Veeva CRM vs. Competitors – Comprehensive Comparison for Life Sciences

[Revised January 8, 2026]

Comparative Study: Veeva Vault CRM vs. Pharmaceutical CRM Competitors

Introduction

Pharmaceutical and life sciences companies require Customer Relationship Management (CRM) solutions tailored to their highly regulated, global, and data-intensive environment. The life sciences CRM landscape underwent a historic transformation in 2025: the Veeva-Salesforce non-compete agreement expired in September 2025, enabling Salesforce to enter the pharma CRM market directly for the first time. This triggered a wave of innovation, with all major platforms launching agentic AI capabilities.

Veeva Vault CRM (the next-generation Veeva CRM built on Veeva's Vault platform) remains a leading life sciences-specific CRM, now enhanced with Veeva AI Agents launched in December 2025 for Vault CRM and PromoMats—including Voice Agent, Pre-call Agent, Free Text Agent, Quick Check Agent, and Content Agent—with additional agents planned throughout 2026. Major customers like Novo Nordisk committed to Vault CRM in January 2026, demonstrating continued market confidence.

Its key competitors include IQVIA's Orchestrated Customer Engagement (OCE) suite—which IQVIA will continue supporting through 2029 while partnering with Salesforce to accelerate Life Sciences Cloud development—Salesforce's Life Sciences Cloud (generally available as of October 2025, now branded as "Agentforce Life Sciences"), Oracle's life sciences CRM solutions (e.g., Siebel Pharma CRM and Oracle CX), and other niche platforms.

The global pharma and biotech CRM software market reached $4.33 billion in 2024 and is projected to grow to $9.85 billion by 2034, with AI-powered CRM expected to grow at 18.4% CAGR ([1]). Market share in 2023 was led by Veeva (26.81%), followed by IQVIA (17.73%), Salesforce (16.40%), and Oracle (11.21%). This report provides a comprehensive comparison of Veeva Vault CRM and these competitors across critical evaluation criteria for IT and business executives.

Key Competitors Covered:

- Veeva Vault CRM – Veeva's dedicated life sciences CRM suite, fully transitioned from Salesforce to Veeva's proprietary Vault platform. Pharma companies on the legacy Salesforce-based Veeva CRM must migrate to Vault CRM by 2030 ([2]).

- IQVIA OCE (Orchestrated Customer Engagement) – IQVIA's life sciences commercial platform (built on Salesforce technology), supporting nearly 400 customers in 130+ countries through 2029 while IQVIA partners with Salesforce on Life Sciences Cloud development ([3]).

- Salesforce Life Sciences Cloud – Salesforce's pharma CRM offering (generally available October 2025), now branded as "Agentforce Life Sciences" with AI agents for clinical, medical, and commercial engagement. Takeda selected Salesforce Life Sciences Cloud in May 2025.

- Oracle Life Sciences CRM – Oracle's CRM solutions for pharma, historically based on Siebel Life Sciences and now evolving under Oracle CX, with a focus on closed-loop marketing and enterprise integration ([4]).

- Other Niche Platforms – e.g. Exeevo's Omnipresence (built on Microsoft Dynamics 365) and smaller regional CRMs (like Ysura in DACH, or Platforce in emerging markets) which offer specialized life sciences CRM capabilities ([5]).

Below, we compare these solutions on regulatory compliance, integration, scalability/deployment, analytics, omnichannel engagement, mobile/offline support, customization, and global support/localization. A summary comparison table is also provided.

High-Level Feature Comparison

To provide a snapshot, Table 1 summarizes how Veeva Vault CRM and its competitors stack up across key dimensions:

| Criteria | Veeva Vault CRM (Life Sciences Cloud) | IQVIA OCE (Orchestrated Customer Engagement) | Salesforce Life Sciences Cloud | Oracle Life Sciences CRM (Siebel/CX) |

|---|---|---|---|---|

| Regulatory Compliance | Industry-specific compliance built-in. Extensive 21 CFR Part 11 support (audit trails, e-signatures) out-of-the-box ([6]). Continuously updated for GxP changes. | Designed for pharma compliance. Adheres to global regs (built on Salesforce compliance infrastructure) with IQVIA's added validation. Includes sample accountability and audit features. | Configurable compliance. Provides standard compliance features (HIPAA, FDA) but may require additional configuration to meet all GxP needs (Salesforce Life Sciences Cloud vs. Veeva CRM [2024]). | Configurable (legacy Siebel). Capable of 21 CFR Part 11 compliance through configuration; offers e-signature and audit trail options, but not pre-validated by default ([6]). |

| Integration Capabilities | Life sciences data integration. APIs and connectors tailored to pharma (e.g. integrates natively with Veeva Vault content, Align, Nitro data warehouse) (Salesforce Life Sciences Cloud vs. Veeva CRM [2024]). Focus on pharma workflows. | Connected ecosystem. Built on Salesforce – leverages Salesforce APIs – and seamlessly integrates IQVIA data assets (e.g. IQVIA OneKey HCP data, market data) and third-party systems. | Salesforce ecosystem. Native integration with Salesforce's own Marketing, Service, and Analytics clouds (Salesforce Life Sciences Cloud vs. Veeva CRM [2024]). Standards-based APIs (FHIR for health data, etc.) for linking to other systems ([7]). | Enterprise integration. Highly customizable integration via Oracle middleware; out-of-box connectors for Oracle ERP, supply chain, etc. Requires more setup but very versatile ([8]). |

| Scalability & Deployment | Cloud/SaaS only (multi-tenant). Delivered as a SaaS via Veeva Vault Cloud (formerly on Salesforce). Scales to tens of thousands of users globally with high performance. No on-premises option, but dedicated cloud instances by region for compliance. | Cloud (Salesforce-based). Provided as SaaS on Salesforce's cloud platform ([3]). Scales with Salesforce infrastructure. Typically multi-tenant; IQVIA manages updates. No on-prem, but can integrate with on-prem data sources. | Cloud (SaaS). Runs on Salesforce's multi-tenant cloud. Extremely scalable (leveraging Salesforce's global infrastructure). No on-premises deployment (though Salesforce offers VPC options for sensitive data if needed). | On-prem or Cloud. Siebel CRM historically on-premises (still used in some orgs); can be hosted on private clouds. Oracle also offers cloud-based CX CRM. On-prem deployment gives control but requires more IT resources. Scalability proven (used by large pharma), but hardware and tuning are customer's responsibility. |

| Analytics & Reporting | Life sciences-focused insights. Includes pre-built dashboards (e.g. for drug sales, HCP engagement) and Veeva Nitro for data warehousing. Offers "CRM MyInsights" and upcoming AI features for suggestions. Strong operational reporting; predictive analytics evolving ([9]) ([10]). | Embedded intelligence. "Connected Intelligence" in OCE provides real-time contextual insights, next-best-action recommendations, and predictive analytics embedded in workflows ([3]). Advanced analytics modules (OCE Insights) turn data into actionable suggestions ([11]). | Advanced AI/ML (Einstein). Deep analytics via Salesforce Einstein AI – predictive models for customer behavior, patient journey insights, etc. (Salesforce Life Sciences Cloud vs. Veeva CRM [2024]). Real-time dashboards and rich reporting across all customer touchpoints (with Tableau CRM/CRM Analytics). | Robust reporting, less AI. Siebel CRM offers extensive reporting (e.g. via Oracle OBIEE) and data warehousing integration. Oracle's new cloud CRM can leverage Oracle Analytics and Adaptive Intelligence, but not as specialized out-of-box predictive models for pharma as competitors. |

| Omnichannel Engagement | Comprehensive omnichannel suite. Supports face-to-face detailing, email (Veeva Approved Email), remote detailing (Veeva Engage), and events management – all unified ([12]). Enables reps to coordinate interactions across channels while maintaining compliance (Salesforce Life Sciences Cloud vs. Veeva CRM [2024]). | Orchestrated multi-channel. Integrates all direct and indirect channels (in-person calls, email, virtual meetings, etc.) into one platform ([13]). Campaign tools to align content with HCP preferences. Aims for "orchestrated" experiences across personal & digital channels ([14]). | Broad omni-channel via add-ons. Core focuses on CRM functionality, but easily connects to Salesforce Marketing Cloud, Pardot, and third-party tools for email, digital campaigns, social, and call centers. Can engage patients, HCPs, payers through unified data but may rely on multiple Salesforce products to cover all channels. | Multi-channel via CLM. Provides closed-loop marketing capabilities: e-detailing, email, call centers, etc. ([4]). Siebel Pharma had a CLM module for coordinated messaging and content reuse across channels. May require integration with Oracle Marketing Cloud (Eloqua) for digital campaigns. |

