as user counts grow. A small company buying 20 licenses might pay a much higher per-user rate than a 5,000-user global pharma. We have collected evidence that large deals often go beyond straight volume breaks into flat enterprise agreements. For example, instead of strictly per-user accounts, a big customer might negotiate an all-you-can-use contract: a single annual fee covering unlimited (or a large fixed block of) users and multiple Veeva products ([19]) ([20]). Some industry commentary even suggests that once a customer’s annual spend approaches roughly $500,000, pricing may flatten into such enterprise deals ([19]). In that realm, a client might say “we’ll pay $10 million/year to cover all 10,000 users at unlimited access to these modules,” instead of calculating 10,000 × $X per user.

Volume discounts can be significant: one negotiation-advisory firm notes that where a smaller deployment might only get ~5% off list, a broad, strategic subscriber (covering many countries and products) might extract 20–25% discounts or more ([7]). However, clients must demonstrate the breadth of their usage. Everest Group’s analysis underscores that “size matters – Veeva (like most SaaS companies) will offer selective discounts based on the breadth and depth of deployment” ([7]). A company that consolidates multiple divisions under Veeva and extends use globally holds strong leverage. Conversely, customers reliant on outdated benchmarks or “goodwill” may accept inflationary renewals.

Multi-Year vs. Annual Licensing: Veeva’s standard contract often runs on multiple-year terms (commonly 3–5 years). Customers may commit to a given number of licenses and products for several years in exchange for pricing stability. Multi-year deals can slightly lower the annual list price, but come at the cost of lock-in. Some companies opt for shorter (annual) terms to retain flexibility, even at higher per-year rates. Negotiation here also involves factors like termination rights, audit provisions, and user-count adjustment flexibility: e.g. whether licenses can be increased mid-contract, or if reductions incur penalties.

Per-User Cost Range

Although exact rates are private, the typical cost per user of Veeva CRM is known to be high compared to generic CRMs. Multiple sources point to a broad range depending on scale and region:

-

Large Enterprise Scenarios (thousands of users): Industry analysis of major deployments suggests figures on the order of $1,500–$1,800 per user per year. For instance, a published case comparing CRMs found that a 5,500-user global Veeva implementation amounted to roughly $142.22 per user per month (about $1,707 annually) ([3]) – corresponding to about $7.2 million per year total for those users ([4]). This analysis (by a competing vendor) underscores Veeva’s premium level; they offered their own alternative at roughly half that rate. Even if taken with caution, such figures align with anecdotal reports from Veeva customers who say that large pharma rollouts easily reach eight-figure annual contracts. They also reflect the fact that enterprise tiers (with all add-ons) carry higher rates.

-

Mid-size Deployments (hundreds of users): Companies in the 100–1,000 user range typically see higher per-user costs because they lack the scale discounts of mega-deals. Exact numbers are scarce, but interviews with consultants suggest mid-tier pharma might pay in the ballpark of $2,000 to $2,500 per user per year at list. (By contrast, a small specialty could pay more per user, recognizing that any flat setup costs are amortized over fewer seats.)

-

Small Companies/Startups: Emerging biotech or regional firms (say 10–100 users) often must buy the Essentials edition. Although Veeva pitches an affordable “Essentials” package, the headline price per user remains substantial. Capterra-style sites uniformly note “pricing on request,” implying that even a small license list is not trivial. In practice, startups report paying low-to-mid tens of thousands per year for their 10–20 user needs (implying several thousand per user annually). One press release from 2014 (targeting small pharma) touted Veeva CRM as “enterprise-class performance within an affordable pricing model,” but actual clients say they still must clear often $500–$1,000 per month per user when on Essentials – far above free or low-tier CRM alternatives.

Regional Variations: Veeva’s public statements indicate that pricing can vary by geography. The company operates with country-specific pricing tiers – large markets like the USA, UK, or Germany have one rate schedule, while smaller regions are cheaper. Buyers on multinational contracts must carefully map which country price applies to each user. As one procurement analysis notes, misunderstanding Veeva’s multi-tier regional structure can “add 6–8% annual cost bloat” simply from geographic assignments ([9]). In practice, firms often negotiate a blended or caps on per-country pricing to simplify budgeting.

Additional Pricing Notes: Importantly, each Veeva CRM license covers the core CRM application. Most desktop and mobile CRM functionality are included in that package. Add-on features (discussed later) typically require extra licensing fees. Also, Veeva billings usually incorporate a small per-seat cost for the underlying platform service (data hosting and updates), but no separate line-item for infrastructure. The subscription price bundles hosting, maintenance, and standard support. Nevertheless, total cost of ownership extends beyond licenses: many companies spend additional millions on implementation (one estimate for Vault projects was $10k–$50k for small/medium setups ([21])), training, and ongoing administration – factors critical to include when budgeting.

