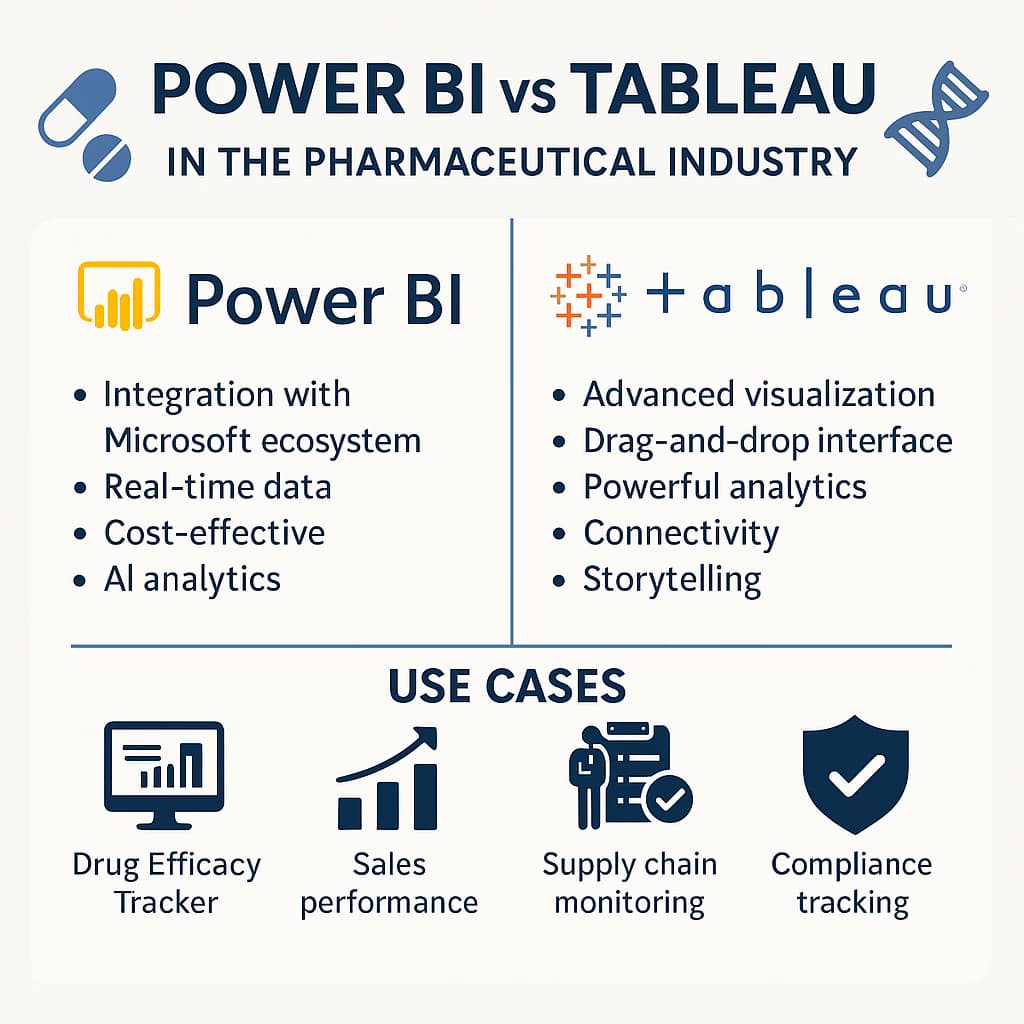

Power BI vs Tableau in Pharma: Full Comparison

Power BI vs. Tableau in the Pharmaceutical Industry: A Comprehensive Comparison

[Revised January 21, 2026]

For a broader overview of analytics platforms in pharma, see our guide: Top Software Tools for Pharma Commercial Analytics in 2025.

Introduction

Business intelligence (BI) tools have become pivotal in the U.S. pharmaceutical industry, where data-driven decisions can influence billion-dollar drug portfolios and patient outcomes. Pharma companies generate massive datasets across R&D, clinical trials, manufacturing, and commercial operations. Effective analytics platforms like Microsoft Power BI and Tableau help transform this raw data into actionable insights for IT professionals and business stakeholders. Recent market research indicates a robust growth in pharma analytics: the global life science analytics market (which includes pharma BI solutions) is projected to grow from about $12 billion in 2025 to nearly $25 billion by 2034 (a ~8.5% CAGR), with some estimates projecting the broader pharma analytics market to exceed $100 billion by 2033 ([1]). North America – led by the U.S. – accounts for approximately 50% of this analytics market ([2]), reflecting strong adoption of BI technologies in the U.S. pharma sector. Moreover, industry surveys show 69% of pharmaceutical commercial teams plan to increase their data analytics budgets (versus only 5% decreasing), and more than 85% of biopharma executives intend to increase investment in data, AI, and digital tools in 2025-2026, underscoring a growing appetite for advanced BI solutions ([3]).

Power BI and Tableau consistently rank as the top two BI platforms globally ([4]), and both are widely used by pharmaceutical companies. Power BI, part of the Microsoft ecosystem, has spread rapidly – as of 2025, Microsoft reports that over 350,000 organizations worldwide use Power BI, with adoption extending across all Fortune 500 companies ([5]). Power BI celebrated its 10th anniversary in 2025, marking a decade of innovation with over 1,500 updates since launch. Tableau, a pioneer in data visualization (now a Salesforce company), is likewise entrenched in pharma – for example, Merck adopted Tableau to enable self-service analytics "from the lab to the boardroom," putting data insights in the hands of employees across the organization ([6]). In 2025, Salesforce launched Tableau Next, an upgraded version integrating natively with their AI suite Agentforce, signaling the platform's evolution toward agentic AI-powered analytics. Many pharma companies leverage one or both tools in different departments. This report provides a detailed comparison of Power BI and Tableau across key dimensions (ease of use, scalability, cost, security, integrations) with a focus on U.S. pharma use cases: commercial analytics, R&D analytics, clinical trial data visualization, and regulatory compliance reporting. Relevant statistics from recent surveys and reports are included to illustrate industry trends, and tables summarize feature comparisons, pricing, and adoption metrics. The goal is to help IT professionals in pharma evaluate these platforms in the context of U.S. market needs and regulations.

Overview of Power BI and Tableau

Power BI is a BI and data analytics platform launched by Microsoft in 2015, which celebrated its 10th anniversary in 2025. It offers a suite of tools including Power BI Desktop (for data modeling and report authoring), the Power BI cloud service, mobile apps, and an on-premises Power BI Report Server. As of 2025-2026, Power BI is now deeply integrated with Microsoft Fabric, Microsoft's unified data and analytics platform that combines data engineering, data science, real-time analytics, and BI in a single SaaS solution. Power BI enables users to connect to numerous data sources, create interactive dashboards, and share insights within the Microsoft environment. It is known for its tight integration with other Microsoft products (Excel, Azure SQL, SharePoint, Teams, etc.) and a relatively low entry cost. Power BI has a strong focus on self-service analytics for business users, while also providing powerful data modeling via the DAX language. Copilot for Power BI, Microsoft's AI assistant, now enables users to generate DAX queries, create reports from natural language prompts, and receive automated insights. Microsoft's ubiquity in enterprises has propelled Power BI to be "the first or second-most popular BI tool" in many surveys ([4]). Gartner named Power BI as a Leader in its 2025 Analytics and BI Magic Quadrant for the eighteenth consecutive year ([7]), citing its dominant market presence and AI capabilities.

Tableau, founded in 2003 (acquired by Salesforce in 2019), is a leading analytics platform that revolutionized visual data exploration. Tableau Desktop, Tableau Server (on-premises) and Tableau Cloud (hosted) allow users to create and share interactive visualizations and dashboards with a drag-and-drop interface. Tableau is often lauded for its advanced visualization capabilities and intuitive user experience, enabling users to uncover insights without needing to write code. In 2025, Salesforce launched Tableau Next, an upgraded version that integrates natively with Agentforce (Salesforce's AI agent platform) and uses Data Cloud as a unified data layer. Tableau Next introduces analytics-focused AI agents including Data Pro, Concierge, and Inspector, putting agentic AI at the heart of the platform. It pioneered features like VizQL for instant visual query and has robust support for connecting to a wide array of data sources. Tableau also added Tableau Pulse for mobile push notifications and automated insights. Like Power BI, Tableau continues to be recognized in Gartner's 2025 Leaders quadrant, with Gartner praising its data preparation tooling and automated insights. Tableau's adoption in life sciences is widespread; for example, pharma companies use Tableau for everything from scientific data analysis to commercial dashboards ([6]).

