Health Insurance Formulary: What It Is & How It Works

Executive Summary

In the United States health insurance system, a formulary is the complete list of prescription medications covered by a particular insurance plan ([1]). Formularies categorize drugs (often by therapeutic class or by “tier” designations) and establish the cost-sharing or utilization controls (like copay tiers, coinsurance rates, prior authorization, step therapy, etc.) for each drug ([1]) ([2]). Because prescription drugs account for a large and growing portion of health care spending ([3]) ([4]), insurers and policymakers use formularies as a primary tool to manage drug costs. By favoring certain medications (for example, cheaper generics, biosimilars, or drugs negotiated at deep rebates) and excluding or restricting others, formularies influence what therapies physicians prescribe and what costs patients face at the pharmacy. Indeed, formularies are widely viewed as a cost-control mechanism. For example, a comprehensive review notes that formulary systems “have proven to be a valuable means to control the pharmacy benefit” ([5]).

However, formulary design also critically affects access to medicines and health outcomes. A restrictive or poorly constructed formulary may force patients onto different drugs, interrupt stable therapy, or raise out-of-pocket costs. As one analysis contends, formularies and associated utilization-management programs can be “as important as nominal benefit design in determining enrollees’ access to medications” ([6]). Indeed, policymakers have repeatedly weighed ingredients of formularies (e.g. requiring certain drug classes be fully covered) to balance cost control against patient needs. For instance, Medicare Part D plans are required to include “all or substantially all” drugs in six protected therapeutic classes, ensuring vulnerable patients retain access to those medicines ([7]). By contrast, Medicaid by law must cover essentially all FDA-approved outpatient drugs (preventing states from excluding medications via formularies) ([8]).

This report provides an in-depth exploration of formularies in U.S. insurance plans from historical, clinical, financial, and policy perspectives. We begin by defining formularies and tracing their origins – from ancient pharmacopoeias to modern hospital lists and managed-care tools ([9]) ([10]). We then examine how health plans and Pharmacy Benefit Managers (PBMs) create and maintain formularies, including pharmacy & therapeutics (P&T) committees, rebate negotiations, and tier structures. We analyze different formulary types (open, closed, partially closed, tiered levels, value-based, etc.) and the implications of each ([11]) ([12]). We compare formulary practices across sectors (employer plans, Medicare, Medicaid, VA/Tricare), including special rules like Medicare’s “two drugs per class” requirement ([13]) and Medicaid’s ban on closed formularies ([8]).

Using data and case studies, we quantify how formularies influence spending and patient cost-sharing. For example, across employer plans today, nearly all covered workers are subject to tiered formularies: in 2023 about 91% faced a multi-tier design ([14]), most with three or more tiers ([15]). Typical copayments climb steeply through the tiers (roughly $11 for first-tier generics, $36 for second-tier brands, $66 for third-tier, and $125 for fourth-tier drugs ([16])). We present novel evidence on outcomes: in one large value-based formulary (Premera Blue Cross’s 2010 design), pharmacy spending dropped 11% below expected without reducing adherence to essential therapies ([17]).

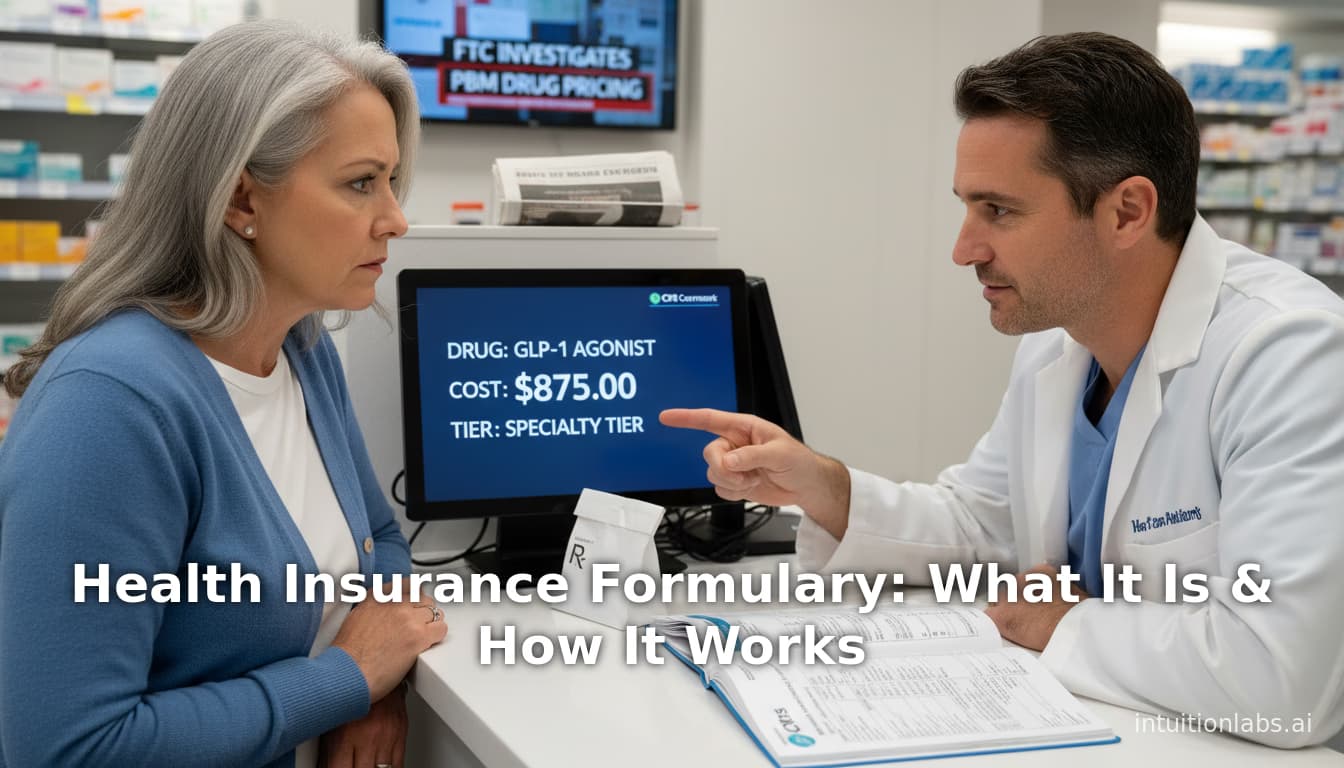

We also address controversies and future directions. For instance, recent regulatory reforms have allowed greater use of utilization management even for protected classes ([18]), and proposals to transform Medicare Part D (such as allowing the government to negotiate prices or create its own national formulary) have implications for insurers’ formularies ([19]). Meanwhile, critics have accused PBMs of steering patients toward higher-priced drugs to secure rebates. A September 2024 FTC lawsuit alleges that major PBMs deliberately excluded lower-cost insulins from formularies to maximize rebate revenue ([20]).

Finally, we consider the evolving landscape: forthcoming high-cost therapies (e.g. novel biologics, cell therapies) may further strain formularies; value-based insurance design is being explored to align copays with clinical benefit; and digital tools (like real-time benefit checkers) aim to make formulary information transparent at the point of prescribing ([21]). The report concludes by synthesizing these findings and outlining future policy directions. All assertions are supported by current data and peer-reviewed sources, government guidance, and industry analyses.