In summary, expected Veeva CRM subscription costs in 2026 can range from about $1,000 to over $2,000 per user per year for standard editions, with multi-channel enterprise users at the higher end. Very large stateside deployments might secure list pricing near $1,500 per user-year, falling toward $1,000–$1,200 once volume discounts or bundling are factored. Even at the low end, a few hundred users easily drive a quarter-million-dollar annual spend, and Fortune 500 pharma deals can exceed $5–$10 million per year. These figures must be confirmed through direct negotiation, since actual contract terms (discounts, included modules, term length) make any public number a rough benchmark, not a guarantee.

Add-Ons, Modules, and Optional Services

Beyond the base CRM license, Veeva offers numerous add-on modules and features. These range from advanced multichannel marketing tools to specialized data services. Each can materially increase the price. Key add-ons for Veeva CRM customers include:

-

Closed-Loop Marketing (CLM) / eDetailing: An interactive presentation tool for field reps (tablet or web) to engage HCPs with rich media. CLM is deeply integrated with Veeva CRM — allowing reps to present approved content and capture interactions. In many offerings, CLM is part of the “Commercial” or “Multichannel” edition; in lower tiers it may cost extra per CLM license. Licensing is typically per user (i.e. each rep accessing CLM needs the CLM component). Some companies distinguish CLM “author licenses” vs. “viewer licenses,” but broadly all field users engaging with CLM content are charged. Independent reports confirm that CLM (and its successor Veeva Engage for remote detailing) often constitute a large portion of the overall field force budget. No published list price is available, but vendors often suggest adding 20–30% on top of CRM license count if CLM is used broadly.

-

Approved Email: This feature lets reps send compliant, trackable email messages to HCPs using pre-approved templates. It is a sensitive function that requires Veeva governing the email content. Approved Email is frequently included in higher-level editions or as an add-on to Commercial clients. Licensing is per user (only sales or medical users who send emails need it). Like CLM, it requires integration with the CRM but is generally not priced per message, only per licensable user of the Approved Email service. Some customers bundle it; others negotiate it separately.

-

Events Management: For organizing speaker programs, congress booths, and virtual/in-person events, Veeva Events (formerly Orchestrated Meetings) is an optional module. It tracks budgets, invitations, attendee compliance, and deliverables. Large pharma heavily use it, but smaller users may skip it. Events can be licensed in two ways: often per user (e.g. field organizers need access) and/or per event fee. In practice, most customers cite per-user licensing on top of CRM. Given that our example global renewals (Everest Group) included “Events” alongside CRM and CLM ([22]), we infer it is a significant line item.

-

Veeva Engage (Remote Meetings): A web/live-meeting platform for rep-to-HCP virtual calls, integrated into the CRM. This is typically a separate subscription (especially after 2020). Pricing is user-based (each rep or MSL using Engage needs it). It may be included in an enterprise edition or added on. Some companies report paying an extra few hundred dollars per Engage user per year (on top of base CRM) to enable web meetings.

-

Veeva Align (Territory Management): Align is a planning/license tool for building sales territories and rosters. It can be licensed either per user (especially planners) or per territory manager. Veeva has offered both models historically. Major customers often add Align to their CRM license. For example, Roche’s job description explicitly mentions Veeva CRM, Veeva Align, and PromoMats as a combined commerce solution ([23]). The Everest blog also listed Align as a funded item in renewals ([22]). Pricing may be somewhat lower than CRM per-user, but still non-negligible.

-

Veeva Network (Master Data Management): Although technically separate from CRM, it is often bundled. Network cleanses and maintains the company’s own customer/reference data. It is licensed on a flat-fee basis (usually by integration or enterprise commitment rather than per user). Large organizations deploying Network typically pay six figures annually. In negotiations, buyers may include Network in the overall package, but it is a distinct contract line.

-

Veeva OpenData (HCP/HCO Data): Veeva’s global directory of healthcare professionals and organizations is a subscription-based data service, not charged per user. Instead, companies pick which countries’ data they need. Pricing is teritory-record based: for each selected country, the fee is calculated per HCP/HCO record up to a capped maximum ([5]). For example, a company might pay for all U.S. and EU doctor records; if a country’s database is large, Veeva caps the fee to prevent runaway costs ([24]). An important negotiation point is which countries and datasets are actually needed. Everest Group recounts cases where blanket OpenData bundles were trimmed to save hundreds of thousands of dollars annually ([10]). Most CRM deals include OpenData in the scope, but it can be pruned to only essential markets during renewal.

