Why Veeva Split from Salesforce: Pharma CRM Shake-Up

Why Veeva Split from Salesforce: Pharma CRM Shake-Up

[Revised January 8, 2026]

Introduction

In a major industry shake-up, Veeva Systems – long known for its customer relationship management (CRM) platform in pharma and life sciences – decided to end its partnership with Salesforce and build its own CRM technology. This split marks the end of a 15+ year collaboration that dominated life sciences CRM, forcing drugmakers and biotech firms to re-evaluate their IT roadmaps. This report examines the reasons behind Veeva's decision to "divorce" Salesforce, outlines a timeline of key events from the first announcement through 2026, and analyzes the strategic implications for pharma companies. We also delve into how the split benefits and challenges Veeva's clients, drawing on commentary from industry analysts and experts.

Background: A Successful Partnership – Until It Wasn't

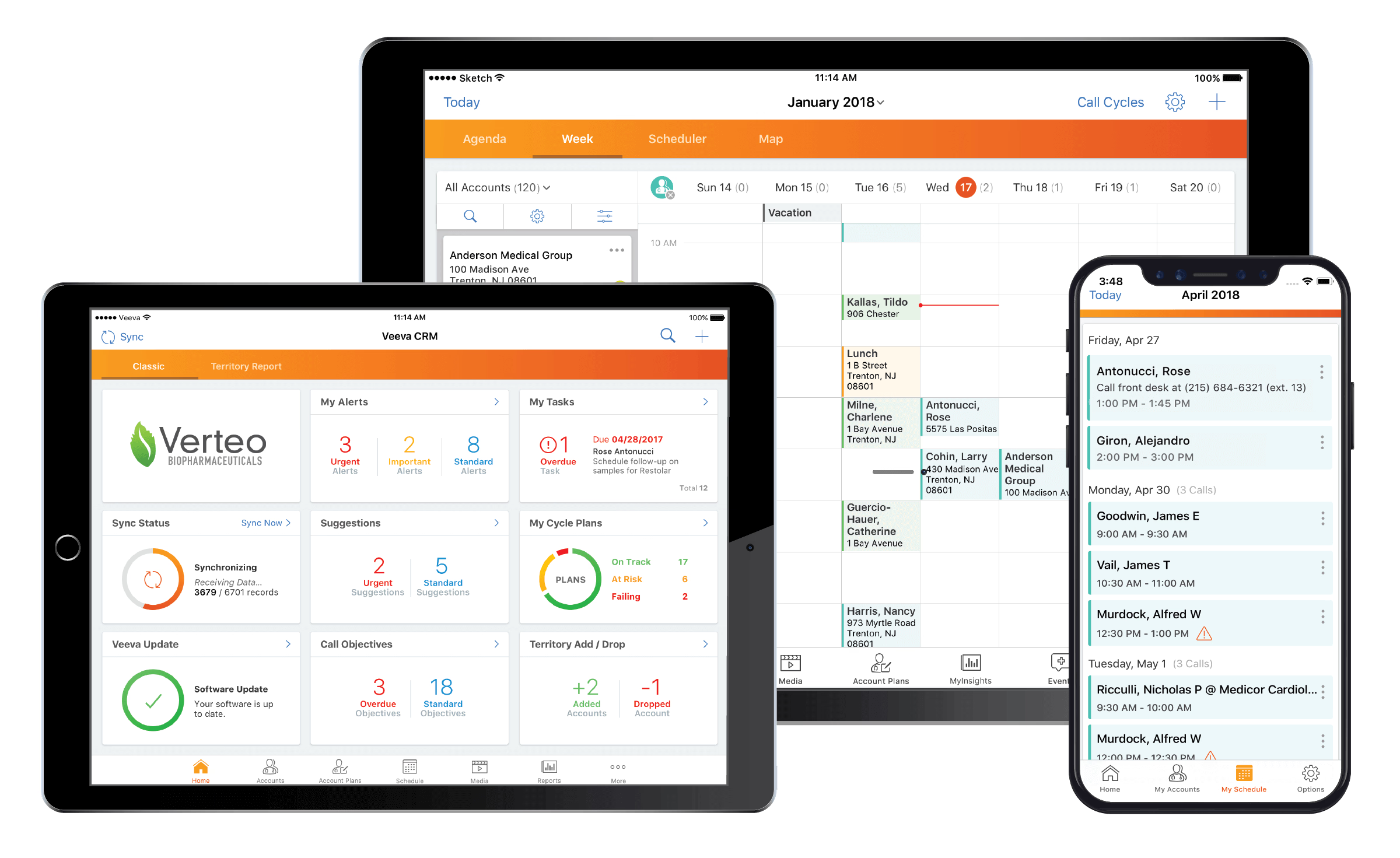

Veeva was founded in 2007 with a unique model: build industry-specific CRM for life sciences on top of Salesforce's cloud platform ([1]) ([2]). The arrangement was mutually beneficial for years. Veeva could rapidly deliver a pharma-tailored CRM without managing its own infrastructure, while Salesforce gained a strong foothold in the pharma and biotech sector via Veeva's specialization ([3]) ([4]). Over time, Veeva became the dominant CRM provider in life sciences, reportedly serving 47 of the top 50 pharma companies by 2019 ([5]) and holding roughly 80% market share in that niche ([6]) ([7]). Salesforce, for its part, agreed not to directly compete in pharma CRM as long as the partnership stood, focusing instead on other domains like medical devices (MedTech) ([8]) ([9]).

