Videos

Browse videos by topic

All Videos

Showing 97-120 of 1435 videos

Veeva's Numbers: My Take on Growth & That Litigation Charge

Corporate Decoder

/@CorporateDecoder

Sep 3, 2025

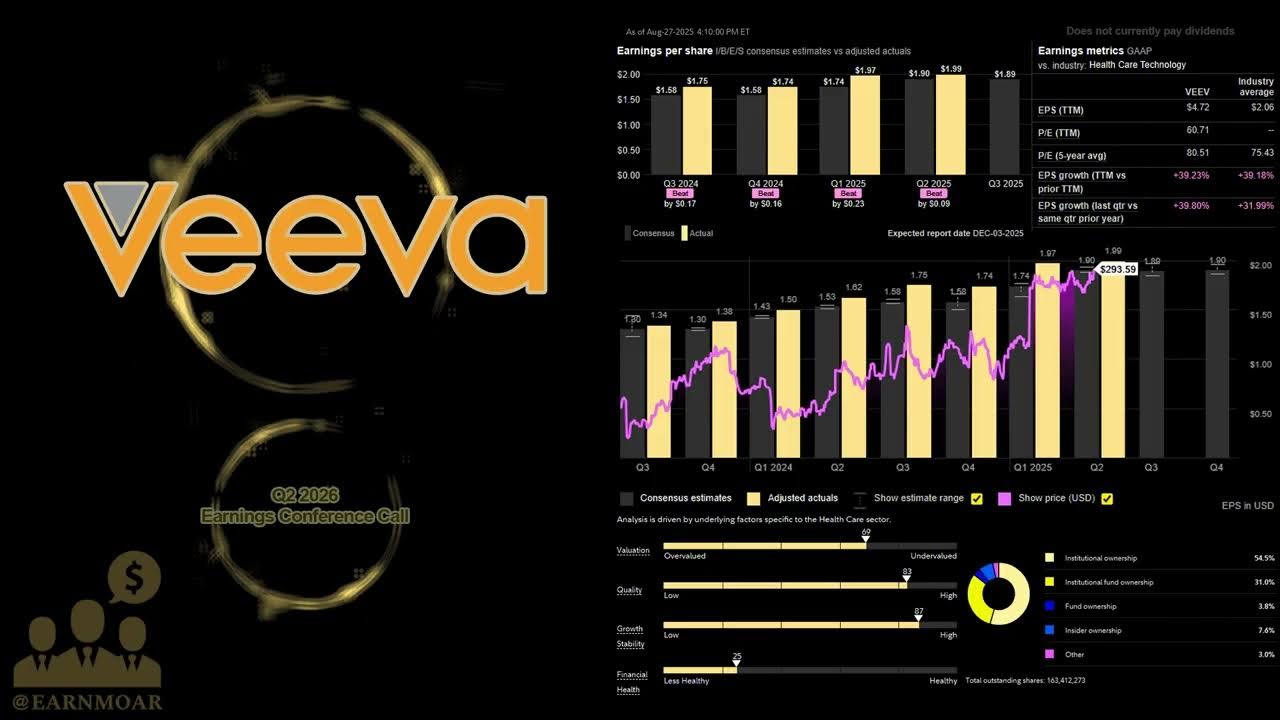

This video provides an in-depth financial and operational analysis of Veeva Systems Inc., based on its 10-Q SEC filing for the three months ending July 31, 2025. The core purpose of the analysis is to peel back the layers of the corporate filing to assess Veeva's financial health, growth trajectory, and critical business risks. The speaker, an expert content analyst, adopts a data-driven approach, systematically reviewing the balance sheet, income statement, and risk factors to provide a comprehensive view of the company's standing within the life sciences technology sector. The analysis begins by establishing Veeva’s exceptional financial stability. As of the reporting date, Veeva was sitting on nearly $2 billion in cash and cash equivalents, coupled with over $4.4 billion in short-term investments, resulting in total current assets approaching $7 billion. This massive liquidity provides a significant buffer against economic volatility. Moving to the income statement, the company reported total revenues exceeding $789 million for the quarter, marking a strong 17% year-over-year growth. Crucially, the majority of this revenue—nearly $659 million—is derived from subscription services, underscoring the predictability and recurring nature of Veeva's income stream. The company maintains a highly profitable operational structure, boasting a total gross margin percentage of 75%. A key focus of the analysis is the impact of a significant, non-recurring expense. While Veeva demonstrated efficiency by slightly reducing R&D and Sales & Marketing expenses as a percentage of revenue, General and Administrative (G&A) expenses jumped from 9% to 12% of revenue. This increase was directly attributed to a substantial $30.6 million litigation settlement charge. The speaker characterizes this charge as a "hiccup" or a one-off event, noting that despite this impact, the net income still grew by $29 million year-over-year to a cool $200 million, confirming the underlying strength of the core business driven by both commercial and R&D solutions. The final segment of the analysis delves into the critical risks facing Veeva, which are highly relevant to the broader life sciences ecosystem. These risks include intense competition from major players like Salesforce and IQVIA, the ongoing challenge of migrating customers to new platforms such as Vault CRM (a process that carries the risk of customer disruption or loss), and the inherent vulnerability associated with handling sensitive customer data (security breaches). Most importantly for the life sciences industry, the analysis highlights Veeva's concentrated reliance on this single sector. This means that adverse regulatory changes (e.g., FDA/EMA), shifts in drug pricing, or government funding fluctuations can directly and severely impact Veeva's revenue and growth prospects. Key Takeaways: • Veeva Systems exhibits exceptional financial resilience, holding nearly $7 billion in liquid assets (cash and short-term investments), which provides a strong foundation for continued platform development and market dominance in the life sciences sector. • The company’s core business is robust, demonstrated by a 17% year-over-year revenue growth and a high 75% gross margin, confirming the sustained investment appetite within pharmaceutical commercial and R&D operations. • The $30.6 million litigation settlement charge is identified as a significant, yet likely non-recurring, expense that temporarily inflated G&A costs; this event should not be viewed as indicative of a long-term decline in operational profitability. • Growth in subscription services revenue is being driven by both Commercial and R&D solutions, signaling that IntuitionLabs should continue to focus equally on optimizing both sides of the pharmaceutical business (e.g., Medical Info Chatbots and clinical data management). • The acknowledged challenge of migrating customers to new platforms, specifically Vault CRM, presents a direct, high-value opportunity for specialized consulting firms to offer expertise in complex system integration, data migration, and change management to ensure seamless adoption. • Competition from tech giants like Salesforce and industry peers like IQVIA remains a constant threat; this necessitates that IntuitionLabs differentiate its Veeva consulting services by integrating advanced AI and LLM capabilities to provide unique value beyond standard implementation. • Veeva’s reliance on a few major customers underscores the high-stakes nature of enterprise engagements in the life sciences sector; successful, long-term partnerships with these key clients are crucial for the stability of the entire Veeva ecosystem. • The concentration of revenue within the life sciences industry means that regulatory and political risks (FDA compliance, drug pricing) are paramount; all custom AI and software solutions developed by IntuitionLabs must prioritize and seamlessly integrate regulatory compliance features. • Veeva’s continued heavy investment in R&D ($92 million in the quarter) confirms a commitment to innovation, requiring consulting partners to maintain deep expertise in emerging Veeva features and API integrations, particularly those related to AI enablement. • The risk of security breaches and unauthorized data access is a top concern for Veeva, reinforcing the need for IntuitionLabs to design all custom software and data engineering solutions with stringent security protocols compliant with GxP and 21 CFR Part 11 standards. Key Concepts: * **10-Q Filing:** A comprehensive quarterly report submitted by public companies to the SEC, providing detailed financial performance data. * **Subscription Services Revenue:** Recurring income derived from software licenses and support, which forms the backbone of Veeva's predictable revenue model. * **Gross Margin:** The percentage of revenue remaining after deducting the cost of revenues (75% for Veeva), indicating high efficiency in delivering core services. * **Vault CRM:** Veeva's next-generation CRM platform, the migration to which is cited as a significant operational challenge and risk factor. * **Litigation Settlement Charge:** A one-time expense ($30.6 million) related to resolving legal disputes, impacting the reported net income for the quarter.

