Business Intelligence & Dashboard Tools in Pharma

[Revised January 23, 2026]

Business Intelligence & Dashboard Tools in Pharma

The pharmaceutical industry is increasingly data-driven, leveraging Business Intelligence (BI) and dashboard platforms for R&D, clinical operations, manufacturing, and commercial analytics. The global healthcare BI market is valued at approximately $11.45 billion in 2025 and is projected to reach $35–40 billion by 2034–2035 (CAGR ~13.5%) ([1]). The U.S. market specifically reached $4.19 billion in 2024 and is expected to grow to $8.85 billion by 2030 ([2]). This growth reflects broader BI adoption across life sciences, driven by AI integration, value-based care initiatives, and the need for data-driven decision-making. The leading BI vendors – Microsoft (Power BI), Salesforce (Tableau), Qlik, Google (Looker), Oracle, ThoughtSpot, and others – continue to expand their portfolios and compliance capabilities. In the 2025 Gartner Magic Quadrant for Analytics and BI Platforms, Microsoft maintained its leadership position for the eighteenth consecutive year, with Qlik, Google, Oracle, and ThoughtSpot also recognized as Leaders. Healthcare and pharma organizations must evaluate these tools not only on functionality and cost, but also on deployment flexibility, integration with clinical/ERP systems, validation and regulatory compliance (HIPAA, GxP, 21 CFR Part 11), and scalability.

Figure: U.S. healthcare BI market growth trajectory, reaching $4.19B in 2024 and projected to grow to $8.85B by 2030 ([3]). According to Grand View Research, by 2030 the U.S. healthcare BI market is expected to reach roughly $8.85 billion (13.3% CAGR) ([3]). This reflects soaring demand for data visualization, self-service analytics, AI-augmented insights, and embedded reporting in hospitals, payers, research organizations, and pharma companies. The integration of artificial intelligence, machine learning, and natural language processing into BI tools is transforming healthcare into a data-driven ecosystem that enables predictive and prescriptive insights.

Major BI tools all offer cloud and/or on-premises deployment models (except Domo, which is cloud-only). For example, Tableau and Qlik each support on-premises servers as well as hosted cloud services, while Microsoft’s Power BI is primarily a SaaS (Azure) service with an optional on-prem Power BI Report Server. Most vendors now provide hybrid options or cloud-managed services to suit enterprise IT requirements. All of these platforms can connect to common enterprise data sources (relational databases, data warehouses, ERP systems like SAP/Oracle, EDC/clinical systems via ODBC or APIs, big data sources, Excel/spreadsheets, etc.) and typically support REST/ODATA connectors and APIs for integration. They also support export and embedding in web apps, and include mobile app clients for iOS/Android.

Below we profile the leading BI/dashboard products, comparing deployment, pricing, integration, customization, security/compliance, and industry adoption. A summary comparison table highlights key aspects of each platform.

Microsoft Power BI

Overview & Core Features: Power BI is a component of Microsoft's Power Platform, known for tight integration with Office 365, Azure, Dynamics, and now Microsoft Fabric – Microsoft's unified data and analytics platform. In 2025, Power BI celebrated its 10th anniversary while introducing AI-first experiences with Copilot integration throughout the platform. It provides a familiar self-service interface (Power BI Desktop) and web portal for drag‑and‑drop reports, plus natural-language Q&A, AI visuals, Copilot-assisted report building, and custom DAX formula capabilities. Power BI supports real-time streaming data, dataflows (ETL), and paginated reports. Its deep integration with Azure Synapse, Azure SQL, Excel, Microsoft Teams, and the Fabric Lakehouse/Warehouse makes it widely adopted in enterprises with existing Microsoft ecosystems. Microsoft was named a Leader in the 2025 Gartner Magic Quadrant for Analytics and BI Platforms for the eighteenth consecutive year.

Deployment Models:

- Cloud: Power BI Service (SaaS on Azure) is the most common deployment. Microsoft also offers a Power BI Embedded service for developers to embed dashboards in custom apps.

- On-premises/Hybrid: For customers requiring on-prem, Power BI Report Server (a local server) is available with Premium or SQL Server Enterprise licensing. Azure offers Government and China regions for data sovereignty.

Pricing & Licensing: Power BI's licensing is primarily per-user or per-capacity ([4]). The free Power BI Desktop can create reports locally. As of April 2025, Power BI Pro is $14 per user/month (annual commitment), enabling sharing and collaboration – this represents a price increase from the previous $10/month. The Premium per User (PPU) tier is $24/user/month and provides advanced features (larger datasets, more refreshes, AI capabilities).

Important 2025-2026 Changes: Microsoft has retired Power BI Premium per capacity SKUs (P-SKUs) as of January 2025, transitioning organizations to Microsoft Fabric capacity SKUs. Organizations with existing Power BI Premium agreements must transition to Fabric SKUs at renewal. Fabric capacity pricing starts at approximately $4,995/month and scales based on Fabric Capacity Units (FCUs). Power BI now operates as both a standalone product and a core workload within Microsoft Fabric, with deep integration into OneLake storage and unified governance via Microsoft Purview ([5]). Pricing is lower for organizations with M365/E5 licenses.

Integration Capabilities: Power BI connects to 100+ data sources: all major databases (SQL Server, Oracle, SAP HANA, IBM DB2, Teradata, etc.), big-data (Spark, Hadoop), cloud warehouses (Snowflake, Redshift, Azure Synapse, Google BigQuery), on-prem systems (SAP BW, SharePoint), and many SaaS apps (Salesforce, Dynamics 365, Workday, etc.). For pharma, Power BI can ingest data from EDC or CTMS systems typically via ODBC/ODBC drivers or APIs (often by first storing trial data in a SQL database or Azure service). It also integrates natively with Excel, Azure Machine Learning, and Azure Cognitive Services for advanced analytics.