Key milestones underscored the closeness of this partnership. In 2010, the companies deepened their alliance to accelerate Veeva CRM's global rollout in pharma. By 2014, Veeva and Salesforce extended their contract through 2025, with Salesforce naming Veeva its preferred worldwide partner for pharma and biotech CRM ([10]) ([11]). For Veeva, Salesforce's platform offered proven scalability, security, and reliability, allowing Veeva to focus on life sciences features rather than basic cloud infrastructure ([3]) ([12]). As Veeva CEO Peter Gassner said at the time, "The Salesforce1 Platform provides the ideal cloud infrastructure for our CRM product, allowing us to focus on delivering deep industry-specific applications and continuous innovation our customers require." ([13]).

However, as the pharma landscape evolved and Veeva expanded its own product suite (including its Veeva Vault content and data platform for R&D and compliance), tensions quietly grew under the surface. By the late 2010s, Veeva was reliant on a third-party foundation that started to feel constraining. The CRM world had also changed – new digital channels, AI-driven analytics, and big data were becoming critical, and both Veeva and Salesforce began plotting their own visions for next-generation life sciences CRM ([14]) ([15]). This set the stage for the eventual split.

Why Veeva Chose to Split from Salesforce

Veeva's decision to break away was driven by several strategic and technological factors. In essence, the company wanted more control and less risk as it prepared for the future of pharma CRM. Analysts note that "mounting risks and roadblocks" in the Salesforce-dependent model ultimately made "going solo" a better option for Veeva's specialized focus ([16]). Key motivations included:

-

Technological Independence: Veeva wanted to build its own cloud platform optimized for life sciences, rather than adapting to Salesforce's general-purpose architecture. This would allow tighter integration with Veeva Vault and other Veeva products, plus more control over the roadmap ([3]) ([12]). The company had already proven its ability to build robust cloud platforms with Vault, giving it confidence to do the same for CRM.

-

API and Integration Control: With its own platform, Veeva could design APIs and integration points specifically for life sciences workflows, rather than working within Salesforce's constraints. This would enable better connectivity with Veeva's API ecosystem and third-party systems ([3]) ([12]).

-

Control Over Product Roadmap: Veeva sought greater autonomy to innovate its CRM without aligning to Salesforce's release cycle or limitations. By migrating to its own Vault Platform, Veeva can pursue an "unconstrained product roadmap" tailored to life sciences needs ([17]) ([18]). As one industry consultant put it, Veeva's Vault CRM is a "strategic consolidation of its tech stack" that lets the company accelerate enhancements and respond agilely to evolving industry needs ([18]). In short, owning the platform means Veeva – and its customers – won't be constrained by a third party's feature set or priorities.

-

Reducing Platform Risk: Running Veeva CRM on Salesforce meant dependence on an external cloud infrastructure (as well as on Amazon Web Services) that was outside Veeva's full control. This brought exposure to outages or performance issues on those platforms. Indeed, Veeva revealed in filings that it had suffered downtime in the past due to Salesforce service disruptions ([19]) ([20]). Such incidents undermined customer experience. By taking CRM in-house, Veeva can directly manage reliability and performance, rather than being "stranded" if Salesforce has an issue or exits a particular market ([19]) ([21]). Veeva's leadership had always been wary of these third-party risks, and all the "what-ifs" (like Salesforce potentially ending the agreement early) added up to a significant strategic concern ([22]).

-

Cost Savings and Pricing Freedom: An often-cited factor in the split is cost. Veeva has been paying Salesforce substantial fees – roughly 12–15% of its total revenue – just for the privilege of running on Salesforce's platform ([23]) ([24]). For a company with over $2 billion in revenue, this means hundreds of millions in expenses going to Salesforce each year. By shifting to its own Vault platform, Veeva can eliminate those hosting/subscription fees and improve its margins ([23]) ([25]). This could potentially translate into better pricing flexibility or more R&D investment. While Veeva publicly emphasizes customer benefits, Everest Group analysts note this "cost of subscription" was the "underbelly" of the Salesforce relationship ([26]). In other words, Veeva's move is also about keeping more value in-house rather than sharing it with Salesforce.

-

Deeper Integration & Data Unification: With CRM on Salesforce, Veeva's various products were split between two platforms – for example, Veeva Vault applications (for clinical, regulatory, content management, etc.) were separate, even if integrated, from the CRM data on Salesforce ([27]) ([28]). Migrating Veeva CRM onto the Vault Platform lets Veeva offer a truly unified ecosystem for its clients. All customer data, content, and interactions can reside in one place, enabling "a better end-to-end experience" across sales, marketing, medical, and clinical teams ([29]). Veeva can ensure seamless data flow between applications and provide more personalized, first-hand support, since everything is under one architecture ([29]). This unified approach is increasingly critical as pharma companies seek to break down silos between field sales, medical science liaisons, marketing campaigns, and patient engagement. Veeva Vault's modern cloud tech (built with open-source technologies on AWS) also offers robust APIs for integration, making it easier to connect CRM with other tools in the pharma IT stack ([30]) ([31]).

