CarePayment is a leading patient financial engagement and financing company that partners with healthcare providers to offer a 0.00% APR open-ended line of credit to patients for medical expenses. The program is designed to bridge the affordability gap, allowing patients to get the care they need without the financial burden of high out-of-pocket costs. It is not a credit card, a collection agency, and participation in the program does not affect a patient's credit score.

Key Benefits for Providers:

- Financial Health: Dramatically improves financial health by increasing cash collections and reducing bad debt. The Hybrid Financing Model seamlessly blends recourse and non-recourse options to maximize cash flow and reduce financial risk.

- Compliance: Ensures compliance with evolving regulatory conditions, including 501r and Medicare Bad Debt compliance, and is consistently zero interest.

- Patient Loyalty: Drives patient satisfaction and loyalty by offering a compassionate, transparent, and ethical financing option.

Main Features and Capabilities:

- 0.00% APR Patient Financing: Patients pay zero interest for the entire repayment period.

- Flexible Terms: Repayment terms up to 72 months are available to keep monthly payments affordable.

- No Application/Credit Impact: No application or credit approval process is required, and there is no impact on the patient's credit score.

- Advanced Patient Engagement Platform: Offers digital-first enrollment, intelligent account servicing workflow, and multi-channel communication tools, including text-to-pay.

- Pre-Care Enrollment: A self-directed platform that allows patients to enroll in financing before services are rendered.

- Consolidated Billing: Patients can add future approved charges to their account, consolidating them into one easy-to-read monthly statement.

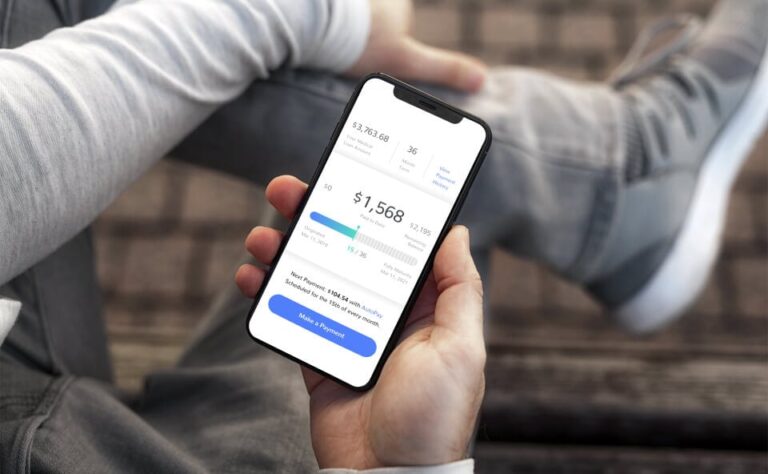

- Online Account Management: Patients can manage their secure account online via a member portal or mobile app.

Target Users and Use Cases:

- Target Users: Hospitals, physician practices, ancillary service providers, and large health systems.

- Use Cases: Patient Financial Engagement, Revenue Cycle Management, Bad Debt Reduction, Increasing Patient Access to Care.