Customization & Scalability: Power BI supports extensive customization: Power BI Desktop allows custom DAX measures and Power Query transformations; custom visuals can be imported or developed (Open-Source visuals exist). Enterprises can automate report deployments via APIs/PowerShell. Scaling is handled via Premium capacities (which scale up to 400 GB models) and Azure elastic compute. Microsoft claims Power BI can handle very large workloads (e.g., Microsoft’s own dashboards aggregate thousands of data points in near-real-time).

Security & Compliance: Power BI offers enterprise-grade security. The cloud service is covered by Microsoft’s HIPAA Business Associate Addendum ([6]), meaning PHI can be stored in Power BI under a signed BAA. Azure’s underlying infrastructure is compliant with FedRAMP, HITRUST, SOC1/2/3, GDPR, etc. Features include Azure AD SSO, multi-factor auth, row-level and role-level security, data loss prevention policies (via Microsoft Purview), and encryption at rest/in transit. For GxP/21 CFR Part 11, IT can implement environment validation: Power BI can capture audit logs of report changes, though formal Part 11 validation of BI is typically handled as part of the overall data platform validation, since Power BI itself doesn’t generate regulated records.

Pharma Use Cases: Power BI is widely used in pharma and biotech. Use cases include clinical trial dashboards (patient enrollment, site performance), pharmacovigilance analytics, manufacturing quality dashboards, and commercial analytics (sales, marketing ROI). For instance, a CRO or sponsor might use Power BI to combine EDC data with lab systems to monitor safety signals. Its low cost and familiarity make it popular for departmental adoption.

Strengths & Weaknesses: Power BI’s strengths are its low entry price (especially for organizations already on Office 365), ease of use for business analysts, and deep MS integration. Its strong community and continuous feature rollout (AI insights, Q&A) are pluses. Weaknesses include a learning curve for advanced modeling (DAX/M), and some limitations on multi-tenant sharing (especially for free users). The on-prem Report Server has fewer features than the cloud.

Salesforce Tableau

Overview & Core Features: Tableau (now part of Salesforce) is renowned for its rich data visualization and ease of creating interactive dashboards. It offers Tableau Desktop (for design), Tableau Server (or Tableau Cloud) and the lightweight web-based Tableau Prep for ETL. Advanced analytics features include Ask Data (NLP), Explain Data (AI-based insight), Einstein Discovery integration in Salesforce environments, and the new Tableau+ bundle with agentic analytics capabilities. Tableau's VizQL engine is optimized for fast visual queries on large datasets. In 2025, Tableau introduced Tableau Next with enhanced AI-powered features and deeper Salesforce integration.

Deployment Models:

- Cloud: Tableau Cloud (formerly Tableau Online) is Salesforce-hosted; it includes all core analytics features and is built on AWS.

- On-premises: Tableau Server can be installed on customer-owned infrastructure (Windows or Linux), allowing fully managed deployments.

- Hybrid: Organizations can run mixed environments, using on-prem data gateways to connect on-prem data to cloud instances.

Pricing & Licensing: Tableau uses a tiered per-user license model ([7]). For Standard Edition (Tableau Cloud or Server):

- Creator (includes Tableau Desktop, Prep Builder, and one server/cloud license): $75/user/month ($900/year)

- Explorer: $42/user/month ($504/year)

- Viewer: $15/user/month ($180/year)

For Enterprise Edition with additional security and governance features:

- Creator: $115/user/month

- Explorer: $70/user/month

- Viewer: $35/user/month

These prices apply whether on Server or Cloud (Tableau covers hosting costs in Tableau Cloud pricing). The Tableau+ bundle is exclusive to Tableau Cloud and provides access to Tableau Next and agentic analytics capabilities – contact Salesforce for pricing. Every deployment requires at least one Creator license. Enterprises often negotiate volume discounts starting around 20-50 licenses.

Integration Capabilities: Tableau connects to hundreds of data sources out of the box ([8]), including databases (SQL, Oracle, Snowflake, SAP, etc.), cloud platforms, big data, and web data connectors. Via ODBC/ODBC drivers (e.g. CData connectors), Tableau can pull from pharma systems like Veeva Vault, SAP QM, Medidata Rave, and more. It can also query Salesforce and other CRMs natively. Tableau’s Hyper engine and Live/Extract options allow blending data from diverse sources.

Customization & Scalability: Tableau Server/Cloud supports custom user roles, extensible APIs (JavaScript, REST, Data), and embedded analytics. Workbooks can have parameterized queries. For large scale, Tableau Server can cluster nodes and supports multi-site deployments. Tableau’s data engine (Hyper) handles very large extracts (hundreds of millions of rows) with in-memory speed.

Security & Compliance: Tableau has robust security suitable for healthcare. Tableau Cloud has achieved HIPAA compliance; the vendor explicitly rolled out measures to meet strict HIPAA requirements ([9]). Tableau Server’s security is customer-managed and can be hosted in a validated GxP environment. Core security features include SAML/SSO, Kerberos, row-level and column-level permissions, encrypted extracts, and logging/auditing of user activity. Salesforce (the parent company) offers BAAs to covered entities. (21 CFR Part 11 compliance would rely on implementing logging/validation on the server and data warehouse side, as with other BI tools.)

Pharma Use Cases: Tableau is used by pharma for diverse analytics. Notable examples include pharmacovigilance (Adverse Event dashboards), supply chain and distribution monitoring, patient journey analysis in healthcare marketing, and research data exploration. Its strong visual capabilities help biostatisticians and clinicians interpret complex trial data. For instance, McKinsey reports that life sciences companies use Tableau to improve clinical trial oversight and decision-making.

Strengths & Weaknesses: Tableau’s strengths are best-in-class visualization and a shallow learning curve for creating dashboards. It handles ad-hoc analysis well and has a very active user community. In pharma, customers praise Tableau for speeding insights (Tableau calls itself the “gold standard” of data viz ([10])). Its weakness can be cost (Creator licenses are relatively expensive) and the need for skilled administration (Server complexity). Live querying can be slower than in-memory modes for very large data. Tableau also relies on partners for data prep at large scale (Tableau Prep is not a full ETL).

