CompassWay is a cloud-based, end-to-end digital lending platform and Loan Management Software (LMS) designed for both B2B and B2C markets, delivered through a cost-effective SaaS model . It automates the entire loan lifecycle, from application and underwriting to servicing and repayment, with a focus on enhancing efficiency and reducing operational costs through smart automation .

Key Benefits & Target Market

While serving general digital lending, microfinance, and e-commerce financing, CompassWay has a specialized focus on Healthcare Financing . The software is designed to revolutionize medical loan origination and management by enabling healthcare providers to offer in-house patient financing and flexible payment plans . This improves patient access to treatment, enhances the patient experience, and helps practices better manage cash flow and potentially increase medical billing . The platform is suitable for all company sizes, including small, medium, and large enterprises .

Main Features & Capabilities

- Loan Origination & Servicing: Manages the complete loan lifecycle from application to repayment .

- AI-Powered Credit Decisioning: Utilizes a built-in credit decision scoring system, AI-powered credit decision engine, and automated underwriting to provide real-time credit assessments and swift loan approvals .

- Compliance & Risk Management: Includes features for Compliance Management, Fraud Detection, and adherence to KYC (Know Your Customer) and AML (Anti-Money Laundering) procedures .

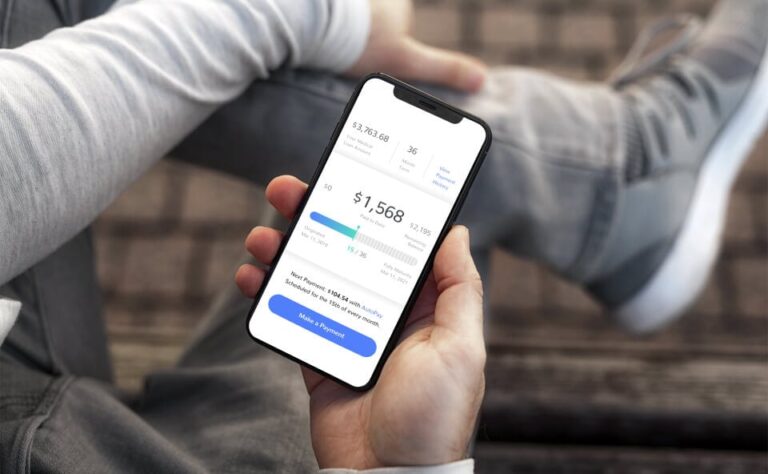

- Customer Portal (Borrow Portal): A dynamic online hub that empowers borrowers with self-service tools for managing accounts, scheduling payments, setting up autopay, and editing repayment plans .

- Document Management: Supports features like e-Signature and comprehensive document handling .

- Payment Processing: Automates payment handling for various transactions, including one-time and recurring payments .

- Reporting and Analytics: Provides customizable dashboards and advanced reporting capabilities for continuous monitoring of business performance and customer behavior .