-

Data Ownership and Compliance: Pharma companies are highly sensitive about data security, privacy, and regulatory compliance. By controlling its own platform, Veeva (and its clients) have more direct oversight of data and how it's stored or managed, without depending on Salesforce's policies. Veeva can tailor data handling to life sciences compliance needs more directly. A Salesforce-focused data management firm pointed out that this split highlights the importance of "keeping your data under your control no matter what happens" with third-party platforms ([32]). In effect, Veeva's move could give clients greater confidence that their critical customer data (such as physician interaction history) is solely within an environment purpose-built for healthcare. Veeva itself also avoids any "customer data sharing" ambiguities that might come from being on a multi-tenant external platform.

-

Lifting Expansion Constraints: The prior Veeva-Salesforce contract included non-compete clauses that constrained both parties' market moves. For instance, Veeva was legally barred from entering certain CRM segments that Salesforce served (notably, the MedTech and medical devices domain) ([33]). This restriction was a "roadblock" to Veeva's growth ambitions beyond pharma ([9]). Once independent, Veeva can pursue adjacent life sciences sectors freely – an important consideration as the company achieved its $3 billion revenue run rate goal in fiscal 2025 ([34]). Conversely, Salesforce will no longer be barred from selling to pharma companies (more on this later), but Veeva clearly decided that opening up new markets was worth that trade-off. Freed from contractual limits, Veeva can also build new applications beyond CRM (e.g. patient engagement tools, as hinted in its roadmap) without Salesforce's involvement ([35]) ([36]).

In summary, Veeva's split was a proactive strategy to control its destiny. As Veeva's CRM general manager Arno Sosna explained, having CRM on Vault gives the company "the most advanced industry-specific CRM ever and an unconstrained product roadmap" going forward ([17]). The move is about de-risking the business and positioning Veeva to deliver faster innovation for its life sciences clients. But it also sets up a direct contest with its former partner.

Timeline of Key Events (2022–2026)

The journey from decision to reality has unfolded over several years. Below is a timeline of major events in the Veeva–Salesforce split, from the initial announcement through the latest developments as of early 2026:

-

March 2014 – A Long-Term Pact: Veeva and Salesforce extend their partnership with a 10-year agreement through 2025, solidifying Salesforce1 (now Lightning platform) as the backbone of Veeva CRM ([37]) ([11]). This deal, including minimum payment commitments by Veeva, effectively set 2025 as the renewal decision point.

-

Late 2021 – Early 2022 – Growing Tensions: Behind the scenes, Veeva's leadership increasingly recognizes the risks of remaining tied to Salesforce. Around this time, Salesforce had grown into a $20+ billion behemoth with its own industry cloud ambitions, and Veeva's Vault platform had matured. Speculation swirled that Veeva might not renew the next contract, although no public statements yet. (Salesforce was even rumored to have considered acquiring Veeva in the past ([38]), underscoring how intertwined their fates had become.)

-

December 1, 2022 – The Breakup Announced: Veeva stunned the market by announcing it will not renew its Salesforce partnership when it expires in September 2025, and will migrate Veeva CRM onto its own Vault Platform ([39]) ([40]). This announcement came during Veeva's Q3 2022 earnings call and was later detailed in a press release and SEC filings. Veeva made clear that it was "moving away" from Salesforce and investing in its homegrown CRM technology ([41]). The news confirmed that a five-year wind-down period would follow the contract end, allowing clients to keep using Veeva CRM on Salesforce until 2030 while transitioning ([42]) ([43]). Salesforce, bound by the existing agreement, could not yet sell a competing pharma CRM solution, but that restriction would lift after September 2025 ([44]).

-

2023 – Transition Planning and Development: Throughout 2023, Veeva engineers worked to rebuild and enhance Veeva CRM on the Vault platform. The product – eventually branded Veeva Vault CRM – was in development and early testing with select customers. Veeva communicated regularly with clients about the upcoming change, assuring them that the user interface and core functionality of Veeva CRM would remain familiar on the new platform ([45]). Pharma companies, for their part, began internal planning for the migration, evaluating whether to stick with Veeva's new platform or consider alternative solutions. Industry consultants urged companies to treat this not just as an IT project, but as a strategic decision about future commercial models ([46]). As Nancy Phelan of Trinity Life Sciences cautioned, "if you're just migrating, you're missing the strategic importance…this is a much bigger decision" ([46]).

-

April 2024 – Veeva Vault CRM Launches: Veeva achieved a key milestone by launching the Vault CRM for general availability in the spring of 2024 ([47]). This first release of Veeva's independent CRM included core sales force automation capabilities equivalent to the legacy product, running on the Vault platform. Veeva touted that customers would now be able to manage content and customer data on a single platform designed for life sciences ([47]). Initial migrations began: by the end of 2024, Veeva reported more than 30 companies live on Vault CRM, with several (including a top-20 pharma) in progress to fully switch over their users by end of 2025 ([48]). Veeva also rolled out new modules like Vault CRM Service Center (for call centers) in mid-2024, indicating an expanded feature set beyond what existed on Salesforce ([49]) ([50]).