Qlik Sense

Overview & Core Features: Qlik Sense (the successor to QlikView) is a modern self-service BI platform with an associative in-memory engine. Users can explore data freely (click any field and all related values highlight) rather than predefined SQL joins. It offers a responsive web interface and desktop client, with features like smart search, AI-assisted visualization suggestions (Insight Advisor), and streaming analytics. Qlik's differentiator is its associative engine that indexes all data, enabling dynamic queries across disparate datasets. Qlik was named a Leader in the 2025 Gartner Magic Quadrant for Analytics and BI Platforms for the 15th consecutive year ([11]).

Deployment Models:

- Cloud: Qlik Cloud Services provides an enterprise SaaS analytics platform. There is also Qlik Cloud Government for FedRAMP compliance.

- On-premises: Qlik Sense Enterprise can be installed in a customer data center or private cloud (Windows or Kubernetes).

- Hybrid: Qlik’s architecture allows hybrid scenarios (e.g. Qlik Sense on Linux with Qlik Cloud components).

Pricing & Licensing: Qlik’s pricing is capacity- and user-based. The newer Qlik Cloud pricing uses packages: Starter is $200/month for 10 users and 25 GB ([12]); Standard is $825/month (25 GB) ([13]); Premium is $2,750/month (50 GB) ([14]). Starter plan includes a fixed user count; higher tiers include 24/7 support and advanced features. Alternatively, Qlik Sense “Enterprise” is often sold via custom quotes for large deployments. Holistics (a BI consulting firm) notes the Standard plan covers ~20 analysts ($825/mo) and Premium adds anonymous (unlicensed) users for heavy consumption ([15]). Real-world deployments range from $60,000/year for 25-user teams to $280,000/year for 500+ user organizations. Cloud deployments cost 20-30% more than on-premise but eliminate infrastructure overhead. A 30-day free trial is available.

Integration Capabilities: Qlik connects to many data sources (databases, files, web APIs) via Qlik Data Integration (formerly Qlik Replicate) and standard connectors. It has native connectors for SAP, Salesforce, AWS services, and more. Qlik Data Catalyst can catalog and govern data. For pharma, Qlik can integrate ERP (SAP/Oracle), LIMS, EDC, and medical devices data. Qlik’s ability to rapidly load and index data makes it suited for blending complex datasets (e.g. combining patient data, production metrics, and sales data in one app).

Customization & Scalability: Qlik’s development environment supports advanced scripting (data load scripts with transformations) and APIs for embedding analytics. Qlik apps can be customized with extensions and mash-ups. It scales through clusters: multi-node Qlik Sense sites can handle large user bases and data volumes. The associative engine is in-memory, but large scale deployments often use Direct Query (connect live to databases) or hybrid approaches to handle massive datasets without full in-memory loads.

Security & Compliance: Qlik Cloud has achieved SOC 2 Type 2 and HITRUST certification, attesting to controls over PHI ([16]). Customers can bring their own encryption keys (Customer-Managed Keys) and sign a HIPAA BAA to host PHI on Qlik Cloud. Qlik Sense Enterprise on-prem can be deployed in a validated environment for Part 11. Access controls include role-based security, section access for row-level filtering, and granular content security rules. Qlik logs user actions for auditing.

Pharma Use Cases: Qlik is used for sales operations analysis, supply chain optimization, and patient data insights. For example, life sciences firms use Qlik to monitor drug inventory across sites, and to explore clinical data without predefined schemas. Its associative model is handy when data relationships are complex or not fully known in advance. Qlik’s customers include hospitals and large healthcare providers, showing its viability for regulated data.

Strengths & Weaknesses: Qlik’s strengths are its powerful associative engine (flexible ad-hoc exploration) and strong governance features for enterprises. It can handle very large, complex datasets well. Customers also cite its fast in-memory performance. Weaknesses include a steeper learning curve (developing Qlik scripts and apps can require training) and historically a more complex administration (though Qlik Sense has improved this). Qlik’s newer SaaS pricing can be expensive for large deployments, and some users find the UI less intuitive than Tableau for basic tasks.

Google Looker

Overview & Core Features: Looker (now Google Cloud Looker) is a modern cloud-native BI platform built for centralized modeling and data exploration. Instead of depending on a proprietary data engine, Looker queries data in-database using its LookML modeling layer. Analysts define metrics and joins in LookML, ensuring consistent metrics across dashboards. Looker's interface provides interactive dashboards, embedded analytics, and a developer-friendly environment. Recent enhancements include Conversational Analytics (launched in 2025 with unlimited access through September 2026), integration of LookML with Git, and tools for data science workflows (Analytics Hub, extension framework). Google was named a Leader in the 2025 Gartner Magic Quadrant for Analytics and BI Platforms for the second consecutive year ([17]).

Deployment Models:

- Cloud: Looker is offered as a fully managed SaaS running on Google Cloud. A Google Cloud account can provision Looker instances in any region.

- On-premises/Hybrid: There is a self-hosted Looker option for private clouds or on-prem hardware (using Docker containers), although most customers use the cloud SaaS version.

Pricing & Licensing: Looker's pricing is enterprise-grade and negotiated individually—there is no self-service signup or free trial ([18]). Three platform editions are available:

- Standard: For small teams (<50 users), includes 10 Standard users + 2 Developer users

- Enterprise: Enhanced security for internal BI needs, up to 100,000 query-based API calls/month

- Embed: For external analytics and custom apps at scale, up to 500,000 query-based API calls/month

User licensing: Viewer (~$30/user/month), Standard (~$60/user/month), Developer (~$125/user/month). Estimated annual costs by team size:

- 10-25 users: $36,000–$60,000/year

- 50-100 users: $84,000–$120,000/year

- 250+ users: $216,000–$360,000+/year

- Average enterprise deal: ~$150,000 annually

Important cost note: Looker doesn't store data—it queries in real-time, so data warehouse costs (BigQuery, Snowflake, Redshift) add significantly to total cost of ownership. Companies with existing heavy GCP spend typically negotiate better bundled pricing. Looker Studio (formerly Data Studio) remains available as a free basic tool.