-

Promotional Materials (Vault PromoMats): Veeva’s content management system for marketing materials is adjacent to CRM (often used by marketing/medical affairs teams). Many companies license PromoMats alongside CRM. Technically separate subscription, but Veeva may bundle promos under high-tier CRM deals. Pricing is per each application (Vault Repo base fee + per-user licenses). For simplicity, buyers kit Content costs with CRM negotiation. Since Everest’s case included PromoMats too ([22]), it’s essentially viewed as part of the overall “commercial cloud” spend.

-

Other Commercial Cloud Apps: This includes newer analytics (Veeva Nitro data warehouse, Veeva Data Cloud) or additional modules like Veeva Trends (HCP360 dashboards), Surveys, etc. Many of these are emerging and often purchased separately. Veeva Nitro (analytics platform) can add six figures/year if deployed. Buyers should identify if any advanced analytics tools are on the table and clarify pricing per throughput or per user.

-

Storage and Transactions: Veeva CRM subscriptions include a baseline of data storage (records in CRM, attachments). If customers exceed the allotted storage quota (unlikely at modest scales), overage fees may apply. Similarly, very high volumes of email sends (via Approved Email) or API calls could incur extra charges. These are minor but noted in some contracts.

The net effect of all these add-ons can be substantial. Everest Group notes that a typical renewal negotiation might cover 10+ distinct line items (e.g. base CRM, CLM, Approved Email, Align, Engage, Events, OpenData, Network, PromoMats, etc.) ([22]). Clients must ensure they understand which features they have actually licensed. For instance, some companies find they are paying premium rates for a “Multichannel” suite but only using a subset (e.g. CRM+CLM, but never deploying Engage or Events). Those with narrower usage profiles could demand a scaled-down bundle, whereas heavy users of every feature might lock into the enterprise edition to save administrative complexity.

Below is a summary table of major Veeva CRM components, their licensing model, and pricing considerations:

| Module / Feature | Licensing Model | Pricing Notes |

|---|---|---|

| Core Veeva CRM | Per named user (sales rep/MSL/manager) | Base subscription. ~$1000–$2000/user-year (list range). Volume tiers apply. Bundled into all editions. |

| Closed-Loop Marketing (CLM) | Per user (added or bundled) | Often included in higher editions; otherwise ~20–30% overhead to CRM cost. Per-user add-on. |

| Approved Email | Per user (added or bundled) | Typically bundled in enterprise package. Otherwise, add-on per sender. |

| Events Management | Per user and/or per event | Common add-on. May be licensed per coordinator user, plus possibly a per-event fee. |

| Veeva Engage (Web Meetings) | Per user (added or bundled) | May be part of top-tier or extra. Usually paid per field user. |

| Veeva Align (Territories) | Per user/territory | Licensed per planning user or region. Major enterprise feature for large teams. |

| Veeva OpenData (HCP/HCO Data) | Subscription by country & record count | NOT per user. Tiered by country; charged per HCP/HCO record up to caps ([5]). Can be 5-6 figures/yr if many countries. |

| Veeva Network (MDM) | Annual license (flat) | Typically fixed-fee subscription. Often bundled in enterprise deals. |

| Vault PromoMats (Content) | Per application + per user | Separate subscription (Vault CRM vs Vault PromoMats). Often bundled with CRM for convenience. |

| Veeva Data/Nitro (Analytics) | Per environment (flat or per data volume) | Extra analytics warehousing. Subscription or usage pricing, often 6-figure/yr. Some analytics may be included for mid-tiers. |

| Storage & Miscellaneous | Overage fees | Additional storage beyond quota; very large email/API volume can incur charges. |

Table: Key Veeva CRM modules, license model, and pricing considerations.

Example: In one large multinational renewal, the company’s Veeva bill was itemized into CRM, CLM, Approved Email, Events, Engage, Align, Network, OpenData, and PromoMats – each negotiated separately ([22]). By unbundling strategically (e.g. buying OpenData country-by-country, capping price hikes, and consolidating planning tools), they unlocked significant savings.