-

June 2024 – Salesforce Life Sciences Cloud Debuts (in Parts): To prepare for life after Veeva, Salesforce teamed up with IQVIA – a leading pharma data and software provider – to develop a new Salesforce Life Sciences Cloud for customer engagement ([51]) ([52]). In an expanded partnership announced April 2024, Salesforce agreed to use IQVIA's Orchestrated Customer Engagement (OCE) technology as a basis for its pharma CRM offering ([53]). The first iteration of Life Sciences Cloud launched in June 2024, focusing on medical technology (MedTech) customers (which Salesforce was already free to serve) ([54]). However, due to the non-compete, Salesforce could not offer sales automation features to pharma/biotech clients until after September 1, 2025 ([55]) ([54]). This meant full pharma CRM functionality in Salesforce's new cloud would only be sold once the Veeva contract officially ended. Salesforce appointed a former Veeva executive to lead its Life Sciences division and started marketing the upcoming platform to pharma accounts ([56]), signaling it was ready to compete.

-

Late 2024 – Intensifying Competition: As the separation date drew closer, the rivalry heated up. Salesforce reportedly began wooing some big pharma customers away from Veeva even before it could deliver its full product. By the end of 2024, news broke that Salesforce had "poached over 40 customers from Veeva – including one of the top 3 pharmas", according to one report ([57]). Bloomberg News likewise reported Salesforce had snagged at least a couple of major drugmakers' CRM contracts from Veeva in late 2024 ([6]). These early wins were likely for Salesforce's interim solution (possibly using IQVIA's OCE in the background) for companies willing to leave Veeva. Meanwhile, Veeva continued to enhance its offering, releasing a major update in December 2024 that delivered the Vault CRM Campaign Manager for integrated sales and marketing campaigns ([58]) ([49]). Veeva's message to clients: its new platform would enable "true customer centricity across the industry" without compromise ([17]).

-

September 2025 – Official "Divorce" Date: The Veeva-Salesforce contract expired in September 2025, formally ending the partnership ([42]). From this point, Veeva stopped paying Salesforce license fees, and Salesforce became free to directly sell into pharma. Veeva CRM on the Salesforce platform is no longer being enhanced, though it remains supported during the transition period. Pharma companies have until 2030 to fully migrate off the legacy Veeva (Salesforce-based) CRM and onto either Veeva Vault CRM or another CRM solution ([42]) ([43]). Salesforce's Life Sciences Cloud for Customer Engagement also became generally available in October 2025, marking Salesforce's full entry into the pharma CRM market.

-

Late 2025 – Salesforce Secures Major Wins: In December 2025, Salesforce announced it had signed more than 40 life sciences customers for its Life Sciences Cloud, including one of the top three global pharma companies that defected from Veeva ([7]). Additional marquee customers announced included Takeda, Pfizer, Boehringer Ingelheim, and Fresenius Kabi ([59]). Salesforce rebranded its offering as Agentforce Life Sciences, signaling its pivot toward AI-powered agentic capabilities.

-

January 2026 – Veeva Reaches 80+ Vault CRM Deployments: As of early 2026, Veeva reported over 80 live Vault CRM deployments, with 28 customers added or migrated in Q1 FY2026 alone. The company reaffirmed its target to surpass 200 Vault CRM customers by the end of fiscal 2026 ([60]). Three of the top 20 global biopharma companies have now adopted Vault CRM. On January 7, 2026, Veeva announced that Novo Nordisk's International Operations committed to Vault CRM ([61]), alongside expanded partnerships with Roche and continued commitments from GSK. Veeva also introduced agentic AI capabilities within Vault CRM, including CRM Bot for voice control and natural language search.

-

2026 and Beyond – The New Landscape: The life sciences CRM market is now in full competitive mode. Veeva Vault CRM and Salesforce Life Sciences Cloud are competing head-to-head for new deals and renewals. Veeva achieved its $3 billion revenue run rate goal in fiscal 2025 and projects fiscal 2026 revenues of $3.16-3.17 billion ([62]). Both companies are aggressively courting customers with AI-driven features – Salesforce with its Agentforce AI agents and Veeva with its Vault CRM agentic AI suite. Industry experts warn that companies delaying migration decisions face a "traffic jam" in later years as vendor and implementation partner capacity becomes saturated. By 2030, the vast majority of current Veeva CRM users will have made their choice and switched to a new platform.

This timeline illustrates that the Veeva-Salesforce split was not a single event but a multi-year process. What began as an amicable partnership is ending in a competitive showdown, with significant planning and preparation on all sides.

Impact on Pharma and Life Sciences Clients

For pharmaceutical and biotech companies, Veeva's move off Salesforce has far-reaching implications. These organizations must weigh the benefits of Veeva's new independent CRM against the challenges and risks of migration. Below we outline the key pros and cons for life sciences companies:

Benefits: Why Staying with Veeva (Vault CRM) Could Pay Off

-

Uninterrupted Industry Focus: Veeva's sole focus is life sciences, and its new CRM is purpose-built for this industry. Clients can expect Veeva to continue delivering pharma-specific features without dilution. As Everest Group noted, Veeva can now offer a better end-to-end experience by hosting all solutions – from clinical to commercial – on a common platform ([29]). This could translate to faster innovation of features like sample management, KOL engagement, and regulatory compliance checks that generalist CRM platforms might overlook.