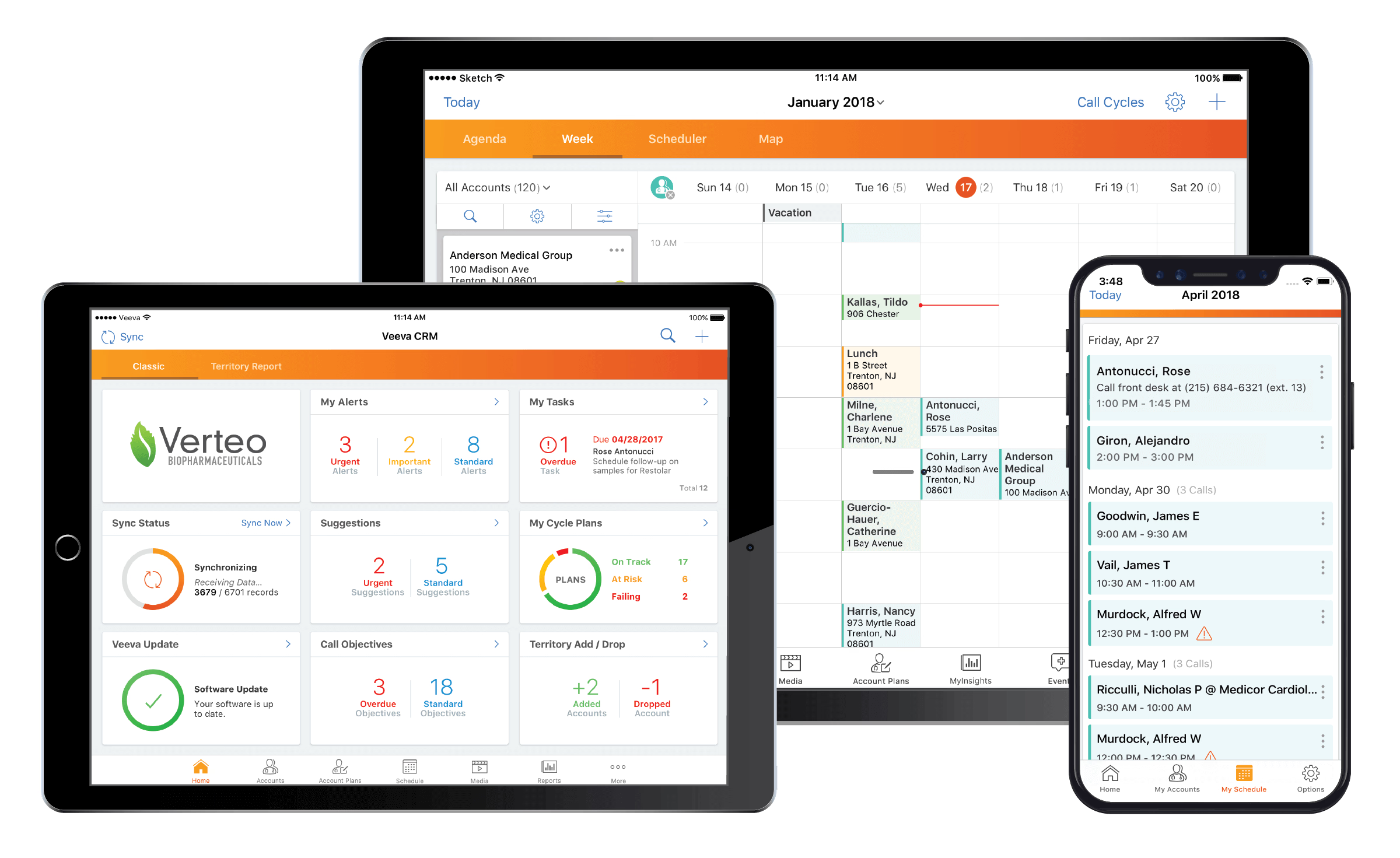

| Mobile Access & Offline | Full offline functionality. Native mobile apps (especially iPad) with full offline support – all data, content, and configurations sync so reps can work without internet ([15]). Designed for field use with rich offline detailing and sample capture. | Strong mobile + offline. Optimized for field teams with a modern mobile app. Described as offering "unmatched mobile access," combining CRM and CLM on tablets ([16]). Reps can detail offline and data syncs when online. | Standard mobile app. Leverages the Salesforce mobile app (online/offline capabilities improving with Salesforce Mobile SDK). Basic offline access (cached records, tasks) is available, but some advanced functions may require connectivity. Salesforce is investing in enhanced offline for Life Sciences Cloud by GA in 2025. | Mobile support available. Siebel has a mobile app and remote client for offline use, but it's legacy and less user-friendly. Oracle's modern CX Sales app offers mobile access but offline support is limited compared to Veeva. Field teams on Siebel often used laptops with periodic sync. |

| Customization & Configurability | Configurable, not highly customizable. Veeva provides a standardized data model and processes for pharma. Companies can configure fields, workflows, and minor customizations, but deep customization or code changes are limited by design ([17]) ([18]). This ensures stability and faster implementation, at the cost of some flexibility. | Configurable (Salesforce-based). OCE can be configured within the Salesforce platform and allows custom extensions, but since it's a managed solution, core changes are limited. IQVIA provides some flexibility to tailor AI models, workflows, etc., but it's not an open-ended development platform. | Highly customizable. Built on the Salesforce platform, it inherits Salesforce's renowned flexibility. Users can create custom objects, workflows, and even custom code (Apex, Lightning components) as needed (Salesforce Life Sciences Cloud vs. Veeva CRM [2024]) (Salesforce Life Sciences Cloud vs. Veeva CRM [2024]). This allows adaptation to unique business needs – though with careful governance to maintain compliance. | Extremely customizable (with effort). Oracle's Siebel CRM was known for extensive customization – from data model to UI – via its tools. Organizations can modify almost any aspect to fit their processes. However, this requires significant time and skilled resources ([19]) and can increase implementation complexity. Oracle's newer cloud CX CRM offers configuration options but less industry-specific default processes than Veeva. |

| Global Support & Localization | Life sciences focus globally. Used by pharma companies worldwide, Veeva CRM is built with region-specific requirements in mind (sample compliance, data privacy, local pharma codes). It "supports all critical region-specific capabilities and regulatory needs – from Brazil to Japan, Germany and beyond" ([20]). Veeva offers multi-language UI and documentation, and a network of partners for local support. | Worldwide presence (IQVIA). IQVIA OCE benefits from IQVIA's global footprint in 100+ countries ([21]). The platform supports multiple languages and local compliance rules (given its Salesforce foundation and IQVIA's domain knowledge). IQVIA provides global customer support and has regional teams specializing in local pharma commercial models. | Salesforce global infrastructure. Life Sciences Cloud is backed by Salesforce's international cloud with data centers in multiple regions. Multi-language support and localization are provided by Salesforce's platform. However, being a newer product, Salesforce is building up industry-specific local templates (with help from partners and acquired experts ([22])). Global system integrators (Accenture, Deloitte, etc.) are available for implementation and support. | Established global usage. Oracle's pharma CRM (Siebel) was adopted globally by many large companies in the 2000s, so it supports many languages and local configurations (e.g. local address formats, country-specific sample regulations via customization). Oracle provides global support contracts. Yet, Oracle's focus has shifted more to cloud applications, so support for the legacy Siebel in life sciences continues but innovation is slower compared to newer platforms. |

Table 1: High-Level Comparison of Veeva Vault CRM and Key Pharma CRM Competitors (Pharma/Life Sciences Industry Focused) (Salesforce Life Sciences Cloud vs. Veeva CRM [2024]) ([3]) ([6]) ([23]).

Regulatory Compliance and Validation

Veeva Vault CRM: Designed exclusively for life sciences, Veeva's CRM has compliance baked in. It ships with built-in features to meet FDA 21 CFR Part 11 and other GxP regulations out-of-the-box. For example, Veeva provides audit trails and electronic signature capabilities for regulated actions like sample dispensing and call sign-offs ([6]). These features are pre-validated and kept up-to-date with evolving pharma regulations. Veeva Vault CRM is "compliant at its core," offering hundreds of compliance features and ensuring it stays aligned with requirements as regulations change ([24]) ([15]). This makes it easier for companies to use the system in validated environments without extensive custom validation.

IQVIA OCE: IQVIA's OCE is also built for pharma and biotech, so it similarly emphasizes compliance. As it runs on Salesforce, it leverages Salesforce's secure, certified cloud (which meets standards like ISO 27001, SOC, etc.) and adds pharma-specific compliance modules. OCE supports 21 CFR Part 11 compliance for digital signatures (for sample drops, HCP acknowledgments, etc.) and provides audit trails for all engagements. IQVIA's pharma domain expertise means OCE comes with "commercial compliance" features and can accommodate global regulatory requirements around interactions with healthcare professionals. In fact, reviewers note that OCE is "built with life sciences regulatory requirements, adhering to global standards like FDA 21 CFR Part 11" ([25]). In practice, pharma companies using OCE still perform system validation, but OCE provides validation scripts and IQVIA support to facilitate compliance.