Introduction and Background

A formularies (or drug list) is fundamentally a detailed inventory of the prescription medications that a health insurance plan will cover and how much the patient must pay for each ([1]). Formulary design is a central element of managing a pharmacy benefit. It shapes patient access and cost-sharing: drugs on preferred tiers or class “formulary” benefit lists cost less out-of-pocket (copays or coinsurance) than non-preferred or excluded drugs ([1]) ([2]). Because producers of new drugs often set high list prices, insurers use formularies to incentivize use of lower-cost therapeutic alternatives (generics, biosimilars, or negotiated brands) whenever clinically appropriate ([1]) ([22]).

The purpose of a formulary is to guide prescribing and drug dispensing toward safe, effective, and cost-efficient choices.A commonly cited definition states that a formulary is more than just a static list: it is “an entire system established to optimize patient care through safe, appropriate, effective, and economic use of drugs,” with the Pharmacy and Therapeutics (P&T) committee as its “cornerstone” ([23]) ([24]). P&T committees (composed of physicians, pharmacists, and others) evaluate evidence and recommend which drugs to include. The formulary and these clinical-management rules (e.g. step therapy, prior authorization) then function together as a stewardship and utilization control program ([25]) ([24]).

Formularies are ubiquitous and long-established. Their ancient roots go back millennia: early “formularies” were essentially pharmacopoeias containing recipes for drug preparation. As one history notes, a Sumerian clay tablet from ~3000 B.C. was the oldest known example of a formulary, with later examples in Renaissance Europe; by the 1700–1800s, hospitals and cities in America had their own published formularies or compendia (e.g. the 1820 USP formulary) ([26]). Over time, formularies evolved from recipe collections into tools for standardizing drug quality (e.g. USP pharmacopoeias) and, ultimately, controlling drug use and costs (e.g. hospital formularies). For example, in the 1930s the New York Hospital formulary began listing generic names and recommending substitutes to curb wasteful or duplicate prescribing ([27]). By mid-20th century, hospitals formally adopted P&T committees and standardized formularies: the Joint Commission on Accreditation of Hospitals required a P&T committee for accreditation by 1965 ([28]), and professional bodies (ASHP, AMA, etc.) issued standards around formularies in the 1950s–60s ([29]).

As health insurance grew and pharmaceutical innovation accelerated (from mid-1900s onward), formularies migrated to the outpatient and managed-care arena ([10]). “By the 1970s and ’80s,” one analysis recounts, “managed care organizations (MCOs) soon realized that the most efficacious product for an inpatient setting would not necessarily be the most appropriate therapy for outpatient use” ([28]). This led insurers to adopt outpatient formularies modeled after hospital lists, but refined for cost management. Thus, the modern health plan formulary arose as a beneficiary of hospital practice: requiring an approved list of drugs in exchange for payment, with organized restrictions such as prior authorizations.

Formularies entered U.S. policy discourse with Medicare Part D (the 2006 expansion of coverage for seniors). Lawmakers recognized that requiring seniors to navigate formulary restrictions was a new phenomenon, so Part D regulations included protections (see Protected Classes and Part D below). More broadly, since 2003 managed care has become the norm in drug coverage: the vast majority of employer-sponsored plans, Medicare Advantage (Part C) and Part D, and even many Medicaid states rely on formularies and PBMs to manage their pharmacy benefits (rather than paying any prescription at 80% coinsurance, for example).

Today, formularies are a point of widespread attention. Rising drug prices and high patient cost sharing have made formularies (and related design choices) politically salient. Manufacturers, patient advocate groups, and policymakers all have stakes in formulary design. Formulary changes—adding a new weight-loss agent, blocking a step-2 therapy—often generate news headlines and lawsuits. As new expensive therapies (specialty biologics, CAR-T genes, etc.) enter the market, formularies are one key battleground for cost control. This report delves deeply into how formularies function in the U.S. insurance system: how they are built, what rules govern them, how they affect spending and health, and what the future may hold.

Formulary Structure and Design

Formulary Terminology and Types

Insurance formularies are categorized in multiple ways. Terminology varies by insurer, but common descriptors include open vs closed vs partially closed, tiered, preferred vs non-preferred, and value-based formularies ([11]) ([12]). Broadly:

-

Open formulary: A very inclusive list of drugs with few coverage restrictions ([11]). All or nearly all drugs are covered with standard cost-sharing, though some “preferred product” list may exist. In an open formulary, clinicians can generally prescribe any medication without major barrier. Open listings may still suggest cheaper alternatives, but they impose “little impact on physicians or pharmacists” since few drugs are excluded ([30]). Historically, many indemnity plans in the 1980s and some HMO plans opted for open formularies to maximize access. (By contrast, the 1990s saw a shift toward narrower formularies as drug budgets ballooned.)

-

Closed formulary: Only a limited, specified list of drugs is covered ([12]). The plan pays for medications only if they are on its formulary list; otherwise the patient must pay the full cost or forgo treatment. The closed list typically includes multiple options in each therapeutic category, but formulary exclusions are significant. A P&T committee chooses which products (often generics plus a few brands) to include. Any non-formulary drug requires special authorization (often a physician letter proving medical necessity) to be covered ([31]). Closed formularies demand more clinician effort but yield the most control over utilization and spending. They “produce high rates of prescriber compliance, foster generic use,” and support negotiating with manufacturers for rebates, according to one review ([32]). Voice-of-industry surveys indicate closed formularies grew dramatically in the 1990s and 2000s, as employers shifted from open designs to types offering maximal savings ([33]). (For example, one contemporaneous source forecast rising closed-formulary adoption from ~8% to 17% of large employers in 1995–97 ([34]).)

-

Partially closed (or partially open) formulary: A hybrid design that is largely open but with specified exclusions ([35]). Usually, only certain drugs or entire drug classes are left off the list. For instance, a plan might cover “all or almost all” drugs except one brand name, or exclude one small category (e.g. cosmetic creams, non-preferred allergy meds). Often the criteria for these exclusions are clinical (e.g. excluding an older formulation) or cost-driven. Partially closed formularies allow insurers to quickly curb costs in targeted areas without building a fully restrictive list. The effect is somewhere between open and closed: patients enjoy broad coverage, but are hit by full price or prior auth for specific non-covered medications.

-

Tiered formulary: Rather than (or in addition to) strict inclusion/exclusion, most modern plans use multi-tier cost-sharing. Drugs are slotted into tiers (e.g., Tier 1: generics; Tier 2: preferred brands; Tier 3: non-preferred brands; Tier 4+: specialty or high-cost agents). Each tier has a different copayment or coinsurance rate ([2]) ([16]). Patients pay more out-of-pocket on higher tiers. Tiering creates financial incentives to pick generic and cheaper drugs but still covers everything. Nearly all U.S. formularies use some tiered structure. In 2023 about 91% of covered workers’ plans had tiered prescription cost-sharing ([14]), and 87% faced three-or-more tier structures ([15]). (By contrast, very few plans now have a “flat” single cost level or only two tiers ([36]).)

