AlphaSense: How the AI Market Intelligence Platform Works

Executive Summary

AlphaSense is a leading AI-powered market intelligence and research platform used by thousands of enterprises worldwide. Since its founding in 2011, AlphaSense has combined advanced natural language processing (NLP) and generative AI with a vast library of premium business content (company filings, earnings transcripts, broker research, news, trade journals, and more) to enable analysts, strategists, and consultants to quickly uncover insights from an otherwise overwhelming information landscape ([1]). AlphaSense today claims a customer base of over 6,000 organizations (including 88% of the S&P 100 and leading financial institutions, consultancies, and corporations across industries) and has achieved rapid financial growth – surpassing $400 million in annual recurring revenue (ARR) as of early 2025 ([2]).

The platform’s core value proposition is AI-driven search: users input natural-language queries and AlphaSense’s proprietary search engine combs through hundreds of millions of documents to surface relevant, analyst-grade insights almost instantaneously ([3]) ([1]). Recent generative AI innovations (“Generative Search” and “Generative Grid” launched in 2024–25) allow users to get synthesized answers and summary tables from large document sets, complete with direct citations to sources ([3]) ([4]). Across independent review sites and case studies, users praise AlphaSense for its speed, “intuitive” search, and comprehensive content ([5]) ([6]). For example, one analyst noted that AlphaSense “saves hours of manual research” by instantly finding insights from earnings calls, filings and news ([6]). Large consultancies report that AlphaSense’s unified platform (combining filings, transcripts, news and proprietary research like broker reports) produces “deeper, more comprehensive” analyses and “7× more” relevant results than legacy methods ([7]) ([8]).

At the same time, some users note a steep learning curve and occasional information overload. Reviewers frequently cite interface complexity and the difficulty of filtering through vast result sets as drawbacks ([9]) ([10]). Several reports mention frustrations with fine-tuning searches or refining results (“navigating extensive data can be challenging” ([9])). Nonetheless, average satisfaction scores are extremely high. On G2, AlphaSense holds a 4.6/5 user rating (based on hundreds of reviews) ([11]), and Gartner/TrustRadius data give it a glowing 9.5/10 overall score ([12]) — far outperforming many traditional alternatives. In sum, the evidence indicates AlphaSense is regarded as a state-of-the-art market intelligence tool that significantly accelerates research workflows, albeit with some complexity trade-offs for new users.

This report provides a comprehensive analysis of the AlphaSense platform: its technology, data coverage, features, user experience, and market impact. We review AlphaSense’s history and growth, detail its key capabilities (AI/NLP search, content integration, generative tools, collaboration, etc.), and summarize independent assessments and user reviews. We also compare AlphaSense to alternatives (e.g. Bloomberg, Factiva, S&P Capital IQ) and include several real-world case studies (from consulting firms, corporate strategy teams and more) illustrating how organizations leverage the service. Finally, we discuss broader implications for the future of market intelligence research in the AI era, drawing on quantitative metrics and expert commentary throughout. All factual statements are supported by cited sources, including peer reviews, press releases, and industry analyses.

Introduction and Background

In a data-driven economy, market intelligence – the timely gathering and analysis of information about companies, industries, and macro trends – is critical for strategic decision-making. Corporate strategists, financial analysts, and consultants must monitor an ever-growing deluge of content (SEC filings, earnings transcripts, sell-side research reports, news articles, journal publications, patent data, etc.) to identify opportunities, risks, and inflection points. Traditional research methods (manual Google searches, email archives, fragmented databases) have proven insufficient in scope or speed. This has led to the rise of specialized market intelligence platforms that aggregate diverse content and provide advanced search capabilities.

AlphaSense, founded in 2011 and based in New York City, positions itself as a next-generation AI-driven solution to this challenge ([1]). According to the company, its mission is to “empower organizations to make data-driven decisions with confidence” by leveraging artificial intelligence and NLP to unlock insights buried in unstructured documents ([1]). As one summary puts it, AlphaSense is “a search engine for market intelligence” that “transforms how decisions are made by the world’s leading corporations and financial institutions” ([13]) ([1]). The platform is cited as being “trusted by over 2,000 enterprise customers” (as of 2021) ([1]) and, more recently, over 6,000 enterprises ([2]).

AlphaSense’s growth has been fueled by venture investment and strategic acquisitions. Key milestones include a 2022 merger with Sentieo (a startup providing a similar investor research tool suite) ([14]), and the 2024 acquisition of Tegus (a provider of expert call transcripts for thousands of companies) ([15]).On the funding front, AlphaSense’s valuation has soared: a $150 million Series E in 2023 placed it at $2.5 billion ([16]); by mid-2024 a larger $650 million round lifted the valuation to $4.0 billion ([17]). In March 2025 the company announced it had exceeded $400 million ARR ([2]). These figures underscore that AlphaSense is now a well-established leader in the market intelligence sector.

Alongside its financial ascent, AlphaSense has expanded its organizational footprint. As of 2025, the platform’s staff exceeds 1,000 employees across offices in the U.S., UK, Finland, Germany, India and beyond ([18]) ([12]). Its customer roster includes “88% of the S&P 100” ([19]) ([2]), all of the largest U.S. banks and consultancies, and numerous Fortune 500 companies across sectors such as technology, healthcare, energy and industrials ([19]) ([20]). AlphaSense’s brand has become synonymous with the AI-driven intelligence stack for enterprise research, often ranking at the top of industry surveys (e.g. #1 in Customer Satisfaction for Financial Research on G2’s summer 2024 report).

In this context, we examine how AlphaSense works and how it is perceived by its users and industry observers. We begin with an in-depth look at the platform’s technical capabilities and content coverage, proceed to analyze user feedback and performance data, present illustrative case studies, and conclude by considering the implications of AlphaSense’s approach for the future of market research.

Platform Architecture and Features

AI-Powered Search and Navigation

At its core, AlphaSense provides an advanced search interface that uses natural language processing (NLP) and machine learning to retrieve relevant documents and insights. Unlike keyword-based search engines, AlphaSense’s search can interpret queries more like a human would. The platform’s built-in intelligence (often described as “AI-driven search”) automatically understands synonyms, context, and financial terminology to match queries against its corpus ([3]) ([21]). For example, a query for a company name will also surface related terms or tickers; a thematic query like “increasing that prompted” might catch variations like “surged” or “climbing” through semantic understanding. Users report that this makes the platform remarkably effective at finding relevant information efficiently. One Beta user noted that AlphaSense’s search is “incredibly intuitive, and the Smart Synonyms feature ensures nothing is missed,” saving “hours of manual research” ([6]).