Integration Capabilities: Looker connects to major SQL databases and warehouses (BigQuery, Redshift, Snowflake, Azure SQL, Databricks, Oracle, etc.) via JDBC. Because it queries the source data, data freshness is real-time (subject to query latency). Looker can connect to cloud services, Hadoop, and has a REST API for custom integrations. It also links well with Google services (e.g. embedding in Google Workspace, integration with Google Ads data). In pharma, Looker can tap into clinical data warehouses and ERP systems in the cloud. It has no native “Excel-like” ETL; data must be prepared upstream, but it excels at leveraging existing data lakes/warehouses.

Customization & Scalability: Looker’s core is LookML, which allows reuse of data definitions and supports version control (Git). It has SDKs for embedding visualizations into other applications or custom portals. Looker scales with the underlying database: since it pushes queries to the warehouse, heavy lifting is done by the database engine. It can handle very large data volumes (billions of rows) if the database is scaled accordingly. Google also offers an autoscaling service on Google Cloud to optimize query performance.

Security & Compliance: Google Cloud, including Looker, supports HIPAA and enters into BAAs ([19]). Customers can sign a Google BAA and configure Looker accordingly. Looker provides robust access controls (LDAP/SAML SSO, row-level security via data_user filters, permission sets). Audit logs and monitoring are available through Google Cloud’s logging. Since Looker is cloud-hosted, GDPR, SOC2, and ISO certifications of Google Cloud cover it. As with other BI tools, 21 CFR Part 11 compliance would be managed by the organization (ensuring audits and user authentication meet FDA requirements).

Pharma Use Cases: Looker is popular for analytical hubs and embedded analytics in life sciences. For example, it is used for commercial analytics (aggregating sales, CRM, and market data) and for research dashboards (e.g. patient data analytics combined with genomics). Its reusability of metrics (LookML) helps ensure consistent KPI definitions across global teams. Some companies use Looker to embed dashboards in partner portals (e.g. for CROs to share trial metrics).

Strengths & Weaknesses: Looker’s strengths include centralized modeling (avoiding “spreadmarts”), strong embedded analytics capabilities, and seamless scaling with modern cloud databases. It also integrates well with Google’s ecosystem (BigQuery, Data Studio). Weaknesses: initial setup requires LookML expertise (it is code-centric), and it is less forgiving for ad-hoc visualization without a prepared model. Its pricing can be high for smaller teams, and since it pushes queries live, performance depends on the database infrastructure.

Domo

Overview & Core Features: Domo is a cloud-native BI and data platform designed for enterprise and department use. It provides a full-stack solution: data connectors, ETL (via Magic ETL or Python/R integration), data warehousing, and front-end dashboards. It emphasizes simplicity – users can set up cards (widgets) quickly and share insights across the organization. Domo now operates on a credit-based consumption model, where you purchase credits upfront and usage consumes credits (1 credit ≈ 1 million rows of data). The platform includes Domo AI capabilities, an app ecosystem ("Domo Apps"), workflows and automation, and built-in Python/R notebooks for data science ([20]).

Deployment Models: Cloud-only. Domo is delivered as a fully managed SaaS (multi-tenant) service. There is no on-prem version. All data and compute reside in Domo’s cloud (hosted on AWS). For on-prem data, organizations route it through secure connectors or data pipelines into Domo.

Pricing & Licensing: Domo operates on a consumption-based pricing model – you pay for what you use, but costs fluctuate based on data queries, dashboards, and connectors ([20]). Key pricing details:

- Minimum contracts: Start around $30,000–$50,000 annually

- Small teams (<25 users): $250–$625/user monthly

- Base user fee: ~$750/year per user for core platform access

- Mid-range deployments: Organizations allocating $100,000–$250,000 annually are the typical fit

- Full access from day one: Data Integration, BI and Analytics, Domo AI, Workflows/Automation, and Governance are included

The platform uses a credit consumption model where you purchase credit buckets upfront. Contracts typically run on annual or multi-year terms and cannot be canceled mid-contract. A 30-day free trial is available with no credit card required. Exact pricing requires consultation with sales.

Integration Capabilities: Domo boasts a library of over 1,000 connectors to databases, cloud apps, and social media platforms. It includes connectors to pharma-relevant sources (Workday, JIRA, Salesforce, Google Analytics, etc.) and can query via JDBC/ODBC for custom sources. Domo’s ETL tools allow blending and transforming data inside the platform. It also supports REST APIs to import from in-house systems (e.g. EDC via web API). Its Magic ETL UI and Magic ETL SQL interfaces let analysts combine multiple datasets.

Customization & Scalability: Domo allows branding of dashboards, white-labeling, and embedding via its own Domo Everywhere solution. Users can create alerts and “Publish to Web” features for sharing insights. Since it’s cloud-based, Domo auto-scales to handle user load; in practice, very large deployments (thousands of users) have been implemented. The platform includes fine-grained governance (data lineage, user groups). Custom apps and plugin development (with HTML/Javascript) are supported.

Security & Compliance: Domo is enterprise-grade secure. According to Domo’s documentation, its platform is certified for SOC 2 Type II, HIPAA, and GDPR ([21]). It supports SAML SSO, two-factor authentication, and row-level security. Encryption at rest and in transit is standard. Domo will sign a HIPAA BAA, enabling healthcare customers to load PHI. As a cloud platform, it inherits AWS’s compliance (SOC, ISO, PCI) for infrastructure.

Pharma Use Cases: Domo markets heavily to healthcare and life sciences. Use cases include hospital operations dashboards, patient engagement analytics, and pharma supply chain visibility. Notable customers include Gilead and Anthem, which use Domo to unify data across clinical, sales, and finance. A case study highlights Regional One Health connecting 100+ systems into Domo for centralized key metrics (e.g. ER wait times, resource utilization). Its quick-to-deploy model appeals to organizations seeking rapid insights without heavy IT setup.