In essence, Power BI and Tableau are both capable, mature BI solutions with overlapping core functionality (data connectivity, visualization, dashboards, sharing). However, there are notable differences in their approach and strengths, which can impact their suitability for certain pharma use cases. The sections below compare these platforms on ease of use, scalability, pricing, security, and integration with pharma systems, followed by specific applications in pharma and industry adoption trends.

Ease of Use and User Interface

Both Power BI and Tableau are designed to be user-friendly, but their approaches differ slightly, which affects learning curve and day-to-day usage for analysts and non-technical users:

-

Tableau: intuitive drag-and-drop analytics. Tableau is often praised for its highly intuitive interface that lets users drag fields onto a canvas to create charts and visuals. "Tableau's intuitive drag-and-drop interface makes data accessible to all—no coding needed," as one description notes ([8]). This ease of visual exploration is one of Tableau's biggest strengths. Users can quickly build interactive charts, perform drill-downs, and combine filters without writing queries. For many, Tableau "is for everyone" due to its focus on visual interactivity ([8]). This means business users in pharma (e.g. a marketing manager or a clinical researcher) can start creating useful visuals with minimal training. However, while basic use is straightforward, mastering Tableau for complex analytics can present a learning curve. Tableau offers a rich feature set and advanced analytical depth, which can require more training to utilize fully ([9]). In fact, one pharma case (Apoteket) found Tableau's overall ease of use appealing, but they also valued its "analytical depth" for power users ([10]). Overall, Tableau's UI is very polished for creating and navigating visualizations, making it a favorite among data visualization enthusiasts.

-

Power BI: familiar for Microsoft users, enhanced by AI. Power BI's interface will feel familiar to those used to Excel and other Microsoft tools. It uses a canvas and fields list approach similar to Excel PivotTables and has a ribbon of options akin to other Office products. This familiarity can shorten the learning curve for pharma companies already standardized on Microsoft – Power BI's interface is often intuitive for users comfortable with Excel and other Microsoft products ([11]). Creating basic charts and dashboards is drag-and-drop as well, and Power BI provides many built-in visuals and customizable chart options. One distinguishing aspect is Power BI's Data Analysis Expressions (DAX) language for creating calculated measures and custom calculations. DAX is powerful but can be complex for new users; however, in 2025-2026, Copilot for Power BI now generates DAX queries automatically, significantly reducing the barrier for non-technical users to create advanced calculations. This represents a major shift – previously, advanced analytics in Power BI (like calculating year-over-year growth, cohort analysis, etc.) required writing DAX formulas manually. Now users can describe what they want in natural language, and Copilot generates the appropriate DAX. Note: Microsoft announced in late 2025 that the legacy Q&A natural language feature will be deprecated in December 2026, replaced by the more advanced Copilot capabilities which provide a generative AI-powered interface for querying data, creating visuals, and exploring insights more accurately ([12]).

-

Learning resources and community. Both vendors offer extensive training resources (online modules, videos, community forums). Tableau has a very active user community (including many in pharma analytics) and a wealth of visualization best-practice content. Microsoft's Power BI community and documentation are also vast, leveraging the broader Microsoft developer network. In terms of user adoption, many organizations find Power BI easy for simple dashboards but Tableau easier for complex visual exploration, though much comes down to user preference. Notably, Tableau was chosen over Power BI by Apoteket's BI team partly because of perceived ease of use and user adoption ([10]), but conversely, some users with deep Excel skills might favor Power BI's style.

In summary, both tools score high on ease-of-use for basic analytics, with Tableau often cited as exceptionally intuitive for interactive visualization and Power BI being immediately familiar in Microsoft-centric environments. Power BI might demand more technical effort for advanced analysis (due to DAX), whereas Tableau's learning curve comes with unlocking its full analytical potential. For pharma IT teams, a key consideration is the skillset of end users: if the user base includes many scientists or analysts already comfortable with Excel/SAS, Power BI's interface may resonate; if the goal is broader self-service across non-technical business users, Tableau's minimal-coding approach could lower the barrier to entry ([8]).

Scalability and Performance

Pharmaceutical companies range from mid-sized biotechs to global enterprises with thousands of users and massive datasets. Any BI tool adopted must scale in terms of data volume, complexity, and number of users. Here's how Power BI and Tableau compare on scalability and performance:

-

Data handling and performance with large datasets: Both Power BI and Tableau are built to handle large data, but benchmarks and user experiences suggest some differences. Tableau generally performs very well with large and complex datasets, partly due to its optimized data engine (Hyper) for in-memory extracts ([13]). Tableau's architecture allows connecting live to databases or importing data into extracts; the Hyper engine is known for fast query response on large data extracts. In practice, Tableau is often reported to handle big data and complex visualizations with better performance, whereas Power BI can experience slowdowns with extremely large datasets or complex models ([13]). One analysis noted "Tableau generally performs better with large data sets... while Power BI might experience some performance lags with very large data" ([13]). This aligns with some pharma companies' experiences: for instance, Apoteket's evaluation found Tableau's scalability to large data and user loads to be a key advantage ([10]). That said, Power BI is no slouch – it uses the VertiPaq in-memory engine which compresses data highly and can handle data models with millions of rows on commodity hardware. Performance in Power BI heavily depends on model design and whether you use import vs. DirectQuery. Power BI can connect live to databases (offloading queries to, say, a SQL Server or Snowflake), which is suitable for huge data, but complex visuals in DirectQuery mode may be slower if the source is slow. In summary, for extremely large data or complex ad-hoc analysis, Tableau has a slight edge in speed/optimization, while Power BI can handle most pharmaceutical data volumes but may require more tuning for performance at the very high end.

-

User scalability (enterprise deployment): In terms of number of users, both platforms have proven deployments in large enterprises. Tableau Server/Cloud can support thousands of users accessing shared dashboards. Tableau's self-service model at scale is illustrated by companies like Merck using it enterprise-wide – Tableau's own site notes it "puts self-service analytics in the hands of everyone at Merck" ([14]). Power BI, leveraged via the Power BI Service (cloud) or Power BI Report Server (on-prem), also scales to large user bases. Microsoft reported that by 2020 over 150,000 organizations (including 97% of the Fortune 500) were using Power BI, with 40 million reports viewed per month ([5]) – a testament to its widespread, scalable use. The key for pharma IT is how easily they can manage and distribute content to many users. Power BI has an advantage for Office 365 subscribers, as it can be deployed organization-wide through existing Microsoft 365 infrastructure (users sign in with corporate credentials and can access Power BI via web or Teams). It's relatively straightforward to integrate with Azure Active Directory for user access control. Tableau Server likewise integrates with corporate directories (AD/LDAP) and can be scaled by adding server nodes for load balancing as usage grows. Both tools support row-level security so that one dashboard can serve many users but each sees only permitted data (important when scaling to many users with different data visibility in a pharma org).

-

Architecture and scaling options: Power BI offers two modes for scaling: Power BI Pro (individual user licenses with shared cloud capacity) and Power BI Premium (dedicated capacity). For large scale, organizations often opt for Premium, which provides a dedicated cloud computing capacity that can handle higher data volumes (large model sizes) and heavy usage concurrency. Premium also enables on-prem deployment via Power BI Report Server for those who need to keep data in-house ([15]). Tableau's equivalent is deploying Tableau Server on-premises (which the company licenses by core count or by users) or using Tableau Cloud (hosted SaaS) which is fully managed by Tableau. Both platforms therefore can scale up (by allocating more cores/memory or Premium capacity) and scale out (more servers/nodes). In pharma, where certain divisions (like global commercial teams) might have thousands of field users, scaling out is critical. Both tools have documented case studies of scaling: e.g., Fresenius Kabi (a pharma company) integrated Power BI with SAP and scaled financial reporting globally ([16]) ([17]), while Johnson & Johnson has publicly discussed large Tableau deployments in their organization (as per Tableau conference talks).

-

Concurrency and real-time data: If real-time or near-real-time dashboards are needed (for example, monitoring clinical trial enrollment daily, or supply chain metrics hourly), both tools support it. Power BI can use streaming dataflows or DirectQuery for real-time updates, and supports real-time data streaming in dashboards ([18]) ([19]). Tableau can auto-refresh extracts frequently or use live connections for up-to-the-minute data; it also supports real-time connectivity. There isn't a stark difference here – both can be configured for high-frequency data refresh, though the underlying infrastructure (and licensing, e.g. Tableau Data Management for prep/flow or Power BI dataflows) might need to be accounted for.