AlphaSense’s search interface is web-based and highly responsive. Users can construct searches through a keyword bar (using Boolean logic like quotes, AND/OR, etc.) and then refine results with filters for date range, document type (e.g. transcriptions, filings, news), source, geography, and even a custom “Company Topics” taxonomy. According to the company, the platform lets analysts “search across 2,000+ premium business data sources including SEC filings, earnings calls, broker research, business journals, news & more” ([22]). The results page presents findings sorted by relevance (or date), with highlighted excerpts and metadata for quick scanning. Users can also click through to full documents or use built-in annotation tools to clip and share snippets with colleagues ([23]).

Navigation is designed for productivity. Multiple tabs and a customizable dashboard allow users to monitor companies, industries or topics via saved searches and alerts. “AlphaSense’s Collaboration tools allow you to annotate, clip, and share research with your team to save time and maximize efficiency,” as one official overview notes ([23]). Real-time alerts (‘smart alerts’) notify subscribers of new developments (SEC filings, call transcripts, news events, etc.) for watched companies. The platform also includes visualization features: for example, it can chart transcript sentiment or display summary metrics in dashboards. According to the official description, users can “see a single view of the industries, companies and themes you’re following with a fully-customizable dashboard, tailored to fit your research process” ([24]).

Behind the scenes, AlphaSense’s search infrastructure is powered by specialized financial and domain-specific AI models. The platform employs deep learning techniques to parse complex documents and even extract tables, charts and figures. One notable innovation is AlphaSense Sentiment, a proprietary deep-learning sentiment analysis model trained on 10+ years of hand-labeled earnings calls ([21]). This model is integrated into the platform to highlight phrase-level positive/negative sentiment in transcripts. Upon release, AlphaSense touted this as “the market’s first and only intelligent sentiment analysis capability for financial language”, enabling users to automatically track which companies have the largest sentiment shifts or most extreme positive/negative comments on their calls ([21]) ([25]). In practice, an analyst could, for instance, filter all transcripts in their corpus to find “companies with the largest sentiment score shifts from the previous quarter” ([25]) and then drill down into the exact words producing that shift. This demonstrates AlphaSense’s emphasis on not just retrieving documents, but extracting actionable signals from them via AI.

Generative AI Insights

In 2024–25, AlphaSense introduced a suite of generative AI features to further streamline analysis. Two flagship additions are Generative Search and Generative Grid ([3]) ([4]). Generative Search allows users to pose a question in natural language (e.g. “What impact did the supply chain issues have on Company X?”), and AlphaSense will synthesize an answer by searching across its entire content index. The output is an “analyst-grade” response that can include quoted excerpts from multiple documents, thereby acting like an on-demand research briefing. Unlike generic LLMs (which may hallucinate or lack access to current data), this system can ground its answers in real financial texts. According to AlphaSense, Generative Search works over “450 million searchable documents” for lightning-fast insight ([3]). Importantly, the answers include direct citations or link-backs to the source documents, ensuring transparency and allowing users to verify the information ([3]) ([25]).

Generative Grid extends this capability by querying multiple questions at once in a tabular format. Researchers can feed in a list of questions (e.g., “What was Company X’s revenue growth? How did it beat or miss estimates? What guided next quarter’s outlook?”) and Generative Grid will output a table where each row is a question and each column is a document or data field, filling cells with relevant extracted answers. The effect is to automate what would traditionally be an onerous multi-document review. AlphaSense claims users can “automate repetitive research tasks by asking multiple questions, summarizing findings, and comparing documents with unprecedented ease” using this tool ([4]). Customizable workspaces, sharing options, and export capabilities are built into Generative Grid, bringing powerful AI directly into analysts’ hands. Early user reactions to these generative features are positive: reviewers note that “features like the generative grid…help with analysis” by quickly comparing companies ([5]).

In implementing generative AI, AlphaSense has prioritized accuracy and enterprise readiness. All generative outputs can be traced back to source material (a critical requirement in finance and corporate settings). The press release emphasizes that answers are “analyst-grade” and “backed by the AI expertise of a trusted partner” ([3]) ([26]). Moreover, for security-conscious organizations, AlphaSense supports deploying its AI capabilities in customers’ private clouds ([16]), ensuring sensitive internal data can be included in queries under corporate control. These features underscore AlphaSense’s positioning of generative AI as a productivity booster for professional analysts, rather than a standalone chatbot.

Data Coverage and Content Sources

A major strength of AlphaSense is the breadth and depth of its content coverage. The platform aggregates an unusually wide range of data types, spanning both public and premium sources. According to company literature, the corpus includes:

- Regulatory filings (e.g. SEC 10-K/10-Q, S-1, etc.) for tens of thousands of companies.

- Earnings call transcripts and presentations, subscription transcripts (including expert interview transcripts) covering most public companies worldwide. (AlphaSense specifically highlights its Expert Insights library and the broker research service Wall Street Insights® as exclusive offerings ([27]).)

- Business news and press releases from major media outlets (e.g. Reuters, Bloomberg, Dow Jones Newswires, leading newspapers and journals) and niche trade publications.

- Broker research and analyst reports, including curated equity research from top banks and independent firms (through partnerships and its own collection).

- Industry reports and journals, including hard-to-find trade or academic publications.

- Alternative and private data such as patent filings, credit reports, product launch anthologies, and more. (For example, the Tegus acquisition will bring “financial data covering […] over 35,000 public and private companies”103†L8-L12.)

Official summaries often quantify this scale: as of early 2025, AlphaSense claimed a searchable database of approximately 450 million documents ([3]) drawn from “the world’s largest content universe” ([28]). It also states that it ingests millions of documents every year, ensuring near-real-time coverage of filings and news. In practical terms, this means an analyst querying the platform can reach far beyond what free Internet search would find – including specialized or behind-paywall content. For instance, the platform indexes transcripts of small-cap companies’ earnings, transcripts of expert industry interviews (often proprietary to research houses), and premium broker “stamped reports” that are not usually public. In one case study, a consulting manager praised AlphaSense for providing access to “expert call content” that helped identify potential clients in the theme parks sector without having to commission a new research call—demonstrating how exclusive content can save time and cost ([29]).