Salesforce Life Sciences Cloud: As a newcomer targeting life sciences, Salesforce's solution includes compliance features but with a more generalist approach. It provides a platform that can be configured to meet GxP regulations – for instance, Salesforce environments can be set up with audit trail tracking, restricted access controls, and e-signature apps. Salesforce emphasizes that Life Sciences Cloud is built on their trusted platform with industry-standard compliance, but organizations will need to ensure proper configuration and possibly add-ons to achieve full 21 CFR Part 11 compliance (Salesforce Life Sciences Cloud vs. Veeva CRM [2024]). Unlike Veeva, which delivers compliance presets out-of-box, Salesforce gives the toolkit to be compliant. In highly regulated uses (like sample management or adverse event tracking), Salesforce may require additional validation effort by the customer. However, Salesforce's recent push into this industry includes hiring domain experts and building compliance templates, so it touts "advanced compliance capabilities with highly configurable options" to tailor to each company's needs ([26]).

Oracle Life Sciences CRM: Oracle's CRM offerings for life sciences (largely stemming from Oracle Siebel Life Sciences) have long supported compliance requirements, but through customization. Oracle provides documentation and tools to configure features like audit trails and e-signatures to satisfy Part 11 ([6]). For example, Siebel Pharma included a "sample and sign" functionality for sample disbursal, capturing a prescriber's signature digitally to ensure compliance ([27]). Oracle even commissioned guidance for customers on validating Oracle systems for Part 11 ([PDF] 21 CFR 11 and General GxP Applicability for Oracle). The key difference is that Oracle's approach is more toolkit than turnkey – it's robust but not automatically tailored to life sciences out-of-box. Companies often had to do extensive validation of Siebel implementations. Still, Oracle's platforms are used in regulated environments (clinical, safety, etc.), so they can meet GxP standards. Oracle's newer cloud-based solutions continue this but rely on the customer to configure industry-specific compliance rules.

In summary, Veeva Vault CRM and IQVIA OCE stand out for delivering immediate compliance alignment (a reflection of their life sciences-only focus), whereas Salesforce and Oracle offer strong security/compliance foundations that require more customer configuration. Veeva's pre-configured compliance is a big selling point for pharma executives who want a faster path to validation (Salesforce Life Sciences Cloud vs. Veeva CRM [2024]) (Salesforce Life Sciences Cloud vs. Veeva CRM [2024]).

Integration Capabilities

In a pharma enterprise, a CRM must integrate with numerous systems – ERP for inventory, data warehouses for sales data, marketing automation platforms, medical information systems, etc. Here's how each solution handles integration:

Veeva Vault CRM: Veeva is built as part of an integrated life sciences ecosystem. Out-of-the-box, it connects seamlessly with other Veeva products – for instance, it integrates with Veeva Vault content management (for regulated content and digital asset management) and Veeva Align (for territory alignment data) (Salesforce Life Sciences Cloud vs. Veeva CRM [2024]). This provides a unified solution if a company invests in the Veeva suite (CRM, content, master data, etc.). Beyond the Veeva family, Vault CRM offers modern REST APIs and pre-built connectors for common integrations (e.g. syncing customer data with ERP or sending calls to a data warehouse). Because Vault CRM is a cloud service, integration often uses web services. Veeva also partners with middleware providers and has interfaces for marketing automation, sample distribution systems, and compliance databases. The focus is to minimize custom coding – much integration is configuration of Veeva's standard connectors or using its open APIs. Specialized data integration needs of pharma (like integrating prescription data or third-party HCP data) are addressed by products like Veeva Nitro (data science platform) and Veeva OpenData (HCP database). In short, Veeva offers built-in life sciences integration capabilities catering to pharma needs ([8]), which simplifies connecting to industry-specific sources. However, integration with non-Veeva systems can still require effort and often goes through Veeva's published APIs or cloud integration tools.

IQVIA OCE: IQVIA OCE benefits from both its Salesforce foundation and IQVIA's unique assets. Being on Salesforce, it can use standard Salesforce integration mechanisms (SOAP/REST APIs, MuleSoft if the customer has it, etc.), making it straightforward to connect with enterprise systems. Additionally, IQVIA has an edge for data integration: it can natively integrate IQVIA's vast healthcare data offerings. For example, IQVIA's OneKey (a global HCP/HCO master data service) can be integrated into OCE for up-to-date customer reference data, and IQVIA's prescription or sales data feeds can flow into OCE's analytics. OCE is pitched as connecting "all customer-facing functions" in one platform ([3]), implying it ties together data from sales, marketing, medical, etc. Many pharma companies integrate OCE with their data lakes and BI tools to leverage its collected customer interaction data. IQVIA likely provides pre-built connectors or templates for common integrations (such as linking OCE with Veeva Vault PromoMats for compliant content, or with SAP for sample inventory). Thanks to IQVIA's consulting heritage, they often assist in integration projects. In summary, OCE offers comprehensive integration – it's essentially a Salesforce CRM coupled with pharma-specific data pipes. It inherits Salesforce's openness and adds IQVIA-specific integration for analytics and data sources ([8]).

Salesforce Life Sciences Cloud: Salesforce's strength is integration, and Life Sciences Cloud is no exception. As part of the Salesforce Customer 360 platform, it "can be integrated seamlessly with other Salesforce solutions, including Marketing Cloud, Service Cloud, and Health Cloud" (Salesforce Life Sciences Cloud vs. Veeva CRM [2024]). This means a pharma company can unify CRM with marketing automation, call centers, patient support programs, etc., if they also use Salesforce products in those areas. Salesforce provides a rich set of APIs and integration tools (such as MuleSoft and a library of pre-built connectors) ([28]) ([28]). For example, integration with an ERP or data warehouse can be done via MuleSoft connectors or custom APIs, and health data integration can use HL7 or FHIR standards (Salesforce Health Cloud offers FHIR APIs for EHR data ([7])). Life Sciences Cloud, being new, likely builds on these existing capabilities rather than introducing new integration tech. The advantage is broad connectivity – Salesforce can connect to virtually any system (SAP, Oracle, in-house databases, etc.), and many third-party apps exist on the AppExchange marketplace for specific integrations. The platform's flexibility allows integration not just of data but also of processes (for example, orchestrating a process that spans CRM and an external system). One consideration is that while integration is powerful, it's up to the customer (or integration partners) to implement; Salesforce provides the tools and ecosystem, not always out-of-box solutions for pharma-specific systems. Nonetheless, Salesforce emphasizes Life Sciences Cloud as part of an "open ecosystem" that can connect to various business services and data providers ([29]), aligning with pharma companies' needs to plug CRM into a larger IT landscape.

Oracle Life Sciences CRM: Oracle's CRM is often part of a broader Oracle stack in large enterprises. Consequently, it offers strong integration options, especially for those using Oracle's ERP, finance, or supply chain systems. Oracle's integration capabilities are extensive but require configuration. Siebel CRM, for instance, has an Integration Objects framework and can use Oracle SOA Suite or middleware to connect with other systems. Oracle provides pre-built adaptors for some common tasks (e.g., Siebel to Oracle EBS order management for sample orders). Because Oracle CRM is not limited to pharma, it doesn't have as many pre-packaged pharma-specific connectors, but its versatility allows connecting to anything. Oracle's new Fusion Middleware and Integration Cloud services can be leveraged to connect the CRM with cloud applications and on-prem systems. In practice, many pharma companies historically integrated Siebel with data warehouses (for call data and sales metrics), with data feeds from IMS (now IQVIA) for market data, and with compliance systems. Those integrations were project-specific, often using ETL tools. Oracle's strength is that it can handle complex, custom integration scenarios – you can mold it to your processes ([8]) – but that also means more effort. Oracle's newer cloud CRM modules can use modern REST APIs and come with connectors for Oracle's own ecosystem (e.g., connecting Oracle Sales Cloud with Oracle Eloqua Marketing Cloud). If a life sciences firm has a heavy Oracle footprint (ERP, HR, etc.), Oracle's CRM can integrate very well into that environment.

Summary: Veeva and IQVIA focus on ready-to-use integrations for life sciences data and workflows, reducing the need for custom development when connecting industry-specific systems. Salesforce and Oracle boast very broad integration capability – virtually any system or standard can be connected – which is ideal for complex IT landscapes, though they rely more on the implementer to tailor those integrations. For a pharma executive, the choice may come down to whether they prefer a pre-tailored ecosystem (Veeva's "built-in" pharma integrations ([8])) or the flexibility of a general platform (Salesforce/Oracle) to integrate with everything. Integration with regulatory content repositories, HCP master data, and data warehouses are common must-haves and all these platforms support them, with different degrees of effort.