In summary, both Power BI and Tableau are enterprise-scalable and can handle the large data and user demands of major pharma companies. Tableau holds a reputation for strong performance on huge datasets and was explicitly chosen by at least one pharma retailer for its "scalability... and analytical depth" ([10]). Power BI's scalability has been demonstrated through its massive adoption in Fortune 500 firms, though extremely complex or large-scale scenarios might require careful performance tuning (or use of Premium capacity). For a U.S. pharma IT team, either tool can be architected to meet enterprise needs. The decision may hinge on existing infrastructure: if the company has invested heavily in Azure/Microsoft stack, Power BI can slot in and leverage those resources; if the requirement is a stand-alone analytics platform that can connect to various systems with top-notch performance, Tableau is an excellent fit. Table 1 below summarizes some scalability and performance considerations:

Table 1. Feature Comparison: Power BI vs. Tableau (Ease of Use, Scalability, etc.)

| Aspect | Power BI | Tableau |

|---|---|---|

| Ease of Use | Familiar Office 365-style interface; easy for basic dashboards. Advanced calculations require DAX formulas (learning curve for non-Excel users) ([20]). Natural language Q&A for quick insights ([12]). | Highly intuitive drag-and-drop interface for visualization ([8]). Little to no coding for most analysis. Steeper learning curve only for advanced analytics or complex data scenarios ([9]). |

| Visualization & UI | Wide range of visuals and custom visuals; integrates with Excel for detailed analysis. Strong interactive slicers and drill-downs. | Renowned for rich, customizable visuals and interactive exploration. Offers storytelling features (dashboards, story points) ideal for data narrative. |

| Data Integration | Deep integration with Microsoft ecosystem (Excel, Azure SQL, SharePoint). Can mash up multiple sources in one model easily. Lacks native support for some statistical file types (no direct .sas7bdat import) ([21]). | Versatile connections to many databases and files. Can directly open statistical files like SAS and SPSS data sets ([22]). Data blending requires defining relationships or joining in data prep. |

| Performance | Handles large data with in-memory compression; performance depends on model design. DirectQuery for huge datasets (with some speed trade-off). May lag slightly on very large/complex visuals without tuning ([13]). | Optimized Hyper engine for large extracts; excels at fast rendering of big data visuals ([13]). Can connect live or in-memory. Generally efficient with complex, multi-million-row data. |

| Scalability | Scales via Power BI Service (cloud) or Report Server (on-prem). Microsoft Fabric capacity available for dedicated resources (P-SKUs retired Jan 2025). Proven at enterprise scale (350,000+ organizations) ([5]). | Scales via Tableau Server (on-prem, multi-node) or Tableau Cloud (fully hosted). Tableau Next built on Salesforce platform with Hyperforce. Widely deployed in large enterprises (e.g. Merck enterprise-wide usage ([14])). Known for enterprise-level stability with many users. |

| Collaboration | Tight integration with Teams, SharePoint; easy to share inside Office 365 tenant. Row-level security for personalized views. Version control via workspace apps. | Robust sharing via Server/Cloud; users can interact via web or mobile. Offers projects/folders for content, and data source version control. Row-level security and permissions handled on Server. |

| Advanced Analytics & AI | Supports R and Python integration (note: R/Python visuals deprecated for embedded scenarios in May 2026). DAX enables complex calculations; Copilot now auto-generates DAX. AI visuals (decomposition tree, key influencers) included. Deep Microsoft Fabric integration for data science workflows. | Integrates with R, Python, MATLAB via external services for advanced models. Tableau Prep provides data prep/ETL visually. Tableau Next introduces Agentforce AI agents (Data Pro, Concierge, Inspector). Tableau Pulse for automated insights and mobile alerts. |

| Typical Pharma Fit | Often favored by small-to-mid teams or those already using Microsoft stack, due to low cost and easy adoption. Also used in enterprise with Premium for broad rollout. Good for quick wins (e.g. Excel replacement for reports). | Often favored by analytics-heavy teams needing deep dives (e.g. biostatisticians, data scientists) thanks to flexible visuals. Chosen by large pharma for complex data visualization (clinical, supply chain). Good for fostering a data-driven culture via self-service. |

Pricing and Licensing Models

Cost is a significant factor for IT decision-makers, especially when deploying BI tools to hundreds or thousands of pharma employees. Power BI and Tableau have very different pricing models and cost structures:

-

Power BI Pricing (Updated April 2025): One of Power BI's strongest selling points has been its affordability, though prices increased in April 2025 for the first time in nearly a decade. The primary licensing is Power BI Pro, which is licensed per user. As of April 1, 2025, Power BI Pro costs $14 per user per month (increased from $9.99, a 40% increase) ([23]). This license allows a user to publish and share dashboards/reports and collaborate in the Power BI cloud service. There is also Power BI Desktop, which is free for individual use (to create reports) but one cannot share reports with others without a Pro license or higher. For larger deployments or advanced features, Microsoft offers Power BI Premium Per User (PPU) at $24 per user/month (increased from $20, a 20% increase) ([23]). Important change: Microsoft has retired the Power BI Premium capacity P-SKUs as of January 2025, consolidating with Microsoft Fabric capacity SKUs. Organizations previously using Power BI Premium capacities must now transition to Fabric SKUs, which offer unified data platform capabilities. Fabric capacity is measured in Fabric Capacity Units (FCUs) and includes all Power BI Premium features plus data engineering, data science, and real-time analytics capabilities. Premium Per User (PPU) unlocks enhanced capabilities: handling very large datasets, AI services including Copilot, paginated reports, and the ability to distribute content to read-only users without each consumer needing a Pro license. On-premises deployment is possible via Power BI Report Server, which is included with Fabric capacity or certain SQL Server Enterprise agreements ([15]). In summary, Power BI's cost tends to scale linearly by user, and it's often cited as more cost-effective for broad deployment than Tableau ([9]). Even at the new $14 Pro price, equipping 100 users costs ~$16,800/year, which is often cheaper than equivalent Tableau licensing (as we'll see below). Many organizations bundle Power BI into their Microsoft 365 enterprise agreements – notably, there are no pricing changes for customers who purchase Power BI through Microsoft 365 E5 or Office 365 E5 annual subscriptions, making the marginal cost very low for these customers.

-

Tableau Pricing (2025-2026): Tableau has a tiered subscription model with role-based licenses across multiple editions. The main roles are Tableau Creator, Explorer, and Viewer. For Standard Edition: A Creator license (for power users who create dashboards) costs $75 per user per month (billed annually, or $900/year) ([24]) and includes Tableau Desktop, Tableau Prep (for data prep), and full authoring capabilities on Server/Cloud. Explorer is for users who need to interact with dashboards and do some minor creation or editing; this runs $42 per user per month (or $504/year) ([25]). Viewer is for read-only consumers of dashboards, at $15 per user per month (or $180/year) ([26]). For Enterprise Edition, prices are higher: Viewer at $35/month, Explorer at $70/month, and Creator at $115/month – this tier includes Data Management, Advanced Management, and eLearning. Salesforce also offers Tableau+, a premium bundle exclusive to Tableau Cloud that includes Tableau Agent (AI capabilities), Tableau Pulse premium features, and Premier Success support. Tableau requires at least some Creators to develop content; the rest can be Explorers or Viewers depending on interactivity needed. Unlike Power BI's free desktop, Tableau Desktop is not free – it's included in the Creator license. For on-premises Tableau Server, pricing can be by user (same as above). Tableau Cloud is available in three editions: Standard, Enterprise, and Tableau+. Additionally, Tableau has add-ons (e.g., Data Management, which includes Tableau Prep Conductor, etc.) that can add to cost if those features are needed.

To illustrate pricing in context, consider a hypothetical U.S. pharma deployment: Suppose you have 10 analysts/developers, 20 intermediate users, and 200 consumers. With Power BI, you might give all 230 people a Pro license (assuming everyone might create/share at some point) – at $14 each, that's about $38,600 per year. Alternatively, you put content on a Premium capacity (~$60k/year) and then only the 30 creators need Pro (30*$1412 ≈ $5,000/year) and the 200 consumers could even be free read-only (since Premium allows sharing with free users), totaling around $65k/year. With Tableau, you might license 10 Creators (10$7512 ≈ $9,000/year), 20 Explorers (20$4212 ≈ $10,080/year), and 200 Viewers (200$15*12 = $36,000/year). That totals about $55,000/year for Tableau. Adding more users can raise costs quickly – e.g., +10 Explorers and +50 Viewers would push it to $70k/year in that scenario ([27]). Tableau's per-user costs are higher, but note that Viewers at $15 are cheaper than giving every user a $14 Pro if those users truly only consume. The break-even often depends on the ratio of creators to consumers. For very large deployments with mostly consumers, Power BI Premium's model can be cost-efficient (unlimited viewers on a capacity), whereas for moderate user counts or where many users need interactivity, the costs might be closer.