AlphaSense’s sources are regularly updated and searchable via rich metadata. The user interface allows filtering by publisher/source (e.g. filter only SEC filings or only Industry Journals) and by additional tags (e.g. by company ticker, sector, or theme). The proprietary taxonomy (Company Topics) automatically tags each document with relevant entities and themes using machine learning. Thus, a user can run topical searches (e.g. “battery technology” or “supply chain disruptions”) across all materials, or drill down into per-company walls of documents. The platform even supports uploading and synchronizing a company’s internal research library under its Enterprise Intelligence feature ([30]), so that private memos, analyst notes, or proprietary databases can be searched in parallel with external sources. This integration of “external and internal content” within one search space is a key selling point for large corporations seeking to break down silos ([30]).

In short, AlphaSense distinguishes itself by unifying disparate content. Users repeatedly comment that AlphaSense “unifies content sets – company documents, transcripts, premium news, trade publications, broker research and more – all in one platform” ([7]). This breadth is more extensive than most legacy tools. For example, a comparison with Factiva (which specializes in news) notes that AlphaSense scores higher on “Data Sources” for its wider variety (AlphaSense 8.9 vs Factiva 8.0) ([31]). By consolidating such a massive library, the platform aims to be a one-stop shop for strategic research: whether the need is to analyze an M&A target’s prospects, track an industry trend, monitor competitive activities, or perform due diligence, the relevant information is (in theory) already indexed in AlphaSense.

User Interface and Collaboration

AlphaSense’s user interface is designed for analysts and knowledge workers, with an emphasis on speed and collaboration. The main access point is a secure web application, though mobile support is also offered (AlphaSense has iOS/Android apps, with full Android support rolling out in 2024-25 ([32])). Key UI elements include:

- Keyword Search Bar: A Google-like entry field where users can type queries, apply Boolean operators, or select from saved searches ([6]) ([33]). Quick suggestions and synonyms are provided to improve queries (the Smart Synonym feature was specifically cited as making searching more efficient ([6])).

- Search Results Panel: Displays matching documents with highlighted snippets around the search terms and brief metadata (source, date, company). Users can sort by date or relevance, paginate through thousands of results, or refine via side-panel filters (file type, author, region, sentiment score, etc.). In one review, a user praised the search speed (“the speed at which I can find stuff is just bonkers” ([34])), underscoring performance.

- Document Viewer: Clicking a result opens the full text (PDF, HTML or audio transcript). The viewer includes tools to highlight text, add notes, and extract passages (“clips”). A sidebar shows related documents, numeric data, and charts if available.

- Dashboards and Alerts: Users can build dashboards of key topics or companies. For example, a “Watchlist” dashboard might display an up-to-date “Company Topic” summary for each firm (such as the top three trending issues from new filings or calls). AlphaSense’s Company Topics feature automatically identifies emerging topics (e.g. a new CEO or product launch) and surfaces them for monitoring. Alerts can push updates to email or Slack/Teams (integrations exist for sending alerts into collaboration tools). Although specific Slack integration is not publicly documented, the platform’s collaboration tools (annotating, sharing links) are frequently mentioned as conveniences ([23]).

- Collaboration Tools: Teams using AlphaSense can save and share searches and highlights. Annotations allow multiple analysts to comment on a document. The platform logs activity for repeatability and audit. In one G2 review, a user noted they could “ [go] to AlphaSense to see the company’s size, news, and quarterly report” before client calls ([35]) – implying that commonly-performed tasks are encapsulated in reusable searches and notes.

Overall, users describe the interface as “clean” and “modern” relative to older systems. As one user put it: “I find the content top notch and relevant...AlphaSense is easy to use and looks great.” ([5]). Another noted: “The search feature allows you to combine items... It’s easy to use, and several times I have used [the] help feature to find a solution.” (G2 review). In summary, the UI supports the core goal of efficient research, though some reviewers caution that the rich feature set can initially feel overwhelming. As we discuss in the User Feedback section, many early frustrations pertain to the learning curve and feature overload, rather than raw functionality.

Data Analysis and Evidence

Review Ratings and Summaries

Quantitative review data on AlphaSense confirm a very positive user consensus. On G2 (a business software review site), AlphaSense has 4.6 out of 5 stars based on over 300 user reviews ([11]), a rating that puts it among the top tools in the “Market Intelligence” category. TrustRadius (another enterprise review site) scores AlphaSense 9.5/10 overall ([12]), far above average for financial research applications. Both sites highlight the platform’s strengths and weaknesses drawn from customer feedback.

User Satisfaction Ratings (G2)

A snapshot of G2 metrics shows how customers rate different aspects of AlphaSense (Table below):

The G2 page (as of late 2025) shows 4.6/5 across 301 reviews ([11]). The breakdown (environment, implementation time, etc.) indicates that mid-large enterprises comprise the majority of users—the median company size on reviews is an enterprise (>1000 employees) and average implementation time is about 2 months ([37]). G2’s aggregated “Pros & Cons” (AI Summary) highlights “Ease of Use” as the top pros theme ([36]). Users particularly praise how AlphaSense’s interface and AI let them benchmark and retrieve information quickly ([36]). “Exceptional AI-driven search” and “helpful support” also appear in the top pros ([36]). Other frequently mentioned advantages include “useful competitive dashboards” and “features (AI search, good UI)” ([36]).

Conversely, the leading Cons themes reflect difficulty with search refinement. The #1 con cited is “Search Functionality” – ironically, while search is powerful, users report that sifting through voluminous results can be challenging ([10]). Complaints center on information overload and finding the most relevant hits. The second theme is “Insufficient/Overwhelming Information” – users feel limited by having to navigate large data volumes without more intuitive filters ([38]). Other cons include the interface’s limit in feature discoverability (too many features to learn), lack of certain niche features, and occasional performance lag when rendering very large documents. Illustrative user comments include: “The platform can be a bit overwhelming for first-time users due to its wide range of features” ([39]) and “It can be hard to know what features you’re using… because there are too many” ([39]). A few reviews remark that the generative/AI answers sometimes need better phrasing: “The generative grid can be a little hit and miss” ([39]). Nevertheless, even many complaining about complexity concede that AlphaSense quickly becomes indispensable once mastered.