The table below summarizes common formulary categories:

| Formulary Type | Characteristics | Examples/Notes |

|---|---|---|

| Open | Extensive drug list; few restrictions. Includes generics and brands, typically covering the vast majority of medications; minimal prior authorization. Has “preferred” products but no coverage denial if non-preferred is used ([30]). | Once common in indemnity and early managed care plans. Rare today in isolation (most plans use some tiering even if broad). |

| Closed | Restricted list; excludes any non-listed drugs. Only formulary drugs are covered; non-formulary requires prior authorization or is paid fully by patient ([12]). Maximizes cost control. | Employed by many PBMs and plans to negotiate rebates. |

| Partially closed | Mostly open but excludes certain drugs/classes. Essentially an open list with specific holes (e.g. excludes brand X, or all weight-loss drugs, etc.) ([35]). Offers immediate cost cuts without full remodeling. | Common for minor tweaks (e.g. cost-control in select categories). |

| Tiered | Coverage by cost-sharing tier. Drugs are “on-formulary” but sorted into 2–5 tiers (gen/ preferred/ non-preferred/ specialty, etc.) with ascending copays or coinsurance ([2]) ([16]). Encourages lower-tier use. | Over 80% of employer plans now use 3+ tiers ([15]). |

| Value-based (VA) | Evidence-driven tiers. Copays and coverage determined by each drug’s clinical value or cost-effectiveness ([37]). High-value drugs have low copays, low-value have higher cost-sharing. | E.g. Premera Blue Cross’s 2010 VBF led to 3% cost drop w/o harming adherence ([17]). Simulations show large potential savings ([38]). |

Examples of tiered copays from large employer plans (2023 KFF survey) are illustrated below; higher tiers (e.g. new brands or specialty biologics) carry significantly higher patient costs ([16]).

| Tier Level | Average Copay (3+ tier plans, 2023) | Average Coinsurance (3+ tier plans) | Drugs Typically Included |

|---|---|---|---|

| Tier 1 (generics) | $11 ([16]) | 20% ([39]) | Generic equivalents |

| Tier 2 (preferred brands) | $36 ([16]) | 26% ([39]) | Brand-name drugs with generics available |

| Tier 3 (non-preferred) | $66 ([16]) | 38% ([39]) | Brand-name drugs without generics (non-preferred brands) |

| Tier 4+ (specialty/new) | $125 ([16]) | 28% (tier 4); 37% (tier 3) ([39]) | Specialty drugs, new therapies, or lifestyle drugs (often coinsurance) |

Formulary Creation and Management

Pharmacy & Therapeutics (P&T) Committees and PBMs. Formularies are typically designed by multidisciplinary P&T committees, which review the clinical evidence and cost-effectiveness of drugs. A P&T committee (composed of physicians, pharmacists, and other experts) “decides the amount of control and form the formulary will take” ([24]). Committees regularly convene to update formularies: adding new drugs, removing obsolete ones, and adjusting tiers. In practice, many insurance plans outsource this work to Pharmacy Benefit Management (PBM) companies (e.g. CVS Caremark, Optum Rx, Express Scripts). PBMs often maintain a "master formulary" developed by their own P&T panels ([40]). Individual insurers or employers (the MCO or plan sponsor) then can adopt the master form, or tailor it into a customized subset. As one review describes: some health plans “contract with a PBM” whose P&T committee “develop [s] and approve [s] a master formulary,” which the plan then uses wholly or adapts ([40]). This means an OptumRx or Express Scripts formulary often underlies many commercial plans.

The formulary committee not only selects drugs but also sets policies: which therapies need prior authorization, which require step therapy, and what substitutions are automatic. For example, it might dictate that any prescription for an expensive inhaler be step-therapied (substituting a cheaper asthma medication first). Because drug markets and evidence change rapidly, formularies are frequently updated (often yearly or even quarterly). PBMs use extensive data (clinical trials, guidelines, utilization patterns) and supplier negotiations; they also solicit input from provider networks. Then CMS or state agencies review these formulary changes for compliance (in Medicare Part D, insurers must submit their updated drug lists for approval each year).

Prior Authorization, Step Therapy, and Other Controls. Most formularies accompany each tier with utilization management rules. For a drug not on the formulary or on a higher tier, plans may require a prior authorization (PA) – pre-approval from the insurer that the drug is medically necessary. Step therapy (failure-first) mandates patients try a lower-cost therapy (e.g. generic or formulary drug) before “stepping up” to a higher-cost alternative. According to CMS, by late 2019 Part D plans were allowed to broaden use of PA/step-therapy even for many protected classes (e.g. requiring PA for initiating new prescriptions of certain antidepressants) ([18]). Formularies often trigger pharmacy edits at point of sale: if a prescriber orders a non-formulary drug, the pharmacy must call the physician or the insurer for an override. Many plans also offer “exception” processes: patients can petition with a medical justification to have a non-formulary drug covered as an exception. While exception mechanisms exist, they impose administrative burdens and delays for victims of formulary changes.

Formulary Tiering and Cost-Sharing. Nearly every formulary is tied to patient cost-sharing. In a typical 3-tier design, Tier 1 copayment (low-cost generics) might be $10–$15; Tier 2 copay (preferred brands) ~$30–$40; Tier 3 copay (non-preferred brands) $60–$75 ([41]) ([16]). A fourth tier (for specialty drugs) often uses coinsurance (e.g. 25–33%). Some employers have even introduced a fifth “cost fiefdom” for certain lifestyle or biosimilar agents. KFF data show these tiers have tightened cost gradients over time. CMS requires Part D plans to allow both copays and up to 50% coinsurance in mandatory tiers, as long as all six protected classes are minimally covered ([7]). (The 2023 KFF report found average copays of $11, $36, $66, and $125 for tiers 1–4 in multi-tier plans ([16]), with coinsurance as a backstop.)

A useful way to summarize formulary structure is to compare plan types, as in Table 2 below. Medicare Part D plans must meet statutory formulary design rules (e.g. two drugs in each category, six protective classes) ([13]) ([7]), whereas Medicaid programs must cover all drugs by law ([8]). Commercial (employer) plans choose design freely but typically tier their lists aggressively to manage premiums ([2]) ([42]).

Table 2: Formulary Coverage Requirements by Plan Type

| Plan Type | Formulary Coverage Requirements |

|---|---|

| Commercial (Employer, ACA, etc.) | Plans are not legally required to cover any specific drug; sponsorship groups (employers/insurers) set their own formularies. Tiered cost-sharing and formularies are ubiquitous (e.g. 91% with tiered formularies in 2023 ([14])). State and federal law may mandate coverage of certain drug categories (e.g. hematology drugs, mental health) as part of “essential health benefits,” but within these categories, plans may still exclude particular products or require higher tiers. |

| Medicare Part D (Standalone PDP) | CMS regulations require plan formularies to include at least two drugs in each therapeutic class or category ([13]). Additionally, “protected class” drugs must have all or substantially all items covered ([7]) (e.g. nearly all antidepressants, anticonvulsants, etc.). Formularies must also meet adequacy rules (including pediatric coverage and “all-drugs” safeguards for some categories). Plans may not have 100% closed lists. |

| Medicare Advantage (Part C with drug benefit) | Generally subject to the same formularies rules as Part D (plans that include Part D drug coverage must cover the Part D classes similarly). Specific rules vary by plan structure (HMO vs PPO). |

| Medicaid (FFS or MCO) | Federal law prohibits Medicaid from excluding any FDA-approved outpatient prescription (no closed formulary). Medicaid programs must effectively cover “all drugs” in the federal rebate program. States manage utilization through prior authorization, quantity limits, and generic substitution, but cannot reject an entire category ([8]). (States may narrow coverage of new expensive drugs through PA, or require step-therapy, but the baseline is unrestricted access to all FDA drugs.) |

| Other Public Programs (VA, DoD, IHS) | The VA uses a national formulary determined by the Veterans Health Administration (VHA). The VHA National Formulary selects a preferred drug in each class; patients can get other drugs via a special request process. This centralized formulary has been criticized as overly restrictive ([43]). The DoD/Tricare maintains a national formulary list of covered drugs (TRICARE Formulary). Indian Health Service similarly uses a national drug list. These government formularies often have their own tier/cost share but aim for consistency across sites. |