Feature-wise included in cost: With Power BI Pro/PPU, you get the full feature set (except the specialized Premium-only features). Tableau's lower tiers (Explorer, Viewer) have some limitations on what those users can do (e.g., Viewers cannot edit or author content). So Tableau's pricing corresponds to functionality levels. In pharma companies, typically a central analytics team would have Creator licenses, data-savvy business analysts might be Explorers, and the majority (sales reps, executives, scientists who just view dashboards) would be Viewers.

Table 2. Power BI vs. Tableau – Pricing Summary (2025-2026)

| License | Power BI Cost | License | Tableau Cost (Standard Edition) |

|---|---|---|---|

| Individual Creator | Power BI Desktop – Free (authoring only, no sharing) Power BI Pro – $14 user/month (cloud sharing, full use) ([23]) | Tableau Creator | $75 user/month (includes Desktop & Prep) ([24]) |

| Enterprise Capacity | Power BI Premium Per User – $24 user/month (enhanced features, Copilot access) ([23]) Microsoft Fabric Capacity – Starting ~$5K/month (replaces P-SKUs, unified data platform) | Tableau Explorer | $42 user/month (can edit existing dashboards, no Desktop) ([25]) |

| Viewer/Consumer | Free for consumers if content is in Fabric capacity; otherwise each consumer needs Pro license ($14). | Tableau Viewer | $15 user/month (view dashboards only) ([26]) |

| On-Premises Option | Power BI Report Server – Included with Fabric capacity (or SQL EE w/ SA) ([15]) (Pro license required for authors) | Tableau Server (On-Prem) – Licensed by user (same as above tiers). | |

| Notes | Volume discounts via enterprise agreements; included in M365 E5 plans (no price increase). Premium P-SKUs retired Jan 2025 – transition to Fabric required. | Enterprise Edition: Viewer $35, Explorer $70, Creator $115/month. Tableau+ bundle adds AI agents, Pulse premium. |

As shown, Power BI is generally less expensive for broad deployments (especially if a pharma company already has Microsoft licensing – Power BI Pro is sometimes an add-on to Office 365 E3/E5 at a low cost). Tableau's higher price per creator license can be justified by its capabilities, but it represents a larger investment. For a U.S. pharma company, budget considerations might favor piloting Power BI for smaller teams or where cost is sensitive, whereas larger firms with big analytics budgets may deploy both (for example, using Tableau in R&D departments and Power BI in back-office reporting, depending on user needs). It's important to note that cost of ownership also includes training and support – if a tool is more widely known internally, that might reduce training cost. Many pharma organizations evaluate the total ROI, where the right tool might pay off in insights even if license costs differ. For instance, a survey of life sciences analytics leaders found that digital analytics initiatives delivered a 5–15% bottom-line improvement over 5 years ([28]) – a strong ROI, meaning the focus should be on which tool can best deliver insights, not just license cost, as long as budgets allow.

Data Security, Governance, and Compliance

The pharmaceutical industry in the U.S. operates under strict regulatory requirements for data security and privacy. Any BI tool must enable compliance with regulations such as HIPAA (for protected health information), 21 CFR Part 11 (for electronic records in FDA-regulated processes), and various GxP (good practices) guidelines. Both Power BI and Tableau have robust security and governance capabilities to meet enterprise and regulatory demands, but there are nuances:

-

Authentication and User Security: Both tools integrate with enterprise authentication systems. Power BI uses Azure Active Directory for its cloud service – this means it supports single sign-on, multi-factor authentication, and conditional access policies as configured in Office 365. In a pharma context, users can be managed via existing AD groups (e.g. only members of "Clinical Data Team" see the clinical dashboards). Tableau Server similarly can integrate with Active Directory or other identity providers (it also supports SAML, Kerberos, etc.), and Tableau Cloud uses the Salesforce login infrastructure or federated identity. Both tools allow granular user and group permissions on content (reports, dashboards, data sources).

-

Row-Level Security (RLS): Often in pharma, different users should only see subsets of data (for example, a sales rep should see only their territory’s sales, or a clinical site monitor should see only their trial site’s data). Both Power BI and Tableau support row-level security to restrict data within a dashboard. Power BI allows defining RLS roles within the dataset model (filters applied per user), and if using live connection to, say, Analysis Services, one can use role-based security from there. Tableau can implement RLS either by using user filters or more elegantly via entitlements tables and the Tableau data model ([29]). Tableau’s recent versions even offer a central way to apply RLS across multiple data sources through “Virtual Connections” and data policies ([30]). In practice, both tools have been used to ensure users only see authorized data, which is crucial for compliance (e.g., blinding in clinical trial data, patient privacy, etc.).

-

Data Encryption and Network Security: In the cloud services (Power BI Service and Tableau Cloud), all data in transit is encrypted via HTTPS, and at rest, data is encrypted on the servers. Microsoft and Tableau both follow industry-standard cloud security practices. Power BI (Microsoft Cloud) compliance is strong – Microsoft provides a Trust Center documentation for Power BI’s compliance with various standards (ISO 27001, ISO 27018 for cloud privacy, SOC 1/2, etc.) ([31]). Power BI can be configured to use customer-managed keys for encryption in Premium. Tableau Cloud runs on AWS and now on Tableau’s own AWS infrastructure; Tableau has announced compliance achievements like HIPAA compliance for Tableau Cloud (with signed business associate agreements for healthcare clients) ([32]). On-premises, security is as good as the environment you set up – both Power BI Report Server and Tableau Server support TLS encryption, and data can remain behind firewalls as needed.

-

HIPAA and patient data: Handling patient health information in analytics requires HIPAA compliance. Microsoft's cloud (including Power BI) is HIPAA-capable – Microsoft will sign a Business Associate Agreement (BAA) for Power BI with customers, and Power BI is covered under Microsoft's HIPAA compliance umbrella ([33]). A Microsoft partner notes that Power BI is compliant with HIPAA regulations when used under the Microsoft BAA, and is part of the Microsoft Trust Center certifications ([31]). Tableau Cloud is now fully HIPAA compliant ([32]); Tableau added HIPAA compliance capabilities in December 2022 and continues to enhance these safeguards. Tableau will enter into BAAs for customers needing to analyze PHI on Tableau Cloud. Security features include storing user passwords in a salted and hashed format, enabling audit logging, and encrypting all communication using SSL/TLS 1.2 or higher. As of June 2025, Tableau uses OpenSSL 3.4.0 and Level-2 security requiring keys of 2048 bits or longer. A significant trend is emerging: many legacy Tableau Server (on-prem) customers are migrating to Tableau Cloud to remove the administrative and maintenance burden from IT departments while maintaining HIPAA compliance. For on-prem Tableau Server, HIPAA compliance depends on the implementation and policies (the software can be configured in a compliant way, but it's on the company to do so). Major pharma companies often have validated systems for BI when used with patient data – e.g., a validated Tableau environment for clinical data review, with all the audit logs and controls required by IT quality.

-

21 CFR Part 11 and system validation: Part 11 is an FDA regulation requiring that electronic systems managing GxP records (GLP, GCP, GMP data, etc.) have controls to ensure data integrity, audit trails, user accountability (electronic signatures), and validation of system performance ([34]) ([35]). Neither Power BI nor Tableau is “automatically” 21 CFR Part 11 compliant out of the box – compliance is achieved by how the system is implemented and validated. Pharma IT typically performs computer system validation (CSV) on BI implementations if they are used in regulated processes (for example, a dashboard that becomes part of a regulatory submission or is used to make GxP decisions). Both tools provide audit logs: Power BI logs user activities in the service (and these can be exported to a Security Incident/Event Management system), Tableau Server similarly logs every user interaction, data query, etc., which can serve as audit trail evidence. Part 11 also requires that if records are modified, an audit trail is kept – in BI, usually source data is not modified by the BI tool (it’s read-only analysis), so the main concern is ensuring the accuracy and access control of the data. Microsoft notes that while their audits/certifications don’t specifically cover FDA Part 11, they align with its objectives and one can build Part 11 compliant solutions on their cloud ([36]). In practice, pharma companies have successfully validated Tableau and Power BI systems: for example, generating validation documentation to show that the BI tool performs as intended, that only authorized individuals can access it, that data is secure, etc. ([37]) ([35]). For electronic signatures (also a Part 11 element), neither tool provides e-sign workflows out of the box (since they are not transactional systems) – usually that’s out of scope for BI unless custom applications are built on top.