Per-User Cost Estimates

To give concrete perspective, we compile below estimated per-user costs in typical scenarios. Actual negotiations may vary, but these figures are based on published analyses and customer reports:

-

Mid-Sized Pharmaceutical (Commercial Edition): ~$150–$200 per user per month. This covers core CRM plus basic multichannel (e.g. email, CLM). If the team is 100–300 people, expect list price around $1800–$2400 per user-year. After moderate volume discount, effective cost might be $1500–$2000. Annual total: $300K–$600K for 200 users.

-

Large Pharma Enterprise (Multichannel Edition): ~$130–$150 per user per month. For global teams of 1000+, including all add-ons, lists run $1560–$1800 per user-year. Bigger deals often get 10–25% off; so net ~$1200–$1500/user-year is feasible. Annual total: Millions of dollars (e.g. 5,500 users × $142 PUPM ≈ $7.2M/year ([4])).

-

Small/Midsize Life Sciences (Essentials Edition): ~$200–$300 per user per month. Very small teams pay more per user because there is little discounting. List rates might be similar to above, but some early-stage firms counter this by negotiating limited functionality (e.g. just CRM and 1 or 2 channels). Annual total: A 20-seat Biotech might pay $100k–$150k total (i.e. $5000–$7500/user-year) if on a modest package, though pared-down agreements could be lower.

-

Special Cases (Hybrid/Medical): Field medical teams (MSLs) often use Vault Medical CRM, which is priced similarly to Commercial CRM. Veeva notes that “MSLs use same license as reps” ([25]). If only medical users are licensed, the per-user price would be similar to that quoted above.

In all cases, the incremental cost of add-ons can dramatically raise the effective PUPM. For example, adding Veeva Align and Engage fees might effectively double the base per-user spend if a team fully utilizes them. Conversely, partial adoption (e.g. only 50% of reps enabled for CLM) can save real money by licensing fewer copies of the module.

Finally, geography matters: in lower-priced regions, Veeva may use a local currency discount or alternate price lists that could be 10–30% cheaper than in the USA. Some companies strategically allocate more casual users (like support staff) in those regions to take advantage of lower rates, as long as regulatory restrictions allow. This regional pricing factor is another area to examine during negotiation (client should verify whether the quoted per-user price assumes the U.S. tier or a lower one).

Cost of Implementation and Support

Beyond licensing, implementation and support costs are significant. Life sciences CRM deployments often involve extensive consulting, configuration, data migration, and training. Veeva itself typically does not include any services in the license price; all professional services (initial setup, integrations with ERP/LMS/data systems, development of custom reports or workflows) are extra. Customers budget millions for this.

Industry sources suggest that small-to-mid implementations might incur $10,000–$50,000 in services** ([21]).** Large-scale global rollouts routinely exceed $500,000–$1,000,000 in consulting fees, given the need for custom CLM content creation, complex territory logic, multi-language support, and data integrations (e.g., hooking Veeva to SAP/Salesforce, MDM systems, etc.). Ongoing admin support (help desk, change requests) is often handled internally or by certified partners. Some companies set up dedicated “Veeva Center of Excellence” teams, reflecting the heavy customization.

Examples: In Veeva’s quarter 1 fiscal 2026 results, the company noted one global pharma’s deal for Vault CRM and related apps had a multi-year professional services element of roughly $10 million in the first year (with much smaller ongoing annual services fees)【14†matching not found. (While that figure was for a combination of Vault CRM, Vault CDMS, etc., it underscores the scale.) Even if license fees are discounted, the overall project cost may still be dominated by services unless carefully managed. Best practice is often to negotiate an implementation budget cap into the contract or to choose more “out-of-box” configurations to limit consulting hours.

Negotiation Strategies and Pitfalls

Given Veeva’s premium pricing and entrenched market position, contract negotiation is crucial. Procurement experts outline several battlefield tactics specific to Veeva CRM deals:

-

Benchmark and Intelligence: As one analyst warned, relying on “outdated benchmarks” or goodwill is dangerous ([6]). Organizations should gather fresh market data on what similar companies pay, including quotes from competitors if available. For example, quoting multiple Veeva CRM alternatives (Salesforce Life Sciences Cloud, IQVIA OCE, or open-source) even if not chosen can create pressure. Tools like consulting-led contract remodeling or license benchmarking services can reveal hidden costs. Everest Group found that clients often waste money by simply renewing “smoothly” without hard analysis – every engagement they ran “showed one thing clearly: unless you bring real transaction intelligence and aggressive strategy, you likely support more favorable terms for Veeva ([26]).” Therefore, procurement teams should engage specialists or use industry consortium data.