Scalability and Deployment Models

Global pharmaceutical companies often have thousands of users (sales reps, medical liaisons, marketeers) across continents. The CRM must scale to handle large volumes of data (millions of customer records, interactions) and possibly be deployed in various regions under different IT policies. Here we compare deployment models (cloud vs on-premises) and scalability:

Veeva Vault CRM: Veeva CRM has traditionally been a multi-tenant cloud (hosted on Salesforce). With Vault CRM, Veeva is moving to its own cloud infrastructure – but it remains a cloud SaaS offering only. Companies subscribe to the service, and Veeva hosts and manages it (including regular updates several times a year). On-premises deployment is not offered – Veeva is an "industry cloud" provider. This means lower IT overhead for customers (no servers to maintain, and Veeva handles scalability). Veeva's cloud is proven to scale to large user bases; many top-20 pharma run Veeva CRM globally. Veeva also provides separate data centers or instances for different regions to comply with data residency (for example, a EU instance for GDPR). The architecture is highly scalable – as evidenced by Veeva's ability to handle the entire global sales force of companies like Pfizer or Novartis. Vault CRM will similarly leverage a modern cloud-native architecture. The scalability extends to data: Veeva CRM can store huge interaction logs, and Vault as a content/data platform is built for enterprise volumes. Veeva's approach allows quick deployments (no lengthy installation, just configuration on the cloud) and easy scaling when a company expands or during peak usage (e.g., new product launch cycles). The trade-off of being cloud-only is that customers must be comfortable with SaaS and entrust their data to Veeva's cloud (which most in pharma now are, given Veeva's track record).

IQVIA OCE: OCE is also cloud-based, specifically it is "built and maintained on the latest Salesforce technology" ([3]). It runs as a managed package on Salesforce's multi-tenant cloud. Thus, like Veeva, it is SaaS with no on-prem option. IQVIA manages the OCE software layer, while Salesforce provides the core infrastructure. This model scales well because Salesforce's platform scalability is very high – it can handle tens of thousands of users and large data volumes (Salesforce routinely supports large enterprises). IQVIA OCE has been deployed in global contexts (for example, Sanofi is adopting OCE across Africa & Middle East per a 2023 press release ([30])). The Salesforce platform auto-scales behind the scenes, so customers don't need to worry about performance engineering – they just need sufficient user licenses and appropriate org limits. One consideration: since OCE and Veeva often serve similar-scale companies, their scalability is comparable. OCE benefits from Salesforce's continuous performance improvements and can leverage Salesforce's data centers around the world (with options for data residency as needed). Deployment is straightforward SaaS; IQVIA handles updates (often 3x a year or as Salesforce updates). There is no need (or ability) to host OCE on-prem. This aligns with most pharma IT strategies which have been shifting to cloud for CRM. IQVIA does offer surrounding tools (like OCE Optimizer) which are also cloud services that can be enabled as needed ([31]). The pure SaaS model means less flexibility in deployment model but quicker global rollout and easier maintenance.

Salesforce Life Sciences Cloud: This is inherently a cloud solution (SaaS) as well, since it's a Salesforce product. Salesforce long ago moved entirely away from on-premise (they have no on-prem version of their platform). Life Sciences Cloud will be available on Salesforce's multi-tenant cloud and likely also on Hyperforce (Salesforce's architecture that can run in public cloud regions for data residency). Scalability is a strong suit: Salesforce platform handles massive volumes and thousands of users – it's used across many industries with similar scale needs. Pharma companies considering Salesforce LSC can expect the same level of reliability and performance as with any Salesforce implementation. Deployment is SaaS, so initial setup involves configuring a Salesforce org with the Life Sciences Cloud package. Salesforce will handle the backend scaling (database clusters, etc.). One nuance: Life Sciences Cloud for Customer Engagement became generally available in October 2025, with sandboxes available from September 2025 for contracted customers ([32]). But from an IT perspective, it's just another Salesforce cloud offering, so it can be deployed globally with support for multiple regions. Companies that require data localization (say, hosting data in EU or in specific countries) can leverage Salesforce's ability to segment data by region (subject to Salesforce's roadmap and availability in those locales). Overall, Salesforce's deployment model is pure multi-tenant cloud, which brings ease of scaling but means companies cannot self-host or deeply control the environment. Given the non-compete with Veeva expired, Salesforce is likely to push Life Sciences Cloud to large enterprises, showcasing its scalability, and possibly offering dedicated support for big implementations.

Oracle Life Sciences CRM: Oracle stands out as the one option that historically supported on-premises deployment. Oracle's Siebel CRM, which was widely used by pharma in the past, is a traditional on-prem software (with a client-server architecture). Many large pharmas in the 2000s and early 2010s ran Siebel in their own data centers. This gave them complete control over environments and upgrades (some still run heavily customized old versions). With on-prem, however, the burden of scalability fell on the company's IT – ensuring servers, databases, and network could handle the load. Siebel can scale to thousands of users (it did so for Pfizer, Merck, etc. in its heyday), but it requires robust infrastructure and tuning (e.g., load-balanced Siebel servers, replication on the Oracle DB). Oracle continues to support Siebel and has modernized it (Open UI, etc.), and some companies may still prefer to keep an on-prem Siebel for certain markets or due to data control needs. Additionally, Oracle now offers Oracle Fusion CX Sales (their cloud CRM) which is SaaS. That cloud is scalable and managed by Oracle, similar to Salesforce's model. But Oracle's cloud CRM for sales is not uniquely pharma-specific; it's a general CRM that could be configured for pharma. So if considering Oracle's CRM, an executive might choose between the legacy Siebel on-prem (or hosted privately) versus Oracle's cloud CX. The hybrid deployment is also possible – e.g., run Siebel on Oracle Cloud Infrastructure (OCI) for a private cloud feel. In terms of global deployment, Oracle has a presence of support and data centers worldwide for its cloud, and Siebel on-prem can be deployed per region if needed (with separate instances per geography to meet local requirements). Oracle's model thus offers the most deployment flexibility (on-prem, private cloud, or Oracle's cloud), but the pure on-prem path is increasingly viewed as legacy except for those with specific reasons (customization or regulatory conservatism). Scalability is proven but will depend on the approach: the SaaS version (Oracle CX) scales like any cloud app (Oracle would ensure performance), whereas Siebel's scalability is in the user's hands and has higher overhead to maintain.

In summary, Veeva, IQVIA OCE, and Salesforce Life Sciences Cloud are all multi-tenant SaaS solutions, meaning faster deployments and vendor-managed scaling – a model the industry has largely embraced for CRM. Oracle's offering is the only one with an on-premises option, which could appeal in scenarios where a company cannot use cloud or wants total control (though this is rarer nowadays). From a scalability standpoint, all solutions can handle large pharma deployments; the difference lies in who manages that scaling (the vendor in cloud models vs the customer in Oracle's on-prem model). Most new CRM deployments in pharma are cloud-first, which gives Veeva, IQVIA, and Salesforce an edge for modern IT strategies, while Oracle remains relevant for those with legacy systems or specific deployment constraints.

Analytics and Reporting Features

Modern CRMs do more than record interactions – they generate insights. Pharma companies crave real-time visibility into field activities, as well as predictive analytics (e.g., which doctor to target next, which channel is most effective). Here's how each solution addresses analytics and AI:

Veeva Vault CRM: Veeva has traditionally offered strong operational reporting tailored to pharma. Out-of-the-box reports cover territory coverage, call activity, sample distributions, etc., aligned to pharma KPIs. Veeva CRM includes tools like MyInsights, which allow interactive dashboards embedded in the CRM for things like sales figures or call plan adherence. Veeva also launched Veeva Nitro, a cloud data warehouse optimized for life sciences, which can integrate data from Veeva CRM and other sources to provide advanced analytics ([33]).

In December 2025, Veeva released its first suite of Veeva AI Agents for Vault CRM and PromoMats, marking a significant advancement in industry-specific AI capabilities ([34]). The available Vault CRM agents include:

- Voice Agent – enables voice input for Vault CRM, making it faster and easier for field teams to capture information and follow-up actions

- Pre-call Agent – provides insights and suggested actions from relevant data, content, activity, and trends to help field reps prepare for calls

- Free Text Agent – scans and analyzes unstructured notes for compliance and actionable insights

Veeva AI Agents use large language models (LLMs) from Anthropic and Amazon, hosted on Amazon Bedrock, and operate within established user access controls, permissions, and audit trails. Additional agents for Safety & Quality are planned for April 2026, Clinical, Regulatory & Medical for August 2026, and Clinical Data for December 2026. Veeva positions Vault CRM as the "fastest path to AI" for life sciences, emphasizing deep, industry-specific intelligence rather than generic AI. In summary, Veeva's reporting is robust and tailored, and its analytics have now achieved AI maturity with agentic capabilities purpose-built for pharma workflows ([35]).