Medical Fraud Waste and Abuse Explained

AHealthcareZ - Healthcare Finance Explained

@ahealthcarez

Sep 1, 2025

This video provides an in-depth explanation of medical fraud, waste, and abuse (FWA), a significant issue estimated by the FBI to account for 3-10% of all healthcare spending. Dr. Eric Bricker, the speaker, breaks down FWA into four distinct categories as defined by the Centers for Medicare and Medicaid Services (CMS): mistakes, waste, abuse, and deliberate fraud, focusing on their impact on employer-sponsored health plans. He emphasizes that while insurance carriers are theoretically responsible for catching FWA, their automated claims processing and historical refusal to allow external audits often lead to substantial financial losses for self-funded employers. The presentation delves into each FWA category with vivid, real-world examples. "Mistakes" are illustrated by a $250,000 infusion medication claim that was double-billed to both a medical plan and a pharmacy benefits manager (PBM) by the same carrier, resulting in a half-million-dollar payout for a quarter-million-dollar service. "Waste" is exemplified by a healthy, normal-risk pregnant woman receiving monthly ultrasounds without clinical indication. "Abuse" is explained through "upcoding," where conditions like pneumonia or urinary tract infections were re-coded as sepsis to secure higher Medicare and commercial plan reimbursements, despite no change in patient management or hospital costs. The most egregious category, "deliberate fraud," is highlighted with two impactful case studies reported by ProPublica. One involves a personal trainer for Southwest Airlines employees who billed over $4 million in physical therapy claims over several years, despite not being a licensed physical therapist. Another details out-of-network physical therapists in New Jersey charging $667 per "medical massage" to a state employee health plan with rich out-of-network benefits, a clear scam. Dr. Bricker points out that carriers often auto-adjudicate claims under $10,000-$15,000 without human review, allowing such fraud to persist, particularly in self-funded plans where the carrier bears no risk. He also addresses the common counter-argument that prior authorizations balance out FWA, illustrating with a diagram how both problems can co-exist and impact different providers, meaning neither should be ignored. The video concludes by offering a concrete solution: independent auditing. Dr. Bricker advocates for employers and benefits consultants to hire separate data analytics firms specifically to review claims for FWA, thereby auditing the carrier's performance. He cites a benefits consultant who reduced health plan costs by 6% for large Fortune 500 companies by strictly addressing FWA. Another example includes an insurance captive that has kept healthcare costs flat for over a decade by employing two outside data analytics vendors to scrutinize carrier data. This "trust but verify" approach, enabled by demanding data access from carriers or switching to those who comply, is presented as a proven method to reclaim significant healthcare spending. Key Takeaways: * **Significant Financial Impact of FWA:** Medical Fraud, Waste, and Abuse (FWA) accounts for an estimated 3-10% of all healthcare spending, representing a substantial financial drain on health plans, including employer-sponsored ones. * **Four Categories of FWA:** CMS categorizes FWA into Mistakes (e.g., double billing), Waste (e.g., unnecessary procedures), Abuse (e.g., upcoding for higher reimbursement), and Deliberate Fraud (e.g., billing for services not rendered or by unqualified personnel). * **Carrier Limitations in FWA Detection:** Traditional insurance carriers often fail to detect FWA due to automated claims adjudication processes for claims under $10,000-$15,000 and a historical reluctance to allow external audits of their FWA departments. * **"Trust But Verify" is Essential:** For self-funded plans, carriers bear no risk for FWA, making it crucial for employers to implement a "trust but verify" strategy rather than solely relying on carrier assurances. * **FWA and Prior Authorization Are Separate Issues:** The existence of egregious prior authorization denials does not negate the need to address FWA; both are distinct problems that require separate solutions and can impact different providers. * **Independent Data Analytics as a Solution:** The most effective strategy to combat FWA is to hire independent, third-party data analytics firms to review claims data and audit the carrier's FWA detection efforts. * **Actionable Steps for Employers:** Employers should demand access to their claims data for independent review. If a carrier refuses, they should consider issuing an RFP (Request for Proposal) to find a new carrier that allows such audits. * **Tangible Cost Savings:** Addressing FWA through independent auditing can lead to significant cost reductions, with one benefits consultant reporting a 6% decrease in health plan costs for large employers. * **Empowering Claims Management:** With independent data analysis, employers can instruct carriers to stop payments on fraudulent claims or withhold future payments to providers who have previously received fraudulent payouts. * **Proven Success Models:** Examples like an insurance captive maintaining flat healthcare costs for over a decade by utilizing multiple outside FWA auditing vendors demonstrate the efficacy of this approach. * **Data Access is Paramount:** The ability to access and analyze comprehensive claims data is fundamental for identifying patterns of FWA that automated carrier systems often miss. **Key Concepts:** * **FWA (Fraud, Waste, and Abuse):** A broad term encompassing intentional deception (fraud), inefficient or unnecessary use of resources (waste), and practices that directly or indirectly result in unnecessary costs (abuse). * **Upcoding:** Billing for a more expensive service or diagnosis than what was actually provided or justified, often to increase reimbursement. * **Auto-adjudication:** The automated processing and payment of claims by an insurance carrier's computer system without human review, typically for claims below a certain monetary threshold. * **Self-funded Plan:** An employer-sponsored health plan where the employer directly pays for employees' healthcare costs rather than paying premiums to an insurance carrier, making them directly responsible for FWA losses. * **Prior Authorization:** A requirement from an insurance plan that a healthcare provider obtain approval before providing a service or prescribing a medication, often used to control costs and ensure medical necessity. * **RFP (Request for Proposal):** A document issued by an organization to solicit bids from potential suppliers for a specific project or service, used here to find carriers willing to allow independent FWA audits. **Examples/Case Studies:** * **Double-billed Infusion Medication:** A $250,000 infusion drug was billed twice (medical and pharmacy claims) by the same carrier/PBM, resulting in a $500,000 payout for a $250,000 service. * **Unnecessary Monthly Ultrasounds:** A healthy, normal-risk pregnant woman received monthly ultrasounds without clinical indication, representing medical waste. * **Sepsis Upcoding:** A significant increase in sepsis diagnoses (from 248,000 to 541,000 cases) was observed after Medicare increased reimbursement, with conditions like pneumonia being re-coded as sepsis to gain higher payments without changes in patient care. * **Southwest Airlines Personal Trainer Fraud:** A personal trainer billed Southwest Airlines' employee health plan over $4 million for physical therapy claims, despite not being a physical therapist. * **New Jersey Out-of-Network Massage Fraud:** Out-of-network physical therapists in New Jersey billed $667 per "medical massage" to a state employee health plan with generous out-of-network benefits, amounting to significant fraud. * **Benefits Consultant Cost Reduction:** A benefits consultant achieved a 6% reduction in health plan costs for Fortune 500 employers by rigorously addressing FWA through independent auditing. * **Insurance Captive Flat Costs:** An insurance captive maintained flat healthcare costs for over 10 years by employing two outside data analytics vendors to audit carrier claims for FWA.