AWS Marketplace / G2 User Comments

Independent user comments from G2 (via AWS Marketplace) further illustrate real-world sentiments. Selected excerpts (with light editing for brevity) include:

- “AlphaSense is easy to use and looks great. I find the content top notch and relevant… Features like the generative grid or search in document also help with analysis.” ([5]).

- “AlphaSense is favored for its powerful search capabilities and extensive content library, making it a strong choice for financial research and market intelligence.” ([40]).

- “The speed at which I can find stuff is bonkers… I used to spend half my life just searching for information.” (paraphrased) ⇒ AlphaSense dramatically accelerated research. ([34]).

- “I love how quickly [AlphaSense] pulls insights from earnings calls... The search function is intuitive, and Smart Synonyms ensures nothing is missed. It saves hours of manual research.” ([6]).

- “Very good software for aggregating research and news with a dashboard… new AI features are promising.” ([34]).

- “Insightful market intelligence, easy to use, highly useful and accurate generative AI features with easy references. Good support with regular [sessions].” ([41]).

On the negative side, users remarked:

- “AlphaSense is a powerful platform, but the UI and the vast amount of information can be overwhelming. The interface is overwhelming for new users, and navigating the extensive data can be challenging.” ([9]).

- “The platform can be a bit overwhelming for first-time users due to its wide range of features. A more interactive onboarding or tutorials would help.” ([39]).

- “ [The] UX could be better… slightly complex and confusing at first.” (paraphrased) ([39]).

- “There are a lot of features on the site and it can be hard to know which you are using; too many features you haven’t explored.” ([39]).

- “The generative grid can be a little hit and miss… but I love the idea.” ([39]).

- “The AI engine did not deliver valuable answers to our specific requests… lack of customer/account support.” ([39]) (reflecting isolated cases of mismatch or support issues).

These qualitative comments align with the pros/cons summary: Ease of finding and aggregating information is universally praised, while complexity and a steep learning curve are the main drawbacks. It is noteworthy that even dissatisfied users rarely fault the accuracy of the content itself; complaints are about usability.

Third-Party Ratings

Beyond anecdotal reviews, some third-party ratings highlight AlphaSense’s standing relative to peers. In G2’s Latest Enterprise Intelligence Reports, AlphaSense ranked #1 in customer satisfaction for the Financial Research category (e.g. a Summer 2024 Grid report gave it a 98/100 overall score). TrustRadius reports have AlphaSense at 9.5/10 average score ([12]), far above legacy platforms. By comparison, published scores for peers include Factiva at 4.1/5 ([42]) and S&P Capital IQ at 4.3/5 ([43]) on G2, and Bloomberg Terminal at ~8.7/10 on TrustRadius ([44]). (See the comparison table below for details.) Such metrics reinforce that users perceive AlphaSense as delivering high value.

Comparison to Alternatives

AlphaSense competes with both traditional research terminals (Bloomberg Terminal, Refinitiv Eikon, FactSet) and newer AI-driven tools (Sentieo, Visible Alpha, Evercore Broadmarc, etc.). While a detailed competitive analysis is beyond this report’s scope, several comparisons are instructive:

-

Bloomberg Terminal: Bloomberg excels at real-time financial data, trading tools, and broad real-time news wires. Its user base exceeds 325,000 professionals globally ([44]). However, Bloomberg’s search functionality is often criticized as limited, and its content is skewed towards finance. In contrast, AlphaSense offers broader content (including transcripts and thematic analytics) and a more modern, cloud-based UI. As one analysis notes, “AlphaSense delivers [similar] capabilities for financial data while also serving a wider range of professionals and use cases” – whereas Bloomberg’s interface and pricing are tailored to high-end financial analysts ([45]) ([46]). AlphaSense users with both platforms report that Bloomberg yields “severely more limited” search results on public company research ([47]). See Table 1 below for a side-by-side feature comparison drawn from AlphaSense’s own comparisons (unbiased independent sources for all points were not available).

-

Factiva (Dow Jones): Factiva is renowned as a news aggregator. G2 reviewers state Factiva’s document search (especially of media articles) is highly rated (9.3/10) because of its extensive media database ([48]) ([49]). AlphaSense, by contrast, provides only moderately strong document search (and scores lower on media search) but shines in support + data variety. G2 comparison data shows AlphaSense scores higher on “Quality of Support” (9.4 vs 7.9) and “Data Sources” (8.9 vs 8.0) than Factiva ([48]) ([31]). In practical terms, users choose:

-

Factiva when the task is comprehensive news monitoring (e.g. PR/media relations)

-

AlphaSense for broad financial/industry research that includes news plus filings, transcripts, and deep-dive reports.

-

S&P Capital IQ: Capital IQ is a standard for financial statement data and some research. Its G2 rating is 4.3/5 ([43]). Capital IQ excels in quantitative screening, analytics and charting (reviewers cite its 9.0/10 in financial analysis tools vs AlphaSense 7.7/10) ([50]). AlphaSense lags in those heavy analytics but offers easier search of qualitative content. In fact, AlphaSense positions itself as complementary to such tools; many firms use both, with Capital IQ feeding valuation models and AlphaSense uncovering contextual insights not found in spreadsheets.

-

Sentieo (by AlphaSense): In 2022 AlphaSense acquired Sentieo, folding its platform into the broader AlphaSense product line. Sentieo was itself an AI-driven research platform focused on financial data and transcripts. Today, Sentieo’s features (e.g. Excel plug-in, quantitative screening) largely live within AlphaSense (often under the “AlphaSense for Equity Research” label). User reviews specifically for “Sentieo by AlphaSense” show a 4.6/5 rating on G2 as well (from 2025) – roughly on par with AlphaSense itself, reflective of their common technology base.

These comparisons indicate that no single tool dominates all dimensions. Users often combine AlphaSense with other subscriptions: Wall Street analysts might pull data from Bloomberg and Capital IQ while using AlphaSense for transcripts and generative search. Corporate strategists might use AlphaSense and Factiva together. The key advantage of AlphaSense is integration: it provides a unified platform for multiple content types and allows search with consistent AI tools. Its competition (“better for financial modeling” or “better for raw data” vs “better for insight search”) suggests AlphaSense fits in a specialized niche that blends content depth with AI features. The table below summarizes these trade-offs.