IQVIA OCE: Analytics is a centerpiece of IQVIA's OCE value proposition. Branded as being powered by IQVIA Connected Intelligence, OCE embeds AI/ML into the rep's workflow ([3]). Concretely, OCE has an "Insights" module that analyzes data from multiple sources (sales, prescription, engagement) to deliver next-best actions and personalize suggestions for each HCP ([11]). The platform offers real-time dashboards for reps and managers – for instance, a rep can see a consolidated view of all interactions with a doctor across channels and any alerts or suggestions on how to improve engagement. OCE's AI might recommend the next customer to target or which content to send, and these recommendations update as new data comes in ([36]). This is the "closed-loop learning" IQVIA describes – performance data feeds back to refine the algorithm continuously ([37]). IQVIA, coming from a data analytics background, has an edge in providing predictive models (they likely use their historical healthcare data to train models for customer segmentation, churn risk, etc.). For reporting, OCE includes standard CRM reports (calls, meetings, etc.) plus unique insights like HCP preference profiles and multichannel engagement metrics ([38]). A key strength is integrating external data (like market sales data or formulary data) into the CRM analytics, since IQVIA can supply those datasets. In terms of AI vs human effort, OCE attempts to automate what was traditionally field planning by managers – the system itself can suggest where reps should focus. Overall, IQVIA OCE delivers advanced analytics with embedded AI-driven recommendations to optimize sales and marketing execution ([3]). It enables a shift from retrospective reporting to forward-looking orchestration (hence "Orchestrated" Customer Engagement). Many see OCE as a response to Veeva's dominance by leveraging IQVIA's data science capabilities for competitive advantage in insights.

Salesforce Life Sciences Cloud: With Life Sciences Cloud generally available since October 2025, Salesforce has rebranded it as Agentforce Life Sciences, emphasizing its pivot from CRM to an AI-powered platform that links patient, medical, and HCP engagement ([39]). The platform leverages Salesforce's powerful Einstein AI and analytics capabilities, with life sciences-specific AI agents designed for clinical, medical, and commercial engagement at scale.

The 2026 roadmap includes significant enhancements:

- February 2026: Stories (bite-sized audio recaps of weekly account activity), Voice-Based Reports (speech-to-structured-data), and Medical Insights & Alerts

- June 2026: Account Plan Workspace and Guardrails in Inquiry Capture (auto-routing adverse events to Safety)

- October 2026: Field Coaching templates, Medical Ops Intelligence, Order Management for pharmacy sales, and Events Management

Additionally, ZS and Salesforce announced a ZAIDYN integration available January 2026 to help life sciences teams improve sales and marketing performance through smarter omnichannel orchestration. The platform can incorporate external data via Data Cloud (formerly Customer Data Platform), enabling comprehensive analytics across clinical trials, medical inquiries, and commercial interactions. To sum up, Salesforce offers very strong AI and analytics capabilities with rapidly maturing life sciences specificity, promising insights to "understand patient needs, forecast demand, and optimize operations" (Salesforce Life Sciences Cloud vs. Veeva CRM [2024]). In May 2025, Salesforce announced a Life Sciences Partner Network to accelerate customer migration, and Takeda selected Salesforce Life Sciences Cloud for customer engagement, signaling enterprise-level validation.

Oracle Life Sciences CRM: Oracle's analytics for CRM have historically been provided via Oracle Business Intelligence tools. Siebel CRM could integrate with Oracle BI Applications which had pre-built analytics for sales, including some pharma-specific modules (like sample inventory analysis, call effectiveness). Oracle's strength is in data handling and back-end analytics, so for a company that likes to build its own data warehouse, Oracle provides the flexibility to extract CRM data and crunch it. However, Oracle's CRM itself (Siebel) did not have AI-driven recommendations built-in in the classic versions. It relied on users running reports or managers analyzing dashboards. Oracle has been adding AI to its cloud products – e.g., Oracle Adaptive Intelligence could provide lead scoring or next best offers, but those are more B2B sales oriented. It's possible Oracle's current CX Sales cloud can use Oracle's AI suite to do things like suggest next best actions or automate some tasks, but it's not specifically targeted to pharma out-of-box. One notable piece in the old Siebel Pharma was Closed-Loop Marketing (CLM) analytics: marketing could design campaigns and track feedback from sales calls (e.g., which detail slide a doctor reacted to) and that feedback loop was analyzed for message effectiveness ([4]) ([40]). Siebel's CLM allowed capturing physicians' responses (like quick surveys or interests) and those data could be reported to refine marketing strategy – an early form of closed-loop analytics. Oracle can claim that through its database and analytics products, any kind of analysis is possible (especially for IT teams that want to do custom data lakes). But compared to Veeva, IQVIA, and Salesforce, Oracle's solution might require more custom work to achieve real-time, AI-driven insights. Oracle does have an analytics edge in other areas of life sciences (for instance, in clinical data or safety signal detection), and some of that tech could be applied, but the CRM domain seems less a focus for Oracle's AI presently. Therefore, Oracle's analytics are robust on fundamentals (reporting, data integration), and companies can definitely implement advanced analytics with Oracle tools, but it lacks the pre-packaged AI/insight features that the others are delivering specifically for commercial teams.

Comparison (Updated January 2026): The AI landscape in pharma CRM has fundamentally shifted. All three major platforms now offer agentic AI capabilities: Veeva released its AI Agents in December 2025, Salesforce has rebranded as Agentforce Life Sciences with AI-native functionality, and IQVIA OCE continues to leverage Connected Intelligence with next-best-action recommendations. Veeva and IQVIA both emphasize actionable insights specific to life sciences, while Salesforce offers the most sophisticated general AI platform now being purpose-built for pharma. Oracle provides the building blocks for analytics and can scale to enterprise reporting needs, but continues to rely on the customer to craft AI solutions. All solutions support basic reporting like call reports, territory dashboards, etc., and all three leading platforms (Veeva, IQVIA, Salesforce) now deliver next-best-action and predictive models natively—a significant convergence in capabilities since 2025.

Omnichannel Customer Engagement

Pharma engagement has shifted from solely rep-driven face-to-face visits to an omnichannel model: reps now interact via email, remote video calls, webinars, and coordinate with digital marketing campaigns. Let's see how each CRM supports omnichannel engagement:

Veeva Vault CRM: Veeva has long led in enabling multichannel (omnichannel) engagement for pharma. Veeva CRM includes several integrated channel modules: Approved Email (for compliant rep-sent emails with tracking), CLM (Closed Loop Marketing for in-person e-detailing on tablets), Veeva Engage (for remote detailing via video conferencing with built-in content sharing), and Events Management (to manage speaker events and conferences) ([12]). All these are part of Veeva's CRM suite and work together. For example, a sales rep can detail a doctor using the iPad app (showing approved slides) and capture feedback, then follow up with an Approved Email that's automatically logged in CRM, and invite the doctor to a webcast via Veeva Engage, all recorded under the same customer timeline. Veeva ensures that content used across channels is compliant (often leveraging Vault PromoMats for storing approved content). This tight integration of channels makes Veeva very powerful for orchestrating interactions: a rep can see in one place all emails the doctor opened, what was presented in person, attendance at events, etc. Veeva CRM was designed to "facilitate interactions across various channels such as face-to-face, email, and online platforms", allowing field reps to deliver a personalized but consistent experience (Salesforce Life Sciences Cloud vs. Veeva CRM [2024]). Moreover, Veeva's tools allow centrally managing the message – marketing can push content to the CLM library for reps to use, and compliance can pre-approve email templates, maintaining control over omnichannel communication. The result is a true omnichannel capability: reps become one part of a larger coordinated customer journey that includes digital touches. Vault CRM will continue this legacy, likely with even more channel integrations (perhaps social media listening or chatbots in the future). Omnichannel is a core strength of Veeva, as it was among the first to offer an all-in-one solution for pharma sales and marketing teams to engage HCPs across multiple touchpoints while staying compliant.