-

Governance and data lineage: In a large pharma setting, data governance is crucial. Both tools allow creation of certified data sources or datasets that act as single sources of truth. Power BI, for instance, lets you mark datasets as certified or promoted, and integrates with Microsoft Purview for data cataloging. Tableau has a data catalog and metadata management in its Data Management add-on, which helps track data lineage (so you can see which dashboard uses which database table – useful for impact analysis when data changes). Such governance features help IT ensure that, say, the sales figures on a dashboard are the official numbers matching what’s in SAP, thereby avoiding discrepancies that could lead to compliance issues.

-

On-Premises vs Cloud data security: Many U.S. pharma companies still opt to deploy BI on-premises or in a private cloud for added control. Both vendors support this: Power BI Report Server allows keeping data and reports on-prem (often used when data can’t leave a secure network, e.g. early research data or pre-release drug data). Tableau Server similarly can be hosted in a pharma’s data center or VPC. An industry report noted that the on-premises model still accounts for a significant portion of life science analytics deployments ([38]), due in part to security and control preferences. That said, there is a gradual trend to cloud as compliance assurances improve – e.g., even highly regulated companies have started using Tableau Cloud with HIPAA compliance ([32]) and Power BI in Azure with FedRAMP/HITRUST certifications for government or health data. IT pros will weigh the convenience of cloud (less infrastructure to manage, always updated software) against the need for internal control (some pharma firms require that analytic tools be validated and not auto-updated).

In summary, both Power BI and Tableau meet the security standards required by pharma, and each can be deployed in ways that maintain compliance with U.S. regulations. Power BI benefits from Microsoft’s heavy investments in cloud security and compliance (e.g., inclusion in Microsoft’s Trust Center with dozens of certifications) ([31]). Tableau, especially under Salesforce, has similarly robust security and has taken steps to specifically address healthcare/pharma needs (like HIPAA on Tableau Cloud). Ultimately, pharma IT must still implement appropriate procedures – user access reviews, system validation, audit log monitoring – but the tools provide the features to support those. The decision may come down to internal policy: some firms trust Microsoft’s cloud more due to longstanding enterprise relationships, whereas others might already have Tableau approved in their quality systems. Both tools have been successfully audited by internal and external auditors in pharma environments when configured properly. IT professionals should involve their InfoSec and QA/Compliance teams early to ensure whichever tool is chosen can be configured to meet all corporate security policies and regulatory guidelines.

Integration with Pharma Data Sources and Tools

Pharma companies rely on a plethora of specialized systems: from research data capture systems and LIMS/ELN (Laboratory Information Management/Electronic Lab Notebooks) in the lab, to clinical trial databases (EDC, CTMS), to manufacturing systems and ERP (often SAP) for supply chain, to commercial data warehouses, CRM, and even legacy SAS datasets. A BI platform’s ability to connect and integrate with these common pharma tools is critical. Here we compare Power BI and Tableau in terms of data connectivity and integration in a pharma IT landscape:

-

SAP and Enterprise Resource Planning (ERP): SAP is heavily used in pharma (for finance, supply chain, manufacturing, HR, etc.). Both Power BI and Tableau have native connectors for SAP databases. Power BI provides connectors for SAP HANA, SAP Business Warehouse (BW), and SAP BusinessObjects. For example, Power BI can connect to SAP BW cubes and queries either by importing data or via direct query, and can also connect to SAP HANA views ([39]). Microsoft even has documentation and support for using SAP’s NetWeaver libraries to ensure connectivity ([40]). Tableau similarly has native connectors for SAP HANA and SAP BW. Many pharma companies have leveraged Tableau on top of SAP – extracting data from SAP BW into Tableau for easier visualization. There is often parity here: both tools will require proper drivers (SAP connector DLLs, ODBC drivers for HANA, etc.) and typically some configuration by Basis/IT, but neither is locked out of SAP data. One difference is that Power BI can integrate with the broader Microsoft/SAP interoperability (for instance, SAP on Azure scenarios), but that’s more about infrastructure. If a pharma company uses Oracle E-Business or other ERP, both tools also connect to Oracle, SQL Server, etc.

-

SAS and Statistical Data Formats: SAS is a long-standing tool in pharma, especially in clinical trial analysis and regulatory submissions. Pharma companies have decades of data in SAS datasets (

.sas7bdatfiles) and often continue to use SAS for advanced stats. Tableau has an advantage in native support here – Tableau can directly connect to SAS files (as well as SPSS and R data files) and treat them as data sources ([22]). A Tableau user can, for example, import a.sas7bdatdataset of clinical results into Tableau and create visuals, without needing to convert it externally. Power BI currently does not have a built-in connector for SAS files ([21]). If one needs to get SAS data into Power BI, a common approach is to export the SAS dataset to CSV or Excel, or use an intermediary. Microsoft provides the ability to run R or Python scripts in Power BI, so one workaround is using an R script with thehavenpackage to read SAS files ([41]), but that’s a bit technical. Another approach is to have SAS output to a database which Power BI can read. This is a notable difference: for pharma teams with lots of SAS data, Tableau offers more direct integration, whereas Power BI would rely on conversion or using SAS’s ODBC driver (which is not commonly used). That said, once data is in a relational or file form, both can consume it. If SAS is used in a live operational sense (e.g., clinical programmers producing analysis datasets), IT could consider automating SAS to push data to a SQL database or data lake, which both Power BI and Tableau can connect to easily. -

Clinical trial databases and pharma-specific systems: Clinical data is often stored in specialized systems like EDC (Electronic Data Capture) databases (e.g., Medidata Rave, Oracle Clinical/OC/RDC, Clinical One, etc.), CTMS (Clinical Trial Management Systems), and safety databases (like Oracle Argus for pharmacovigilance). These systems usually use underlying relational databases (Oracle, SQL Server) or provide export capabilities. Power BI and Tableau can connect to any relational database given the appropriate drivers. For example, if clinical data resides in Oracle, both tools can use Oracle connectors to query the data (with SQL or via a semantic layer if one exists). In practice, many pharma companies create a data warehouse or data lake where critical data from these systems is consolidated for analysis. Both Tableau and Power BI excel at connecting to warehouses and lakes (be it a SQL data warehouse, Snowflake, Redshift, etc.). For clinical data visualization, a common pattern is: export aggregated data (like subject visit status, enrollment counts, adverse event tallies) from the clinical system to a CSV or database that BI tools refresh from. Some vendors also integrate with BI: for instance, LabKey (a research data platform) partnered with Tableau to allow direct visualization of lab and clinical data stored in LabKey Server ([42]) ([43]). This kind of partnership indicates that Tableau is often used in research/clinical data contexts as a front-end for custom databases. Power BI, being newer in pharma, is increasingly being connected to clinical data too – especially as companies modernize data infrastructure to Azure or similar.

-

Electronic Lab Notebooks (ELN) and Laboratory Systems: Research labs generate data from experiments, often stored in ELNs or LIMS. Examples include Benchling, IDBS E-WorkBook, BIOVIA, LabWare LIMS, etc. These systems may have their own reporting, but for cross-experiment analysis or R&D portfolio dashboards, BI tools are needed. Typically, data from ELN/LIMS can be exported or accessed via ODBC/JDBC. Both Power BI and Tableau can connect to the resulting data source. If an ELN uses a SQL back-end (some use SQL Server or Oracle), direct queries are possible. There are also cases of integration: e.g., Benchling (a cloud ELN) provides APIs and has customers using Power BI to pull metrics on R&D productivity ([44]) (Benchling’s report noted high adoption of R&D data platforms – 70% ([44]) – and these platforms often then feed BI tools). Tableau might have a slight edge in the number of native connectors (including some scientific file formats as mentioned), but both can connect to data if it's made accessible. If an ELN exports Excel or CSV files of experiment results, Power BI and Tableau can ingest those easily (both connect to CSV/Excel). If more real-time integration is needed, IT might build a pipeline where ELN data is replicated to a central database that BI tools update from periodically.

-

Data Lakes, Big Data, and Cloud integration: Modern pharma analytics is trending toward big data (genomic data, real-world evidence data, etc.). On this front, both tools have kept up: Power BI has native connectors to Azure Data Lake, Azure Synapse, Spark, etc., and leverages power query (M language) to transform data from big sources. Tableau can connect to Hadoop, Spark SQL, cloud data warehouses like Snowflake, Google BigQuery, Amazon Redshift, etc. No major differences here – if a pharma company has, say, a large patient dataset in Snowflake, both Tableau and Power BI can connect (Power BI via ODBC or native Snowflake connector using Power Query, Tableau via its native connector). Performance may vary, but generally both can push query down to these platforms. It’s worth noting that Power BI’s integration with Azure ML and cognitive services could be a plus if a team wants to apply machine learning models to data and then visualize in Power BI (there are features to invoke Azure ML models within Power BI). Tableau has introduced Tableau Science (integration with Python/R) which can call out to scripts for advanced analysis on the fly. For example, a pharma data scientist could use a Python script in Tableau to calculate a predictive score for each drug compound and visualize it, and similarly Power BI could use an R script visual for a Kaplan-Meier survival curve from clinical data.