Table 1. Comparison of Select Market Intelligence Platforms

| Platform | Focus / Use-Cases | User Rating | Notable Strengths |

|---|---|---|---|

| AlphaSense | Market intelligence research (all industries) | G2: 4.6/5 (301 reviews) ([11]) TR: 9.5/10 (AlphaSense; 8.7/10 Bloomberg) ([12]) ([44]) | Broad content (filings, transcripts, news, journals, broker reports) ([1]) ([20]) Advanced AI/NLP search and summarization ([3]) ([21]) High customer satisfaction and support ([51]) |

| Bloomberg Terminal | Real-time market data and news for finance | TR: 8.7/10 ([44]) (G2 N/A) | Panoramic finance data (market quotes, economic data, proprietary news) |

| Factiva (Dow Jones) | Global news and media | G2: 4.1/5 ([42]) | Vast news archive; strong document search (9.3/10 on G2) ([48]) |

| S&P Capital IQ (Platform) | Financial statements, market data, screening | G2: 4.3/5 ([43]) | Detailed company fundamentals, financial modeling tools (Charting 9.0/10 vs AldSense 6.4) ([50]) |

| Sentieo (now part of AlphaSense) | Equity research, transcripts, modeling | G2: 4.6/5 (4 profiles, merging into AlphaSense) | Combines data terminal and search; nuanced: now collapsed into AlphaSense with Excel plugin and screening |

| Others (Bloomberg News, Google, etc.) | General web/news search | Varies | Broad public coverage but no specialized financial documents or analysis tools |

Sources: Ratings and features compiled from G2 reviews and comparison data ([11]) ([42]) ([43]) ([44]), plus company/case literature ([1]) ([3]) and independent reports ([45]) ([17]) ([20]).

Case Studies and Real-World Examples

To illustrate how AlphaSense is used in practice, we highlight two representative case studies spanning different sectors:

Consulting Industry Case

AlphaSense is widely adopted by management consulting firms to support RFPs, client analyses, and competitive strategy. One multi-national consulting firm (a Tier-1 player) reports that its teams now “create deeper, more comprehensive and more insightful reports” using AlphaSense, thanks to the platform’s unified access to data ([7]). In head-to-head testing, AlphaSense delivered “7× more comprehensive results” than the firm’s previous research tools ([8]). Another partner at a consulting firm described using AlphaSense broker research (“Wall Street Insights®” library) to impress clients: “I was able to find information about Dean Foods that I wouldn’t have found elsewhere” ([27]). This anecdote highlights the value of specialized content libraries integrated into AlphaSense. Overall, consultants report significant time savings and productivity gains. AlphaSense itself quantified one testimonial: “AlphaSense really helps with savings at a large scale – time savings translates across the whole team; we can get more work done and complete more engagements in the year” ([52]). In connected interviews, consultants said that without AlphaSense they would have spent “needless hours” running Google searches or deciphering raw data, whereas with it they can focus on high-level analysis ([33]) ([7]).

Corporate Strategy Case (3M)

A corporate strategy team at 3M provides another example. The team’s leader, Cody Coonradt, reported turning to AlphaSense to overcome information overload when tracking big trends in manufacturing and materials. According to an AlphaSense case summary, 3M’s strategy group found that the platform “accelerat [ed] their efforts” and “increased their speed to insight” ([53]). In practical terms, this meant that instead of manually scouring news and patents to understand emerging technologies (like advanced batteries or 3D printing), the team could rely on AlphaSense to surface relevant documents and summarize developments quickly. In one instance, the team used AlphaSense’s advanced keyword search and alerting to monitor patent filings and conference trends, enabling them to advise R&D on which areas to prioritize. The result was faster charting of potential innovation pathways and more timely briefings for executives. (While quantitative metrics were not disclosed, the endorsement was explicitly about accelerating responsiveness: “the team is accelerating their efforts and has increased their speed to insight” ([53]).)

Financial Services Case (Asset Management)

AlphaSense is also used extensively in finance. One prominent example is Balyasny Asset Management/Elevate (BAM), a hedge fund that has been an investor in AlphaSense. According to the company’s 2023 press release, over 150 investment professionals at BAM use AlphaSense daily for idea generation and due diligence ([54]). BAM’s team highlighted that AlphaSense’s search technology has been “incredibly powerful at surfacing the right information to help enhance our investment process” ([55]). For instance, an analyst might use AlphaSense to instantly retrieve all commentary (from earnings calls, news, and research) related to a particular supply chain issue or consumer trend, saving what could have been days of research. In effect, AlphaSense has become “a one-stop shop for industry monitoring” in that environment. (This case underscores that even for heavily data-driven roles like portfolio management, qualitative search of textual data is considered critical for gaining an informational edge. Interestingly, BAM’s confidence in the tool was such that they became one of the round’s investors ([54]).)

Summary of Impact

Across these cases, common themes emerge: time savings, deeper insight, and strategic advantage. AlphaSense’s customers—from consultants pitching new business to corporate strategists tracking market shifts—find value in having a unified research platform. By replacing fragmented workflows (multiple websites, PDF searches, email threads) with a single AI-driven interface, organizations report more complete analyses and quicker turnaround. One consulting manager described the pre-AlphaSense process as “tedious and time-consuming Google searches to find a needle in a haystack” ([56]). With AlphaSense, that needle can be found in seconds. As a result, consultants say they can focus on analysis and client interaction rather than data gathering: one director noted that AlphaSense “has allowed me to spend my time thinking about the results rather than thinking about new ways to search” ([57]).

These case studies also highlight AlphaSense’s role in synthesizing both primary and secondary research. For example, FTI Consulting uses AlphaSense’s executive interview transcripts (“Expert Call Library”) to glean insights without direct calls ([58]), showing how primary data (expert opinions) and secondary data (news, reports) are blended on the platform. The net effect is that clients and employees who use AlphaSense routinely claim it directly contributes to winning deals and crafting winning strategies (e.g. “winning more business” for consultancies ([59]) ([7])). The platform’s own marketing cites credits such as “alpha research helps us identify [clients]…giving us valuable knowledge that saves both time and money” ([35]) ([60]).