IQVIA OCE: As the name "Orchestrated Customer Engagement" suggests, IQVIA's solution is built around the idea of coordinating multiple channels and functions to engage customers. OCE integrates functionalities for sales, medical liaisons, key account management, etc., in one platform ([41]). It "integrates all touchpoints across customer-facing roles" and includes CRM plus CLM in one mobile app ([16]). This means a user of OCE Personal can do what they would in Veeva: present content, send emails, schedule meetings, all from one system. IQVIA highlights that OCE enables companies to manage an "increasingly complex mix of direct and indirect communication channels" and deliver a consistent, targeted experience ([13]). Concretely, OCE likely has features for email (possibly using Salesforce Marketing Cloud integration or their own module), remote engagement (some OCE users mention an "OCE Remote" for virtual meetings), and field activity. Since it's on Salesforce, it can leverage things like Salesforce Communities or Experience Cloud for HCP portals if needed. IQVIA's differentiator might be how it "orchestrates" across teams – for example, a medical science liaison (MSL) and a sales rep can both see all interactions with an HCP and coordinate their outreach. The omnichannel strategy with OCE is not just multi-channel, but ensuring each channel's use is informed by data (remember the AI recommendations about content). The press release quote from Sanofi's executive underscores using OCE to "accelerate our omnichannel strategy to interact with our customers and healthcare partners", across retail and other channels ([42]). So IQVIA OCE provides capabilities for digital marketing integration as well – possibly connecting to campaign management tools to tie rep activities with broader digital campaigns. Overall, OCE's omnichannel support is comprehensive, covering face-to-face calls, emails, virtual meetings, and coordinated digital campaigns, all under a single orchestrated plan. It aims to break silos between channels so that, for instance, if an HCP prefers digital updates vs in-person, the CRM strategy can adapt accordingly.

Salesforce Life Sciences Cloud: Salesforce's approach to omnichannel is through its Customer 360 platform. Life Sciences Cloud itself focuses on CRM (sales/engagement) and presumably includes some basic channel features (like call documentation, maybe email logging via Salesforce Inbox). For full omnichannel, it relies on integrating with other Salesforce products: Marketing Cloud/Pardot for mass email and automated campaigns, Interaction Studio (Salesforce's personalization engine) for tracking digital behavior, and even Service Cloud if patient or HCP inquiries need to be handled. In the context of pharma, Salesforce can enable an omnichannel experience by connecting these pieces: e.g., a rep's activities in Life Sciences Cloud could trigger a marketing journey in Marketing Cloud (say, after a call, the HCP gets a follow-up email campaign). Conversely, if an HCP interacts with a marketing email or a website, that data can feed into Life Sciences Cloud to inform the rep (via Salesforce's unified data profile). Essentially, Salesforce provides the infrastructure for omnichannel – email, web, social, call center, etc. – but a lot depends on configuring the system and using multiple cloud products together. On its own, Life Sciences Cloud will likely include basics like recording emails sent and scheduling meetings, but to match Veeva or OCE's integrated feel, a Salesforce-based organization would likely utilize Marketing Cloud for approved emails (with appropriate consent capture for HCPs) and maybe integrate with webinar platforms for remote meetings. The advantage Salesforce has is any new channel (e.g., SMS, chat) can be plugged in through its app ecosystem. They tout the "open ecosystem" and connectors ([29]), so companies can use best-of-breed solutions for each channel with Salesforce as the hub. Also, Salesforce has a strong concept of customer journey mapping – they acquired Evergage (Interaction Studio) to personalize across channels. For pharma, this could translate to tailoring content and channel per HCP preference automatically. In summary, Salesforce can achieve omnichannel engagement, but it's more of a build-your-own approach compared to the pre-integrated channel suite of Veeva. As Life Sciences Cloud matures, Salesforce might create more pre-packaged omnichannel capabilities specifically for pharma (they mention Events and other modules in their roadmap ([43])).

Oracle Life Sciences CRM: Oracle's CRM solutions for pharma addressed multichannel engagement primarily through the Closed-Loop Marketing (CLM) module in Siebel. As described in Oracle's materials, Siebel's CLM allowed "Personalized, multi-channel communications and continuous feedback" to improve customer interactions ([4]). This included delivering messages via different channels (sales calls, emails, maybe later SMS) and capturing feedback. Siebel had a concept of marketing campaigns and segmentation that could be executed through various channels, and reps could use digital content during calls (Siebel did have an e-detailing capability). For example, Siebel could be used to send approved emails too, though historically many companies integrated Siebel with third-party email tools. Oracle also had an add-on called Oracle Real-Time Scheduler that some used for scheduling rep visits and online meetings. In recent times, Oracle's marketing cloud (Eloqua) is a separate product that could integrate with Oracle Sales Cloud to provide automated digital engagement. So Oracle's omnichannel story is somewhat fragmented: the pieces exist, but not as seamlessly unified as Veeva's. An Oracle CRM user might use Siebel/Oracle CX for the sales rep piece and use Oracle Eloqua or third-party tools for digital channels, connecting them via Oracle's integration services. That said, Siebel's CLM was quite advanced in its day – it allowed aligning communications and processes across multiple channels by ensuring consistent messaging and gathering customer feedback from each interaction ([44]) ([45]). It was essentially an on-premise precursor to what Veeva and Salesforce do in the cloud now. Companies that still use Siebel likely customized it to handle email (with audit trails) and maybe integrate with their event management systems. Oracle's focus on "Personalized content delivery" and "continuous feedback" ([23]) shows they understand omnichannel conceptually, but executing that with their tools may require significant integration. Oracle's current CX suite might allow a more cloud-based omnichannel approach (similar to Salesforce's style, using Oracle Marketing, Oracle Service, etc.), but it's not clear if Oracle offers a pharma-specific package that ties it all neatly. Therefore, Oracle can support omnichannel but not as an out-of-the-box unified solution – it's more an a la carte combination of Oracle products to cover each channel, or relying on the older Siebel CLM functionalities with custom enhancements.

Omnichannel Summary: Veeva and IQVIA OCE provide ready-to-use omnichannel capabilities purpose-built for pharma reps and MSLs, meaning a rep can do everything (call, email, remote detail, event follow-up) from one platform (Salesforce Life Sciences Cloud vs. Veeva CRM [2024]) ([14]). Salesforce and Oracle, being broader platforms, certainly enable an omnichannel strategy but often by integrating multiple modules or external systems. Veeva's unified approach ensures ease of use and compliance (since all channels are tracked in one system and content is controlled), which is a reason it became so popular in the industry when multichannel marketing took off. IQVIA's OCE matches that and adds orchestrated planning so that each channel is used optimally per customer. Salesforce offers immense flexibility (any channel, any new innovation can be connected), which might appeal to companies with complex needs or those who want a holistic customer engagement spanning beyond HCPs to patients or payers. Oracle's solution is more old-school but proven in traditional rep-driven models and can be extended to digital with effort. For an IT/business executive, if omnichannel excellence with minimal integration is a priority, Veeva or OCE have an edge due to their purpose-built nature. If the company has an existing marketing cloud or other channels they want to leverage tightly, Salesforce might provide a more unified platform (especially if they already use Salesforce for other aspects of the business).

Mobile Access and Offline Functionality

Field sales representatives and medical liaisons often work on the go – in clinics, hospitals, rural areas – where connectivity can be unreliable. Therefore, strong mobile support and the ability to work offline (and sync later) is a crucial factor in pharma CRM. Here's how the competitors compare:

Veeva Vault CRM: Veeva is known for its excellent mobile app with full offline capabilities. Veeva CRM (on Salesforce) pioneered the use of iPads among pharma reps about a decade ago. The Veeva CRM mobile app (initially "Veeva iRep" on iPad) was game-changing: it allowed reps to carry all their product presentations, customer data, and planning tools on a tablet that worked even with no internet. Vault CRM continues that mobile-first philosophy. Veeva's mobile app offers a rich user experience including interactive CLM (content), call scheduling, note entry, and sample recording. All of this works offline and then synchronizes seamlessly when the device goes online ([15]). In practice, a rep can enter a day's worth of calls in a remote area and once they connect to Wi-Fi in the evening, the app will sync all new data to the cloud and fetch any updates. This reliability is critical and Veeva has refined it to be fast and stable (they understand a lost day of data entry is not acceptable). Veeva also supports offline signatures (e-sign capture on the device for sample sign-off) that comply with Part 11. On mobile platforms, Veeva historically supported iOS primarily (as iPad was the pharma standard device), and also Windows for laptop users. Vault CRM likely continues with iOS and possibly web responsive access. The key is full functionality offline – Veeva explicitly advertises that "data, configuration, and content are seamlessly synchronized across mobile devices," giving field teams instant access online and offline ([15]). So even complex things like a library of large detail aids (videos, etc.) are stored on the device for offline use. Veeva's focus on mobile has made the rep's life easier and is a strongpoint that competitors had to match.