-

Unified Platform & Data: Companies that use other Veeva products (for content management, clinical trial management, etc.) stand to gain from having CRM on the same Vault platform. All teams work from a single data repository, enabling 360-degree visibility. Sales, medical, and marketing can collaborate more seamlessly, since customer data and content (e.g. approved marketing assets, medical inquiry info) are in one system ([63]) ([50]). This unification can improve data quality and analytics – for example, linking sales interactions with outcomes or identifying unmet needs through integrated data. It also simplifies IT architecture (fewer integrations between disparate systems).

-

Product Roadmap Control: With Veeva no longer constrained by Salesforce's development schedule or rules, clients gain more influence over the CRM's evolution. Veeva has promised an accelerated roadmap of enhancements now that it "owns" the platform ([18]). Pharma customers can push for new capabilities (like advanced AI suggestions for reps or new digital engagement channels) knowing Veeva can build them natively. There's no dependency on Salesforce delivering a generic feature first. Essentially, Veeva can tailor its CRM roadmap purely based on life science customer feedback and emerging industry needs, which could mean more frequent and relevant updates for users.

-

Potential Cost Savings: While switching platforms has costs, in the long run Veeva's independence could benefit customers financially. Veeva will no longer owe Salesforce a 15% cut of CRM revenues, which opens the door for more competitive pricing or at least less upward price pressure on clients ([24]). Moreover, Veeva can offer bundle deals across its suite (since all on one platform) that might be more cost-effective than piecemeal solutions. Some analysts believe owning the full stack will let Veeva optimize performance and costs, possibly passing on savings to customers or investing more in support services ([23]) ([25]).

-

Data Residency & Compliance: With Vault CRM, data is hosted in Veeva's controlled cloud (likely on AWS in Veeva's chosen regions). Pharma companies dealing with strict data residency laws or GDPR requirements may appreciate the flexibility of Veeva's hosting versus being tied to Salesforce's infrastructure. Veeva can architect data handling to meet GxP and 21 CFR Part 11 regulations common in life sciences. And because Veeva is solely focused on this industry, it may be more attuned to upcoming regulatory changes (like new privacy rules) that could be built directly into the platform. Overall, customers might feel they have greater ownership and oversight of their data when it's managed by a vendor dedicated to their sector.

-

Service and Support Tailored to Pharma: Under the old model, Veeva clients sometimes had to work with both Veeva and Salesforce for certain issues (especially deep technical platform problems). Post-split, Veeva provides one-throat-to-choke support – there's no hand-off to Salesforce for platform-level fixes. Veeva also can enforce service level agreements suited to pharma's needs. Everest analysts highlight that Veeva can now leverage its own partner ecosystem to provide more personalized service in areas like data migration, validation, and training ([29]). Clients should get faster responses for issues because the entire stack is Veeva's responsibility. In theory, this could improve reliability and user satisfaction.

-

Freedom from Salesforce's Constraints: Many life sciences companies use Veeva precisely because it was the de facto standard. But they were also indirectly tied to Salesforce (e.g., needing Salesforce administrator skills, staying compatible with Salesforce updates, etc.). By moving to Vault CRM, clients free themselves from Salesforce's ecosystem requirements. They no longer need to maintain Salesforce-specific customizations or integrations, which in some cases means less overhead. Also, any concerns about Salesforce's future directions (unrelated platform changes, pricing of Force.com, etc.) are taken off the table. In a sense, customers who commit to Veeva Vault CRM are betting on a more focused, stable long-term path for their commercial operations software.

Disadvantages: Challenges & Risks of the Transition

-

Migration Complexity: Moving an entire CRM system is non-trivial, especially in a regulated industry. Pharma companies face a complex migration of data, processes, and integrations from the old Veeva (Salesforce) CRM to the new Vault CRM. Customer records, history, and multi-year data need to be transferred and validated. Any integrations with other systems (like marketing automation, data warehouses, ERP, medical information systems) have to be rebuilt or adjusted for the new platform ([64]) ([65]). This requires careful planning and resources. Many organizations will need to form dedicated migration teams, engage consultants, and allocate budget to execute this transition smoothly ([66]). For global pharma companies with thousands of reps in the field, the data migration and cutover is a major IT project that can take many months of preparation and testing.

-

Short-Term Disruption Risks: During the transition period, there is potential for business disruption. Sales and medical teams might experience downtime or reduced functionality as systems switch over. Even with parallel running, users have to be trained on the new Vault CRM interface and features ([67]). There may be a learning curve, and productivity could dip in the short run if the new system isn't tuned perfectly. Additionally, if a company is mid-launch for a new drug or executing critical sales strategies, any hiccups in CRM availability or accuracy could impact operations. Pharma firms are thus wary of a risky "big bang" switchover. Many are choosing phased migrations (e.g., one country or one business unit at a time) to mitigate this, but that prolongs the period of running two systems in parallel, which itself is challenging.