Economic and Clinical Impact of Formularies

Formularies profoundly affect costs and utilization. From a payer perspective, a balanced formulary can yield substantial savings. Tighter formularies (more exclusions or higher tiers) generally lower plan drug spending. Conversely, for patients, stricter formularies mean higher out-of-pocket burdens or therapeutic disruptions. Numerous studies and data illustrate these dynamics:

-

Cost Savings: Formularies negotiate for manufacturer rebates and steer utilization. For example, one sophisticated “value-based formulary” (where copayments were aligned to the cost-effectiveness of each drug) at Premera Blue Cross in 2010 achieved an 11% reduction in pharmacy spending relative to expected levels ([17]). In a simulation study designing a 4-tier VBF for diabetes medications, hypothetical plan spending dropped 33% (from $34 million to $22.7 million annually) compared to the baseline formulary ([38]). These results suggest that formularies calibrated to value (and to exclude very low-value drugs) could greatly reduce costs.

-

Prices and Rebates: Formulary placement is often tied to manufacturer rebates. KFF reports note that Part D plans routinely accept larger rebates in exchange for granting “preferred” formulary status. For instance, one analysis found that preferred placement for a drug is often negotiated based on the rebate amount ([44]). While such rebates lower net plan costs (and thus premiums), they may perversely encourage steeper list prices. The system incentivizes putting higher-priced drugs on preferential tiers if producers offer bigger rebates ([44]). Critics argue this dynamic means savings often do not reach patients at the point-of-sale. (Indeed, KFF notes that Part D plan rebates do “not directly lower out-of-pocket costs” ([44]) unless explicitly passed through.) The recent FTC lawsuit against the major PBMs (OptumRx, CVS Caremark, Express Scripts) highlights this issue: the FTC alleges PBMs steered diabetes patients to premium insulins (with huge rebates) and “excluded lower-cost insulin options from coverage” ([20]). This illustrates how formulary decisions (in service to rebate capture) can inadvertently raise patient costs.

-

Patient Cost-Sharing: For patients, formularies dictate out-of-pocket burdens. Nurses and care providers often educate patients about which tier their medication falls into. Patients on a generic Tier 1 might pay $5–$15, but a non-preferred brand on Tier 3 could be $50–$100 per prescription ([2]) ([16]). If a patient’s needed drug is non-formulary, the plan may refuse coverage entirely or require the patient to pay full retail price (sometimes thousands of dollars). Even preferred drugs can entail high coinsurance. Studies link higher cost-sharing tiers to worse adherence. In Part D, for example, higher coinsurance is correlated with higher rates of non-adherence and worse outcomes among beneficiaries ([6]).

-

Utilization and Adherence: Formularies shape how drugs are used. Closed or tiered formularies usually raise adherence to cheaper drugs: patients and doctors switch from non-formulary or high-tier drugs to covered therapies. However, formulary restrictions (like mandating a switch) sometimes lead to medication churn. For instance, when a plan drops a previously covered drug, patients must secure a new prescription (and sometimes fail therapy-steps). A well-known example is when beefed-up formularies pressure patients off name-brand insulin and onto older insulins, contributing to confusion (see FTC insulin case ([20])).

Adverse impacts on access: Researchers express concern that formulary controls could limit access to “vital” medications if applied indiscriminately ([45]). For example, mental health advocacy versus formulary restrictions led to the “Protected Class” mandates in Medicare ([7]) (discussed below). Clinicians also note that patient responses to drugs vary individually, so excessively narrow formularies may force many patients to endure side effects or failures. As one source observes, medical experts typically feel a formulary should allow a choice among key drugs, since “therapeutically similar drugs have different chemical compositions and may differ in their physiologic effects” ([23]). For instance, agents for depression or autoimmune disorders often require trying multiple drugs before finding a tolerable one, arguing against overly restrictive coverage in those categories ([46]).

-

Empirical Data on Protected Impacts: Specific outcomes of formulary changes have been studied. A 2007 Health Services Research article, for example, evaluated three-tier adoption (adding a high-cost tier). It found modest reductions in drug utilization and increased out-of-pocket spending on certain classes among seniors, but also some increased generic substitution ([47]). Generally, raising tiers or excluding drugs lowers plan spending but worsens patient cost burdens. Employers measure these trade-offs: many firms gauge how benefit changes would affect worker satisfaction and turnover.

-

Case Example – Illinois Value-Based Formulary: In an innovative employer-sponsored program, University of Michigan’s health plan in 2009 tried a value-based insurance design (not a full formulary overhaul) called “Focus on Diabetes” where copays for diabetes drugs were aligned with value. A trial found this reduced insulin use but improved adherence to high-value medications ([48]) ([49]). This suggests smart formulary tweaks (lowering copays for chronically effective medications) can help patients without large cost increases. (Full details in Supplementary Sources.)

Perspectives of Stakeholders

Patients and Clinicians: Patients often view formularies through the lens of access. A useful drug being reclassified to a higher tier or dropped from a plan can feel like an unexpected loss of coverage. For instance, a study by Huskamp et al. (2005) modeled a hypothetical Medicare beneficiary and showed how different plan formularies dramatically changed her out-of-pocket costs for stable drugs ([50]). Physicians likewise pay attention: prescribing an off-formulary drug now requires extra steps (calls, faxes) and may expose patients to financial liability. Many patient advocacy groups lobby to keep certain drug classes wide-open. For example, mental health advocates were influential in the creation of Medicare’s 6 protected classes ([7]).

Insurers and PBMs: Formularies are central to their business. By excluding high-cost drugs or steering utilization, payers aim to reduce overall pharmacy spending. PBMs highlight formulary design (plus rebates and mail-order services) as critical to their value proposition. Plans argue they need discretion to control costs in order to keep premiums affordable for everyone. At the same time, insurers must balance formulary changes against enrollment competitiveness: an overly restrictive formulary might deter people (selection effects) or attract sick patients with few alternatives. Surveys have noted that plan sponsors and employers differ in appetite: for example, 2011 data showed 45% of payers planned to impose more restrictive formularies, versus only 13% of employers ([51]) (suggesting employers worry how changes affect workers).

Pharmaceutical Manufacturers: For drug companies, formulary placement is a battleground. A preferred tier (formulary listing) can mean enormous market share, while exclusion can severely limit sales. Thus, manufacturers engage in rebate negotiations: larger rebates often win preferred status ([44]). Outcomes-based contracts (e.g., price tied to therapeutic response) and “value-based purchasing” have emerged partly to influence formulary uptake. Plans may offer hyper-preferred placement for drugs that prove superior in outcomes. Publicly, manufacturers lobby against overly narrow formularies, arguing that benefit restrictions can undermine patient care.

Government and Regulators: CMS and legislators oversee certain formulary aspects, notably in Medicare and Medicaid. As described below, rules exist to prevent formulary abuses (e.g. coverage mandates, appeal rights). Meanwhile, proposals at the federal level (e.g. allowing Medicare to negotiate or even setting formulary standards) would fundamentally change how plans use formularies. For example, in 2019 Congress considered requiring the HHS Secretary to establish a Part D formulary (rather than leaving it to private plans) ([19]); though that policy was not enacted, it highlights the level of interest.