IQVIA OCE: IQVIA understood it needed to meet or exceed Veeva's mobile/offline capabilities to compete. OCE Personal is designed with a mobile-first approach as well. IQVIA provides a unified mobile app (tablet-focused) that includes CRM and CLM features together ([16]). They tout "unmatched mobile access," highlighting that the app is comprehensive and user-friendly for field teams ([16]). It supports offline use extensively – since it's built on Salesforce, it likely uses a combination of Salesforce Mobile capabilities and custom offline logic to allow working without signal. Users can plan their calls, view HCP profiles, present content, and enter notes offline. All data will sync back when connectivity returns. IQVIA OCE's mobile app also spans roles (a sales rep or an MSL uses the same app with relevant functionalities), which is convenient if roles overlap. Field feedback on OCE indicates it has a modern interface and is quite intuitive. The sync performance and reliability would be critical – IQVIA claims it's robust, and being relatively newer, they might have optimized the data sync tech (potentially learning from any shortcomings of early Veeva versions). Additionally, because IQVIA OCE is Salesforce-based, it can run on multiple operating systems (Salesforce's platform allows tablet apps on iOS, Android via containers, etc., though iOS is still standard in pharma). A unique angle is IQVIA's mention of capabilities like AI on the device – for example, voice input or on-demand insights while mobile. Overall, OCE provides first-class mobile and offline support – a necessary feature to be viable in this market. There is essentially feature parity between OCE and Veeva in this regard; both let a rep function fully while offline. The mention of "advanced embedded intelligence" on mobile ([16]) suggests reps might even get AI recommendations on their tablet in real-time, which is powerful in the field.

Salesforce Life Sciences Cloud: With Life Sciences Cloud now generally available (October 2025), Salesforce has addressed mobile capabilities through enhanced offline functionality specifically designed for field teams. The Salesforce mobile app supports iOS and Android natively, with improved offline caching for CRM data. Recognizing that existing Veeva users are accustomed to top-notch iPad apps, Salesforce invested in matching mobile/offline capabilities before GA. Mobile access via Salesforce is strong in online mode, with dashboards, call logging, and rich media support. The Salesforce mobile platform can accommodate content presentations, though Veeva's specialized media handling may still be more refined for large detail aids. For offline, Life Sciences Cloud now allows creating records offline, viewing recently accessed records, and caching key data for field use. Salesforce's approach leverages its Mobile SDK with enhanced offline capabilities for the life sciences package. While Salesforce has narrowed the gap significantly, industry observers note that Veeva and IQVIA remain slightly ahead in offline capability due to their longer optimization for pharma field workflows. However, Salesforce Life Sciences Cloud now offers competitive mobile and offline functionality, including call recording, content access, and sample management capabilities that enable field teams to work effectively in low-connectivity environments.

Oracle Life Sciences CRM: In the Siebel days, mobile/offline was a challenge. Siebel's main "mobile" solution was a laptop client (Siebel Remote) that would sync via file exchanges – it was complex but it worked for offline access, although sync could be slow. Siebel later developed mobile apps (Siebel Mobile) and a tablet UI, but these still typically required connectivity or used local browser storage in a limited way. In short, Siebel never reached the ease of use of Veeva's iPad app for offline. Oracle's newer CX Sales cloud has a mobile app which is cloud-only (so offline might be minimal caching, similar to Salesforce's standard offering). Oracle likely expects that pharma companies preferring Oracle would perhaps not be as demanding on the mobile front, or they might have smaller field forces or Wi-Fi in clinics (which is not always true). If an organization was on Siebel and needed offline badly, they often ended up implementing Siebel Remote for laptops or just accepted that reps might have to tether to get data. Comparatively, this is a weak area for Oracle relative to the specialized competitors. Oracle could try to fill this gap by, say, offering an iPad app for its CRM with offline access to key objects, but as of now, Oracle's focus in mobile has been more on online usage. Thus, in mobile/offline, Oracle lags – a consideration for companies with primarily field-based users. If a pharma company is still on Siebel, one of the major drivers to move to Veeva in the past was indeed the superior mobile experience.

Mobile/Offline Summary (Updated January 2026): Veeva Vault CRM and IQVIA OCE both excel in mobile and offline functionality, providing rich native apps that allow reps to do everything without a network connection and then sync later ([15]) ([16]). This is critical for user adoption in the field. Salesforce Life Sciences Cloud has now achieved competitive mobile/offline parity since its October 2025 GA, having invested significantly in offline capabilities to compete with Veeva and IQVIA. Oracle's solution offers mobile access but not the same degree of offline ease, which might be acceptable in some scenarios but is a disadvantage in classic pharma sales models. An executive evaluating these tools should consider the day-in-the-life of a rep: Veeva and OCE let the rep focus on their interactions without worrying about connectivity or manually syncing – it "just works." Salesforce has now reached near-parity with enhanced offline capabilities. Oracle might require a more network-connected usage or old-school sync methods. The user experience on mobile is a major factor for field productivity, and all three leading platforms now meet the bar set by specialist vendors.

Customization and Configurability

Every pharmaceutical company has its own business processes, terminology, and strategic nuances. CRM systems must be adaptable to these unique needs. However, there is a balance between out-of-the-box best practices and flexibility for customization. Here's how each platform handles customization and configuration:

Veeva Vault CRM: Veeva's philosophy is to provide a pre-configured, industry-standard CRM so that extensive customization is rarely needed. Veeva CRM comes with a data model and workflows reflecting common pharma processes (accounts = HCPs/HCOs, contacts, calls with signature capture, sample inventories, etc.). Administrators can configure many elements: add custom fields, tweak page layouts, create custom reports, define call cycle plans, etc. Veeva also allows some business rules configuration (like allowed sample limits, or custom validations on data entry). But when it comes to deep customization – such as adding entirely new modules or writing custom code – Veeva is more restrictive. On the Salesforce platform, Veeva did allow some custom development (customers could write limited Apex code or use the Salesforce platform capabilities), but the core managed package was locked down to preserve upgradeability. With Vault CRM, Veeva likely continues this approach: it's a structured architecture with limited customization to ensure smooth upgrades (since Veeva pushes updates to all customers simultaneously). This means if a company has a very unique requirement outside of what Veeva supports, they might have to adjust their process to Veeva's design or use Veeva's defined extension mechanisms. For example, if a company wanted a completely different customer hierarchy or a non-standard workflow for something, Veeva might not support that if it deviates greatly from industry norms. The benefit is faster implementation – you're using best practices that Veeva has seen across many clients. The downside is less flexibility for edge cases. The consensus is that Veeva is "more standardized...easier to implement but less flexible for specialized needs outside of built-in capabilities" (Salesforce Life Sciences Cloud vs. Veeva CRM [2024]). It's essentially a trade-off: Veeva decided that consistency and compliance are more important than unlimited customization. That said, Veeva has over the years expanded configuration options when enough customers demanded them (for instance, adding fields or new minor functionalities). And integration can sometimes fill gaps (if Veeva itself doesn't do X, perhaps integrate another system that does, while Veeva handles core CRM). In summary, Veeva prioritizes configuration over customization – enabling customers to tailor within a framework, but not break the mold. This results in faster deployment times and easier maintenance, which many pharma IT departments appreciate, especially after having experienced the heavy lifting of Siebel in the past.

IQVIA OCE: OCE, being built on Salesforce, inherently can leverage Salesforce's customization capabilities. However, as a managed solution by IQVIA, it likely has some constraints similar to Veeva. IQVIA delivers OCE with pre-built objects for calls, meetings, etc., and provides an admin interface for configurations (business rules, territory assignments via OCE Optimizer, etc.). Customers can probably add custom fields and maybe small custom processes. If OCE is delivered as a managed package, the core code is not editable by the client, but they might be able to build custom logic around it (e.g., custom Lightning components or use Salesforce Flow to automate something). IQVIA might be a bit more open to letting customers extend because they can point to Salesforce's flexibility, but they also must ensure OCE's upgradability. So it's likely a middle ground: extensible but not freely hackable. One difference from Veeva is IQVIA does not have the same degree of contractual restriction on using Salesforce capabilities (whereas Veeva historically limited direct Salesforce admin changes). So a client with OCE could potentially utilize Salesforce's own tools (like Apex programming or custom objects) in their org if needed. But doing too much custom work might complicate OCE upgrades and support. IQVIA's messaging suggests OCE can cater to each commercial team's needs with tailored configurations ([46]). We also know IQVIA is open to building bespoke solutions or enhancements for big clients as a service engagement. In practice, OCE offers a high level of configuration (via built-in settings and Salesforce admin tools) and moderate customization – enough for most pharma use cases, but maybe not total freedom if it undermines the product's integrity. Since IQVIA's competitor is Veeva, they might try to be more flexible as a selling point. For example, some users have noted Veeva can be inflexible unless it's explicitly designed to do something, whereas with OCE (and Salesforce's openness) you have more ways to achieve a requirement. It's fair to say OCE is "highly flexible with seamless integration across Salesforce solutions" ([17]) (taking advantage of the platform's strength), but core OCE components remain standardized.