-

Office Productivity and Collaboration tools: Pharma professionals often live in tools like PowerPoint, Excel, and now Slack/Teams for collaboration. Power BI’s reports can be easily embedded in Microsoft Teams channels or SharePoint sites, which is convenient if the organization uses Teams for project collaboration. This can streamline how, for example, a clinical project team reviews a Power BI dashboard each week within their Teams workspace. Tableau, being now under Salesforce, has integration with Slack (Salesforce owns Slack) – Tableau can send alerts to Slack or be embedded in Slack conversations. Tableau also provides embed options for intranet portals. If the pharma uses Office 365 exclusively, Power BI might have an edge in seamless collaboration integration (e.g., Outlook and Teams have Power BI plugins). However, Tableau’s collaboration features stand independently (Tableau Server’s web interface is quite user-friendly for sharing and commenting on dashboards).

-

Integration with Pharma CRMs and analytics tools: Pharma sales teams often use CRM systems like Veeva (which is built on Salesforce) for managing doctor interactions. Tableau, being a Salesforce product, can naturally integrate with Salesforce data (including Veeva CRM data) through native connectors, potentially making it easier to visualize CRM data in Tableau. Power BI can also connect to Salesforce/Veeva via API connectors (and some pharma companies do that, pulling CRM data into Power BI for combined analysis with other data). If the company uses other analytics tools like Spotfire (still used in some clinical monitoring) or Qlik, those are separate siloed tools; sometimes companies migrate Spotfire dashboards to Power BI or Tableau for consistency.

To highlight a key integrative difference relevant to pharma: Tableau’s ability to open SAS datasets directly vs Power BI’s lack of native SAS support can be a deciding factor for analytics teams entrenched in SAS. For instance, a pharmacovigilance group that has adverse event data in SAS files might lean towards Tableau to avoid a conversion step ([22]) ([21]). On the other hand, a company heavily using Excel and Access for data might find Power BI’s integration (Power BI can easily import Excel data and even keep a live connection to Excel files on OneDrive/SharePoint) extremely convenient, reducing friction in moving people off manual Excel reporting.

Overall, both Power BI and Tableau are very flexible in connecting to the data sources common in pharma – whether it’s an SAP data warehouse, a clinical trial database, or a CSV from an instrument. Tableau has a slightly broader list of native connectors, and its partnership ecosystem in life sciences (e.g., LabKey, as mentioned, and many consulting firms building Tableau dashboards for R&D) is strong ([42]) ([43]). Power BI, being part of the Microsoft stack, integrates naturally in environments already using SQL Server, Azure, or Office files – for example, one report notes “Power BI’s hallmark lies in its seamless integration with existing systems” in pharma contexts ([45]). This suggests that a pharma company with a heavy Microsoft footprint might plug Power BI into their data pipeline with minimal effort (especially if using Azure Data Factory, Synapse, etc., where connectors to Power BI are native).

The choice may come down to specific integration needs: If a critical need is to visualize clinical SAS datasets or use statistical tools output, Tableau might reduce ETL effort. If integration with Microsoft Power Platform (PowerApps, Power Automate) is desired – for instance, building an app where users input data that goes to Power BI – then Power BI has an advantage as part of that platform. Both tools also support API access to their services (Power BI REST API, Tableau REST API) so they can be programmatically integrated into custom pharma applications (for example, embedding an interactive dashboard into a custom web portal for investigators).

Pharma-Specific Use Cases and Examples

The true test of a BI platform is how well it addresses real-world use cases. In the pharmaceutical industry, some of the key analytics use cases include commercial (sales & marketing) analytics, R&D and scientific analytics, clinical trial data visualization, and regulatory compliance and operations reporting. Below, we explore each of these and how Power BI and Tableau are being utilized:

Commercial Analytics (Sales & Marketing)

In pharma commercial teams (sales, marketing, market access), BI tools are used to analyze sales performance, market share, physician targeting, promotional efforts, and more. These use cases involve large datasets like prescription sales data (e.g., IQVIA data feeds), CRM data (rep visit logs from Veeva), marketing campaign metrics, etc. Both Power BI and Tableau are widely used for sales dashboards and market analytics in pharma.

Power BI for commercial analytics: Many mid-sized pharma companies and sales teams appreciate Power BI’s ease and quick setup for sales reporting. It integrates well with Excel – historically sales data was wrangled in Excel, and moving to Power BI allows automated refresh and interactive slicing (by region, product, timeframe). One source notes Power BI is ideal for small to mid-sized pharma companies looking at market trends, sales data, and competitive intelligence ([46]). For example, a pharma sales operations team can use Power BI to create an interactive dashboard showing current sales versus targets by territory, with slicers for each product line. Sales managers can filter to their region and even use Power BI’s Q&A to ask questions like “show me growth in cardiology products on the West Coast.” Power BI’s ability to handle real-time or streaming data can be useful if, say, integrating weekly prescription data feeds for near real-time market share updates. Another advantage is mobile access – Power BI mobile apps allow sales reps on the road to check their latest numbers. Microsoft also offers Power BI Embedded, which some pharma companies use to integrate sales analytics into internal portals or even rep iPad apps. There are documented examples of pharma leveraging Power BI for sales: e.g., a case study of a Fortune 500 pharma in New Jersey that used Power BI combined with an analytics accelerator (Visual BI’s ValQ) for advanced sales forecasting ([47]). The low cost per user means even large salesforces can be equipped with analytics without huge licensing cost, which is attractive in commercial operations that might have hundreds of reps.

Tableau for commercial analytics: Tableau is heavily used by pharma commercial analytics teams as well, especially at larger companies. Its strength in data visualization helps in analyzing complex market data. For instance, Tableau can easily create maps for regional sales (built-in geo support for territories), which is great for visualizing prescription volumes by state or sales rep region. Pharma marketing teams use Tableau to analyze and share sales data across departments, as seen in the Apoteket case: after adopting Tableau as a standard platform, their sales organization took a more strategic approach and could “analyse and share sales data with different departments”, increasing collaboration and preventing costly mistakes ([48]). The self-service nature of Tableau allowed other teams (marketing, finance) to also tap into sales data without it being siloed ([48]). Tableau’s visuals can combine data (for example, linking sales figures with marketing spend to compute ROI in a single dashboard). Another commercial use is market access analytics – pricing and reimbursement data can be visualized to help market access teams optimize contracts; Tableau’s flexibility can merge financial and sales data to support these analyses. Given that sales & marketing is the largest segment (31.5%) of life science analytics applications ([49]), both tools find heavy usage here. The choice often depends on company standards: some big pharmas standardized on Tableau earlier for sales force dashboards, while others now pilot Power BI due to costs. It’s not uncommon that a marketing analytics group uses Tableau for its advanced visuals, while a field sales group uses Power BI via their O365 licenses – both tools ultimately capable of similar outcomes (e.g., identifying high-prescribing physicians, tracking market share changes after a drug launch, etc.).

From an outcome perspective, better commercial analytics leads to improved strategy. A 2024 survey of pharma commercial execs showed 79% agreed that more accurate insights positively impact brand performance ([50]). Using these BI tools, teams can quickly identify which drug brands need attention, which territories are underperforming, or which marketing campaigns yield the best ROI – and then act to optimize resources. For example, a dashboard might highlight that a certain region’s sales are 15% below target due to low call frequency; the sales director can then adjust tactics. Both Power BI and Tableau facilitate such insight-to-action loops in the commercial domain, with Power BI perhaps integrating slightly better into the workflow if an organization lives in Outlook/Teams (one could have alerts emailed via Power BI, etc.), and Tableau offering rich visuals that can be embedded into presentations or portals (the mantra often is “Tableau for powerful storytelling with data”).

Research & Development (R&D) Analytics

R&D analytics covers early drug discovery data, preclinical studies, and other scientific analytics. This can involve experimental data from labs (compound libraries, assay results), research portfolio management, and even omics data. Traditionally, scientists used tools like Spotfire or custom graphs in statistical software, but Power BI and Tableau are increasingly used to give management and scientists a high-level view of R&D progress and data.