Strengths & Weaknesses: Domo’s strengths are its all-in-one cloud architecture (no ops for the customer) and user-friendly interface. It excels at bringing data from disparate sources into unified dashboards. The large connector ecosystem and ETL tools simplify integration. Weaknesses include cost (Domo is relatively expensive) and potential data volume limits (customers note high-tier needed for massive data). Some users find its data modeling less flexible than competitors. Because Domo is SaaS-only, customers reliant on legacy on-prem systems may face additional integration work.

Sisense

Overview & Core Features: Sisense is an analytics platform that emphasizes embedding analytics into applications. As of November 2025, Sisense has shifted to a primarily cloud-native pricing model. Sisense's core feature is its in-chip (ElastiCube) engine, which stores data in a columnar format with optimized CPU usage for fast query performance. Sisense also offers a newer "Fusion" architecture for elastic scaling and data virtualization. The platform provides drag-and-drop dashboard building, a code-free UI, and the ability to script transformations in SQL or Python. Sisense also embeds machine learning and predictive AI analytics tools ([22]).

Deployment Models: Sisense supports multiple deployment options:

- Cloud: Sisense Cloud (SaaS) is hosted on AWS or Azure.

- Private Cloud: Sisense Cloud-managed gives customers a dedicated cloud environment.

- On-premises: Sisense can be installed on-premises or on private servers/kubernetes clusters. This flexibility allows pharma firms to host Sisense behind firewalls (important for GxP validation) or use managed cloud services.

Pricing & Licensing: Sisense emphasizes "no-surprise" pricing with customized solutions, but does not publicly reveal pricing ([22]). Based on available data:

- Entry-level: ~$10,000–$25,000/year for small teams (5 users self-hosted starts ~$10K; cloud ~$21K)

- AWS Marketplace tiers: Essentials ~$40k/year, Advanced ~$70k, Pro ~$109k

- Average enterprise deal: ~$137,000 annually (~$11K/month)

- Maximum pricing: Can reach up to $4.4M for large deployments

Pricing is tied to user roles (viewers cost less than designers) and data volume (each additional ElastiCube can cost $10,000–$35,000/year). Warning: Some users report dramatic price increases at renewal—one experienced a 400% increase. The total cost depends on data volume, user count, and features needed.

Integration Capabilities: Sisense supports common connectors (databases, cloud services, flat files) and has APIs for custom data ingestion. It can connect to pharma systems via generic interfaces: SQL (for LIMS, ERP DBs), SOAP/REST (for cloud apps), and ODBC/JDBC. Sisense’s in-chip engine can extract data from any JDBC-compliant source and accelerate it. For ETL, Sisense provides data pipelines (ElastiFlows) and also integrates with data preparation tools (Python/Pandas, SQL).

Customization & Scalability: Sisense is highly customizable: developers can use its Javascript SDK to embed dashboards, create custom plugins, or white-label the UI. It supports complex analytics (R/Python scripting inside). Sisense Elastic (the new architecture) allows scaling out to handle large data and concurrent users (even in cloud auto-scaling mode). The platform can manage very large data models (hundreds of GB) distributed across multiple nodes.

Security & Compliance: Sisense is designed with healthcare security in mind. Sisense’s compliance page states the platform is “HIPAA-ready” ([23]) and Sisense undergoes annual SOC 2 audits ([24]). It supports encryption in transit (TLS 1.2+), and encourages encryption at rest via customer configuration ([25]). Sisense can operate in a HIPAA environment: the vendor says it complies with HIPAA Security and Privacy rules as a business associate ([26]). Access controls (SSO, AD integration, multi-tenancy) are built-in. For 21 CFR 11, Sisense does not explicitly claim Part 11 certification, but being HIPAA-ready and SOC2 audited means it has many required controls; validation of analytics reports would be the customer’s responsibility.

Pharma Use Cases: Sisense is used by biopharma companies for embedded analytics (e.g. embedding dashboards in intranet portals), and by CROs for integrating clinical and operational data. For example, a pharmaceutical company might embed Sisense dashboards into a clinical data application to let users visualize trial data without switching tools. Sisense itself highlights life sciences customers using its analytics for supply chain KPIs and regulatory reporting.

Strengths & Weaknesses: Sisense’s strengths include flexibility and developer-friendliness. Its in-chip engine can handle large data faster than traditional engines by leveraging CPU caching. It’s praised for embedding (customers often include Sisense in custom applications). Weaknesses include pricing (Sisense tends to be an expensive enterprise platform) and the need for technical expertise to manage its clusters and ElastiCubes. Some newer users report a learning curve in understanding Sisense’s architecture.

MicroStrategy

Overview & Core Features: Strategy (formerly MicroStrategy, rebranded in 2025) is an enterprise AI+BI platform known for its robust architecture and advanced analytics. The company now positions itself as pioneering AI advancements for business intelligence ([27]). It includes Strategy One Cloud (hosted SaaS) and traditional on-prem software. Key features include a pixel-perfect report engine, highly customized dashboards, "HyperIntelligence" (contextual insights delivered via browser plugins or mobile), and strong mobile app support (Mobile SDK). Strategy supports both relational and OLAP sources, and offers built-in features like geospatial mapping and statistical functions. Strategy World 2026 conference is scheduled for February 23–26, 2026.

Deployment Models:

- On-premises: Enterprises can deploy Strategy on their own servers (Windows or Linux).

- Cloud: Strategy One Cloud is offered as a managed subscription (including HIPAA-ready options). It is available on AWS and Azure marketplaces with private IP configurations for data security.

Pricing & Licensing: Strategy offers flexible licensing options:

- Per-user licensing: Ranges from $600–$5,000 depending on user type (Project Architect, Business User, Developer)

- Analytics module: Starting at $600 one-time license

- Strategy One Cloud Basic: ~$62,000 annually (includes one named user each for Client-Architect, Power User, and Consumer User, plus AWS charges)

- Monthly cloud costs: Typically range from $2,000/month (small teams) to $20,000+/month for enterprise deployments

Strategy One deploys on AWS and Azure with options for private IP configurations for data security. Implementation, data migration, customization, and training are additional costs. Large organizations typically negotiate enterprise agreements.