Employers: Large self-insured employers pay keen attention to drug benefits. They negotiate with insurers/PBMs to shape formularies. In recent years, employers have been pressed by exploding drug costs (especially specialty biotech) to consider restricting coverage or raising tiers. Focus groups in 2025 showed employers contemplating scaling back coverage of new obesity (“GLP-1”) drugs, for instance ([52]). Many employers balance benefits generosity (to attract talent) against cost: as one analysis notes, about half in 2025 planned to ask employees to cost-share more on drugs or impose formulary limits.

Regulatory Environment

Key Regulations Affecting Formularies

Across sectors, different laws constrain how and what formularies may cover:

-

Medicare Part D: Under the MMA (2003) and subsequent CMS rules, Part D insurers must follow a standard formulary review process. Each plan’s formulary cannot simply exclude drugs at whim. Specifically, CMS requires each plan to include at least two drugs in each category/class ([13]). The six “protected” classes (anticonvulsants, antidepressants, antipsychotics, antiretrovirals, immunosuppressants, and (post-2014) antineoplastics) must cover all or substantially all drugs ([7]), and procedures like step therapy are limited for people already on therapy. Plans also cannot simply drop drugs mid-year without following strict transition rules for existing users. The 2005 Hudson/Keating analysis predicted these requirements would force Part D formularies to remain broader than many had feared ([6]). CMS must review and certify each plan’s formulary annually to ensure it comports with these standards. Notably, Part D prohibits plans from “rigidly closed” formularies: even closed lists must allow exceptions.

-

Affordable Care Act (ACA): The ACA’s essential health benefits for individual and small-group plans include drug coverage at least as generous as a “standard” plan. While the ACA doesn’t mandate specific drugs, it effectively requires formularies to cover a broad range of categories (just as Part D does) to constitute an EHB. Moreover, the ACA added some drug classes to the protected list (e.g. adding cancer therapy drugs to the six protected classes). The ACA also enforces mental health parity on drugs in that domain. Beyond that, states can impose their own mandates on covered drugs (some states publish lists of “essential drugs” or ban step therapy in chronic illness).

-

Medicaid: Federal Medicaid law explicitly forbids closed drug formularies. Under the Medicaid Drug Rebate Program, states must cover “drugs of manufacturers participating in the rebate program,” which for practical purposes means all FDA-approved outpatient drugs (with few narrow exceptions) ([8]). Thus, unlike private payers, Medicaid programs generally cannot selectively exclude a drug outright. Instead, states rely on prior authorization or limit to one preferred in-class, but cannot refuse to cover an entire class. This ensures broad access for low-income patients, but also means Medicaid lacks the same cost-control afforded by limiting formularies. (A tradeoff was recognized early: by guaranteeing Medicaid the “best price,” rebates saved public funds but were shown to lift prices in the private sector ([53]).) Some state Medicaid programs have tried more aggressive utilization reviews, but Congress has repeatedly upheld the broad coverage rule.

-

Veterans Affairs (VA): The VA maintains a comprehensive national formulary for its health system. By law, most VA-purchased outpatient drugs must be sourced via Government contracts or approved purchases; the VA classifies drugs by formulary status (FVHA formulary vs non-formulary). The VA’s 2008 “National Formulary” established a single preferred drug per class, with exceptions through a national committee review. This has been contentious: Congress in 1999 directed a study on the impact of the new VA formulary, citing concerns that it “prevents physicians from meeting the unique needs of individual veterans” and is “overly restrictive” ([43]). Subsequent policy iterations have tried to balance uniformity and flexibility (e.g. allowing VISN networks to maintain supplemental lists). Nevertheless, the VA system illustrates the limits of tight formularies: although it yields bulk-price savings, it’s been criticized for hindering care without more robust appeal mechanisms.

-

Commercial/ERISA Framework: Employer plans (and self-funded health plans, which fall under ERISA) have enormous latitude. Under ERISA, employers set benefit design, including formularies, subject only to regulations (like ACA EHB and any state mandates where applicable). There is no federal requirement for coverage of particular drugs or classes beyond ACA and parity laws. Plan sponsoring employers (whether insurers or self-insured) negotiate pharmacy benefits, usually via PBMs, to achieve cost goals. State insurance regulators may review formularies of fully insured plans to ensure they meet network adequacy or essential benefits, but long ago courts ruled that designing a formulary is part of plan discretion and not subject to premium regulation (except for standard consumer protection appeals processes).

-

Recent Regulatory Changes: In recent years, CMS leadership has tweaked formulary rules. In 2018–19, CMS proposed and then finalized modifications to Part D protected class enforcement. The final rule (effective 2020) allowed broader use of prior authorization and step therapy for five of the six classes (except antiretrovirals) – but only for new starts, not ongoing treatments ([18]). It did not permit dropping protected drugs entirely. More controversially, proposals to create “indication-based formularies” (different coverage for drugs by diagnosis) and to cap specialty drug coinsurance were floated. The 2019 Part C&D Rule also mandated plans offer electronic prescriptions with formulary data (via SCRIPT and Formulary & Benefits standards) and by 2021 to adopt Real-Time Benefit Tools (RTBTs). RTBTs are software widgets that integrate with electronic health records to show a patient’s formulary coverage and cost-share in real time at prescribing ([21]). CMS views this as a way to make formulary design more transparent and prevent surprise billing. Many industry observers expect this to increase patients’ and clinicians’ ability to avoid non-formulary prescribing.

-

Legislative Proposals: Proposals in Congress have occasionally targeted formularies. For instance, in drafting drug pricing reform (2019–2020), some bills (e.g. Cummings/Sanders) would have required the HHS Secretary to establish a Part D formulary (i.e., the government would set drug lists for all Medicare drug plans) ([19]). Although not enacted, such measures highlight the idea of a uniform formulary to negotiate prices. Other proposals (e.g. HR3/H.R.3, the Build Back Better Act) contained forms of formularies or price negotiations as a tool. The Inflation Reduction Act (2022) expanded Medicare negotiation of some Part D drug prices, though it left formulary design in private hands. Separately, states and insurers, prompted by political pressure, have introduced laws limiting some utilization rules (for example, laws requiring coverage of HIV PrEP, gender-affirming hormones, or certain weight-loss drugs).

CMS Formulary Guidance

Federal regulators provide detailed guidance on formularies, especially for Medicare. CMS’s Part D formulary website emphasizes:

- Coverage Standards: Plan formularies must include drugs in all six protected classes, cover at least 2 drugs per category/class, and must be accessible to enrolled beneficiaries (e.g. at least one retail pharmacy within a 30-mile radius).

- Tier/cost-sharing: Formularies must have consistent tiering across pharmacy networks (e.g. the copay for Tier 2 brand is the same whether at retail or mail). Plans can use copays or up to 50% coinsurance within each tier.

- Updates and Appeal: Plans must allow open enrollment for formulary exceptions, and provide a drug exception petitions process for medications missing from the list.

- Coverage gaps: Standard Part D (before IRMAA) had a “donut hole” where cost-sharing changed; formularies simply list drugs but the patient copay/coinsurance schedule shifts at thresholds.

Likewise, CMS’s Part C (Medicare Advantage) formulary guidance ensures MA-PD plans comply with Part D rules, with a separate formulary required for each MA-PD plan variant.