Tableau in scientific research: Tableau’s ability to handle complex data and allow custom visuals makes it popular in R&D settings. Large pharma companies use Tableau for clinical data analysis and drug development analytics ([51]). For instance, in drug discovery, scientists might generate large tables of screening results for thousands of compounds – Tableau can visualize these as scatter plots of activity, allowing researchers to filter and find promising candidates. One cited use is “in-depth molecular analysis” where Tableau can visualize chemical structure data or assay results to help identify potential drug candidates ([52]). Tableau also helps in research portfolio dashboards: management can see all ongoing research programs, their timelines, resource usage, etc., in one interactive view. Because R&D data can be very heterogeneous (different formats, from instrument CSVs to database entries), Tableau’s flexibility in data source integration is beneficial – researchers can pull data from a CSV exported from an ELN and combine it with data from a project tracking database in one Tableau dashboard. Another example: Merck’s research teams have used Tableau to navigate supply chain complexities for R&D and ensure better outcomes ([53]) (like ensuring critical compounds reach the right labs – a mix of R&D and ops). Additionally, data science teams often prefer Tableau when they want to quickly visualize results of models (like plotting actual vs predicted activity of compounds) because it’s quick to drag results in and iterate visuals for understanding patterns.

Power BI in R&D: Power BI is also making inroads in R&D, especially in organizations that standardize on Microsoft. It offers strong data modeling which can be useful if R&D data from different systems needs to be related. For example, linking a compound registry (chemical IDs) with assay results and perhaps literature references – Power BI’s data model can create relationships and allow unified analysis. During COVID-19, many pharma R&D teams needed to quickly analyze research data and Power BI was sometimes deployed due to its agility. A tech blog noted that “Power BI empowers pharma companies to turn complex data into clear, actionable insights” ([45]) in research contexts. This includes integrating data from logistics, experiments, and even external sources. For instance, predictive analytics in manufacturing or process development (like analyzing process parameters vs outcomes across batches) can be done in Power BI with its strong calculation engine, then visualized for process scientists. While historically Tableau had more adoption in R&D, post-2020 more R&D IT groups consider Power BI because of cost and integration with emerging cloud data warehouses (some R&D data lakes are on Azure, making Power BI a natural choice). Microsoft’s AI features (like automated insights) may also help research teams find patterns without manual analysis.

It’s worth mentioning that R&D analytics often require custom analyses (e.g., statistical calculations, non-linear regression plots). Tableau and Power BI can handle some of these but might need to integrate with R/Python for heavy stats (both can: Tableau via external services, Power BI via R/Python visuals). If a pharmacologist needs to do a specific analysis (say, a dose-response curve fit), they might do it in R, then import results to Tableau or Power BI for visualization to a broader team.

Importantly, R&D analytics is a fast-growing area – the life science analytics market analysis shows the R&D segment is expected to grow at the fastest CAGR through 2034 ([49]). This growth is driven by adoption of AI/ML and advanced analytics in discovery. Power BI and Tableau are being used as front-ends for these advanced analytics: for example, a machine learning model might predict drug targets and the results are visualized in an interactive dashboard to allow scientists to explore different scenarios.

A quick example of each: A Tableau R&D dashboard might allow drill-down from a portfolio view (projects colored by phase and risk) into experimental data for a specific project, employing filters to find experiments with outlier results (indicating a potential problem or breakthrough). A Power BI R&D report might mash up data from a compound database and an external bioinformatics API to show a profile of a molecule across various data sources, using custom visuals or DAX to combine scores.

Clinical Trial Data Visualization

Managing and monitoring clinical trials is data-intensive. There are subject enrollment numbers, protocol deviations, adverse events, site performance metrics, timelines – all critical to trial success and regulatory submissions. Traditionally, clinical operations teams relied on static reports or CRO-provided summaries, but now interactive dashboards are revolutionizing trial oversight.

Tableau in clinical trials: Tableau has been used by clinical data management and clinical operations teams to create real-time trial dashboards. For example, a CRO (Contract Research Organization) called Advanced Bio-Logic Solutions (ABL) leveraged Tableau to implement a risk-based monitoring approach for clinical trials, following FDA guidance ([54]) ([55]). The FDA recommended using data to identify high-risk trial sites so monitors can focus on those; ABL recognized that to do this efficiently, disparate clinical data (from multiple systems) needed to be aggregated and made easily understandable to non-data experts ([56]). They chose Tableau as the solution to integrate multiple data sources and deliver intuitive analytics quickly ([55]). The result was that trial managers could see, for instance, which sites had higher error rates or more protocol deviations (Tableau can visualize this, perhaps as control charts or color-coded site metrics). This enabled proactive management, potentially reducing trial costs by focusing monitoring on problem areas ([57]) ([58]). The impact of such use is huge: reducing even a fraction of that “30% of trial cost due to site monitoring” can save millions ([59]), and more importantly, catching issues early can improve data quality for regulatory submissions.

Tableau is also used for clinical data review dashboards – e.g., medical monitors and data reviewers use it to track patient progress and safety signals. A dashboard might show enrollment over time, dropout rates, lab result outliers, and severe adverse events, all with filters for site, country, patient demographics, etc. The flexibility of Tableau’s visuals (like boxplots for lab values, or timelines for patient visits) is very useful here. Some pharma companies have Tableau as part of their clinical data review portal, connecting to clinical data warehouses updated nightly from EDC.

Power BI in clinical trials: Power BI is increasingly applied to clinical trial management as well. Microsoft even partners with companies to create Power BI templates for clinical trial analytics. For instance, Power BI can be used to provide a “study enrollment dashboard” where trial managers track how many patients have been screened, enrolled, completed, etc., and whether they are meeting enrollment targets. WaferWire (a consulting firm) notes that even clinical trial tracking can be handled by Power BI for companies conducting trials, helping report progress, enrollment, and adverse events – with simplicity making it accessible to trial managers ([60]). This implies that a study coordinator (not necessarily a data scientist) could use a Power BI dashboard to see real-time recruitment numbers and maybe drill into a particular site’s performance.

Power BI’s strengths in combining data could also play out when merging operational data (like site activation dates, monitoring visit dates) with clinical data (enrollments, data queries). For example, a Power BI report could correlate the number of monitoring visits with data query resolution times to identify if more monitoring helps a site’s data quality. With the integration into Teams/SharePoint, a trial team could have the Power BI report available in their project site for all team members to consult.

On the safety side (pharmacovigilance), while specialized signal detection tools exist, Power BI and Tableau are sometimes used to create safety dashboards – e.g., showing the frequency of adverse event types across studies or geographies, to spot any unusual patterns. Pharmacovigilance is listed as one of the application areas of life science analytics ([61]), so BI tools have a role in aggregating and visualizing safety data too (though typically post-marketing safety has huge data, requiring big data solutions, but initial visualization can be done in these tools).

Ease of use for medical staff: One advantage of using BI dashboards for clinical data is that non-statistical staff (like study physicians or project managers) can interact with the data without waiting for biostatisticians to produce reports. They can filter to a specific patient to see their timeline of events, or generate a graph of a lab value over time for a subset of patients. Tableau’s drag-drop can allow a medical monitor to do exploratory analysis if given sufficient access. Power BI’s simplicity might allow a project manager to self-serve answers like “which sites are lagging in data entry?” by clicking on a map visual to isolate those with low enrollment.

In practice, both tools have been successfully used in clinical trial oversight. The risk-based monitoring example with Tableau (ABL) shows tangible benefits: focusing on risk signals, thus “getting life-saving therapies to market faster, better, and less expensively” ([62]). Similarly, a pharma might use Power BI to unify data from multiple CROs in a single view, giving a sponsor real-time insight instead of static monthly reports. The ability to quickly identify a trend (like a higher adverse event rate in one arm of a trial) can speed decisions or trigger necessary actions (like a safety review), ultimately impacting patient safety and trial success – outcomes far more important than the tool choice, but facilitated by good BI.

Regulatory Compliance and Quality Reporting

Pharmaceutical companies must adhere to stringent regulatory standards in manufacturing and quality control, as well as ensure compliance in everything from promotional activities to data integrity. BI tools are invaluable in tracking and reporting compliance metrics and in generating the reports needed for regulators or internal quality management.