-

Compatibility and Feature Gaps: While Veeva has strived to make Vault CRM feature-complete, initial versions of any new platform may have some gaps or differences. Certain custom extensions or third-party plugins that companies built for Veeva CRM on Salesforce might not immediately exist on Vault. For example, if a company used a specific Salesforce AppExchange add-on for e-signatures or sample inventory, they'll need to see if Veeva's new platform supports it or find an alternative. Some integrations (like with Salesforce Marketing Cloud or Service Cloud) that were straightforward before may need re-working, since the underlying data model has changed ([68]) ([69]). Early adopters of Vault CRM have generally reported that the core functionality is equivalent, but power users could notice subtle differences that require adjustment. Until the new platform fully matures, clients face some uncertainty about whether all their use cases are met out-of-the-box.

-

Resource and Training Burden: Implementing Vault CRM isn't just a software upgrade; it can be seen as a new system deployment. Companies will need to retrain hundreds or thousands of end users (sales reps, managers, MSLs, etc.) on any UI changes and new capabilities. They also need to re-skill their CRM administrators and IT staff to learn the Vault Platform configuration and administration, which differs from Salesforce's tools. For years, many organizations have built internal expertise around Salesforce/Veeva configuration (workflow rules, custom objects, etc.); now they must invest in developing Vault CRM expertise. In the interim, companies might depend heavily on Veeva's professional services or consultants, which can be costly. Smaller biotechs with lean IT teams could feel this burden acutely.

-

Multi-Vendor Juggling (If Not Staying with Veeva): Some pharma companies might consider switching to Salesforce's new Life Sciences Cloud instead of staying with Veeva. That path has its own challenges – it essentially means adopting Salesforce (potentially with IQVIA's help) as a direct CRM vendor. Those who choose that route face a migration as well (to a different CRM entirely) and might lose the tight integration with Veeva's other suites (like Vault R&D). Conversely, companies that stick with Veeva Vault CRM will lose native compatibility with Salesforce's broader ecosystem (Salesforce apps or partners). Either choice involves trade-offs, and clients must "think through the choices, timing, and approach" carefully to set themselves up for a different future ([46]). There is no zero-effort option, which makes some organizations uncomfortable. Essentially, pharma companies are forced to make a strategic CRM decision that they haven't had to make in over a decade, and this analysis itself is a significant undertaking.

-

Uncertainty in a Two-Vendor Race: Once the dust settles, clients will be relying on whichever vendor they choose (Veeva or Salesforce) to continually meet their needs. There's a risk in leaving the known for the unknown. If a company follows Veeva to Vault and for some reason Veeva struggles with this new platform, the client could face a setback. On the other hand, if they go with Salesforce's nascent Life Sciences Cloud and Salesforce doesn't invest enough (since pharma is still <1% of its revenue ([70])), they could end up with a less responsive partner. In short, pharma firms are betting on vendor execution. The conservative nature of the industry makes this a notable disadvantage – many would prefer the status quo stability, but that status quo is ending. Some may hedge by delaying the decision as long as possible (using the 2030 deadline), but eventually they must commit one way or the other.

Despite these challenges, most observers believe the transition is manageable with proper planning. Veeva and Salesforce have each offered extensive support resources to help customers migrate. The five-year window (2025–2030) is purposely generous, allowing larger enterprises to transition at their own pace ([66]) ([71]). As one life sciences IT blog noted, early planning – establishing internal task forces, assessing current systems, and running pilots – will be crucial to minimize risks and ensure continuity during the switch ([66]) ([65]).

Strategic Implications and Industry Reactions

The end of the Veeva-Salesforce union is reshaping the competitive landscape of pharma tech. Both companies, once close partners, are now fully pivoting to compete in the life sciences CRM arena, which has several important implications:

-

Direct Competition Breeds Innovation: For the first time, pharma companies will have a choice between two heavyweight CRM platforms purpose-built (or customized) for their industry. This competition is spurring both Veeva and Salesforce to up their game. Salesforce is investing in a next-generation platform infused with AI and advanced analytics, aiming to "transform the future of HCP engagement" with a unified solution ([72]) ([73]). Veeva, leveraging its domain expertise, is rapidly enhancing Vault CRM with new capabilities (like tighter omnichannel marketing integration and even patient engagement features) to stay ahead ([35]) ([36]). Industry watchers expect a cycle of leapfrogging innovations – for example, if Salesforce introduces a cutting-edge AI-driven suggestion engine, Veeva will likely develop a life-sciences-tuned equivalent, and vice versa. The heightened competition could ultimately benefit pharma companies, as it will lead to more choice and faster feature development than when Veeva was the only real option in the space ([74]) ([15]).

-

Salesforce's Pharma Foray: From Salesforce's perspective, losing Veeva as an ISV partner (<1% of Salesforce's revenue) won't hurt the bottom line much, but it opens a much larger opportunity. Salesforce can now directly go after the multi-billion-dollar pharma CRM market that Veeva has dominated ([75]). It has partnered with IQVIA and hired life sciences veterans to quickly build credibility. Salesforce's Life Sciences Cloud (launching fully in 2025) is positioned as a fresh start, unencumbered by legacy designs, and can leverage Salesforce's broader technology (like Einstein AI, Marketing Cloud, etc.) in new ways ([51]) ([76]). However, Salesforce faces skepticism from some analysts who note that Salesforce's strength has been horizontal products and acquisitions, not developing industry-specific solutions from scratch ([38]). Competing with Veeva requires deep domain understanding and focus. It remains to be seen if Salesforce will dedicate sustained attention to pharma once the initial land grab is over, or if its myriad other priorities will dilute its efforts. For now, Salesforce is certainly signaling that it intends to be a major player in life sciences – a development that CIOs in pharma are watching closely.