Salesforce Life Sciences Cloud: Since this is essentially a Salesforce product, it likely offers the highest degree of customization of all the options. Salesforce's CRM platform is known for allowing extensive customization: administrators and developers can create custom objects (new data entities), fields, validation rules, automate processes with workflows or the more advanced Flow engine, build custom user interfaces with Lightning Components, and even write Apex code for complex logic. All this is available in Life Sciences Cloud because underneath it's Salesforce. The product will come with a data model and templates for life sciences, but customers are free to extend it. For instance, if a pharma company wants to add a module to track scientific research collaborations or a custom process for sampling, they can build that on the platform. Salesforce would support that flexibility as long as it doesn't violate multi-tenant resource limits. The Life Sciences Cloud is described as "highly flexible, allowing companies to configure the platform to suit various business requirements... Custom workflows, automation, and data models can be tailored to meet unique needs." (Salesforce Life Sciences Cloud vs. Veeva CRM [2024]). This is a key selling point for Salesforce – you're not constrained by what the vendor thinks a pharma company needs; you can innovate on the platform. Of course, with great power comes the need for governance: too much customization can make the system complex and harder to upgrade (though Salesforce provides robust backward compatibility, you still test everything with new releases). Compared to Veeva, Salesforce's direct offering means you're dealing with a more generic but flexible toolkit. For organizations that felt stymied by Veeva's "one-size-fits-all" approach, Salesforce LSC could be attractive because you can mold it exactly to your processes, or even use it to manage processes beyond commercial (like incorporating clinical or patient data if desired). In short, Salesforce LSC is the most customizable and extensible, as it benefits from the full Salesforce Platform's capabilities, and it encourages using that to create a unified solution for the company's needs.

Oracle Life Sciences CRM: Oracle's Siebel was historically the poster child for heavy customization. Companies often spent months or years customizing Siebel Pharma to fit their exact operating model – adding custom screens, altering how samples are tracked, integrating custom approval workflows, etc. Siebel provided a development environment (Siebel Tools) where you could virtually change anything: object definitions, UI layouts, business logic scripts. This was powerful: e.g., a company could implement complex algorithms for call planning right into Siebel, or create a unique form for reps to fill out specific survey data. The downside was the cost and complexity – each customization had to be maintained and re-validated with upgrades. Many pharma companies ended up with highly tailored Siebel systems that were hard to upgrade (some skipped upgrades entirely for long periods, leading to very outdated instances). This pain was a catalyst for switching to Veeva for some. With Oracle's modern cloud CX, the approach is more configuration-first (similar to others), but Oracle still allows significant flexibility. Oracle Sales Cloud can be extended with custom objects and logic, and if on-prem (Siebel), you still have total control if you wish. Therefore, Oracle offers the maximum freedom to customize – especially if using Siebel on-prem, you can do virtually anything at the cost of complexity ([18]). If using Oracle's cloud, it's somewhat less (because Oracle won't let you break the cloud multi-tenant model, though Oracle's cloud is more single-tenant per client in some cases, allowing deeper changes). One can say Oracle is "highly customizable, suitable for a wide range of industries", which implies it's not pre-tailored but you can tailor it fully ([47]). This is good for unique needs, e.g., if a company has an unconventional business model or wants to incorporate other business lines into one CRM system, Oracle's toolkit can handle it. The caution is that heavy customization might reintroduce the issues of old: long implementation timelines and challenging upgrades. Oracle tries to mitigate that with newer technology (like metadata-driven config in Oracle Fusion apps), but it's still more open-ended than Veeva or OCE.

Customization Summary: There is a clear spectrum: Salesforce (Life Sciences Cloud) and Oracle are on the far end of flexibility, enabling extensive customization to meet any requirement ([18]). Veeva is on the opposite end, offering a controlled, standardized solution with faster time-to-value but less room for deviation ([17]). IQVIA OCE lies somewhere in between, benefiting from Salesforce's inherent flexibility but still being a guided solution. The decision for an executive might hinge on the company's strategy: If you want a CRM that "just works" with industry best practices and you prefer not to reinvent the wheel, Veeva (or OCE) gives you that out-of-box process consistency. If your company prides itself on unique processes or wants one platform to handle many functions (beyond what Veeva/OCE supports), Salesforce or Oracle might be more appealing due to their configurability and extensibility. Another consideration is internal IT capacity: customizing requires skilled developers and clear vision, whereas a product like Veeva requires more admin/config skills but not heavy coding. Many pharma companies in recent years have been happy to go with the "config over code" approach of Veeva to avoid the Siebel-like scenarios. However, with digital transformation, some now desire more flexibility to integrate patient data, digital engagement, etc., which is where a more open platform can help. Ultimately, this criterion is about balancing innovation vs. standardization – each company must decide how much they value a tailor-made system versus a proven template.

Global Support and Localization

Pharmaceutical companies operate globally, meaning their CRM must support users in different countries, languages, and comply with local regulations and business practices. Additionally, vendor support and partner ecosystems are crucial for successful deployments worldwide.

Veeva Vault CRM: Veeva, from its inception, has been focused solely on life sciences and has deployed CRM solutions in just about every major (and many minor) pharma market in the world. The CRM is inherently multi-language – Veeva provides translations and locale support for dozens of languages so that, for example, a sales rep in Japan and one in Germany can each use the system in their local language. Beyond language, Veeva builds in region-specific capabilities. For instance, certain countries have unique requirements (like Japan's joint work call rules, or Brazil's sample lot tracking regulations, or China's data privacy laws) – Veeva often has features or settings to accommodate these. Veeva Vault CRM "supports all critical region-specific capabilities and regulatory needs – from Brazil to Japan, Germany and beyond" ([20]). This indicates that Veeva actively updates the product to reflect changes like European transparency reporting or Middle East specific compliance codes. In terms of global support, Veeva has a worldwide presence but notably uses a partner model for a lot of implementation. They have Veeva offices and support teams in North America, Europe, and Asia-Pacific, and an extensive certified partner network (global SIs like Accenture, Deloitte, IBM, as well as specialized consulting firms). Clients often work with these partners for local rollouts, with Veeva backing them. Veeva also offers 24/7 support (with follow-the-sun support centers) and user communities. As a trusted partner to the industry, Veeva has gained a reputation for understanding pharma business globally. The company's decision to be a Public Benefit Corporation and its exclusive focus on life sciences reassure customers that Veeva will prioritize their needs. So for an executive, choosing Veeva means you are getting a vendor that speaks the pharma language in every region – you likely won't have to explain why certain compliance matters exist in certain countries; they already know. Moreover, Veeva's multi-tenant model ensures every customer worldwide is on a consistent version, simplifying global governance (no country left behind on an old version, etc.). Localization in Veeva CRM covers UI translation, localized date/currency formats, and importantly, alignment with local pharma codes (like Europe's EFPIA disclosure requirements or sample limits per country). All told, Veeva is very strong in global capabilities – which is why nearly all top 20 pharmas standardized on Veeva CRM globally in the 2010s.

IQVIA OCE: IQVIA is a global company (with presence in 100+ countries and tens of thousands of employees) ([21]), and OCE is positioned as a global solution as well. OCE being on Salesforce means it inherits Salesforce's robust multi-language support (Salesforce supports many languages and locale settings). IQVIA likely provides the OCE-specific translations for any custom components. IQVIA's long history (as IMS Health) in providing services to pharma worldwide means they are well-versed in local pharma market nuances. They have local offices that can support CRM projects and a network of consultants knowledgeable in, say, the LATAM pharma market or the APAC markets. For example, IQVIA's team in Europe would ensure OCE meets the requirements of EU regulations like GDPR and country-specific laws (Germany's healthcare system intricacies, etc.). OCE has been implemented in various regions; in fact, the press release we saw is about Africa & Middle East – not traditional early adopters – which shows OCE is expanding globally ([30]). IQVIA likely has regional data centers through Salesforce or uses Salesforce's infrastructure in-region to host data in compliance with data residency rules. As for global support, IQVIA offers both technical support and consultative support. They can provide on-site training, account managers per region, etc. One selling point of IQVIA is that they can bundle their data services with OCE for each region – for instance, providing local HCP data sets (OneKey) pre-loaded or easily integrated, which eases starting up in a new country. The IQVIA OCE user community is smaller than Veeva's (since Veeva had more customers historically), but it's growing, and IQVIA organizes user groups and knowledge sharing especially focusing on how to leverage OCE in different markets. All in all, IQVIA OCE is globally capable and backed by a strong organization presence in all pharma markets, plus leveraging Salesforce's globally distributed cloud. Companies choosing OCE can expect to have local IQVIA contacts and resources during rollouts. If a pharma wants a single CRM system worldwide, OCE is designed for that, with support for multiple affiliates, languages, currencies in one org (just like Veeva or Salesforce would do).