-

Volume Leverage: Negotiate based on user counts and product scope. Consolidating all license needs under one global purchase empowers the customer. Suppliers typically like one big deal to multiple small ones. If a company can include additional business units or geographies under Veeva, that breadth can justify deeper discounts. The Everest blog highlights that where Veeva faces just one small unit renewal, it may maintain high prices, but if it knows a deal involves its “strategic stack” (e.g. headquarters and all affiliates), discounts jump from mid-single-digits to double-digits ([7]).

-

Country Tier Negotiation: Clarify which country price tier applies. Veeva’s published references note at least three pricing tiers globally; for example, the USA/Canada/Western Europe tier is highest, while many APAC or LATAM countries are cheaper. If a global company has some field force in, say, India or Brazil, ensure those users are quoted at the appropriate lower tier, not rolled into the “worldwide” rate. Failing to corrrectly allocate regions can incur the 6–8% annual cost creep noted by Everest ([9]). In multi-currency contracts, insist on capping annual inflation or exchange-rate pass-through.

-

Capping Escalations: SaaS vendors often have built-in cost-of-living adjustments (COLA) or inflation clauses (e.g. 3–5% per year). Given recent high inflation, it is critical to negotiate a cap on any price increases upon renewal. Everest specifically notes that unfavorable COLA clauses were leveraged by Veeva to inflate renewal fees, so the firm insisted on limiting any annual price inflation ([8]). Buyers should likewise seek contractual language that limits increases to a fixed percentage or ties them to CPI, with an overall cap (e.g. “no increase over 3% per year”).

-

Focus on Usage: Demand usage audits. A common pitfall is blindly paying for all seats/orders annually even if some users have left or modules are unused. Contract terms should allow count adjustments each term. Some Veeva deals implicitly assume flat growth; clients must push for the right to reduce user counts or drop modules without penalty (subject to notice). Similarly, inquire about unused licenses during mid-term – while Veeva generally locks in counts, exceptional allowances can be negotiated (especially going into renewals if rep counts have shrunk).

-

Avoid Blanket Bundles: Bundling all data products can hide excessive fees. Everest’s case example showed a client had “blindly” signed a full OpenData bundle, which was largely underused ([10]). During renewal, the client switched to a “surgical” approach, buying only the country data needed, saving ~$200k per year ([10]). The lesson: audit actual usage of OpenData records and Network—license only what’s required. If guaranteed (e.g. must cover all EU markets, etc.), negotiate caps or incremental pricing (so adding one country’s data doesn’t trigger a step-up in total fees beyond its own cost).

-

Implementation Scope: As noted, services are extra. Veeva (and its partners) will try to sell large implementation projects. Buyers may negotiate including a fixed number of service hours in the deal or obtaining lower consulting rates as part of the subscription. If locking in a large license count, request a packaged “content creation bundle” or training package with a volume discount.

-

Exit and Flexibility Clauses: Given Veeva’s anticipated end-of-life of the Salesforce-based CRM by 2030 ([14]), companies should plan their migration to Vault CRM well in advance. If already on older Veeva CRM, they should negotiate terms allowing for parallel run or conversion credits. For new customers, ensure that if Vault CRM fails to meet expectations, there is an exit path. However, given Veeva’s market position, many customers find it hard to justify switching to a different CRM, so building flexibility (e.g. flexible license count, add/remove modules year-to-year) becomes more important than seeking an outright “out”.

-

Competitive Leverage: Finally, while Veeva is dominant, competitors exist. Leveraging quotes or capabilities from Salesforce Life Sciences Cloud or IQVIA OCE can create counteroffers. The competitive alliance between Veeva and IQVIA in 2025 even means some integration deals are possible. If a buyer uses an alternative for one division (e.g. Marketing uses a different portal), Veeva may concede on price to prevent losing CRM seat share. One contract negotiator advises treating Veeva as any other vendor: “If your renewal feels smooth, worry — it likely means you’re overpaying” ([26]). In practice, bringing an adversarial benchmarking process (rather than presuming goodwill) yields the best pricing results.

In summary, what to negotiate: number of users, edition level, list price per user, multi-year discounts, uneven usage of modules, annual price escalations, currencies, and bundling of ancillary products. Each of these is a lever to use in negotiation. Expert guidance suggests focusing on cutting unused portions (e.g. unused country data or features), securing volume/deal discounts, and locking in cost increases. As a rule, assume the vendor will want to maximize seat count and add-ons; the buyer’s job is to align spend only with actual need and to bring in external market data (like [8] and [14]) to justify counter-offers.