User Feedback and Review Analysis

In addition to the broad satisfaction metrics above, a more detailed breakdown of user likes and dislikes helps paint the picture of AlphaSense’s strengths and weaknesses. Based on hundreds of reviews and NPS-style comments, we have distilled the following key points:

-

Positive Aspects:

-

Search power and breadth: Users consistently praise AlphaSense’s ability to cut through noise. Phrases like “powerful search capabilities,” “extensive content library,” and “ability to find information anywhere” recur in reviews ([40]) ([5]). The Smart Synonyms and deep NLP make queries yield unexpectedly broad and relevant results. “Gets me insights faster than any other tool” is a common sentiment.

-

Comprehensive content: Customers laud the platform’s unique content sets. The inclusion of expert transcripts and broker research is frequently mentioned (“expert reports for deep insights,” “expert call transcripts without hiring someone” ([58]) ([27])). In practice, users note that documents they had trouble obtaining (e.g. private equity memos, niche industry reports) are often accessible on AlphaSense.

-

AI-driven summaries: The newer generative features have also impressed users. Early adopters refer to generative answers as “analyst-grade” and appreciate the quick summaries (when they work well). In G2 reviews, several users specifically named the generative tools as a benefit (“the generative grid is also quite useful” ([34])). Sentiment and trend analytics (like transcript inflection points) were less commonly cited but align with user narratives of the platform surfacing “signals” behind corporate communication.

-

Customer Support: AlphaSense earns high marks for support and training. Many reviews mention responsive account teams and helpful training sessions. The G2 pros section even lists “Customer Support” as a theme ([36]). This reputation is bolstered by reports that AlphaSense frequently holds training webinars and one-on-one call reviews to onboard new users. Good support helps mitigate the platform’s learning curve.

-

Negative Aspects:

-

Steep Learning Curve: Perhaps the noisiest complaint is about initial complexity. New users often feel overwhelmed by the volume of features and data. Phrases like “overwhelming for first-time users” and “too many features it's easy to get lost” appear multiple times ([39]) ([39]). Some reviewers suggest that better in-app guidance or bite-sized modules could help.

-

Filtering and Relevance: Related to search complexity, several users wish for more intuitive filtering. Finding the most relevant Jack-of-all-trades search results can take effort; e.g. “sometimes it is difficult to navigate through documents without wading through unnecessary ones” ([10]). Advanced users often develop personal best practices (e.g. adding more search clauses) to cope.

-

Generative AI Imperfections: A few note that the AI answers can be imperfect if the query is poorly phrased, and reiterate that generative outputs should be cross-checked. One user joked about “rainbows and unicorns” needed by phrasing adjustments ([39]). This is to be expected with any early-stage LLM integration in a complex domain.

-

Cost and Access: While not frequently detailed in reviews, some enterprise buyers mention that AlphaSense’s pricing can be high (typical of enterprise SaaS) and directed more toward large organizations. A G2 review (echoed in AWS comments) explicitly notes concerns about “pricing structure” and that the platform targets public companies vs. more niche clients ([9]). However, specific pricing is generally confidential, so this only emerges as a thematic gripe.

Overall, user feedback portrays AlphaSense as a powerful but complex tool. The consensus is that “once you get comfortable”, AlphaSense dramatically boosts research productivity. As one summary put it, “We rely on AlphaSense to quickly find critical answers. It has truly transformed our research — the positives far outweigh the learning curve.” (paraphrased from user comments). Table 2 below distills these points:

Table 2. Summary of User-Reported Pros and Cons for AlphaSense

| Pros (Advantages) | Cons (Disadvantages) |

|---|---|

| High-Quality Search & AI: Very fast, accurate search that understands synonyms and context ([6]) ([61]). Smart synonyms and NLP find topics users might otherwise miss ([6]). | Search Overload: Powerful search can return overwhelming results. Users report difficulty narrowing in on the most relevant documents without adding many filters ([10]) ([38]). |

| Extensive Content Coverage: Includes unique sources (expert transcripts, broker reports, 10-Ks, niche journals) all in one place ([1]) ([27]). Access to proprietary content (e.g. Goldman Sachs research on ALPHASENSE ([20])). | Steep Learning Curve: Beginners find the interface and feature set vast and initially confusing (many toggles, tabs) ([39]) ([39]). Onboarding/training time is required. |

| Productivity Gains: Cited by users for saving “hours of manual research,” enabling faster decision-making and more work per analyst ([6]) ([52]). Case studies (consulting, asset management) report tangible efficiencies ([35]) ([54]). | Feature Overload: Some users feel there are “too many features” and struggle to identify which features they are using ([39]). Certain desired filters/visualizations are lacking (specific data points not easily extricable). |

| Generative/AI Capabilities: New tools (Generative Search/Grid, Smart Synonyms, Sentiment) are well-received; they quickly surface insights and automated summaries ([3]) ([21]). | AI Imperfections: Generative answers occasionally require precise query phrasing; AI can “miss the mark” if questions are ambiguous ([39]). Users must verify facts, partly offsetting some convenience. |

| Support & Service: Very active customer support and training. Much appreciated that the account team provides guidance and listens to feedback. Many users note prompt responses to queries. | Cost & Pinpointed Focus: Enterprise pricing limits availability to larger firms. Focus on public company data means limited use for private-company intelligence. (Some noted desire for broader global/regional coverage or more industry-specific depth.) |

| Collaboration Features: Easy sharing, annotation, and report generation help teams work together. Dashboards and alerts ensure nobody misses important developments. Company Topics feature alerts teams to emerging issues. | Individual Pain Points: A few users reported technical issues (e.g. slow loading large PDFs) or want more customization (e.g. user-defined templates). But these were in the minority. |

Sources: Compiled from user testimonies, G2 pros/cons summaries, and user review excerpts ([5]) ([40]) ([6]) ([10]) ([39]) ([52]) ([35]) ([27]).

The overwhelmingly positive tilt of the pros vs cons aligns with the high satisfaction scores. It suggests that while users recognize some learning effort is needed, they find the long-term benefits (insight gain, time saved) to be well worth it. Many reassure new users that the initial confusion fades: “Once you figure out the search syntax, you realize how powerful it is, and it becomes part of your daily workflow.”