Manufacturing & Quality KPIs: Pharma manufacturing (often under FDA’s cGMP – current Good Manufacturing Practice) generates data on batch production, deviations, CAPAs (Corrective and Preventive Actions), audit findings, etc. Both Power BI and Tableau can connect to manufacturing execution systems or quality management systems to produce quality dashboards. For example, a quality assurance team could have a Tableau dashboard for compliance that shows the status of all CAPAs and audit observations across plants, highlighting any overdue actions – this was mentioned as a use case where Tableau’s customization helps create compliance dashboards and risk assessments tailored to specific regulatory requirements ([63]). A large pharma might have hundreds of manufacturing deviations a month; tracking them by category, product, and plant in an interactive way helps ensure none fall through cracks and identify systemic issues (e.g., many deviations of a certain type in one plant might signal a training issue). Tableau’s ability to present complex data in an understandable way can aid plant managers in their continuous improvement meetings.

Power BI for compliance reporting: Power BI is also used in the quality/compliance arena. For instance, global quality teams might use Power BI to consolidate metrics from various sites in a single report that gets distributed to the head of quality. An article on Power BI in healthcare noted that it can effectively address healthcare compliance reporting with HIPAA and GDPR in mind ([64]), which by extension applies to pharma data privacy compliance. If a pharma needs to ensure all promotional materials go through review, a Power BI dashboard could track the review cycle times and approver compliance to SOPs.

One concrete area is 21 CFR Part 11 audit readiness: an IT compliance manager could use BI to ensure all systems are validated and all user access reviews are up to date. For example, feeding data from an IT compliance database into Power BI to create a dashboard of validation status for each system (including Tableau or Power BI themselves if validated!). It’s a bit meta, but plausible.

Regulatory submission reporting: When pharma companies file NDAs/BLAs (new drug applications) with the FDA, they must often summarize tons of data – some companies have started to use internal dashboards to ensure the submission data is consistent and complete. While the actual submission to FDA is in documents, the teams preparing them might use Tableau to cross-check data sources. Also, after approval, regulators often require periodic safety or manufacturing reports – BI tools can automate some of this by pulling data and allowing teams to generate the needed tables/graphs with minimal manual effort. For example, an Annual Product Review (APR) requires summarizing quality data for each product; a Power BI report could produce the APR figures (like number of batches, number of deviations, out-of-spec results, etc.) automatically from data sources, ensuring consistency and saving time.

Audit trails and transparency: One nice feature of using BI for compliance is transparency. Instead of digging through spreadsheets, leadership can have a live view of compliance status. Many pharma companies have internal compliance dashboards for management – e.g., to ensure training compliance (everyone completed their required GMP training), or to monitor that studies registered on ClinicalTrials.gov are updated in a timely manner (there are rules for that in the U.S.). These dashboards provide accountability: if something is off, it’s visible. In a U.S. environment with high regulatory scrutiny, being on top of compliance metrics is crucial to avoid warning letters or fines.

Pharmacovigilance and post-market monitoring: As part of regulatory compliance, tracking of adverse events and product complaints is mandated. While specialized safety systems do signal detection, summary dashboards in BI tools can present the state of compliance (e.g., what percent of adverse event cases were processed within the required 15-day window, how many are backlogged). A BI dashboard can integrate data from the safety database to give quality/regulatory leaders a clear picture.

In all these cases, both Power BI and Tableau can be used effectively. The choice might depend on the specific workforce: compliance and quality teams might prefer a tool that they can use with minimal technical fuss (some quality professionals have Six Sigma training and are used to Minitab/Tableau). Tableau’s popularity in some pharma quality circles is notable (because it was often adopted by manufacturing divisions to replace legacy reports). Power BI, if the company is already using it elsewhere, could be extended to compliance use cases easily.

To illustrate, consider a U.S. pharma manufacturing site dashboard: Using Power BI, it pulls data from the site’s batch record system and shows real-time batch status, any deviations flagged, and whether environmental monitoring is within limits. It might integrate with an SPC (statistical process control) tool output to show control charts of critical parameters. The site quality lead checks this Power BI dashboard every morning to ensure all processes are in control, rather than waiting for weekly reports. Meanwhile, the corporate quality VP might have a Tableau dashboard aggregating data from all sites with high-level KPIs (like batch success rate, deviation rate per 100 batches, audit scores). Both tools could do either, but maybe the site started with Power BI because it was quick and cheap, and corporate started with Tableau historically for consistency of visual reporting.

Ultimately, the BI tool enables a culture of proactive compliance – by making compliance data visible and understandable, issues can be addressed before they escalate. As one pharma analytics blog put it, with BI “you can harness information at hand and remain compliant at all costs”, providing each department with insights in real-time ([65]) ([66]). This is a critical benefit in an industry where compliance is not optional.

Industry Adoption Trends and Statistics

To put the comparison in context, it's helpful to review how BI tool adoption is trending in the pharmaceutical industry and how Power BI and Tableau are faring in this sector:

-

Growing investment in analytics: Pharma companies are ramping up analytics capabilities across the board. In a March 2024 survey of U.S. pharma industry executives, 69% of commercial teams said they are increasing their spending on data analytics solutions (only 5% were cutting back) ([3]). More significantly, more than 85% of biopharma executives intend to increase investment in data, AI, and digital tools in 2025-2026, aiming to reduce drug development costs and timelines. Healthcare's investment in AI is growing exponentially, with spending increasing to $1.4 billion in 2025, almost triple the investment from 2024. This aligns with broader digital transformation efforts as pharma recognizes data as a strategic asset. The same survey highlighted that lack of timely insights was a top challenge cited by 74% ([67]), which explains the budget increases – companies are trying to fix that gap with better BI and AI tools.

-

Reliance on external vs in-house solutions: Interestingly, that survey found 76% of pharma commercial execs still turn to consulting agencies for analytics (and 58% to technology vendors), while only 21% use in-house solutions ([68]). This indicates that many pharma companies historically outsourced a lot of their analytics or used vendor-provided tools. However, with the advent of user-friendly BI platforms, there’s a push to bring more analytics in-house (for agility and deeper institutional knowledge). Tools like Power BI and Tableau are catalysts for this insourcing because they empower internal teams. We might expect that 21% figure to grow as companies build internal analytics competency using these BI tools, reducing reliance on consultants for routine insights.

-

Market share of BI tools in pharma: While specific industry share is proprietary, we know in general that Microsoft Power BI and Tableau are the market leaders in BI usage. The 2025 Gartner Magic Quadrant positions Microsoft as the clear market leader, with Gartner commending its "dominant" market presence. Both Power BI and Tableau (Salesforce) remain in the Leaders quadrant, with Google and Qlik also maintaining Leader status ([4]). Some analyses put Power BI ahead in global market share, with estimates showing Power BI at approximately 30% market share vs Tableau at around 20% ([69]). A notable observation from Gartner's 2025 report is that traditional BI vendors no longer control the analytics conversation – native analytics capabilities in data platforms like Databricks and Snowflake are increasingly serving organizational needs. In pharma, Tableau had strong early adoption in the 2010s (especially in R&D and commercial analytics departments), but Power BI adoption has surged in recent years due to its inclusion in many enterprise agreements, lower cost, and deep Microsoft Fabric integration, leading some pharma companies to pilot or switch to Power BI for new projects. Many large pharma companies actually use both – for example, one division might use Tableau and another uses Power BI, depending on legacy and needs. The trend, however, is that Power BI's popularity continues rising – Microsoft now reports over 350,000 organizations worldwide use Power BI ([5]), so new pharma use cases may lean towards Power BI if there's no incumbent tool, especially in cost-conscious environments.

-

Adoption of enabling tech in R&D: The 2023 Benchling “State of Tech in Biopharma” report revealed that R&D data platforms are adopted by 70% of biopharma companies (the most widely adopted tech in that survey) ([44]). This means a majority have some system in place to capture research data. However, it also noted only 18% are using SaaS software for the majority of R&D work ([44]). This suggests that while data is being captured, the use of cloud or modern analytics is still nascent in some R&D areas – an opportunity for BI tools as they often come as SaaS. As these companies become more comfortable with cloud (given the availability of validated cloud options), one can expect increased use of tools like Tableau Cloud or Power BI Service for R&D analytics.

-

Regional focus (U.S. vs elsewhere): North America (led by U.S.) is the largest market for life science analytics, with over 52% share ([2]). U.S. pharma companies often have bigger budgets and are early adopters of tech compared to some other regions, meaning they have driven a lot of the BI adoption. Many U.S. pharma have been using Tableau for over a decade now. The fact that the U.S. is so dominant in share indicates that any trends (like shift to self-service BI) are likely being pushed strongly by U.S. companies. Europe and APAC are catching up in analytics but often the decisions and headquarters are in U.S. For BI vendors, this means focusing on U.S. pharma needs (hence the emphasis on HIPAA, Part 11 compliance, etc., which both vendors have done).

-