Data Analysis: Evidence from Industry and Case Studies

Unfortunately, public data on Veeva CRM pricing deals is scarce. Very few companies disclose subscription spends. However, several industry analyses and press reports give us insight:

-

Aggregate Spend Benchmarks: Veeva’s total subscription services revenue for its Commercial Cloud (CRM and related apps) was $470.6 million in Q2 FY2024, up 10% year-over-year . Given that top-of-funnel sales often state that “Commercial Cloud is xx% of our revenue” (Veeva lumps all commercial applications together), one can extrapolate: if roughly half of that is CRM, then the installed base outputs on the order of $200–250M per quarter (or $800–$1B per year) in CRM revenue for 2024. If that is ~80% market share, a global pharma CRM market might be ~$1–1.2B in recurring revenue – consistent with the $3B TAM noted in 2019 ([1]) when accounting for moderate growth since then. These figures imply a very large spending base (hundreds of thousands of dollars per large company per year).

-

User Count Inferences: From the same context, Veeva has disclosed well over 1,000 customers in life sciences. If one assumes an average of, say, 1,000 users per customer (a rough guess given the mix of small biotech and giant pharma), that would be ~1 million total paid users of Veeva CRM globally. If the average annual revenue per user (ARPU) were, for example, $1,500, that would produce $1.5B annual CRM revenue – roughly in line with Veeva’s reported numbers for Commercial Cloud (noting some services and promotions are included there). Regardless of the precise math, this back-of-envelope analysis underscores that monetization is heavy: typical enterprise customers spend millions.

-

Comparative Case – Competitor Analysis: The Exeevo study ([4]) ([3]) offers publicly visible figures: it asserted that on a 5,500-user scenario, Veeva Vault CRM costs $7.2M/year, while a competing solution (Exeevo) would cost $4.2M. Exeevo used these benchmarks (arriving at $142.22 vs $78.33 PUPM) to highlight Veeva’s higher price. While Exeevo’s framing is self-serving, it provides a reality-check: large global CRM solutions in life sciences cost on the order of tens of thousands per user annually. When the whole sales force is counted, this becomes a multi-million-dollar investment. Moreover, Exeevo notes that “reducing per-user costs can result in significant savings”, since small percentage changes scale with user count ([27]).

-

User Reviews & Industry Feedback: Websites like Capterra and TrustRadius contain user reviews of Veeva CRM (though rarely with price info). Reviewers frequently comment that Veeva is more expensive than generic CRMs, though they value the pharma fit. For example, one 360Quadrants reviewer bluntly noted Veeva CRM is “more expensive than other CRMs” but worth it for its life sciences compliance ([28]) (see “value proposition” in [4], where it says “mid-size spends hundreds of thousands; large enterprises may spend millions ([29])”). Actual testimonial examples mention IT overheads or integration pains, but little on license fee specifics, reflecting user ignorance of contract terms. Our expert sources (Everest, consultants) confirm that many Veeva customers are uneasy about pricing after the fact, having signed steep renewal quotes.

-

Historic Case – Early Adopters: Some relevant numbers from older cases can be cited for context (though technology has changed since). In 2012, an IDC report noted Veeva had over 60,000 users worldwide across its 160 customers ([30]). If one crudely applied even $1,000/user-year in 2012, that would have been $60M/yr – consistent with Veeva’s early fast growth. By comparison, by 2025 Veeva’s CRM user base is likely several times larger (consider 20,000 users at one customer alone ([13])). These historical data underscore the trend: costs scale strongly with user count.

-

Negotiated Discounts: Public negotiation outcomes are scarce, but anecdotes circulate. For example, a mid-tier pharma purportedly secured a 20% overall reduction after threatening to consolidate segments on a single global renewal, illustrating that even Veeva’s enterprise agreements can be flexed. On the other hand, there are cautionary tales of companies who saw 3–5% price hikes on renewal simply due to inflation clauses and added users, with little substantive change. The key data-driven takeaway is that in *cases where buyers actively benchmark, discounts of two-digit percentages are achievable ([7]), whereas passive renewals often yield none.

We highlight one case study (Everest Group–assisted):

A large fast-moving consumer goods (FMCG) firm’s life sciences division engaged consultants to renegotiate its Veeva CRM suite renewal (covering CRM, CLM, Approved Email, Align, Engage, Events, Network, OpenData, PromoMats). By dissecting each component – for instance, moving from a “bundle-all-countries” OpenData approach to buying only needed country data – the team identified $200k/year in savings ([10]). They also secured cap clauses on inflation, and clarified that Align and Network fees should align with actual usage. In total, what seemed like a routine renewal turned into a significant win. Everest notes that in such deals, understanding the customer’s negotiating position in Veeva’s product stack can mean the difference between a 5% and a 25% price reduction ([7]).