Integration Capabilities: MicroStrategy connects to almost all major data sources via native connectors (databases, cloud warehouses, Big Data platforms) and has strong support for Oracle, SAP, and cloud data sources. It also can serve as a semantic layer for multiple sources at once. Through its SDKs, MicroStrategy dashboards and reports can be embedded in other applications. MicroStrategy also integrates with Hadoop, enabling predictive modeling and advanced analytics (it can run R scripts internally).

Customization & Scalability: MicroStrategy is known for scale. It supports high concurrency and large deployments, with clustering and caching options. Developers can use MicroStrategy Developer (the full authoring environment) or MicroStrategy Desktop. It provides a robust metadata layer (project objects) to ensure consistency. Reports can be extremely customizable (pixel-precision, bursting). For big data, MicroStrategy’s in-memory “Dossier” architecture and Intelligent Cubes allow federated queries across sources.

Security & Compliance: Strategy has an extensive security program. The managed cloud service is HIPAA-compliant with ISO and SOC2 certifications for its cloud infrastructure. Strategy supports SAML, LDAP, Active Directory, role-based security, and object-level security. In the cloud, data is encrypted and access is logged. For GxP, deployments can be validated; Strategy explicitly mentions compliance ("SoX-compliant systems" and HIPAA-ready cloud). It also supports two-factor authentication and threat detection (via integration with SIEM tools).

Pharma Use Cases: Strategy's power-user features and large-scale capabilities make it suitable for global pharma enterprises analyzing sales and supply chain data. It is used for executive dashboards, manufacturing analytics (integrating MES/SCADA with ERP), and large clinical data reviews. Its mobile SDK has been used by pharma reps for interactive dashboards on tablets. Because Strategy was historically strong in Finance, many pharma finance teams also use it for budgeting and compliance reporting.

Strengths & Weaknesses: Strategy's strengths are enterprise robustness and security. It offers a comprehensive set of features (including embedded intelligence like HyperIntelligence, broad OS support, and strong governance) with a new focus on AI integration. Weaknesses include complexity and cost; it often requires skilled BI developers to leverage fully. The user interface, while improved, can be seen as less modern than some competitors. Also, licensing can be costly for smaller teams.

IBM Cognos Analytics

Overview & Core Features: IBM Cognos Analytics is IBM’s flagship BI platform. It evolved from IBM Cognos BI and now emphasizes AI-infused insights (with Watson). Cognos provides report authoring (cognos reports, dashboards), data modeling (Framework Manager), and self-service data modules. Key features include natural language querying, automated chart suggestions, and the new Watson Assistant for data (question-answering). It also offers mobile apps and broad enterprise reporting capabilities (PDF, Excel, etc.).

Deployment Models:

- On-premises: IBM Cognos Analytics can be installed on-premises on Linux or Windows servers, or as a Docker container.

- Cloud: IBM offers Cognos Analytics on IBM Cloud (SaaS) and Cognos Analytics on IBM Cloud Pak for Data. These services can be provisioned via the IBM Cloud Marketplace.

- Hybrid: Data can reside on-prem or in cloud; Cognos can connect to both.

Pricing & Licensing: IBM Cognos Analytics comes in Standard and Premium cloud tiers ([28]):

- Standard (Cloud): ~$10.60/user/month – offers dashboards, stories, and light modeling

- Premium (Cloud): ~$42.40/user/month – fully managed with advanced features

On-premises licensing uses perpetual or subscription models (per CPU core or per user). IBM also offers Cognos Analytics as part of their broader Cloud Pak for Data subscriptions. A free 30-day trial is available for cloud (no credit card required). Note that IBM Cognos pricing is considered higher than some competitors, though it targets medium to large enterprises with sophisticated analytics needs.

Integration Capabilities: Cognos has native connectivity to IBM data sources (Db2, Informix) as well as open databases (Oracle, SQL Server, SAP BW). It can leverage IBM Cloud storage and also connect to Hadoop (via Spark), Cloudant, and other NoSQL sources. Cognos can consume data from data warehouses and virtualization layers (IBM Watson Query). In pharma, typical integrations include SAP ERP, PLM systems, and LIMS data (often via data warehouse staging). Cognos also supports REST/ODATA for custom web data sources, and Excel/CSV imports.

Customization & Scalability: Cognos provides a metadata modeling tool (Framework Manager) for defining a semantic layer. Dashboards are interactive but somewhat less freeform than Tableau or Power BI (more guided). IBM offers Cognos SDKs and extensions for embedding (e.g. Cognos JS API). Cognos scales to large enterprise use: it can run in a distributed, clustered mode and handle thousands of users and large report burstings (email/publish). The underlying architecture supports high availability and workload management.

Security & Compliance: IBM Cloud (which hosts Cognos on-demand) supports HIPAA with a BAA ([29]). Cognos on cloud runs in an ISO/SOC2 environment. Cognos provides row-level security and strong permission controls, integrates with LDAP/Active Directory, and supports SAML SSO. It has auditing of user actions. For regulated data, IBM Cloud Pak deployments can be validated; IBM services follow strict data controls. 21 CFR Part 11 compliance would be addressed by environment controls (Cognos itself can record audit trails of report generation, but electronic signature at record entry is outside Cognos’s scope).

Pharma Use Cases: Cognos has a long history in regulated industries. Pharma companies use Cognos for finance and manufacturing analytics (batch records, cost analysis), as well as for clinical data reporting. Its ability to produce pixel-perfect reports is useful for regulatory submissions and quality control. IBM has case studies of Cognos for global product planning and for EHR analytics in hospitals. Its Watson integration also appeals to data science teams in large pharma.