Season 2, Episode 5: The Heart of the TMF with Ann Ackley-Fifer

Heart of the Trial

/@HeartoftheTrial

Sep 1, 2025

This episode features an in-depth discussion with Ann Ackley-Fifer, a TMF expert and consultant, exploring the evolution of the Trial Master File (TMF) from paper-based systems to modern digital strategies. The conversation emphasizes the TMF’s role as the "heart of the trial," detailing Ann’s nearly 20-year journey from manually digitizing paper documents to becoming a Veeva-certified expert focused on system configuration and end-user empowerment. A central theme is the necessity of foundational TMF knowledge, arguing that while technology (including AI and machine learning) can handle the 'what' (data collection and synthesis), human expertise is required for the 'why' (context, patient focus, and regulatory interpretation). The discussion heavily focuses on the impact of regulatory changes and the shift toward digital compliance. A significant portion addresses the implications of ICH GCP E6(R3), specifically highlighting the increased emphasis on sponsor oversight and the need for greater transparency from Contract Research Organizations (CROs). Ann argues that E6(R3) gives sponsors the necessary leverage to demand visibility into in-progress documents, missing items, and quality control metrics, preventing CROs from guarding messy data until the last minute. The speakers stress that inspection readiness must be a continuous mindset, not a periodic activity, noting that regulators are increasingly demanding direct access to electronic TMF (eTMF) systems and are adept at identifying last-minute cleanup efforts via audit trails. Furthermore, the conversation delves into the future of TMF management, emphasizing the move toward standardized, digitally native documentation. Ann highlights the work being done by CDISC with the M11 standardized digital protocol and the TMF Reference Model version 4, which aims for data in a system to print out a document narrative, rather than documents being mined for data. This shift is seen as crucial for enabling cooperation among smaller biotech companies by ensuring their systems speak the same language and collect standardized data points. However, a major concern raised is the potential loss of fundamental TMF knowledge as entry-level roles become obsolete due to decentralization and automation, stressing the need for TMF champions within functional areas to maintain oversight and context. Ann’s consulting philosophy centers on the end-user experience, recognizing that even the most sophisticated eTMF system fails without practical training and user understanding. She notes that many consulting engagements, initially focused on technology configuration, quickly pivot to addressing end-user education and process adoption. The goal is to demonstrate the tangible benefits of proper documentation—such as using system filtration to generate a list of expiring documents for a site monitor—to create an "aha moment" that encourages consistent compliance. The ultimate message is that TMF integrity is paramount because it represents the complete story of the trial, and any gaps or inconsistencies raise red flags for inspectors regarding the integrity of the entire study. ### Detailed Key Takeaways * **Inspection Readiness is a Mindset, Not an Activity:** TMF compliance should be a continuous process, not a quarterly or biannual cleanup effort. Regulators are aware of last-minute pushes; audit trails expose when a high volume of documents were QC’d or logged just weeks before an inspection, which serves as a major red flag. * **ICH GCP E6(R3) Demands Transparency:** The updated guidelines place a strong focus on sponsor oversight, empowering sponsors to demand visibility into their CROs' TMFs. CROs must move beyond only showing approved documents and provide insight into in-progress items, missing documents, and quality control trends to remain competitive. * **The Importance of Foundational TMF Knowledge:** As technology automates entry-level tasks, there is a risk of losing the "detective" skills gained by early TMF professionals who learned the 'why' and context of documents by reverse-engineering them. Technology is a research assistant, not the professor; human expertise is needed to connect the dots across functional areas. * **Metrics Must Be Straightforward:** If a CRO's TMF metrics require extensive caveats and nuanced explanations, the resulting number is likely worthless. Reliable metrics should have a clear, straightforward calculation that accurately reflects the quality and status of the TMF. * **End-User Education is Critical for System Success:** The biggest challenge in TMF management is often not system configuration, but end-user education. Consultants must focus on practical application and demonstrating how consistent data entry benefits the user (e.g., using system filters to generate actionable lists), rather than simply demanding compliance. * **Leveraging Digital Standards for Cooperation:** The adoption of standards like the CDISC M11 standardized digital protocol will enable all industry players to speak the same language. This standardization can allow smaller biotech companies to form consortia and cooperate on data sharing, enabling them to compete more effectively with larger organizations. * **The Shift to Digitally Native Documents:** The future of TMF involves moving away from scanning paper or mining documents for data. Systems will become "digitally native," where data points entered into the system will automatically generate the required document narrative, streamlining compliance and ensuring data integrity. * **TMF Champions in Functional Areas:** Companies should identify and empower TMF champions within each functional area (e.g., Data Management, Clinical Monitoring). These champions can speak specifically to the documents their area produces and act as liaisons between their team and the central TMF team, ensuring consistency and context. * **TMF is the Story of the Trial:** The TMF is the complete regulatory record of the trial. If pages are missing or the record is incomplete, the sponsor lacks the full story, jeopardizing regulatory approval and potentially patient safety. ### Tools/Resources Mentioned * **Veeva:** Mentioned as a leading electronic Trial Master File (eTMF) platform. The guest is a Veeva-certified expert. * **ICH GCP E6(R3):** International Council for Harmonisation of Technical Requirements for Pharmaceuticals for Human Use, Good Clinical Practice, Revision 3. * **21 CFR Part 11:** FDA regulation concerning electronic records and electronic signatures, relevant for compliant eTMF systems. * **CDISC (Clinical Data Interchange Standards Consortium):** Mentioned in relation to industry standardization efforts. * **M11 Standardized Digital Protocol:** A CDISC initiative aimed at standardizing digital protocols. * **TMF Reference Model (Version 4):** Discussed as the standard moving toward digitally native documents. ### Key Concepts * **Trial Master File (TMF):** The collection of essential documents that individually and collectively permit the reconstruction and evaluation of the conduct of a clinical trial and the quality of the data produced. Referred to as the "heart of the trial." * **eTMF (Electronic Trial Master File):** A digital system used for managing and storing TMF documents, often including audit trails and compliance features. * **Digitally Native Documents:** Documents where the data is captured and stored directly within the system, allowing the system to generate the document narrative, rather than relying on scanned paper or manually uploaded files. * **Sponsor Oversight:** The regulatory responsibility of the trial sponsor (the company funding the trial) to ensure the quality and integrity of the trial, including documentation managed by CROs. * **Audit Trail:** An electronic record that details all actions performed on a document or system entry (who, what, when), which regulators use to verify data integrity and compliance history.