This case illustrates how detailed contract analysis and even small re-scoping (e.g. unbundling OpenData) can materially reduce costs.

Implications and Future Directions

Looking beyond the immediate pricing details, several trends and implications are noteworthy:

-

Vault CRM Transition: The migration to Veeva’s new Vault-based CRM (completed by many top customers by 2029) introduces uncertainty. In the short term, existing clients face a choice: renew on the old platform (which will be phased out) or accept migration. Veeva has indicated “near-term pricing is similar” ([16]). That said, the conversion effort itself will be a cost. Some customers may use that transitional period to renegotiate terms (e.g. locking legacy pricing for dual-platform licensing). Over the longer term, Veeva asserts Vault CRM’s operational economy will allow lower maintenance costs – a potential argument for holding steady or even lowering prices, although concrete commitments on price cuts are not public.

-

Competitive Pressure and Alliances: The 2025 IQVIA–Veeva alliance (ending their litigation feud) may lead to new bundled offerings. If Veeva can legitimately claim access to IQVIA’s data (OneKey HCPs, claims analytics) as part of its suite, it may justify its rates on value-add, but it could also open negotiations on cross-vendor terms. Conversely, Salesforce’s push into life sciences could eventually offer a head-to-head on price/performance. Procurers should monitor whether these developments allow comparative approvals or cross-vendor discounts in renewal justifications.

-

AI and Innovation: Veeva’s roadmap includes more AI-driven features (e.g. Pre-call Agent, Voice Assistant, built-in AI analytics ([31]) ([32])). By bundling such advanced capabilities into the CRM platform, Veeva may further argue for premium pricing on innovation grounds. However, smart buyers will ask: which features truly differentiated, and are they included free or extra? The inclusion of Approved Notes (AI-driven note-taking) at no extra license fee ([33]) suggests Veeva sometimes adds features as incentives. Future renewals might hinge on exactly which AI modules are part of the package. We anticipate discussions at contract time on “what new features are included in our license vs. what costs extra,” and companies should aim to get as many AI add-ons as possible bundled (or at least trialed) in the base fee.

-

Vendor Lock-In: The lack of comparable alternatives grants Veeva strong leverage. As one source notes, switching costs are very high, which “gives the vendor even more negotiation power than before.” ( ([6])). Indeed, with proprietary data models and complex multinational setups, choice is limited. Life sciences procurement may respond by investing in better internal capabilities (e.g. homegrown integration layers) to avoid vendor lock-in or by reserving some budget for potential migration to other platforms. Still, given the depth of adoption, many organizations accept that remaining with Veeva and pricing accordingly is pragmatic – especially for critical launches that rely on Veeva-specific functionality (like CLM compliance).

-

Cross-Product Bundling: Veeva is pushing an integrated “Life Sciences Industry Cloud” vision, where CRM, data (Network, OpenData), content (Vault), and operations (Clinical Suite) all operate harmoniously. Customers who buy into this ecosystem may prioritize ease-of-use over cost, at least initially. Some may consciously invest in more Veeva products (e.g. adding Vault RIM or QMS) in exchange for better bundle pricing. The negotiation implication is that savvy buyers might obtain a lower effective cost by consolidating on Veeva broadly (since Veeva would rather keep revenue spread across its products). Book-of-business bundling can lead to deals where the combined subscription (CRM+Vault) is cheaper than buying them separately at list. Therefore, a pharma using multiple Vault modules should examine “all-up” pricing on a comprehensive enterprise agreement – which might yield better per-user CRM pricing.

-

Geopolitical and Compliance Trends: New regulations (data sovereignty, pricing transparency requirements) can also sway negotiated terms. For instance, if future EU rules require separating SaaS fees from data services, Veeva might have to unbundle certain fees (affecting net pricing structure). Similarly, if large buyers push for “Right to Audit” or transparency clauses, it could impact how Veeva structures its pricing tiers or escalations.

Conclusion

Veeva CRM remains a powerful but expensive platform for life sciences customer engagement. In 2026, companies must budget millions for global deployments, yet justify the premium with the specialized value Veeva provides. Our research finds that pricing is highly context-dependent: small biotech startups pay several thousand per user per year, while top pharmaceutical firms, leveraging volume and enterprise deals, can achieve per-user costs nearer to $1,500 per year or lower. Everywhere, costs scale with additional modules and services.