-

Veeva's Expansion and Focus: Freed from the Salesforce alliance, Veeva is doubling down on life sciences specialization. In addition to retaining its pharma CRM clients, Veeva can chase customers it previously couldn't. One likely area is medical devices and diagnostics companies (MedTech), where Salesforce had been the leader. Veeva can now offer a version of Vault CRM for MedTech sales, entering that niche market and growing its customer base ([34]). Veeva's leadership also hinted at extending CRM to cover things like patient services or more clinical-commercial collaboration tools ([35]). By owning the full platform, Veeva could unify clinical trial data with commercial data, for example, to help inform launch strategies – synergies that were harder to achieve when CRM was separate. On the flip side, Veeva must now support all the underlying tech itself. It loses the advantage of Salesforce's R&D and infrastructure. Meeting enterprise expectations for scalability and performance is now squarely Veeva's burden ([77]). Any major Vault platform outage or security issue would fall entirely on Veeva. The company is investing heavily to ensure its cloud can match Salesforce's reliability, and so far there's confidence in the Vault platform (which has been used for years in other areas). Still, Veeva's evolution from an application ISV to a full-stack platform provider will be a critical watch point in the coming years.

-

Clients Reevaluating CRM Strategy: Perhaps the most profound implication is the forced reexamination of CRM strategy by life sciences companies. Many big pharma firms had basically "set it and forget it" with Veeva CRM for a decade. Now, as Trinity Life Sciences consultant Nancy Phelan observed, these companies realize this is "a much bigger decision" tied to future commercial models ([78]) ([46]). It's prompting questions about how they want to engage HCPs and patients in the next 10 years. Some are using this moment to consider alternative CRM options beyond Veeva and Salesforce – for instance, exploring Oracle or other niche players, or even building custom solutions, though Veeva and Salesforce remain the frontrunners for most ([79]) ([74]). Additionally, companies are thinking about data strategy in a new light: if they switch to Salesforce's cloud, how to integrate it with their existing Veeva Vault apps, and if they stay with Veeva, how to ensure innovation if the broader market moves toward AI-heavy CRM. In effect, the Veeva-Salesforce split has sparked a wave of IT strategy projects across the industry, as every affected organization must map out a CRM roadmap aligned with its business goals and tech stack. This is why experts are advising firms to start planning early and view the migration as an opportunity to modernize and optimize their commercial operations, not just a lift-and-shift exercise ([80]) ([81]).

-

Analyst and Expert Commentary: The industry commentary on this split has been rich. The Everest Group, in a detailed analysis, concluded that "the move may lead to increased competition and innovation in CRM solutions tailored to the sector", and that enterprises should take the chance to re-evaluate what platform aligns best with their evolving needs ([82]) ([83]). Some experts have noted that Salesforce's foray could bring more AI and data-driven capabilities quickly, given Salesforce's resources, whereas Veeva's solution offers familiarity and depth in pharma-specific workflows ([74]) ([15]). Financial analysts, such as those at Baird, generally see the split as a manageable transition, with Veeva expected to retain the bulk of its customers by facilitating a smooth migration of their data and customizations (making it easier to stay than to switch) ([84]). At the same time, there is acknowledgment that Veeva has never faced a rival of Salesforce's caliber before, and it will have to execute extremely well to maintain its market share as the two platforms mature ([85]) ([86]). The good news for Veeva is that it enters this contest with a strong reputation in life sciences and deep client relationships, which count for a lot in this trust-based industry.

In terms of market impact, early results show that a segment of cost-sensitive or Salesforce-loyal clients have defected – Salesforce secured over 40 customers including a top-3 global pharma company by the end of 2025. However, the majority have stayed with Veeva: Veeva now has over 80 live Vault CRM deployments with major commitments from Novo Nordisk, Roche, and GSK. Veeva reported fiscal 2025 revenues of $2.75 billion (up 16% year-over-year) and projects fiscal 2026 revenues of $3.16-3.17 billion, demonstrating continued strong growth despite competition ([62]). The "pharma CRM war" is now fully underway, representing a sea change from the previous decade when Veeva faced little meaningful competition.

Conclusion

The split between Veeva and Salesforce represents a transformative moment for the pharma and life sciences IT landscape. What began as a pioneering partnership to bring cloud CRM to pharma has evolved into a competitive duel, driven by Veeva's need for autonomy and Salesforce's desire to capture a lucrative market. From the initial December 2022 breakup announcement through the product launches of 2024, the contract's end in September 2025, and the competitive landscape that has emerged in 2026, we have witnessed a carefully orchestrated transition that will continue unfolding until 2030.

For life sciences companies, this is more than a vendor switch – it's an opportunity to modernize customer engagement strategies, but also a mandate to navigate technical complexity. The benefits of Veeva's independent path – an integrated platform, potential cost savings, and a laser focus on industry innovation – are proving compelling, with over 80 Vault CRM deployments live and major pharma companies like Novo Nordisk, Roche, and GSK committed to the platform. Meanwhile, Salesforce has demonstrated it's a serious competitor, securing over 40 customers including Takeda and Pfizer for its Agentforce Life Sciences offering. The challenges – data migration, re-training, and uncertainty – are non-trivial but surmountable with proper planning. As one expert emphasized, viewing this as "just an IT migration" would be a mistake; it is a strategic inflection point ([46]). Organizations that proactively assess their options and chart a thoughtful course will be best positioned to thrive in the new CRM landscape.