Strengths & Weaknesses: Cognos’s strengths are enterprise reporting robustness and deep integration with IBM’s software stack. It can handle complex corporate BI requirements and is proven in regulated industries. Weaknesses include a steeper learning curve for self-service users and a somewhat outdated UI compared to newer tools. Some users find ad-hoc data exploration in Cognos less intuitive. Cognos’s licensing and deployment (especially on-prem) can be complex to manage.

Comparative Overview

The table below summarizes key aspects of these BI platforms:

| Tool | Deployment | Typical Pricing (2025-2026) | HIPAA/Compliance |

|---|---|---|---|

| Power BI (Microsoft) | Cloud SaaS (Azure + Microsoft Fabric); On-prem via Report Server; Hybrid | Pro $14/user/mo, PPU $24/user/mo; Fabric capacity from ~$5K/mo | Microsoft HIPAA BAA; Azure/Government HIPAA-ready; SOC, ISO, FedRAMP compliant |

| Tableau (Salesforce) | SaaS (Tableau Cloud), On-prem (Server), Hybrid | Standard: Creator $75/mo, Explorer $42/mo, Viewer $15/mo; Enterprise tier higher | Tableau Cloud HIPAA-compliant; on-prem can be GxP validated; TISAX, ISO 27001, SOC 2/3 |

| Qlik Sense | SaaS (Qlik Cloud), On-prem Enterprise, Hybrid | Standard ~$825/mo for 20 users; Enterprise $60K-$280K/year | SOC2/HITRUST certified; HIPAA BAA available; FedRAMP/DoD for Gov Cloud |

| Looker (Google) | SaaS (Google Cloud), On-prem container (rare) | Viewer ~$30/mo, Standard ~$60/mo, Developer ~$125/mo; avg enterprise ~$150K/yr | Google Cloud BAA covers Looker; HIPAA-ready, SOC2/ISO certified |

| Domo | Cloud-only (SaaS) | Consumption-based; min ~$30-50K/yr; mid-range $100-250K/yr | SOC2 Type II, HIPAA, GDPR certified; HIPAA BAA available |

| Sisense | Cloud (SaaS), Private Cloud, On-prem (Kubernetes) | Essentials ~$40K/yr, Pro ~$109K/yr; avg enterprise ~$137K/yr | "HIPAA-ready"; SOC2 audits; ISO 27001, PCI compliant |

| Strategy (fka MicroStrategy) | SaaS (Strategy One Cloud) or On-prem | Per-user $600-$5K; Cloud basic ~$62K/yr; $2K-$20K+/mo for cloud | HIPAA-compliant cloud; SOC2, ISO 27001, PCI certified |

| IBM Cognos Analytics | SaaS (IBM Cloud), On-prem, Hybrid | Standard ~$10.60/user/mo, Premium ~$42.40/user/mo | IBM Cloud HIPAA BAA; FedRAMP, SOC2, ISO 27001 compliant |

Each tool's strengths vary: e.g. Power BI for Microsoft/Fabric ecosystem, Tableau for visual analytics, Qlik for associative data discovery, Looker for governed cloud analytics, Domo for all-in-one simplicity, Sisense for embeddability, Strategy for enterprise scale, and Cognos for integrated IBM environments. Weaknesses likewise differ (e.g. Tableau's cost, Power BI's transition complexity to Fabric, Domo's pricing model, Sisense's complexity, etc.). The choice depends on organizational needs and existing technology stacks.

BI Adoption in Healthcare/Pharma

BI adoption continues to accelerate in healthcare and pharma. The global healthcare BI market is valued at approximately $11.5 billion in 2025 and is projected to reach $35-40 billion by 2034-2035 ([1]). North America dominates the market, with the U.S. accounting for over 40% of global healthcare BI revenue. Asia Pacific is expected to grow at the fastest rate during the forecast period. In life sciences, analytics is increasingly used for evidence generation, patient monitoring, real-world data analysis, and commercial optimization.

Industry reports show healthcare BI usage accelerating, driven by:

- AI/ML integration: Natural language processing, automated insights, and predictive analytics are now standard features

- Value-based care initiatives: Requiring sophisticated data analytics for quality metrics and outcomes tracking

- Big data explosion: Rising volumes of healthcare data from EHRs, wearables, and clinical trials

In practice, many pharma companies adopt a hybrid BI strategy: small teams may use cloud services (Power BI with Fabric, Tableau Cloud) for agility, while enterprise divisions invest in private cloud for regulated data. The 2025 Gartner Magic Quadrant for Analytics and BI Platforms identifies Microsoft, Salesforce (Tableau), Google, Qlik, Oracle, and ThoughtSpot as Leaders – reflecting their strong feature sets, AI capabilities, and healthcare usage.

Tablets and mobile dashboards are common in clinical settings (e.g. hospital C-level mobility dashboards). AI/ML features (automated insights, predictive analytics, Copilot-style assistants) are now standard across major platforms. Most BI vendors market "augmented analytics" and "agentic analytics" (natural language queries, automated pattern detection, AI-generated insights), which aligns with pharma's interest in data science and rapid insights (e.g. spotting safety signals or trial anomalies faster).

Key 2025-2026 Trends:

- Platform convergence: Microsoft Power BI's deep integration with Fabric, Salesforce's Tableau+ with agentic capabilities, Google's Conversational Analytics in Looker

- AI-first experiences: Copilot integration across platforms, improved natural language query capabilities

- Consumption-based pricing: Shift from per-user to capacity/credit-based models (Domo, Microsoft Fabric)

Overall, BI tools are increasingly embedded in pharma IT strategies. Compliance remains a top concern: HIPAA, GxP, and 21 CFR 11 regulations require secure, validated data handling. All major BI platforms now support HIPAA through BAAs or on-prem options ([6]) ([9]) ([16]). Life sciences IT teams validate data pipelines end-to-end, often treating the BI layer as part of the validated system. As a result, BI usage in clinical trials and manufacturing is growing, backed by large-vendor support for healthcare security standards.

This article was updated in January 2026 with the latest pricing, features, and market data for all covered platforms.