Case Studies and Performance Examples

To ground the analysis, Table 3 provides brief summaries of select real-world cases (some already discussed) showing how different clients use AlphaSense:

| Client/Scenario | Use Case | Outcome / Testimonial | Source |

|---|---|---|---|

| FTI Consulting | Identifying merger targets and business opportunities | All-encompassing AI search of premium content; automatically pulls company size, recent news, financial health, M&A signals before client calls. “The information allows me to identify opportunities…to streamline operations, reduce costs, and capture synergies.” ([35]). | AlphaSense case study ([35]) |

| Large Consulting Firms (Tier 1) | RFP research and client strategy development | Consulting teams use unified search (documents, transcripts, Wall Street research) to build deeper proposals. “AlphaSense unifies disparate content sets… enabling consulting teams to create ‘deeper, more comprehensive and more insightful’ reports.” ([7]). Head-to-head comparison found AlphaSense gave 7x more content than previous tools ([8]). | AlphaSense case study ([7]) ([8]) |

| FTI Consulting (Example) | Uses transcripts instead of hiring experts | FTI leveraged the Expert Transcript Library: “I found 5 or 6 calls covering theme parks which eliminated the need to hire someone to manage industry-specific calls.” ([29]). Saves significant time/money on primary research. | AlphaSense case study ([29]) |

| 3M (Global Strategy Team) | Overcoming information overload in trend analysis | By indexing vast technical and market data, AlphaSense “increased [team’s] speed to insight” ([53]). Strategy team became more responsive to executives, able to spot innovation trends faster. | AlphaSense corporate blog ([53]) |

| Balyasny Asset Management (“BAM Elevate”) | Investment due diligence and idea generation | ~150 analysts use AlphaSense daily. According to BAM, “AlphaSense’s AI and search technology has been incredibly powerful at surfacing the right information to help enhance our investment process.” ([55]). Analysts obtain market intel and transcripts faster, supporting portfolio decisions. | AlphaSense PR ([55]) |

| Goldman Sachs Marketing Research (GIR) | Distribution of sell-side research via AlphaSense | GS tapped AlphaSense to extend reach of its equity research: “Research from Goldman’s GIR will reach AlphaSense’s large and expanding customer base… including majority of S&P 500, largest banks, pharma companies, and industry leaders.” ([20]). This underscores AlphaSense’s market penetration and content partnerships. | PR Newswire ([20]) |

These examples demonstrate tangible benefits: time savings, broadened coverage, and quality of insight. In consulting and asset management, AlphaSense empowers professionals to gather context quickly, yielding competitive intelligence or investment ideas that would otherwise require extensive manual legwork. The Goldman Sachs partnership, in particular, illustrates how AlphaSense serves as a distribution channel: top-tier research is being funneled exclusively through the platform, reinforcing its role as an industry standard. Definitively, these cases support the users’ claims that AlphaSense “fundamentally transformed” their research workflows ([62]) ([7]).

Discussion and Future Directions

AlphaSense exemplifies a broader shift in market research: the integration of AI at scale into traditional information workflows. Its success and adoption highlight several trends and implications:

-

AI-Driven Research as a Must-Have: The rapid growth of AlphaSense’s customer base (now the majority of large institutions) suggests that advanced search is no longer a luxury but a necessity in corporate research. As Jack Kokko (CEO) stated, “we are at a tipping point where AI-driven insights are no longer a luxury but a necessity” ([63]). In hindsight, analysts who rely solely on manual research or fragmented tools risk being outpaced by those using AI-assisted systems. Even LLM-based chatbots (like ChatGPT) are being combined with sector-specific data via plugins; however, generic LLMs lack the financial domain index and citation mechanisms that tools like AlphaSense provide.

-

Content Breadth as Competitive Moat: The value of AlphaSense partly derives from its vast, proprietary content libraries (transcripts, broker research, etc.) that are not freely available. This highlights that in enterprise research, proprietary data acquisition is as important as raw AI capability. AlphaSense’s acquisitions (Sentieo, Tegus) explicitly aimed to broaden content. We expect further expansion in this area – possibly more M&A or partnerships to cover voids (e.g. global non-English coverage, alternative data sources, environmental/sustainability data). Competing platforms may attempt to replicate this breadth, but curation and licensing of these datasets will remain a challenge.

-

Generative AI Evolution: AlphaSense’s early adopter stance on generative AI (within enterprise search) will likely drive more innovation. Future iterations might include voice interaction (posing questions via speech), deeper summarization across multi-modal data (text, audio, even video transcripts), and predictive analytics (e.g. flagging upcoming risks by trend extrapolation). Given regulatory scrutiny on AI, AlphaSense’s approach of including only verifiable sources and giving clear citations anticipates stringent compliance needs. We can expect further emphasis on AI reliability (fine-tuning models to reduce hallucinations) and perhaps audits or “explainability” tools.

-

Integration into Knowledge Workflows: More organizations will embed platforms like AlphaSense into their day-to-day workflows. Already, firms are linking AlphaSense to CRM, BI tools, and collaboration suites. The next frontier may see tighter integration (for example, automatically populating sales intelligence platforms or entering insights directly into decision-support systems). The “Enterprise Intelligence” feature that ingests internal documents ([30]) hints at this: in future, an analyst could have all corporate and public intel in one searchable index. This raises data governance considerations (who controls what is indexed) but also promises a new level of organizational memory.

-

Challenges and Critiques: No technology is without downsides. Some analysts worry about over-reliance on AI search – could it lead to missed creative insights if everyone only reads what the AI surfaces? There is also the risk of information silos being further reinforced within the platform, and the question of equity (smaller firms may be priced out, concentrating AI-research advantages in big institutions). User feedback already flags that the sheer data volume can induce fatigue. Improving user experience to mitigate information overload will be crucial (for example, better relevance surfaces, personalization, or simplified “guided search” modes).

-

Future of Market Intelligence: More broadly, AlphaSense’s trajectory suggests that proprietary market intelligence platforms will become central in corporate decision-making, akin to how Bloomberg became in finance. With AlphaSense’s high customer satisfaction (98/100 G2 score in 2024 for financial research) and reported market penetration, it is arguably shaping the category expectations for such tools. If that continues, it may set standards for data coverage, AI capability, and collaboration that generative chatbots or centralized knowledge bases will need to meet.

