TurnKey Lender is an award-winning, AI-based Unified Lending Management (ULM) platform that automates the entire loan lifecycle for traditional, alternative, and embedded finance providers . The end-to-end solution covers every step from the loan application and borrower evaluation to origination, underwriting, servicing, collections, reporting, and compliance .

The platform's core is its proprietary Decision Engine, which utilizes deep neural networks and machine learning algorithms to provide instant, highly accurate credit scoring and risk decisioning, often in less than 30 seconds . This intelligent automation is credited with helping clients achieve a 49% growth in portfolio profitability and a 283% increase in operational efficiency .

Key Capabilities:

- AI-Powered Underwriting: Automated credit scoring, risk assessment, and decision-making based on traditional and alternative data .

- Loan Origination: Fully configurable application flows, document management, and e-signature integration .

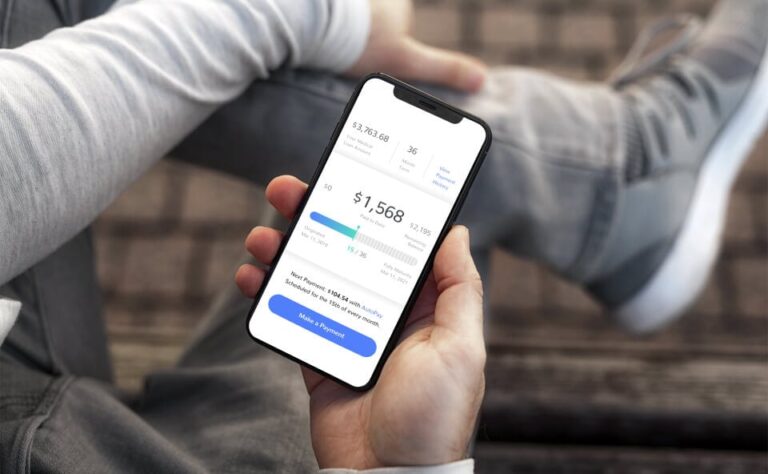

- Loan Servicing: Management of payments, schedules, loan renewals, and customer relationship management (CRM) .

- Debt Collection: Automated collection workflows, delinquency management, and AI-based collections scoring .

- Compliance: Built-in compliance management for KYC, AML, and regulatory reporting .

TurnKey Lender is a cloud-based, modular, and fully white-labeled solution, allowing for fast deployment and customization . It serves a global client base in over 50 countries, including large/mid-size banks, credit unions, multi-finance companies, non-profits, governments, and small-to-enterprise businesses .