Season 2, Episode 5: The Heart of the TMF with Ann Ackley-Fifer

Heart of the Trial

/@HeartoftheTrial

Sep 1, 2025

This podcast episode provides an in-depth look into the evolution and current state of Trial Master File (TMF) management in clinical research, featuring TMF expert and Veeva-certified consultant Ann Ackley-Fifer. The discussion traces the journey of TMF from its paper-based origins in the early 2000s—where the process was simply "tag it and bag it"—to the complex digital strategies employed today. A core theme is the necessity of foundational TMF knowledge, emphasizing that even the most advanced electronic TMF (eTMF) systems fail without empowered and educated end-users who understand the "why" behind documentation requirements. Ann highlights that her consulting work often pivots from technical system review to focusing on end-user training and experience, ensuring practical application of the technology. A significant portion of the conversation focuses on the impact of regulatory changes, particularly the impending ICH GCP E6 R3 guidelines. The speakers stress that R3 places a much greater emphasis on sponsor oversight and demands increased transparency from Contract Research Organizations (CROs). This transparency is crucial for sponsors to maintain proper control over their clinical trial documentation and data integrity. The shift in regulatory language from "documents" to "records" underscores the industry's move toward digitally native data. The speakers warn that CROs must adapt by offering better oversight tools—such as visibility into in-progress items, issue trends, and quality control metrics—to remain competitive against sponsors who are increasingly bringing eTMF management in-house to gain control. Looking toward the future, the episode explores the potential of industry standardization and cooperation. Ann expresses optimism about the CDISC M11 standardized digital protocol, which aims to ensure all industry players speak the same language and collect uniform data points. This standardization, she argues, will enable greater cooperation, allowing smaller biotech companies to form consortia and compete effectively with larger organizations by sharing data and systems that seamlessly communicate. Furthermore, the discussion touches on the concept of "digitally native documents," where data in the system automatically generates a document narrative, reversing the current process of mining documents for data. However, a major concern raised is the potential loss of foundational TMF knowledge among new entrants, as entry-level roles become increasingly automated by AI and machine learning, risking a lack of understanding regarding the context and patient impact (the "why") of the documentation. Key Takeaways: • **TMF is the Heart of the Trial:** TMF documentation is not a low-priority administrative task; it is the comprehensive, auditable story of the trial from beginning to end, and its integrity directly impacts regulatory approval and patient safety. • **E6 R3 Mandates Sponsor Oversight and CRO Transparency:** The new ICH GCP guidelines empower sponsors to demand greater visibility into the TMF, requiring CROs to provide robust oversight tools and metrics that clearly show the status of documents, quality control, and issue trends. • **Inspection Readiness is a Mindset, Not an Activity:** TMF management must be a continuous process, not a quarterly or semi-annual cleanup effort; regulators look for signs of last-minute QC pushes (e.g., a large influx of QC activity just before an inspection) and view this as a major red flag. • **Veeva Certification Requires Continuous Learning:** Maintaining expertise in platforms like Veeva requires ongoing annual testing and updates to stay current with new features and modules, highlighting the need for specialized, up-to-date system configuration knowledge. • **The Importance of End-User Education:** Technology alone is insufficient; most TMF problems stem from end-user misunderstanding or lack of practical training on how the eTMF system works and how it benefits their specific functional area (the "aha moment"). • **Beware of Worthless Metrics:** If metrics used by a CRO require extensive caveats, nuances, and complicated explanations to calculate, they are likely not providing straightforward, actionable insights for sponsor oversight. • **The Shift to Digitally Native Documents:** Future standards (like CDISC M11) are moving toward systems where data points are standardized and documents are generated from that data, requiring a fundamental shift in how documentation is managed and utilized. • **Risk of Losing Foundational Knowledge:** The increasing automation of entry-level TMF tasks via AI and machine learning risks eliminating the opportunities for new professionals to gain the detective-like, ground-up understanding of regulatory documents and their context. • **Cooperation Drives Competition:** Industry standardization (like CDISC) will facilitate cooperation among smaller biotech companies, allowing them to leverage shared data standards and systems to compete more effectively with large pharmaceutical organizations. • **Identify TMF Champions in Functional Areas:** Companies should designate TMF champions within each functional area (e.g., data management, clinical operations) to bridge the gap between specialized TMF teams and the document producers, ensuring context-specific compliance. • **Audit Trails Tattle:** Regulators will use system audit trails to identify inconsistencies, such as a lead data manager not logging in for months, or a massive backlog of documents being QCed immediately prior to an inspection. Tools/Resources Mentioned: * **Veeva:** Mentioned as a leading electronic Trial Master File (eTMF) platform. * **ICH GCP E6 R3:** The latest version of the International Council for Harmonisation of Technical Requirements for Pharmaceuticals for Human Use (ICH) guidelines for Good Clinical Practice. * **CDISC M11 Standard:** The standardized digital protocol being developed by the Clinical Data Interchange Standards Consortium (CDISC). * **TMF Reference Model (Version 4):** A reference model being updated to address digitally native documents. Key Concepts: * **Trial Master File (TMF):** The collection of essential documents that individually and collectively permit the evaluation of the conduct of a clinical trial and the quality of the data produced. * **Electronic TMF (eTMF):** A digital system used to manage the TMF, often required to be 21 CFR Part 11 compliant. * **Digitally Native Documents:** Documents or records where the data originates and resides within a structured digital system, rather than being digitized from paper or unstructured files. * **Sponsor Oversight:** The regulatory requirement for the pharmaceutical company sponsoring the trial to maintain control and visibility over the activities delegated to CROs. * **21 CFR Part 11:** FDA regulations governing electronic records and electronic signatures, ensuring data integrity and security.

My Take on Veeva's Strong Q2 Financials

Corporate Decoder

/@CorporateDecoder

Aug 30, 2025

This video provides a financial analysis of Veeva Systems' second quarter fiscal 2026 results, highlighting strong performance across key metrics. The speaker details Veeva's revenue growth, profitability, and cash flow, positioning the company as a robust cloud-based software provider for the life sciences industry. The analysis delves into the breakdown of revenue streams, noting significant growth in customer services, and discusses the implications of these numbers for Veeva's market position and operational efficiency. Key Takeaways: * **Veeva's Strong Financial Health:** Veeva Systems reported impressive Q2 fiscal 2026 results, with total revenue increasing 15% year-over-year to $779 million, operating income up 20%, and net income surging 25%, demonstrating robust growth and profitability. * **Customer Services Driving Engagement:** Customer services revenue saw a substantial 21% year-over-year increase, outpacing the 12% growth in subscription revenue. This indicates a deepening relationship with existing clients, suggesting increased adoption of additional support, consulting, and expanded use of Veeva's platforms. * **Operational Efficiency and Leverage:** The faster growth in operating income (20%) and net income (25%) compared to total revenue (15%) signifies that Veeva is effectively managing its costs and achieving operational leverage, translating top-line growth into even stronger bottom-line results. * **Stable and Growing Ecosystem:** Veeva's consistent growth and specialization in the life sciences industry create a stable and expanding ecosystem. Its strong financial trajectory underscores the ongoing demand for specialized software and services within the pharmaceutical and biotech sectors.