Looking ahead, the competition is spurring accelerated innovation as Veeva and Salesforce compete head-to-head, each leveraging their strengths (deep industry expertise vs. broad technology prowess) to win over pharma clients. Both companies are now investing heavily in agentic AI capabilities – Veeva with CRM Bot and voice-enabled features, Salesforce with its Agentforce AI agents. For customers, the silver lining of this split is a future with more choices and more advanced capabilities in their CRM tools than ever before. The pharma CRM of 2030 will look very different from that of 2020, thanks in large part to this "creative destruction" of an old alliance.

Ultimately, Veeva's break from Salesforce underscores a broader theme in enterprise technology: the need to balance partnership and control. Veeva decided that to serve its specialized market better, it had to control its own destiny. Pharma companies now must decide which path will best control theirs. The ripple effects of this decision will be felt across the industry for years, making it one of the most significant enterprise software shifts in recent memory.

Sources:

- Gibney, M. (2025). Salesforce or Veeva: How drugmakers can navigate the upcoming CRM split. PharmaVoice ([42]) ([1]).

- Everest Group (2023). Will It Be Happily Ever After Post Veeva-Salesforce Divorce? ([87]) ([26]).

- Cyntexa (2023). Veeva CRM Leaving Salesforce: Impact on Life Sciences Cloud ([88]) ([89]).

- Assemble Digital (2023). Hello New Veeva CRM, Salesforce is Out – What You Need to Know ([19]) ([90]).

- IQVIA Press Release (2024). IQVIA and Salesforce Expand Global Partnership (Life Sciences Cloud) ([52]) ([54]).

- QPharma (2025). How Will You Transition Your CRM During the Veeva–Salesforce Separation? ([91]) ([64]).

- Salesforce Ben (2024). Veeva vs. Salesforce: Who Will Win the Cloud Pharma Battle? ([92]) ([93]).

- LinkedIn – S. Donaldson (2023). Veeva or Salesforce? Big Decisions for Pharma ([38]) ([84]).

- Veeva Systems Press Release (2014). Veeva Extends salesforce.com Partnership Into 2025 ([10]) ([11]).

- Veeva Systems Press Release (2024). Vault CRM Suite with Campaign Manager Launch ([17]) ([48]).

- Veeva Systems (2025). Fiscal Year 2025 Results ([62]).

- Veeva Systems (2025). Fiscal 2026 First Quarter Results ([60]).

- Bloomberg (2024). Salesforce Stokes Fight With Veeva by Snagging Drug Customers ([7]).

- Salesforce (2025). Takeda Selects Salesforce Life Sciences Cloud ([59]).

- PR Newswire (2026). Novo Nordisk International Operations Commits to Veeva Vault CRM ([61]).

External Sources (93)

Need Expert Guidance on This Topic?

Let's discuss how IntuitionLabs can help you navigate the challenges covered in this article.

I'm Adrien Laurent, Founder & CEO of IntuitionLabs. With 25+ years of experience in enterprise software development, I specialize in creating custom AI solutions for the pharmaceutical and life science industries.

DISCLAIMER

The information contained in this document is provided for educational and informational purposes only. We make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability, or availability of the information contained herein. Any reliance you place on such information is strictly at your own risk. In no event will IntuitionLabs.ai or its representatives be liable for any loss or damage including without limitation, indirect or consequential loss or damage, or any loss or damage whatsoever arising from the use of information presented in this document. This document may contain content generated with the assistance of artificial intelligence technologies. AI-generated content may contain errors, omissions, or inaccuracies. Readers are advised to independently verify any critical information before acting upon it. All product names, logos, brands, trademarks, and registered trademarks mentioned in this document are the property of their respective owners. All company, product, and service names used in this document are for identification purposes only. Use of these names, logos, trademarks, and brands does not imply endorsement by the respective trademark holders. IntuitionLabs.ai is an AI software development company specializing in helping life-science companies implement and leverage artificial intelligence solutions. Founded in 2023 by Adrien Laurent and based in San Jose, California. This document does not constitute professional or legal advice. For specific guidance related to your business needs, please consult with appropriate qualified professionals.

Related Articles

Veeva CRM vs. Competitors – Comprehensive Comparison for Life Sciences

An in-depth analysis comparing Veeva CRM with other CRM solutions in the life sciences industry, examining features, compliance, and industry-specific capabilities.

CRM Platforms for the Biotech Industry

A comprehensive overview of Customer Relationship Management (CRM) platforms tailored for biotech companies, comparing various solutions and their features for compliance, sales, and customer relationship management in the life sciences sector.

CRM in Pharma vs. Life Sciences: Tailoring Sales, Marketing, Compliance, and Patient Engagement

A comprehensive comparison of CRM requirements between pharmaceutical companies and other life sciences organizations, examining key differences in sales, marketing, compliance, and patient engagement approaches.