Rectangle Health Bridge, officially known as Practice Management Bridge®, is a unified, cloud-based platform designed to simplify the business and administrative side of healthcare for practices of all specialties and sizes. The platform is comprised of three core modules: Bridge™ Engagement, Bridge™ Payments, and Bridge™ Compliance, all of which integrate seamlessly with existing Practice Management Systems (PMS) and EMR/EHR systems to enhance efficiency and accelerate revenue cycles.

Bridge™ Engagement focuses on the patient journey, automating communications to reduce administrative burden and improve patient satisfaction. Key features include online self-scheduling, automated appointment reminders (via text, email, and voice), waitlist management to fill last-minute cancellations, and digital patient intake forms. Practices using this module have reported a 35% reduction in no-shows.

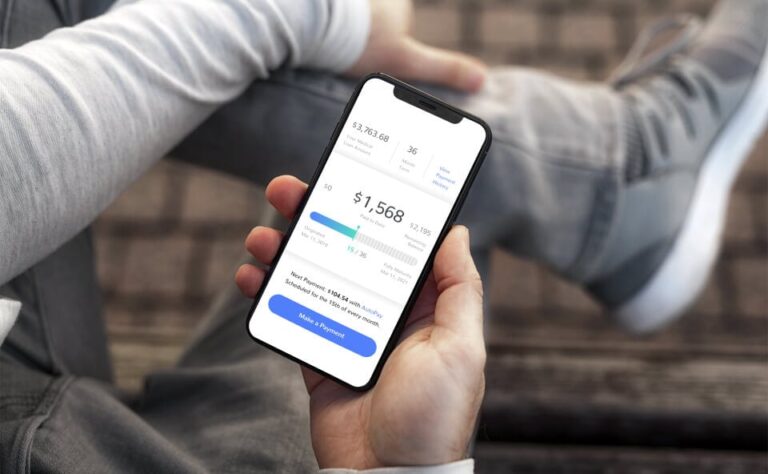

Bridge™ Payments provides flexible and convenient payment options to accelerate collections and reduce Accounts Receivable (A/R). It supports Text-to-Pay, secure Card-on-File storage, online payments, contactless payments (ApplePay, GooglePay), automated payment plans, and patient financing options. A core benefit is the automatic posting of payments to the practice's existing PMS/EMR, which can cut the time spent collecting and posting payments by up to 30%.

Bridge™ Compliance helps practices navigate regulatory complexities by providing HIPAA and OSHA compliance management, including access to policies, trainings, and cybersecurity support. This feature helps safeguard Protected Health Information (PHI) and reduces the risk of costly fines.

Overall, the platform is recognized for its ease of use and ability to deliver measurable results, such as a 97% in-office payment collection rate and a 47% decrease in outstanding A/R for customers.