Veeva Systems Q2 Earnings Breakdown: AI & IQVIA Deal Power Growth

TalkTickers: AI Podcast Discussing Earnings Calls

/@TalkTickersPodcast

Aug 30, 2025

This video provides an in-depth analysis of Veeva Systems' Q2 2026 earnings, arguing that the market's negative reaction to a short-term GAAP earnings miss is fundamentally misguided. The core thesis presented is that three massive strategic catalysts—the resolution of the IQVIA dispute, the ambitious "Agentic AI" roadmap, and dominant execution in the next-generation CRM market—are being severely undervalued, positioning Veeva for significant long-term growth within the life sciences sector. The analysis details two major strategic shifts. First, the landmark partnership with IQVIA resolves a decade-long legal and data access conflict that the CEO previously characterized as a major structural weakness. This deal transforms a competitor into an ally, enabling Veeva to integrate IQVIA's crucial, top-tier datasets into its platform offerings (like Network and Nitro). This integration fundamentally derisks Veeva’s entire commercial business, removes a significant objection faced by its global sales teams, and allows Veeva to offer a more complete, wholesome solution to biopharma clients. Second, the video highlights Veeva’s long-term commitment to "Agentic AI." This is defined not as simple feature additions, but as the creation of super-smart digital assistants designed to automate complex, multi-step workflows across the life sciences value chain. Veeva asserts it holds a "structural advantage" because its software already serves as the industry's operational backbone, allowing it to deeply integrate these AI agents directly into existing workflows—a capability generic AI companies lack. The roadmap is concrete and phased: the first AI agents are scheduled for deployment in the CRM platform in December 2025, followed by subsequent waves targeting clinical, regulatory, and safety domains through 2027. Finally, the video underscores Veeva’s strong current execution, particularly in the competitive battle for the next-generation CRM market. Veeva’s Vault CRM has secured 9 of the top 20 biopharma giants, compared to only 3 for its main competitor, Salesforce. More critically, Veeva has already achieved successful customer go-lives, demonstrating a massive execution gap, as the competitor’s earliest similar customer deployment is not anticipated until late 2026. This execution prowess, combined with the strategic data and AI initiatives, leads the analysts to conclude that Veeva is an "outperform" stock pick, asserting that the market is focusing on short-term noise while missing the long-term value creation. Key Takeaways: * **Veeva's AI Strategy is Workflow-Centric:** Veeva is investing heavily in "Agentic AI"—specialized, multi-step digital assistants designed to automate complex tasks within life sciences workflows (CRM, clinical, regulatory, safety). This validates the industry trend toward highly integrated, domain-specific AI solutions rather than generic LLMs. * **Structural Advantage in AI Integration:** Veeva’s competitive edge in AI is based on its deep integration as the existing workflow backbone for the life sciences industry. Consulting firms like IntuitionLabs must leverage their own deep industry knowledge and existing integration capabilities (especially around Veeva platforms) to create custom AI solutions that capitalize on this structural advantage. * **Agentic AI Roadmap Confirms Future Focus:** The phased rollout of AI agents—starting with CRM in December 2025, followed by clinical, regulatory, and safety through 2027—provides a clear signal regarding Veeva’s strategic priorities. IntuitionLabs should align its custom AI/LLM development (e.g., Medical Info Chatbots, Sales Ops Assistants) to complement or integrate with these specific platform expansions. * **IQVIA Deal Enhances Commercial Data Strategy:** The resolution of the decade-long IQVIA data dispute removes a major barrier, allowing Veeva to integrate crucial datasets into products like Network and Nitro. IntuitionLabs should anticipate increased client demand for data engineering and integration services focused on leveraging combined IQVIA and Veeva data assets for commercial intelligence. * **Vault CRM Dominance is Confirmed:** Veeva has secured 9 of the top 20 biopharma companies for its new Vault CRM, establishing it as the dominant platform for future commercial operations in the largest pharmaceutical enterprises. This confirms Vault CRM consulting as a high-growth service area. * **Execution Gap Creates Opportunity:** The fact that Veeva has major Vault CRM customers live while competitors lag significantly (with projected go-lives not until late 2026) highlights the critical importance of successful, rapid implementation. IntuitionLabs must emphasize speed and expertise in its Veeva CRM consulting services to capitalize on this competitive execution gap. * **Regulatory and Clinical AI is a Priority:** The explicit mention of AI agents for regulatory and safety domains confirms Veeva’s commitment to automating compliance and quality processes. This reinforces the need for IntuitionLabs to prioritize developing AI solutions that streamline compliance tracking, audit trails, and GxP requirements. * **Market Focus on Long-Term Value:** The video argues that the market is obsessing over short-term financial metrics (GAAP miss) while ignoring massive strategic catalysts (IQVIA, AI). This reinforces the need for IntuitionLabs to communicate the long-term strategic value of its AI and compliance solutions to clients, focusing on derisking operations and unlocking new commercial opportunities. Tools/Resources Mentioned: * Veeva Systems (Vault CRM, Network, Nitro) * IQVIA (Data giant and strategic partner) * Salesforce (Main competitor in the CRM space) Key Concepts: * **Agentic AI:** A term used by Veeva to describe highly specialized, multi-step digital assistants or agents capable of handling complex jobs autonomously, trained specifically on life sciences workflows. * **Structural Advantage:** Veeva’s competitive edge derived from its existing position as the foundational software platform (the "backbone") where life sciences work is already performed, allowing for deep, seamless AI integration. * **Vault CRM:** Veeva’s next-generation Customer Relationship Management platform, built on the Vault architecture, which is rapidly gaining adoption among top biopharma companies.

Veeva Systems Stock Price Target Surges Amid Positive Analyst Ratings

NewsBOT Business

/@NewsBOTBusiness

Aug 30, 2025

This video provides a detailed financial analysis of Veeva Systems (NYSE:VEEV), focusing on recent positive adjustments to stock price targets by major financial analysts, reflecting a strong and optimistic outlook on the company's performance within the cloud-based software sector for the life sciences industry. The analysis establishes that despite some cautious ratings, the overall market sentiment is bullish, driven by impressive recent earnings and Veeva’s sustained position as a market leader providing essential solutions to pharmaceutical and biotechnology firms. The core of the analysis centers on the consensus among financial institutions. While Morgan Stanley raised its target from $210 to $222, it maintained an "underweight" rating, suggesting caution. However, this cautious view is offset by significantly more optimistic ratings from other firms: Mizuho raised its objective from $280 to $295 with an "outperform" rating, and BTIG increased its target from $335 to $340 with a "buy" rating. Barclays and Evercore ISI also adjusted targets upward, leading to a strong consensus rating of "Moderate Buy" among analysts, with an average target price settling near $299.88. This broad agreement highlights the perceived stability and growth potential of Veeva’s regulated enterprise software platforms. This bullish sentiment is strongly supported by Veeva’s recent financial disclosures. The company reported earnings per share (EPS) of $1.97 for the last quarter, significantly surpassing the consensus estimate of $1.74 by 23%. Furthermore, quarterly revenue reached $759.04 million, exceeding analyst expectations of $728.38 million. This financial performance marks a substantial 16.7% increase in revenue compared to the same period last year, demonstrating robust growth in a competitive market. Financially, Veeva maintains excellent health, evidenced by a net margin of 27.29% and a return on equity of 14.19%. Looking forward, analysts predict Veeva Systems will post an EPS of $4.35 for the current fiscal year, reinforcing expectations of continued expansion. The video notes that Veeva continues to innovate and expand its product offerings, specifically mentioning Veeva Commercial Cloud and Veeva Vault. These platforms are crucial for enabling pharmaceutical and biotech firms to enhance operations and improve customer engagement while navigating complex regulatory environments. The growing interest from institutional investors, alongside the positive analyst momentum, suggests that Veeva is well-positioned for sustained growth, confirming its dominance in providing compliant, cloud-based solutions tailored for the highly regulated life sciences sector. Key Takeaways: * **Veeva’s Market Dominance is Validated:** The strong consensus among analysts, resulting in a "Moderate Buy" rating and an average price target of nearly $300, confirms Veeva’s secure position as the indispensable technology provider for life sciences commercial and clinical operations. * **Significant Revenue Growth Signals Market Expansion:** Veeva’s 16.7% year-over-year revenue increase and the $759.04 million quarterly revenue beat indicate that the life sciences sector is rapidly adopting and expanding its use of Veeva platforms, creating an expanding addressable market for specialized consulting and integration services. * **High EPS Beat Reflects Effective Monetization:** The substantial beat on EPS ($1.97 actual vs. $1.74 estimated) suggests that clients are not only adopting Veeva but are also successfully implementing and leveraging the platform’s high-value features, often requiring expert guidance in areas like AI integration and complex system customization. * **Focus on Core Products:** The explicit mention of Veeva Commercial Cloud and Veeva Vault reinforces that these product lines are the primary drivers of Veeva’s growth, signaling where consulting firms should concentrate their expertise and custom AI development efforts. * **Financial Health Guarantees Platform Stability:** Veeva’s robust financial metrics (27.29% net margin and 14.19% ROE) ensure sustained investment in R&D, meaning the platform will continue to evolve rapidly, necessitating continuous training and specialized consulting for clients to keep pace with new features and regulatory updates. * **Institutional Confidence in Life Sciences Tech:** The acquisition of stakes by institutional firms like Trust Company of Toledo and Abound Financial highlights that major investors view the regulated life sciences cloud sector as a stable, high-growth area, validating the strategic decision to specialize in this niche. * **Anticipated Complexity Requires Expertise:** The predicted EPS of $4.35 for the current fiscal year implies continued product complexity and feature rollouts, increasing the demand for expert Veeva CRM consultants and AI developers capable of integrating advanced solutions (like LLMs) into the core Veeva architecture. * **Strategic Alignment with Regulatory Compliance:** As Veeva continues to solidify its role in providing solutions that enable pharmaceutical and biotech firms to enhance operations, the need for partners who can ensure these enhancements remain compliant with FDA and GxP standards (a core offering of IntuitionLabs.ai) will intensify. Tools/Resources Mentioned: * Veeva Systems (NYSE:VEEV) * Veeva Commercial Cloud * Veeva Vault Key Concepts: * **Price Target:** A financial analyst’s estimate of the future price of a stock, used to guide investment decisions. * **Underweight Rating:** An analyst rating suggesting that the stock is expected to perform worse than the average stock in its sector or the overall market. * **Outperform/Buy Rating:** Analyst ratings suggesting the stock is expected to perform better than the market or is a strong investment opportunity. * **Earnings Per Share (EPS):** A company's net profit divided by the number of outstanding common shares, a key indicator of profitability. * **Net Margin:** The percentage of revenue left after all operating expenses, interest, taxes, and preferred stock dividends have been deducted, indicating financial efficiency.

