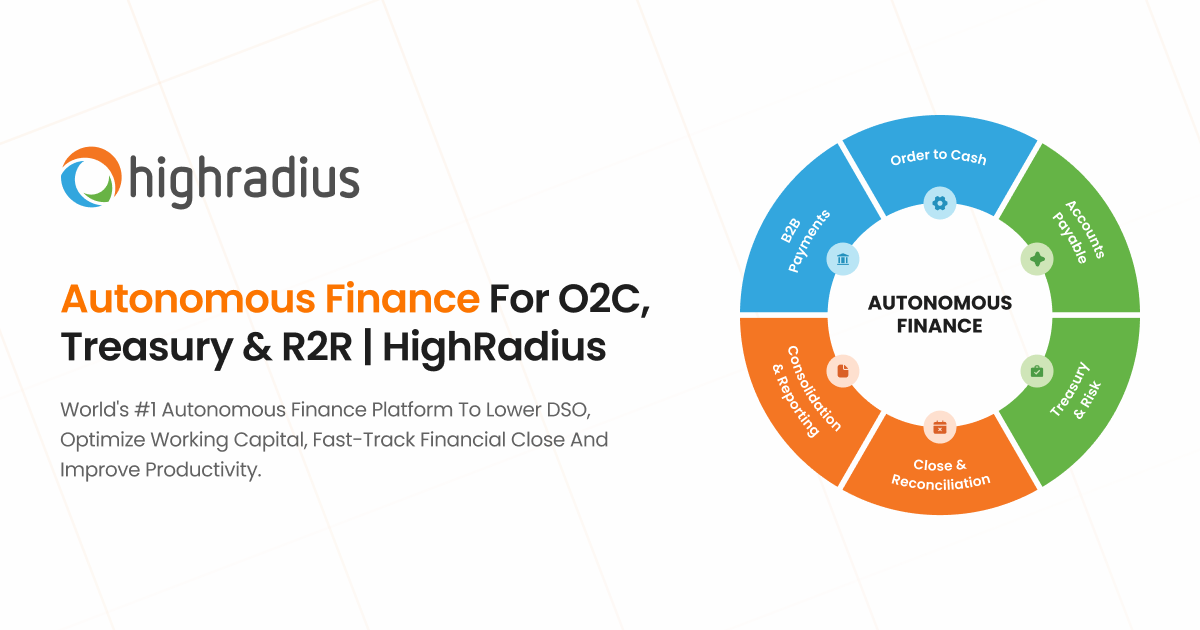

HighRadius is a fintech Software-as-a-Service (SaaS) company that provides an Autonomous Finance Platform for the Office of the CFO. It leverages Artificial Intelligence (AI), Robotic Process Automation (RPA), and Natural Language Processing (NLP) to automate and optimize financial processes across the Order-to-Cash (O2C), Treasury Management, and Record-to-Report (R2R) cycles.

The platform is designed to increase operational efficiency, reduce Days Sales Outstanding (DSO), improve cash flow, and fast-track the financial close process. Key product suites include the Integrated Receivables platform for credit, collections, cash application, deductions, and electronic invoicing; Treasury Management Applications for cash management, forecasting, and bank reconciliation; and solutions for Financial Close, Reconciliation, and Consolidation & Reporting.

HighRadius is ERP agnostic, offering pre-built integrations with all major enterprise resource planning systems like SAP, Oracle, and Microsoft Dynamics 365, ensuring rapid deployment and minimal IT intervention. It is primarily targeted at mid-market and large global enterprises, including over 200 Global 2000 companies, helping them to modernize their financial operations with data-driven, AI-powered automation.

Key Benefits:

- Up to 95% no-touch cash posting rates.

- 10% Lower Past Dues/DSO.

- 30% Lower Days to Close.

- 40% Increase in Productivity.