Sources: This article draws from authoritative industry reports and vendor documentation including:

- 2025 Gartner Magic Quadrant for Analytics and BI Platforms

- Grand View Research US Healthcare BI Market

- Precedence Research Healthcare BI Market

- Microsoft Power BI Pricing

- Tableau Pricing

- Qlik Cloud Pricing

- Google Cloud Looker Pricing

- Domo Pricing

- Sisense Platform

- IBM Cognos Analytics Pricing

Vendor compliance and security documentation was consulted to ensure accurate coverage of HIPAA, SOC2, and regulatory compliance capabilities.

External Sources (29)

Need Expert Guidance on This Topic?

Let's discuss how IntuitionLabs can help you navigate the challenges covered in this article.

I'm Adrien Laurent, Founder & CEO of IntuitionLabs. With 25+ years of experience in enterprise software development, I specialize in creating custom AI solutions for the pharmaceutical and life science industries.

DISCLAIMER

The information contained in this document is provided for educational and informational purposes only. We make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability, or availability of the information contained herein. Any reliance you place on such information is strictly at your own risk. In no event will IntuitionLabs.ai or its representatives be liable for any loss or damage including without limitation, indirect or consequential loss or damage, or any loss or damage whatsoever arising from the use of information presented in this document. This document may contain content generated with the assistance of artificial intelligence technologies. AI-generated content may contain errors, omissions, or inaccuracies. Readers are advised to independently verify any critical information before acting upon it. All product names, logos, brands, trademarks, and registered trademarks mentioned in this document are the property of their respective owners. All company, product, and service names used in this document are for identification purposes only. Use of these names, logos, trademarks, and brands does not imply endorsement by the respective trademark holders. IntuitionLabs.ai is an AI software development company specializing in helping life-science companies implement and leverage artificial intelligence solutions. Founded in 2023 by Adrien Laurent and based in San Jose, California. This document does not constitute professional or legal advice. For specific guidance related to your business needs, please consult with appropriate qualified professionals.

Related Articles

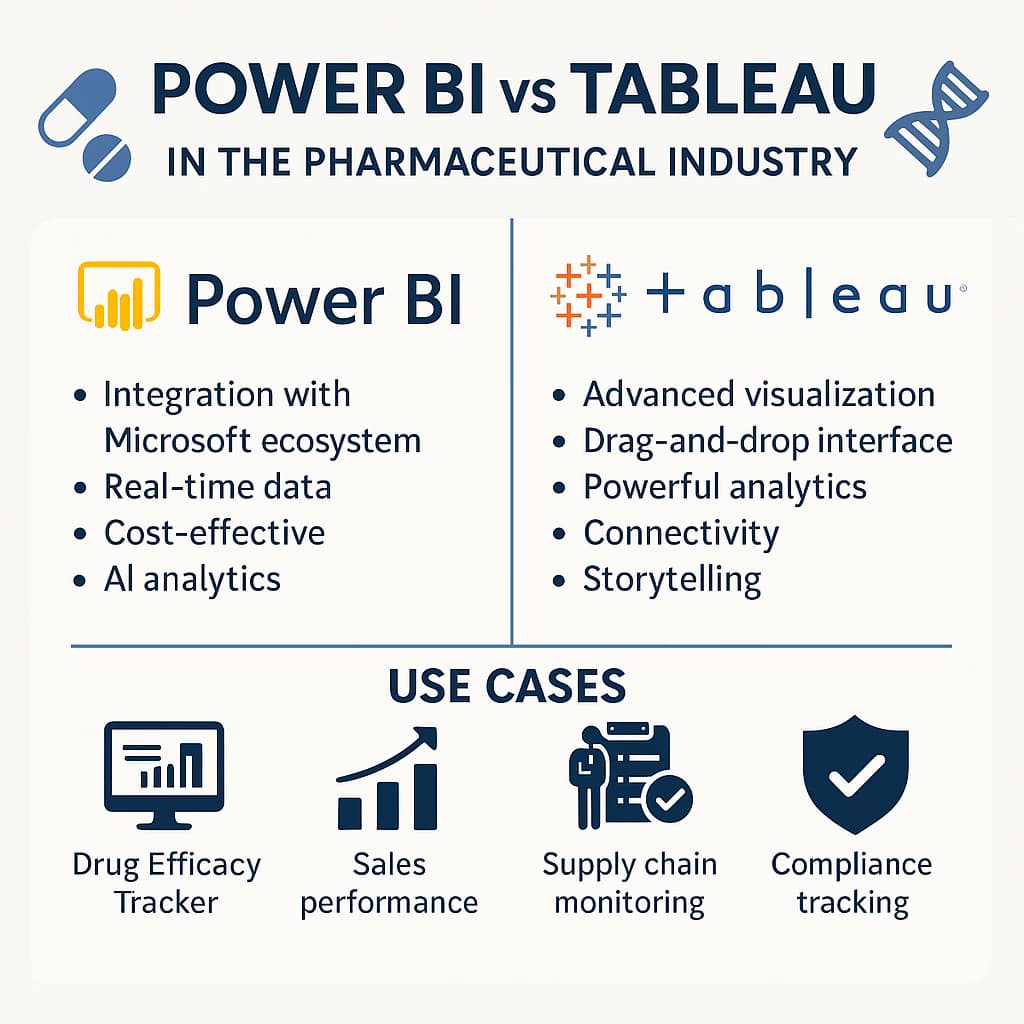

Power BI vs Tableau in Pharma: Full Comparison

Comprehensive comparison of Power BI and Tableau for pharma: features, pricing, compliance, and use cases for IT and analytics teams.

Tableau vs. Power BI: BI Platform Market Analysis & Comparison

Explore a comprehensive comparison of Tableau and Power BI, analyzing market share, features, pricing, and adoption trends for data professionals. Updated with 2025-2026 data including Gartner MQ 2025, Forrester Wave Q2 2025, and April 2025 pricing changes.

Marketing Technology (MarTech) API Integrations in Life Sciences

Guide to MarTech API integrations for pharma: CRM, marketing automation, analytics, consent, compliance, and best practices for unified digital engagement.