Veeva Systems Q2: IQVIA, AI & CRM Wins vs. Market Expectations

TalkTickers: AI Podcast Discussing Earnings Calls

/@TalkTickersPodcast

Aug 29, 2025

This video provides an in-depth analysis of Veeva Systems' Fiscal Q2 2026 earnings call, dissecting the life sciences software giant's financial performance, strategic initiatives, and market reception. The discussion highlights Veeva's strong underlying revenue and non-GAAP EPS beats, which were paradoxically met with a stock dip due to a GAAP EPS miss, underscoring intense investor scrutiny and high expectations within the current market. The hosts meticulously break down the numbers, management's outlook, and the significant strategic developments that are shaping Veeva's future in the pharmaceutical and biotech sectors. A major focus of the earnings call, and subsequently the podcast, was the "transformative" IQVIA settlement. This resolution of a decade-long legal dispute eliminates critical data-use restrictions that had previously hampered Veeva's commercial and clinical offerings, particularly for products like Veeva Network, Nitro, and Veeva EDC. This strategic shift turns a former rival into a collaborator, allowing for seamless data integration and positioning IQVIA as a Contract Research Organization (CRO) partner for Veeva's clinical trial software. This foundational change is expected to significantly strengthen Veeva's long-term market position, making its ecosystem stickier and harder for competitors to penetrate. Furthermore, the video delves into Veeva's ambitious "agentic AI" strategy, which involves AIs designed to actively perform tasks, interact with systems, and make decisions. The debut of these AI agents is planned for December within Vault CRM and commercial content applications, with a phased rollout across clinical, regulatory, safety, quality, and clinical data agents through 2027. While no material revenue contribution is expected in the immediate fiscal years, Veeva aims to create billions in industry value through automated workflows and a fundamental shift in user interaction. The company believes its "structural advantage"—its deep industry footprint and existing 50+ specific applications as systems of record—gives it a unique right to win in life sciences AI. The podcast also examines the accelerating momentum of Vault CRM, which now boasts over 100 live customers and commitments from nine of the top 20 global biopharmas, rapidly gaining ground against Salesforce with faster implementation speeds. Key Takeaways: * **Veeva's Q2 Financials and Market Disconnect:** Despite reporting strong revenue ($789.1 million, up 17% YoY) and non-GAAP EPS ($1.99) beats, Veeva's stock dipped by 3.7% after hours due to a GAAP EPS miss of $1.11. This illustrates high investor expectations and sensitivity to earnings quality, even when underlying operational performance is robust and guidance is raised. * **Transformative IQVIA Settlement:** The resolution of a decade-long legal battle with IQVIA is a "hinge event," eliminating data-use restrictions that previously limited Veeva Network and Nitro. This allows for seamless data integration, enhances Veeva EDC by positioning IQVIA as a CRO partner, and significantly strengthens Veeva's commercial and clinical cloud offerings. * **Ambitious "Agentic AI" Rollout:** Veeva plans to launch its first "agentic AI" solutions in December, starting with Vault CRM and commercial content applications. This will be followed by a phased release of agents for clinical, regulatory, safety, quality (2026), and clinical data (2027), aiming for a fundamental shift in user interaction and workflow automation. * **Long-Term AI Value Creation, Not Immediate Revenue:** While Veeva anticipates its AI strategy to create billions of dollars in value for the industry by boosting efficiency, no material revenue contribution is expected in fiscal 2026 or 2027. The focus is on early adoption and proving value, indicating a long-term strategic play. * **Veeva's "Structural Advantage" in AI:** Veeva believes its deep industry footprint, with around 50 existing industry-specific applications serving as systems of record, provides a "structural advantage" for its AI strategy. This allows them to embed AI directly into existing workflows, offering integrated solutions rather than standalone tools. * **Vault CRM Gaining Significant Traction Against Salesforce:** Vault CRM now has over 100 live customers, including commitments from nine of the top 20 global biopharmas, with two already live in major markets. This is presented as a significant lead over Salesforce, which reportedly has only three top 20 verbal commitments. * **Faster Implementation as a Key Differentiator:** Veeva highlights its ability to bring top 20 pharma customers live in major markets in under two years for Vault CRM, contrasting with Salesforce's projected longer timelines (late 2026 for a single region, potentially 2029 for global implementation). * **Expanded Focus on Quality Cloud:** Veeva is elevating its internal focus on Quality Cloud, expanding its offerings to include Laboratory Information Management Systems (LIMS), batch release, and validation management, aiming to build a comprehensive quality suite. * **Supportive Macro Environment:** Veeva benefits from positive industry tailwinds, including rising large pharma R&D spending and accelerating global medicine spending. The potential for AI to shorten drug development cycles further supports a stable environment for Veeva's customers. * **Strategic Transformation to a Comprehensive Platform:** The Q2 results underscore Veeva's successful multi-year transformation from solely a CRM provider to a comprehensive platform, data, and services partner for the entire life sciences industry, with the IQVIA deal and AI strategy being central to this evolution. * **Execution Risk in Large Migrations:** While the long-term strategic narrative is compelling, investors will closely monitor Veeva's execution of large Vault CRM migrations over the next couple of years (fiscal 2026-2027) as a key execution risk. **Tools/Resources Mentioned:** * **Veeva Network:** A data solution for managing healthcare professional data. * **Veeva Nitro:** A commercial data warehouse solution. * **Veeva EDC:** Electronic Data Capture for clinical trials. * **Vault CRM:** Veeva's customer relationship management platform for life sciences. * **Quality Cloud:** Veeva's suite of quality management applications, expanding into LIMS, batch release, and validation management. * **Crossix Audiences:** Veeva's data analytics segment, particularly its usage-based component. * **Compass Prescribers:** A Crossix product for measuring marketing effectiveness for healthcare providers. * **SAP, Workday:** Mentioned as large enterprise systems with which Veeva's AI agents will interoperate. **Key Concepts:** * **Agentic AI:** Refers to AI systems designed to not just process information but to actively perform tasks, interact with other systems, and make decisions, thereby automating complex workflows. * **Structural Advantage:** Veeva's term for its competitive edge in AI, stemming from its existing deep integration within the life sciences industry through over 50 specialized applications that serve as systems of record, allowing AI to be embedded directly into established workflows. * **Horizontal Software:** Veeva's ambition to expand its software offerings beyond the life sciences industry, initially using its CRM platform as a base for broader market applications.