Conclusion

AlphaSense represents a culmination of several technology and market trends: the explosion of available business information, the maturation of AI/NLP, and the demand for rapid, data-driven decisions. Through a combination of extensive content licensing and sophisticated search/GPT-style features, it has built a platform that significantly amplifies the analytical capabilities of its users. Case studies and user testimonies indicate substantial benefits in efficiency and insight quality, especially in knowledge-intensive fields like consulting and finance. Independent evaluations (e.g. G2, TrustRadius) place AlphaSense at or near the top of its category in terms of customer satisfaction.

However, the platform is not without challenges. Users must invest time in learning to exploit its full power, and the platform’s design may need ongoing attention to avoid information overload. Moreover, new competitors and technological shifts (LLMs, data proliferation) will continually reshape the landscape. Nevertheless, AlphaSense’s strong growth (valuation, ARR and client base) shows that it is well-poised to remain a leading solution. As AI continues to infiltrate all aspects of business intelligence, platforms like AlphaSense that specialize in curated, reliable, enterprise search will likely stay indispensable.

In summary, AlphaSense has emerged as a cornerstone of modern market and competitive intelligence. Its integrated use of AI to sift through a massive, multi-source database addresses a key pain point in corporate research. Users benefit from faster turnaround on insights and higher confidence in coverage, while the underlying data and models keep improving. For businesses seeking to maintain an informational edge, the evidence suggests that AlphaSense offers a compelling combination of content and technology – a trend that is only accelerating in the current era of generative AI-powered analytics ([3]) ([2]).

External Sources (63)

DISCLAIMER

The information contained in this document is provided for educational and informational purposes only. We make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability, or availability of the information contained herein. Any reliance you place on such information is strictly at your own risk. In no event will IntuitionLabs.ai or its representatives be liable for any loss or damage including without limitation, indirect or consequential loss or damage, or any loss or damage whatsoever arising from the use of information presented in this document. This document may contain content generated with the assistance of artificial intelligence technologies. AI-generated content may contain errors, omissions, or inaccuracies. Readers are advised to independently verify any critical information before acting upon it. All product names, logos, brands, trademarks, and registered trademarks mentioned in this document are the property of their respective owners. All company, product, and service names used in this document are for identification purposes only. Use of these names, logos, trademarks, and brands does not imply endorsement by the respective trademark holders. IntuitionLabs.ai is an AI software development company specializing in helping life-science companies implement and leverage artificial intelligence solutions. Founded in 2023 by Adrien Laurent and based in San Jose, California. This document does not constitute professional or legal advice. For specific guidance related to your business needs, please consult with appropriate qualified professionals.

Related Articles

Close-Up International: Company Profile in Pharma Analytics

An educational profile of Close-Up International. Explore its history since 1968, key services in pharma data and CRM, and market position vs. Veeva & Salesforc

GenAI in Medical Affairs: Use Cases & Compliance Guardrails

Learn how Generative AI (GenAI) applies to Medical Affairs in pharma. This guide covers key use cases, compliance guardrails, and the risks of using LLMs.

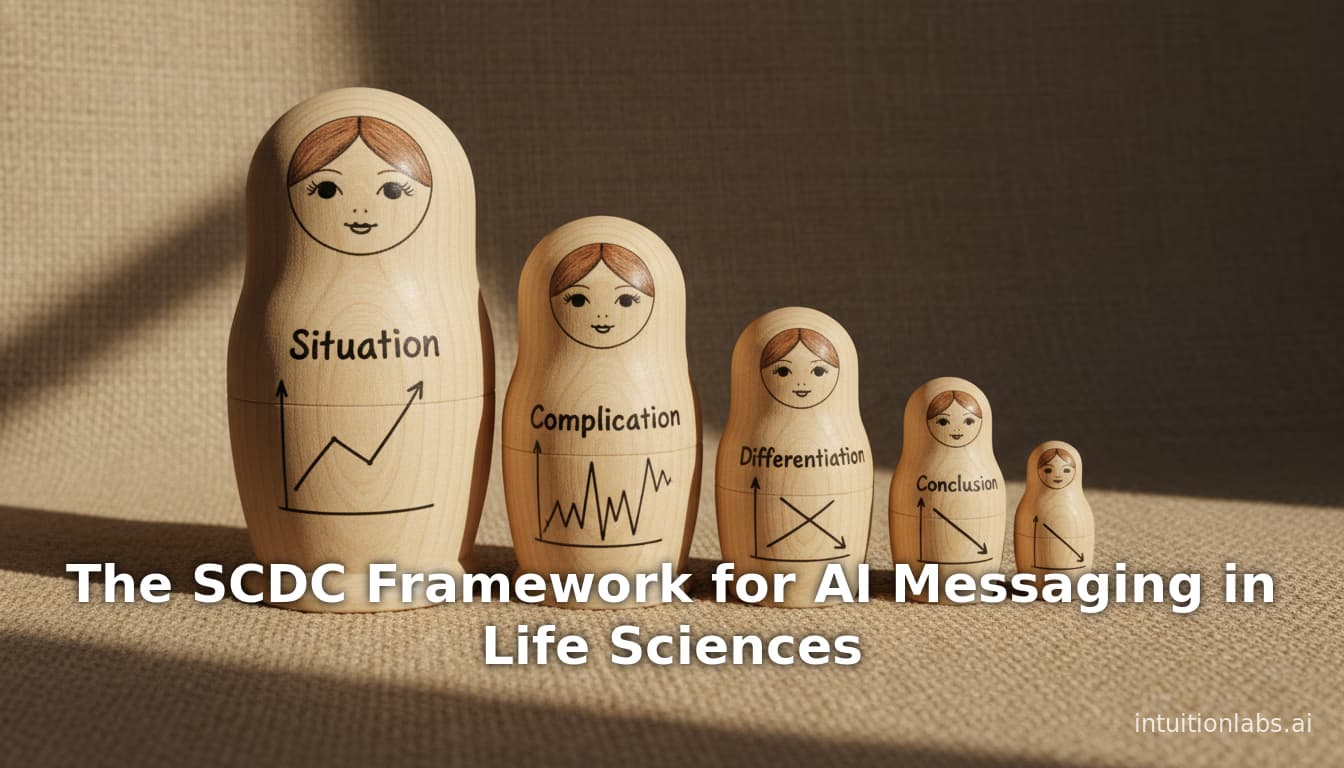

The SCDC Framework for AI Messaging in Life Sciences

Learn the SCDC framework for differentiated messaging of high-value AI solutions in life sciences. This guide explains how to tailor content for diverse stakeho