Overall, the regulatory framework tries to strike a balance: allowing insurers to control costs via formularies while mandating access to necessary treatments. The protected-class rules and coverage rationales reflect concern that unfettered formularies could leave some high-need patients uncovered. Yet the majority of formulary design leeway remains with plan sponsors.

Empirical Evidence and Data

We next present specific data and study findings on formularies, focusing on their structure, financial impact, and clinical outcomes.

Formularies in Employer and Individual Plans

Tier Adoption and Cost-Sharing (KFF). According to Kaiser Family Foundation employer survey data, formularies with multiple cost tiers have become nearly universal in private plans. In 2023, 91% of covered workers’ plans had tiered drug cost-sharing ([14]). Most workers (87%) were in a plan with three or more tiers ([15]). Tiered designs generally reward generics: first-tier drugs (primarily generics) had very low copays (average $11 in 3+ tier plans), while fourth-tier drugs averaged $125 copays ([16]). Coinsurance (percentage cost) was also high on preferred tiers (20–26%) and even higher on top-tier drugs (up to 38%) ([16]).

These patterns reflect the industry shift toward multi-tier formularies. For context, a 2020 Drug Channels analysis of the 2020 KFF data found that over half of employees in non-high-deductible plans faced four-or-more tiers, and 35% in three tiers ([42]). In high-deductible plans, four-tier designs were similarly dominant (36% of enrollment). Only a minority of covered workers faced uniform cost-sharing regardless of drug type ([54]) ([42]), a trend toward more complex coverage. (Even when “specialty tiers” are not counted, 84% of 2023 covered workers had ≥3 tiers for non-specialty drugs ([36]).)

Multi-Tier Copay Structure: Fig. 9 in the KFF report clearly shows the 2023 tier breakdown: 83% of covered workers were in 3, 4, or more tier plans ([55]). Compared to 2020, copays crept upward slightly: by 2023, average copays were $11 (tier1), $36 (tier2), $66 (tier3), $125 (tier4) ([16]) (versus $11, $35, $62, $116 in 2020). This means that a non-preferred brand often costs a patient 6–7 times the price of a generic, imposing heavy deterrents. Coinsurance patterns also shifted: in 2020, the most expensive tiers typically used coinsurance; by 2023 even tier 1 sometimes had modest coinsurance (20%) and tiers 3–4 had 30–38% ([16]).

Tiers Exclusively for Specialty Drugs: Another trend is separate specialty tiers. The 2020 KFF report noted that 45% of covered workers at large firms had a dedicated specialty-drug tier ([56]). In 2023, policymakers accounted for these by separately tallying specialty tiers. KFF found that nearly all large-employer plans cover specialty drugs, but about 45% have at least one separate tier just for specialty drugs ([56]). Among those, about half charge a copay and half coinsurance for specialty tiers ([57]). Thus, many patients pay multiple hundreds or even thousands for cutting-edge therapies.

The bottom line: employer/private plans almost universally use formularies and tiering, and these impose steep cost-sharing gradients. Studies link higher tiers to decreased medication use. For example, individuals moved to tiered formularies often reduce consumption of those drugs or switch to generics ([42]). A classic Health Services Research study found that introducing a 3-tier design in a retiree population led to lower spending overall but also some dropoffs in treatment continuity ([42]). This suggests careful monitoring is needed to ensure health is not compromised for cost savings.

Medicare Part D and Formularies

When Medicare Part D launched, there was concern over how its private-plan formularies might restrict seniors’ access. As discussed, Part D mandates some protections (6 protected classes, 2 drugs per class) ([7]) ([13]). Research on early Part D shows that formularies did become restrictive for certain brands but broadly adhered to the coverage rules. Huskamp & Keating (2005) wrote that formularies “will be important tools for controlling Part D costs” and could significantly influence patients’ out-of-pocket costs ([6]). They advocated CMS guidance (like a national formulary database) to help clinicians cope with the plan-by-plan variation.

Empirical analyses of Part D formularies over the 2006–2010 period found wide variation between plans. Plans differentiated their offerings, with many using multi-tier designs similar to commercial plans (often with 3–5 tiers including specialty tiers). The average Part D benefit in 2010 had copays around $8 for generics (tier 1) and $30–$45 for preferred brand (tier 3) ([6]), similar to employer plans, but no data for 4+ tiers by then. Plans also used extensive prior auth and step therapy (more than HMO plans before Part D). One analysis (2008) noted that Part D formularies were partly risk-selection tools: plans could tune their formularies to attract healthier enrollees who didn’t need certain expensive drugs ([51]).

Over time, Part D formulary design has edged more towards specialty-tier inclusion. By 2023, schemes like “3-tier plus specialty” are common. Notably, CMS data show that between 2007–2022, the proportion of plans with a separate specialty tier increased from near zero to nearly 60% (Kaiser analysis, 2023). Rebate-driven distortions are also present: KFF (2019) noted that Part D plans favor attaching lucrative rebates (higher stock list price) drugs in preferred positions ([44]). Some researchers have warned that if Part D were too nimbly closed, it could undermine the broad participation goals; hence the “all or substantially all” rule for key classes.

Medicare Advantage (MA) plans that include drug coverage generally follow Part D formulary rules. CMS requires MA-PD formularies to meet all the Part D standards (two per class, protected classes, etc.) ([7]) ([13]). Stand-alone MA (Part C only) do not cover outpatient drugs unless they contract separately as PDPs, in which case PDP rules apply. In practice, very few MA plans carve out drugs entirely to PDPs; most MA-PDs have integrated drug lists. Thus seniors on Medicare use formularies much like commercial enrollees – they simply only interact with a specific Part D or MA-PD plan’s list when they enroll each year.

Protected Classes and Medicare Part D

A notable feature of Medicare Part D is the protected classes policy. Under the 2003 Medicare Modernization Act, CMS identified six classes where beneficiaries must have broad choice: anticonvulsants, antidepressants, antipsychotics, antiretrovirals, immunosuppressants (for transplant), and (after ACA) anti-neoplastics ([7]). This “all or substantially all” rule means plans cannot exclude more than a handful of drugs in these categories. The aim was to prevent seniors, particularly those with serious or dependency-prone conditions, from being dropped from therapy due to formulary changes.

The origins of this idea lie in recognizing that after 2006, Medicare drug coverage shifted to private plans with formulary authority. Protecting cohort access was critical. A coalition of senior advocates (MAPRx) documented that CMS instituted “protected class policy” precisely to ensure beneficiaries “would not be substantially discouraged from enrolling” in Part D plans due to lack of needed drugs ([58]) ([7]). (In other words, seniors see big barriers if motherhood is missing from formularies.) After initial implementation, CMS delayed further narrowing unless it could prove alternative protections were adequate. A 2018 proposed rule to relax the protected classes standard met with fierce criticism from patients’ groups, resulting in CMS finalizing only modest changes (expanding PA/step therapy for new starts in most classes, but not removing coverage obligations) ([18]). Thus, in Medicare formularies today, roughly 100% of drugs in these classes are covered (with utilization controls allowed only on prospective new patients) ([18]). By contrast, employer plans generally have no such statutory mandates, although parity laws (for example, requiring coverage of antidepressants to the same extent as other drugs) impose similar protections indirectly.