Season 1 Episode 1: Building the Right Data and Technology Foundation for Safety

Veeva Systems Inc

@VeevaSystems

Aug 29, 2025

This video, from the Veeva podcast "Safety Revolution," features David Kološić (Veeva) and Aniket Agarwal (Director for Data Operations and Analytics in Patient Safety at Sandoz), discussing the critical role of a robust data and technology foundation in pharmacovigilance (PV). The conversation centers on how Sandoz, as a large generic and biosimilar company, is navigating its growth while enhancing operational efficiency and speed in patient safety through strategic technology adoption. The discussion highlights Sandoz's deliberate shift from a historical landscape of "best-in-class" siloed systems to a platform-based approach. This transformation is driven by the need to overcome challenges associated with maintaining complex integrations between disparate systems and to ensure sustainable growth without a proportional increase in operational teams. Aniket explains that while other domains like clinical and regulatory have adopted platforms earlier, PV's slower pace is due to stringent regulations, frequent inspections, and the necessity of maintaining data compatibility for products with long market lifecycles (30-40 years). The core idea is to harmonize data and technology across global development (clinical, regulatory, safety) to establish a single source of truth, reducing manual reconciliation and improving data quality. A significant portion of the conversation is dedicated to the strategic application of automation and AI in PV. Aniket advocates for a "grounded approach," emphasizing that organizations should first identify specific problems and leverage simpler automation for quick efficiencies before deploying more complex AI solutions. He identifies high-impact AI use cases, particularly in the Individual Case Safety Report (ICSR) space, such as ingesting unstructured data (e.g., non-E2B reports which constitute a significant portion of incoming data) and generating human-readable narratives. Beyond ICSRs, AI is seen as transformative for moving from traditional to predictive signal detection, enhancing the quality of detected signals. The speakers also touch upon the balance between making reporting easy for healthcare professionals and patients (e.g., supporting regional languages) and the need for technology to structure this diverse intake downstream. The ultimate vision for 2030 is "no-touch" end-to-end case processing, with AI solving the remaining 40% of complex scenarios, contingent on evolving regulatory frameworks and building confidence in AI-generated data. Key Takeaways: * **Shift to Platform-Based PV:** Sandoz is moving from siloed, "best-in-class" systems to a unified platform approach to achieve sustainable operations, reduce integration complexities, and ensure systems evolve at a consistent pace. This is crucial for long-term efficiency and growth in pharmacovigilance. * **Drivers for PV Platform Adoption:** The need for harmonization of data and technology across global development (clinical, regulatory, safety) is a prime driver. A platform approach simplifies data flow, reduces maintenance, and supports cross-functional collaboration. * **Challenges in PV Technology Evolution:** PV has been slower to adopt platform solutions due to strict regulations, frequent inspections, the need for data compatibility for products with decades-long market presence, and the inherent risk associated with system changes. * **Importance of Data Standardization:** Standardizing data across regulatory, clinical, and safety domains is critical for establishing a "one source of truth," reducing manual reconciliation efforts, and improving the efficiency and quality of reporting (e.g., for PSURs/DSURs). * **Overcoming Data Silos and Mindset Shifts:** Achieving data standardization requires breaking down historical departmental silos and fostering a mindset shift towards common organizational goals, even if it involves an iterative process and governance to align definitions. * **Grounded Approach to Automation and AI:** Prioritize solving specific problems with simpler automation for quick wins and agility. Reserve AI for more complex, high-impact use cases where traditional automation is insufficient, adopting a phased approach if necessary. * **High-Impact AI Use Cases in PV:** Key areas where AI can drive significant value include ingesting and structuring unstructured incoming data (e.g., non-E2B reports), generating advanced, human-readable narratives for ICSRs, and transitioning from traditional to predictive signal detection. * **Balancing Reporting Ease and Data Structure:** To encourage higher reporting rates, it's essential to make the reporting process as simple as possible for users (e.g., supporting regional languages, flexible input formats). Technology, particularly AI, can then be leveraged downstream to decipher and structure this diverse information. * **Benefits of Cross-System Analytics:** A platform approach enables efficient, real-time cross-system analytics for periodic reports, reducing manual data extraction and reconciliation, and ensuring consistent information for regulatory submissions and inspections. * **Regulatory Harmonization and Frameworks:** Organizations like ICH, EMA, and FDA are actively working on frameworks and guidance to support the adoption of automation and AI in PV, indicating a growing openness and a shared goal with the industry towards safer and more efficient processes. * **Vision for "No-Touch" PV:** The aspirational goal for 2030 is end-to-end automated (no-touch) case processing, where systems can consistently handle a vast majority of scenarios, driving both quality and efficiency, and freeing up resources for more complex tasks. * **Building Regulator Confidence in AI:** As AI technologies advance, it's crucial to collaborate with regulators to understand their expectations, address concerns like hallucination, and ensure AI-generated data remains usable and fit for purpose within a compliant framework. **Tools/Resources Mentioned:** * **Veeva:** A leading platform provider in the pharmaceutical industry, hosting the podcast. * **E2B:** An international standard for the electronic transmission of individual case safety reports (ICSRs). * **ICH (International Council for Harmonisation of Technical Requirements for Pharmaceuticals for Human Use):** Mentioned as an organization striving for harmonization. * **EMA (European Medicines Agency):** Referenced for its efforts in standardization (e.g., through UdraVigilance) and guidance on AI. * **FDA (U.S. Food and Drug Administration):** Referenced for its guidance on AI. * **CIOMS (Council for International Organizations of Medical Sciences):** Mentioned as producing material on AI. **Key Concepts:** * **Pharmacovigilance (PV):** The science and activities relating to the detection, assessment, understanding and prevention of adverse effects or any other drug-related problem. * **Individual Case Safety Report (ICSR):** A report detailing a single suspected adverse drug reaction in a patient. * **Periodic Safety Update Report (PSUR):** A periodic report providing an update on the worldwide safety experience of a medicinal product. * **Development Safety Update Report (DSUR):** A periodic report providing an update on the worldwide safety experience of an investigational medicinal product. * **Signal Detection:** The process of identifying and assessing potential safety signals from various data sources. * **Generics and Biosimilars:** Types of pharmaceutical products Sandoz specializes in. * **GxP (Good x Practice):** A collection of quality guidelines and regulations created to ensure that products are safe and meet their intended use. * **21 CFR Part 11:** Regulations issued by the FDA that set forth the criteria under which electronic records and electronic signatures are considered trustworthy, reliable, and equivalent to paper records.

Tom Broker's 3 Tips To CRUSH Your Q4 Sales Goals

Self-Funded

@SelfFunded

Aug 29, 2025

This satirical video, presented by the persona "Tom Brokers," offers a cynical and aggressive perspective on how sales professionals, particularly those in the brokerage or high-stakes commercial sector, are pressured to meet and exceed their quotas during the critical fourth quarter (Q4). The video frames Q4 not as a time for winding down or maintaining client relationships, but as a period of intense, singular focus on new revenue generation and commission maximization, often at the expense of long-term client service and ethical practice. The core methodology presented is a three-pronged approach designed to maximize immediate sales volume and personal margin. The first, and most foundational, tip is the complete abandonment of existing clients—referred to as "straight up ghosting." The rationale is that every minute spent addressing current client service issues, such as explaining deductibles or managing existing contracts, is a minute diverted from closing new business. This strategy effectively pushes all service obligations and potential client dissatisfaction into the next fiscal year, prioritizing short-term quota achievement over client retention and satisfaction, highlighting the chaotic nature of misaligned sales incentives. The second and third tips focus on exploiting market conditions and competitor weaknesses during the critical renewal season. Tip two advises against fighting or negotiating carrier-mandated rate increases (cited as 30%), instead recommending that the broker simply forward the increase to the client and use "inflation" as a universal, unchallengeable excuse. This tactic shields the broker from accountability while shifting blame to external economic factors, such as tariffs, supply chains, or even historical events like the Suez Canal blockage. This strategy allows the broker to maintain their relationship with the carrier while avoiding difficult value-justification conversations with the client. Finally, the third tip leverages the anticipated service vacuum created by competitors who are likely following Tip Number One. By positioning themselves as a "knight in shining armor," the aggressive broker swoops in to "save" neglected customers. This late-year opportunity is used not just to acquire new clients, but specifically to sell high-margin, complex, or ancillary products—such as GAP plans, Icas (Individual Coverage Health Reimbursement Arrangements), and "tax loophole wellness products"—that may be poorly understood but generate substantial commission. The ultimate goal is to "maximize them margins," reinforcing the video's theme that Q4 is purely about personal financial gain, regardless of the complexity or long-term suitability of the products sold. Key Takeaways: • **The Peril of Q4 Quota Pressure:** The video highlights how intense, short-term sales pressure in Q4 can lead to severely misaligned incentives, causing sales professionals to abandon fundamental business practices like client service and relationship management in favor of immediate revenue capture. • **Acquisition Over Retention Strategy:** The satirical advice to "ghost" existing clients underscores a common, yet detrimental, sales pitfall: prioritizing the closing of new business over nurturing the current customer base, which is crucial for long-term recurring revenue and operational stability. • **Leveraging Renewal Cycles for Opportunity:** Renewal season is presented as a high-stakes period where large rate increases (e.g., 30%) create both risk and opportunity; the strategy is to use external factors (inflation, supply chain) as a shield to avoid responsibility for price hikes. • **The Value of Competitor Service Gaps:** A critical insight is that poor service delivery by competitors creates immediate, high-conversion sales opportunities late in the year, allowing aggressive sales teams to position themselves as rescuers rather than mere vendors. • **Maximizing Ancillary Product Sales:** The focus shifts from core offerings to high-margin, complex products (GAP plans, Icas, wellness products) that are often easier to push during a time of client distress, generating higher commissions even if their value proposition is opaque. • **The Role of Excuse-Making in Sales:** The concept of "advanced excusemaking" (blaming inflation, tariffs, etc.) demonstrates the need for sales teams to have ready-made justifications for market volatility, though in a professional context, this translates to robust value justification and proactive communication. • **Misaligned Incentives and Client Outcomes:** The skit serves as a warning about the consequences of commission structures that heavily reward new sales volume without balancing metrics for client satisfaction, retention, or long-term relationship health. • **Time Management and Focus:** The core time management principle, though exaggerated, is that sales reps must ruthlessly prioritize activities that lead directly to closing new deals, viewing service tasks as distractions during peak sales periods. • **The "Hero" Positioning:** By capitalizing on competitor neglect, the sales professional can bypass the typical sales process and adopt a "hero" or "consultant" persona, which often reduces client scrutiny regarding commission rates or product complexity. Key Concepts: * **Ghosting:** The complete cessation of communication or service delivery to existing clients to free up time for new sales acquisition. * **Renewal Season:** The critical period, typically late in the year, where existing client contracts are renegotiated, often involving significant rate changes, creating high churn potential and new sales opportunities. * **Margin Maximization:** The strategy of focusing sales efforts specifically on products or services that yield the highest personal commission or profit percentage, often prioritizing these over the client’s optimal solution. * **Advanced Excusemaking:** A satirical term for developing and deploying external, non-negotiable reasons (like inflation) to justify unfavorable market conditions or price increases to clients.