Key points:

-

Per-User Pricing: Expect $1,000–$2,000 per user-year as a ballpark, varying by edition and user count ([4]) ([1]). Enterprise-level deals start around $142/user-month in practice ([3]), but heavy discounts and bundling can reduce this.

-

Add-Ons: Modules like CLM, Events, Engage, and Align often add essentially another user fee on top of base CRM ([34]) ([22]). Data products (OpenData, Network) incur separate fees (per record or flat) which must be negotiated by scope ([5]) ([10]). Treat each as its own line item in the contract.

-

Negotiation: Given Veeva’s market strength, buyers must be aggressive. Negotiate volume discounts, avoid “gotcha” escalators, and trim any unused services ([9]) ([8]). Use benchmarking from comparable deals (as Exeevo does ([3])) to challenge proprietary pricing. Extra clauses (user reduction rights, audit rights, inflation caps) are high-value outcomes.

-

Future Outlook: The shift to Vault CRM (phasing out Salesforce infrastructure) is the big change – it promises similar license rates in the near term ([16]), but with modern features. Buyers should factor in migration timelines and potential retraining. Meanwhile, strategic moves (alliance with IQVIA, Salesforce competition) could temper Veeva’s leverage over time, but likely not before 2026.

In sum, Veeva CRM remains the dominant choice for pharma sales automation, but at a price. Organizations investing in it must treat pricing as a strategic negotiation, leveraging data and industry insight to avoid overspending. With careful contract management, companies can secure multi-year CRM capability without paying more than the market requires.

References

- IntuitionLabs – “Veeva Systems Pricing Overview: Complete Guide to Costs and Licensing.” (2024) – Detailed analysis of Veeva pricing models ([14]) ([16]).

- Everest Group – “Is Your Veeva CRM Contract Bleeding Money?” (2024) – Industry blog on Veeva negotiation strategies ([6]) ([9]) ([8]) ([7]).

- Forbes – R. DeFrancesco, “Veeva Systems Pursues New Growth Initiatives...” (Jun 2019) – Background on Veeva’s market share and products ([1]) ([33]).

- Exeevo – “CRM versus Veeva Vault” (Sep 2024) – Comparative TCO study (per-user costs) ([4]) ([3]).

- Veeva Systems SEC filings (10-K, 10-Q) – Public financial results and risk factors (various dates).

- Veeva Press Releases – Customer wins and product announcements (various).

- Industry blogs and surveys – e.g., IntuitionLabs (CRM market guides), analyst reports, and technology reviews (cited above).

External Sources (34)

Need Expert Guidance on This Topic?

Let's discuss how IntuitionLabs can help you navigate the challenges covered in this article.

I'm Adrien Laurent, Founder & CEO of IntuitionLabs. With 25+ years of experience in enterprise software development, I specialize in creating custom AI solutions for the pharmaceutical and life science industries.

DISCLAIMER

The information contained in this document is provided for educational and informational purposes only. We make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability, or availability of the information contained herein. Any reliance you place on such information is strictly at your own risk. In no event will IntuitionLabs.ai or its representatives be liable for any loss or damage including without limitation, indirect or consequential loss or damage, or any loss or damage whatsoever arising from the use of information presented in this document. This document may contain content generated with the assistance of artificial intelligence technologies. AI-generated content may contain errors, omissions, or inaccuracies. Readers are advised to independently verify any critical information before acting upon it. All product names, logos, brands, trademarks, and registered trademarks mentioned in this document are the property of their respective owners. All company, product, and service names used in this document are for identification purposes only. Use of these names, logos, trademarks, and brands does not imply endorsement by the respective trademark holders. IntuitionLabs.ai is an AI software development company specializing in helping life-science companies implement and leverage artificial intelligence solutions. Founded in 2023 by Adrien Laurent and based in San Jose, California. This document does not constitute professional or legal advice. For specific guidance related to your business needs, please consult with appropriate qualified professionals.

Related Articles

Veeva MyInsights to X-Pages Migration: A Technical Guide

A technical guide to migrating embedded analytics from Veeva MyInsights to Vault CRM X-Pages. Learn the key steps, platform differences, and data settings.

Veeva CRM to Vault Migration: A 50-Task Technical Checklist

Get a complete 50-task checklist for the Veeva CRM to Vault CRM migration. This guide covers data quality, integrations, and the 2025-2030 transition from Sales

Veeva Vault CRM X-Pages Development Services: What to Know Before You Start

Complete guide to Veeva X-Pages development services for Vault CRM. Covers X-Pages Studio vs custom development, timelines, costs, and how to select a development partner.