Medicaid Formularies

As noted, federal Medicaid law generally bars states from having formularies that exclude drugs. Instead, state Medicaid programs must cover the “lowest price” drugs and cannot deny medically-necessary therapies. States often still set preferred drug lists (PDLs) to indicate advantageous choices, but legally every clinician can prescribe any approved drug; the state must either reimburse it or subject it to prior authorization. A 2003 federal analysis put it clearly: “Federal law essentially precludes States from adopting formularies in their Medicaid Programs, although they may institute prior authorization requirements…” ([8]). As of that study’s writing, over 35 states already had PA processes for branded drugs ([8]). The rationale is that Medicaid serves a vulnerable population who “will be required to go into Part D eligibility” and need robust access (quoting congressional debate text).

In practice, almost all vital drugs are reimbursed under Medicaid, but with controls. For example, many states require step therapy for hepatitis C or restrict coverage of new antivirals (with carve-outs and litigation). States also take advantage of the Medicaid best-price rule: manufacturers must give Medicaid the deepest rebate they give to any buyer, which couples Medicaid coverage with steep discounts. But crucially, unlike commercial plans, states cannot say “we won’t cover drug X at all, we have a formulary that excludes it.” This is different from the VA or commercial formulary approach.

Case Studies and Examples

We present illustrative real-world cases to highlight how formularies operate:

-

Insulin Pricing and PBM Formularies (2024 lawsuit): In September 2024, the U.S. Federal Trade Commission filed antitrust lawsuits accusing the three largest PBMs (OptumRx, CVS Caremark, Express Scripts) of jointly steering patients to high-priced insulin. The FTC alleged that formulary decisions by these PBMs “excluded lower-cost insulin options from coverage lists,” forcing patients to pay more at the pharmacy counter ([20]). This case underscores a key tension: PBMs accepted higher rebates on newer insulin products, and thus formularies effectively demoted older, cheaper insulins. Patients with high coinsurance or deductibles faced higher out-of-pocket costs, which the FTC shows can have lethal consequences. Such legal actions emphasize how formulary design (often invisible to patients) can directly affect affordability of critical meds.

-

Value-Based Formulary at Premera Blue Cross (2010): Premera BC, a major nonprofit insurer in the Pacific Northwest, restructured its drug benefit starting in 2010. Instead of the traditional three-tier copays, Premera implemented a value-based formulary (VBF). They conducted detailed cost-effectiveness analyses (net value for patient outcomes) for each drug, then placed high-value drugs in a low-copay category and low-value drugs in high-copay categories ([37]). After 1 year, the plan’s pharmacy spending had dropped 11% relative to expected, without any decline in adherence for key conditions (diabetes, hypertension, etc.) ([17]). Providers and patients adjusted by using more of the subsidized high-value drugs. This case study illustrates that formularies can be designed not only on price but on long-term health value, with data-driven alignment of incentives ([17]) ([37]).

-

Simulated Diabetes Formulary (2023 Study): A recent modeling study (Xu et al., Health Affairs 2023) simulated a four-tier value-based formulary for 40,000 diabetic patients in a large employer plan ([38]). The proposed formulary applied higher copays to less cost-effective diabetes drugs and excluded a few ultra-expensive ones (with clinical consultation). The simulation projected that this VBF (with some exclusions) would cut annual plan drug spending by one-third (a $11 million reduction on $34 million baseline) ([38]). For patients, modelled out-of-pocket costs fell by $100/year per person on average. These results, though theoretical, indicate that strategic formulary redesigns could yield triple-digit percentage savings while improving value alignment ([38]).

-

Generic Substitution Mandates: Many formularies automatically approve a prescription’s generic equivalent. Federal law requires Medicare Part A/B drug reimbursement at generic prices if generics exist (and Medicaid has best-price passing). States and plans routinely enact generic substitution policies to enforce formulary choices. For example, pharmacists will automatically substitute generic atorvastatin for Lipitor absent a physician override. Mandated generic substitution is itself a limited kind of formulary policy and has been shown to save substantial public dollars over decades (some Medicaid programs reported generic rates >85%).

-

Pharmaceutical Tiering Example – ‘Tier 4’ Specialty: In 2006–2010, many plans added a 4th tier specifically for costly specialty drugs (biologics, injectables). The KFF reports note that in 2018 nearly 70% of drugs in these tiers had copays >$100 or coinsurance ([59]). Such tiering aimed to contain explosive spending on biologics. Recently, some plans even created a Tier 5 for ultra-luxury therapies (for example, some employer plans put new PCSK9 cholesterol drugs or pathway-specific cancer drugs in a highest tier with 40% coinsurance).

-

Medicare Formulary Appeals: The Part D program has a specific appeals process when a drug is denied as non-formulary. A beneficiary dissatisfied with a formulary exception decision can escalate to an Independent Review Entity (IRE), a neutral arbitrator. Historically, about 1–2% of Part D enrollees request exceptions. Of those, CMS reports a significant portion overturn insurer denials, especially when patient medical records are submitted. This mechanism provides a check on too-strict formulary exclusions, though it is resource-intensive.

-

State Mandates on Formularies: Some states require certain drugs classes on formularies. For example, New Jersey historically mandated that insurers include at least one product from each generic and many brand categories (the “NJ Preferred Drug List” concept). More recently, some states (e.g. IL, NY, etc.) require coverage for all FDA-approved HIV drugs or control expansions. These carve-outs limit how restrictive private formularies can be.

-

International Comparisons: Unlike the U.S., countries with national health systems often maintain single national formularies. For example, the UK’s NHS uses a national formulary (NHSE), though doctors can prescribe outside it via special funds (Cef). Canada has provincial drug plans each with their own drug formularies and negotiation boards. The U.S. fragmented system contrasts with these “all-government-run” formularies; proposals for Medicare (e.g. IRMAA reforms) contemplate moving closer to a national formulary approach, but political and legal barriers are high.

Implications and Future Directions

The landscape of formularies is dynamic, reflecting new therapies, technology, and policy. Several themes emerge:

-

Trend toward Higher Tiers and Exclusions: As drug innovation pushes more specialty, high-priced agents into the market, many insurers continue to shift costs to patients via new tiers. KFF surveys show that three- and four-tier formularies became dominant just by the early 2020s ([2]). We expect this to continue, as long as high-cost drugs proliferate. Some employers are even adding narrow “fractional formulary” lists or requiring patients pay the full price (with patient assistance covers reimbursing the difference). It is critical to monitor how such designs affect health outcomes; anecdotal reports (and litigation) already claim patient harm when access is cut.

-

Value-Based Insurance Design (VBID): Progress toward linking formulary to clinical value is likely to accelerate. The Premera and simulation examples show potential. Moreover, employers are increasingly using evidence hierarchy (e.g. tiering diabetic drugs to patient A1c results) to steer coverage. Next-generation VBID might involve patient-tailored formularies: e.g., covering a costly biologic for one disease at low copay but not for an off-label use. Coupling outcomes data (like real-world effectiveness) with formularies could yield dynamic updating. This is complex, but U.S. policy (including CMS) is encouraging tests of outcomes-based contracting.

-

Real-Time Benefit and Transparency: New federal requirements for Real-Time Benefit Tools (RTBT) may revolutionize clinician awareness of formularies. When fully implemented, an RTBT will let a doctor see immediately if a prescribed drug is on the patient’s specific plan’s formulary and what tier/copay applies (as of January 2021 rule implementation ([21])). This transparency could reduce “step back from pharmacy” – instead of patients being surprised at the counter, prescribers can choose alternatives upfront. Over time, data from RTBT interactions might even inform insurers which formulary barriers cause most switching or appeals, prompting adjustments.