Veeva Systems Stock Soars: Analysts Boost Price Targets Amid Strong Earnings

NewsBOT Business

/@NewsBOTBusiness

Aug 29, 2025

This video provides a comprehensive financial analysis of Veeva Systems (NYSE: VEEV) following a robust earnings report that significantly surpassed market expectations. The central focus is the resulting surge in analyst confidence, leading to multiple upward revisions of stock price targets. The analysis establishes that Veeva's strong financial performance validates its continued dominance and strategic importance within the life sciences technology sector, particularly concerning regulated enterprise software and cloud solutions. The analysis details the impressive financial metrics that fueled the market excitement. Veeva reported an Earnings Per Share (EPS) of $1.97 for the quarter, which exceeded the analysts' consensus estimate of $1.74 by a notable 23%. Furthermore, the company’s quarterly revenue reached $759.04 million, significantly outpacing the anticipated $728.38 million. This revenue figure marks a substantial 16.7% increase compared to the same quarter in the previous year, demonstrating accelerated growth and successful execution across its product lines. This financial strength prompted a flurry of positive assessments from major financial institutions. Wells Fargo and Company raised its target from $300 to $326, assigning an "overweight" rating. Other significant target increases included Evercore ISI (from $285 to $295), Truest Financial (from $217 to $230), and UBS Group (from $250 to $285). The overall market consensus, based on insights from 16 buy ratings, seven holds, and two sells, stands at a "moderate buy" with an average target price of $298.68, reflecting widespread confidence in Veeva’s future performance and growth trajectory. The video also touches upon the market structure supporting Veeva, noting strong institutional ownership currently standing at 88.2%, with several large financial entities recently establishing new positions. Crucially for the life sciences industry, the analysis reinforces Veeva’s core value proposition: providing cloud-based software solutions tailored for the sector, specifically citing key offerings such as Veeva Commercial Cloud (for Customer Relationship Management, or CRM) and Veeva Vault Promomats (for digital asset management). The positive outlook is further cemented by analysts forecasting an EPS of $4.35 for the current fiscal year, suggesting sustained momentum and platform expansion. ### Key Takeaways * **Validation of Veeva Ecosystem Investment:** Veeva’s robust financial performance and 16.7% year-over-year revenue growth validate the strategic decision by pharmaceutical and life sciences companies to standardize on the Veeva platform, confirming the long-term viability and necessity of specialized Veeva consulting services. * **Growing Demand for Implementation Partners:** The significant revenue beat and growth indicate expanding adoption and deeper integration of Veeva products (Commercial Cloud, Vault) across the target market, creating a growing demand for expert partners capable of complex implementation, customization, and system optimization. * **Focus Areas for Commercial Operations:** Specific mention of Veeva Commercial Cloud (CRM) and Veeva Vault Promomats highlights the areas where clients are currently directing substantial investment, providing clear focus areas for AI and consulting services aimed at enhancing commercial workflows and digital asset compliance. * **High Analyst Confidence Signals Stability:** The consensus "Moderate Buy" rating and the average target price of $298.68 offer strong reassurance to potential clients that their investment in the Veeva platform is supported by a financially stable and growing vendor, mitigating platform risk. * **Opportunity for AI Integration in Regulated Workflows:** Veeva’s outperformance in the regulated software space reinforces the need for technology solutions that maintain compliance. This creates a prime opportunity for firms specializing in integrating AI and LLMs into Veeva workflows while adhering to GxP and 21 CFR Part 11 requirements. * **Institutional Support for Long-Term Dominance:** High institutional ownership (88.2%) suggests that major financial entities view Veeva as a long-term leader in the life sciences technology space, confirming that specialization in the Veeva ecosystem is a strategically sound, low-risk business decision. * **Minimal Insider Selling Impact:** While some insider trading activity was noted (two directors selling shares), the transactions were minor relative to their retained holdings, which collectively still represent 10.3% of the company’s stock, indicating that the sales were likely routine portfolio management rather than a sign of internal concern. * **Future Platform Expansion Expected:** The forecast of $4.35 EPS for the current fiscal year implies continued investment in product development and R&D by Veeva, which will inevitably introduce new features, modules, and integration points that require specialized consulting expertise for client adoption. ### Tools/Resources Mentioned * **Veeva Systems (NYSE: VEEV):** The primary subject of the financial analysis. * **Veeva Commercial Cloud:** Cloud-based software suite focused on customer relationship management (CRM) for the life sciences industry. * **Veeva Vault Promomats:** A specific Veeva Vault application used for digital asset management and ensuring regulatory compliance of promotional materials. * **MarketBeat.com:** Cited as the source for the consensus analyst rating and average price target. ### Key Concepts * **EPS (Earnings Per Share):** A company's net profit divided by the number of outstanding shares of its common stock; used as an indicator of profitability. Veeva's reported EPS of $1.97 significantly beat estimates. * **Overweight Rating:** An analyst recommendation suggesting that a stock is expected to outperform the average return of the stocks in the analyst's coverage universe or the relevant benchmark index. * **Institutional Ownership:** The percentage of a company's stock held by large financial organizations, such as mutual funds, pension funds, and endowments. High institutional ownership (88.2% for Veeva) often indicates strong market confidence. * **Digital Asset Management:** The process of organizing, storing, and retrieving digital assets (like marketing materials or regulatory documents), a key function provided by Veeva Vault Promomats in a regulated environment.

Veeva Systems Q2 2026 Earnings Call | Q2 2026 Earnings Conference Call | Q2 2026 Results

Investing 101

/@i101_in

Aug 28, 2025