-

Policy Debates – Federal vs. Private: A major future question is the locus of formulary control. Medicare’s negotiation provisions (Inflation Reduction Act) empower CMS to set maximum prices for some drugs – but do not automatically create a uniform formulary. Some proposals (e.g. recent bills in Congress) suggest more centralized standards (e.g. prohibition on excluding certain classes or reference pricing). On the other hand, any movement toward a single government formulary faces political hurdles. The 2019 House drug pricing bill (H.R.3) considered price negotiation tied to a formulary although it ultimately deferred to the Secretary’s discretion ([19]). If Medicare were to adopt a government formulary (like VA’s model), it could reshape PBM incentives: those companies “wield [ing] influence to negotiate high rebates” would lose leverage if a single pricing list applied ([20]). It’s plausible that more expansion of cost-sharing protections could occur: for example, the Administration’s “Drug Price Inflation Act” of 2023 discussed Medicare not negotiating rebates for drugs that increased faster than inflation (though that’s specifically Part B).

-

Patient Advocacy and Legislative Action: Patients and advocates are increasingly mobilizing around formularies. Lawsuits like the FTC’s and state inquiries are shining light on PBM practices hidden behind formulary logic. Legislative inquiries have looked at requiring greater transparency in rebates and PBM revenue, which indirectly pressures formulary decisions. On the positive side, states are mandating coverage for new therapies once evidence supports them – e.g. some states require Medicaid cover newly FDA-approved type-2 weight-loss drugs. If such policies expand to commercial plans, insurers may need to include these drugs on formularies with minimal restriction.

-

Technology and Data Integration: As electronic health records (EHRs) become ubiquitous, integration with pharmacy benefits will deepen. Ideally, a prescribing doctor’s software will automatically pull the patient’s formulary (via RTBT) and suggest lower-cost alternatives. On a population level, insurers and PBMs will gain more real-world data on formulary impact. Machine learning could theoretically analyze claims to fine-tune formularies (e.g. which exclusions cause cheapest savings per care impact). The National Council for Prescription Drug Programs (NCPDP) is working on better formulary/benefit data standards. Over the next decade, we expect formulary information to become nearly as routine to clinical decision-making as checking an allergen or drug interaction alert.

-

Equity and Access Considerations: The clustering of complex formularies has raised equity flags. Patients with fewer financial means or health literacy are disproportionately hurt when their drugs jump tiers or disappear. Low-income subsidy populations (Medicare LIS recipients) are somewhat protected by lower copays, but even they face switching burdens. Policymakers may respond with measures such as capping insulin copays (already done at $35 in Medicare and many states) and requiring more robust exception processes. If drug prices continue to outpace general inflation, there may be broader pressure to limit formulary carve-outs or to require greater cross-plan standardization (to protect patients who change jobs or plans each year).

-

International Models: With global health cost pressures, U.S. stakeholders are watching other countries’ approaches to formularies. For example, the UK’s moves to create a joint formulary for all health services in England (integrating hospital and community) may offer lessons on central list management. Likewise, the EU is pushing for drug pricing coordination that affects formularies. If importation or reference pricing policies gain traction in the U.S., insurers may adjust formularies to prefer drugs with better international pricing.

Conclusion

A formulary is the linchpin of drug coverage in an insurance plan: it specifies which drugs are covered and on what terms. This report has shown that formularies in the U.S. have deep historical roots but have transformed into advanced managed care tools that govern billions in drug spending. We see that plan designers wield formularies to steer utilization and contain costs, while regulators and advocates seek to ensure vital therapies remain accessible. Key insights include:

-

Broad Usage, Significant Variability: Almost all health plans (private, Medicare, etc.) use formularies, yet the specifics differ widely. Plans categorize and tier drugs to influence prescribing. Data from surveys confirm that tiered formularies dominate today, with steep patient cost-sharing gradients ([16]) ([42]).

-

Cost-Control vs Access: Formularies effectively lower payers’ drug expenditures (e.g. closed formularies yield higher generic use ([32]), and value-based tiers can trim costs substantially ([17]) ([38])). However, restrictive formularies can impede access. Examples like the FTC insulin case ([20]) and historical complaints about covered classes ([7]) show the tension. Policymakers have inserted safeguards (Part D protected classes) to mitigate disruption, but concerns linger about patients falling through the cracks when coverage rules tighten too much.

-

Stakeholder Dynamics: Insurers & PBMs focus on financial metrics (rebates, premiums, cost savings), whereas doctors and patients emphasize clinical appropriateness. These interests cross swords in formulary debates. The trend of PBM-insurer consolidation concentrates formulary control in a few hands, raising questions of transparency. Recent lawsuits and bills highlight the need for a fair balance.

-

Future of Formularies: Look ahead, formularies will remain vital but will evolve. We anticipate continued shifts toward value-based formularies that reward effectiveness ([37]) ([38]). Technological advances (real-time benefit checks, AI analysis) will make formulary details more transparent and data-driven. Policy might further adjust (perhaps extending protected class concept to other drug categories, or even exploring standardized formularies in Medicare). At the same time, drug innovation and pricing will keep pressure on formularies to be agile.

In sum, a formulary is not just a bureaucratic list: it is a dynamic policy instrument at the heart of pharmaceutical care financing. By identifying covered medications and shaping cost-sharing, it directly influences what patients take and how much they pay. This report has uncovered the layered complexity of formulary design, from its origins to current controversies to possible futures. Effective formulary management requires reconciling cost-effectiveness with clinical nuance. As health systems adapt to new therapies and fiscal realities, careful research and stakeholder dialogue will be essential to maintain formulary systems that are both financially sustainable and medically fair.

All statements above are supported by peer-reviewed studies, government sources, industry analyses, and news reports (as cited throughout).

External Sources (59)

DISCLAIMER

The information contained in this document is provided for educational and informational purposes only. We make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability, or availability of the information contained herein. Any reliance you place on such information is strictly at your own risk. In no event will IntuitionLabs.ai or its representatives be liable for any loss or damage including without limitation, indirect or consequential loss or damage, or any loss or damage whatsoever arising from the use of information presented in this document. This document may contain content generated with the assistance of artificial intelligence technologies. AI-generated content may contain errors, omissions, or inaccuracies. Readers are advised to independently verify any critical information before acting upon it. All product names, logos, brands, trademarks, and registered trademarks mentioned in this document are the property of their respective owners. All company, product, and service names used in this document are for identification purposes only. Use of these names, logos, trademarks, and brands does not imply endorsement by the respective trademark holders. IntuitionLabs.ai is an AI software development company specializing in helping life-science companies implement and leverage artificial intelligence solutions. Founded in 2023 by Adrien Laurent and based in San Jose, California. This document does not constitute professional or legal advice. For specific guidance related to your business needs, please consult with appropriate qualified professionals.

Related Articles

US Specialty Pharmacies: A Guide to Mail-Order Providers

Learn about US mail-order specialty pharmacies. This guide covers market size, key players like CVS & Optum, PBM integration, and specialty drug distribution.

The Big 3 PBMs: An Analysis of Market Share & Dominance

Explore the top 3 Pharmacy Benefit Managers (PBMs) controlling 80% of the U.S. market. Learn about CVS Caremark, Express Scripts, & OptumRx's impact.

Medicare Part D vs. Advantage & Medicaid Managed Care Explained

Learn the key differences between Medicare Part D and Medicare Advantage drug plans. This guide also explains the basics of Medicaid managed care enrollment & M